Brace For More Market Pain: Investors' Risky Strategy

Table of Contents

Ignoring Fundamental Analysis in Favor of Speculative Trading

Many investors, lured by the potential for quick profits, have abandoned traditional fundamental analysis in favor of speculative trading. This risky approach often prioritizes short-term gains over long-term value, leaving portfolios vulnerable to significant losses.

The Rise of Meme Stocks and Cryptocurrencies

The rise of meme stocks and cryptocurrencies exemplifies this trend. These assets often lack fundamental value, their prices driven by hype, social media trends, and FOMO (Fear Of Missing Out). This speculative bubble can burst rapidly, resulting in substantial losses for investors.

- Examples of meme stock and crypto crashes: The collapse of GameStop's stock price after its initial surge, the dramatic fall of several major cryptocurrencies like Luna, and the volatility in Dogecoin all highlight the inherent risk.

- Importance of understanding underlying assets: Before investing, thoroughly research the company's financials, its business model, and its future prospects. Similarly, with cryptocurrencies, understand the technology, the team behind it, and the potential for adoption.

- Dangers of FOMO: The fear of missing out can lead to impulsive decisions and investment in assets without proper due diligence, increasing your exposure to market pain.

The Dangers of Leverage and Margin Trading

Leverage and margin trading amplify both profits and losses. While they can potentially boost returns, they dramatically increase the risk of substantial losses, even leading to liquidation if the market moves against you.

- Illustrative examples of margin calls and liquidation: An investor using high leverage to bet on a falling stock price can face a margin call if the price moves unexpectedly in the opposite direction. Failure to meet this call can result in the liquidation of their assets, causing significant financial hardship.

- Importance of understanding leverage ratios: Before using leverage, carefully assess your risk tolerance and understand the potential consequences of magnified losses.

- Strategies for mitigating leverage risk: Only use leverage if you fully understand the risks, and use it conservatively. Diversify your investments and maintain sufficient capital to absorb potential losses.

Underestimating the Impact of Inflation and Rising Interest Rates

Ignoring the effects of inflation and rising interest rates represents another significant risk for investors. These macroeconomic factors significantly impact investment returns and portfolio valuations.

The Erosion of Purchasing Power

Inflation erodes the purchasing power of money over time. This means that the real value of your investments can decrease even if their nominal value remains constant. This is particularly problematic for fixed-income assets like bonds.

- How inflation affects different asset classes: Inflation impacts different asset classes differently. Real estate and commodities often perform better during inflationary periods, while bonds and cash may lose value.

- Strategies for hedging against inflation: Consider investing in inflation-protected securities, real estate, commodities (gold, oil), or assets that historically maintain their value during inflation.

The Impact of Rising Interest Rates on Bond Yields and Equity Valuations

Rising interest rates generally lead to lower bond prices, as investors demand higher yields to compensate for the increased risk. This inverse relationship impacts the valuation of equities as well, as higher interest rates increase borrowing costs for companies and can dampen economic growth.

- How rising interest rates impact borrowing costs for companies: Higher interest rates increase the cost of debt financing for companies, reducing profitability and potentially impacting stock valuations.

- The effect on investor sentiment and capital allocation: Rising interest rates can shift investor sentiment, leading to reduced risk appetite and a reallocation of capital towards safer investments.

Lack of Portfolio Diversification and Over-Concentration

A poorly diversified portfolio is highly vulnerable to market downturns. Over-concentration in a single asset or sector exposes investors to significant risk.

The Importance of a Balanced Portfolio

Diversification across different asset classes (stocks, bonds, real estate, commodities) is crucial for mitigating risk. A well-diversified portfolio can help to absorb losses in one sector while benefiting from gains in another.

- Examples of well-diversified portfolios: A balanced portfolio might include a mix of stocks from various sectors, bonds with different maturities, and alternative investments like real estate or commodities.

- Importance of asset allocation based on risk tolerance and investment goals: Your asset allocation should align with your risk tolerance and investment goals. Conservative investors may prefer a larger allocation to bonds, while more aggressive investors may hold a higher proportion of equities.

The Dangers of Over-Reliance on a Single Investment

Concentrating your investments in a single asset or sector exposes you to significant losses if that particular asset underperforms. This lack of diversification can be devastating during market downturns.

- Case studies of investors who suffered significant losses due to over-concentration: Numerous examples exist of investors who lost a substantial portion of their wealth by heavily concentrating their portfolios in a single stock or sector that experienced a significant decline.

- Strategies for reducing portfolio concentration: Diversify your holdings across different asset classes and sectors to reduce your overall risk. Regularly review and rebalance your portfolio to ensure it remains aligned with your investment goals and risk tolerance.

Conclusion

The current market conditions demand a cautious and strategic approach to investing. Ignoring fundamental analysis, underestimating macroeconomic factors, and failing to diversify your portfolio are risky strategies that could lead to significant market pain. To navigate this challenging environment, investors must prioritize careful due diligence, robust risk management, and a well-diversified portfolio. Don't let the fear of missing out cloud your judgment. Prepare for more market pain by adopting a prudent and informed investment strategy. Implement a well-researched plan to mitigate risks and safeguard your financial future. Remember, understanding and managing risk is crucial for long-term success in any market, but particularly during times of increased volatility. Learn to identify and avoid risky strategies to effectively navigate the current market challenges and minimize your exposure to market pain.

Featured Posts

-

Understanding The Dynamics Of The Countrys Emerging Business Hubs

Apr 22, 2025

Understanding The Dynamics Of The Countrys Emerging Business Hubs

Apr 22, 2025 -

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 22, 2025

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 22, 2025 -

The End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 22, 2025

The End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 22, 2025 -

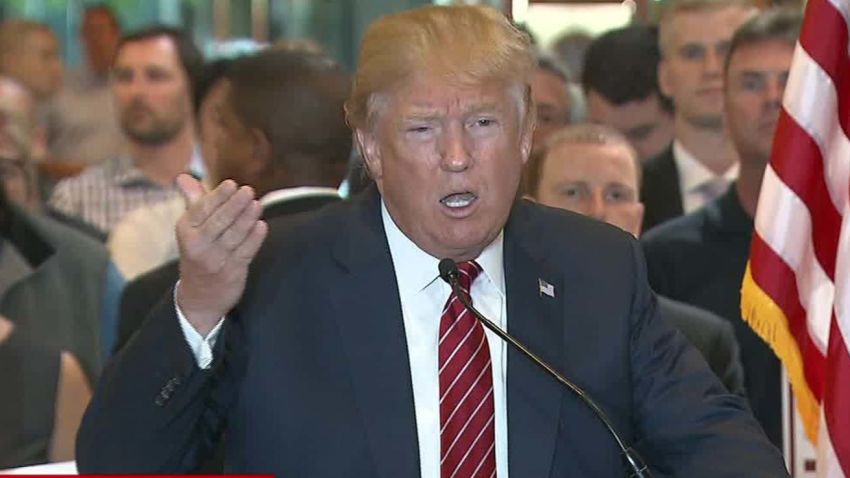

Trump Administration Threatens Harvard With 1 Billion Funding Loss

Apr 22, 2025

Trump Administration Threatens Harvard With 1 Billion Funding Loss

Apr 22, 2025 -

Just Contact Us A Tik Tok Trend Exploiting Tariff Gaps

Apr 22, 2025

Just Contact Us A Tik Tok Trend Exploiting Tariff Gaps

Apr 22, 2025