Boston Celtics Sold For $6.1 Billion: Fans React To Private Equity Ownership

Table of Contents

The $6.1 Billion Sale: A Record-Breaking Deal

The $6.1 billion sale price represents a record-breaking transaction in NBA history, significantly exceeding previous franchise valuations. This underscores the immense value and potential of the Boston Celtics brand and its loyal fanbase. The purchasing entity, Bain Capital, a prominent global private equity firm, brings a wealth of experience and financial resources to the table. Their investment history showcases a focus on long-term growth and strategic acquisitions, suggesting a potentially lucrative future for the Celtics.

- Record-Breaking Price: The $6.1 billion sale price surpasses all previous NBA franchise sales, solidifying the Celtics' position as one of the league's most valuable assets.

- Bain Capital's Involvement: Bain Capital, known for its successful investments across various sectors, now assumes ownership of the Celtics, injecting significant financial capital into the franchise.

- Ownership Transition: While specifics of the sale process remain somewhat opaque, the transition marks the end of an era for previous owners and the beginning of a new chapter under Bain Capital's leadership.

- Financial Implications: The influx of capital opens up significant opportunities for the Celtics, including investments in player acquisition, facility upgrades, and enhanced operational efficiency, potentially leading to increased on-court success.

Fan Reactions: A Mixed Bag of Emotions

The $6.1 billion sale of the Boston Celtics has generated a wide spectrum of reactions among the passionate fanbase. Social media platforms have become a battleground for expressing both excitement and apprehension. While some fans welcome the potential for increased investment and improved team performance, others express concerns about the implications of private equity ownership.

- Social Media Sentiment: A quick scan of Twitter and other platforms reveals a mix of positive and negative comments. Many express hope for a brighter future with increased resources, while others voice concerns about potential ticket price hikes and a shift away from the team's community focus.

- Concerns about Accessibility: A recurring theme among apprehensive fans is the fear of reduced ticket accessibility and a potential increase in prices, making attending games more challenging for long-time supporters.

- Impact on Fan Connection: The change in ownership raises concerns about the team's long-term connection with its loyal fanbase. Maintaining the unique atmosphere and community feel will be crucial for the new owners.

- Example Fan Comments: One fan tweeted, "Excited about the potential, but worried about ticket prices!" Another commented, "Hope they don't lose the Celtics' unique identity."

The Role of Wyc Grousbeck and the Future Leadership

While Bain Capital assumes primary ownership, the role of Wyc Grousbeck, a long-time figurehead within the Celtics organization, remains a critical aspect of the transition. His continued involvement offers a degree of continuity and familiarity, potentially mitigating some fan concerns. However, the impact of Bain Capital's influence on team management and long-term strategy remains to be seen.

- Grousbeck's Continued Involvement: The extent of Grousbeck's role in the post-sale organization will be vital in maintaining the team’s established culture and values.

- Impact on Front Office and Coaching: The influence of Bain Capital on the hiring and retention of front-office personnel and coaching staff will significantly impact the team’s direction.

- Changes in Team Strategy: Private equity ownership often brings a sharper focus on financial performance. This could lead to strategic changes in player acquisition and team-building approaches.

Implications for the Future of the Boston Celtics

The $6.1 billion sale presents both opportunities and challenges for the Boston Celtics' future. The injection of significant financial resources from Bain Capital offers the potential for unprecedented success, but it also introduces potential risks associated with private equity's focus on profitability.

- Potential Benefits: Increased financial resources could lead to significant investments in player recruitment, better facilities, and improved scouting, potentially creating a more competitive team.

- Potential Challenges: The pressure to deliver financial returns may lead to difficult decisions regarding player salaries and roster construction. Balancing financial goals with the need to maintain a competitive team will be a key challenge.

- Impact on Player Recruitment and Retention: The team's ability to attract and retain top talent will be crucial in determining the success of the new ownership model. The financial resources available will be a key factor.

- Long-Term Outlook: The long-term outlook is complex. While the potential for success is high, careful management will be crucial to navigating the challenges of private equity ownership and maintaining the team's strong connection with its fanbase.

Conclusion

The $6.1 billion sale of the Boston Celtics marks a pivotal moment in the franchise's history. While the transition to private equity ownership brings opportunities for financial growth and potential success, it also raises concerns among fans regarding ticket prices, team management, and the team's long-term connection with its fanbase. This unprecedented sale sets a new benchmark for NBA franchise valuations and underscores the enduring appeal and value of the Boston Celtics brand.

Call to Action: Stay informed about the latest developments regarding the Boston Celtics' new ownership and its impact on the team's future. Continue following the Boston Celtics saga and share your thoughts on the implications of this record-breaking $6.1 billion sale. Let us know your concerns and hopes for the future of the Celtics in the comments below!

Featured Posts

-

Jimmy Butler Picks Rockets Vs Warriors Game 6 Predictions And Best Bets

May 15, 2025

Jimmy Butler Picks Rockets Vs Warriors Game 6 Predictions And Best Bets

May 15, 2025 -

Nhl Announces Canadian Partnership With Ndax For Stanley Cup Playoffs

May 15, 2025

Nhl Announces Canadian Partnership With Ndax For Stanley Cup Playoffs

May 15, 2025 -

March 22 Nhl Picks Maple Leafs Vs Predators Betting Preview

May 15, 2025

March 22 Nhl Picks Maple Leafs Vs Predators Betting Preview

May 15, 2025 -

Vont Weekend Photos From April 4th 6th 2025 Kissfm 96 1

May 15, 2025

Vont Weekend Photos From April 4th 6th 2025 Kissfm 96 1

May 15, 2025 -

Bobrovskiy Voshyol V Istoriyu N Kh L 20 Luchshikh Vratarey Pley Off

May 15, 2025

Bobrovskiy Voshyol V Istoriyu N Kh L 20 Luchshikh Vratarey Pley Off

May 15, 2025

Latest Posts

-

Renos Boxing Future A Heavyweight Champions Initiative

May 15, 2025

Renos Boxing Future A Heavyweight Champions Initiative

May 15, 2025 -

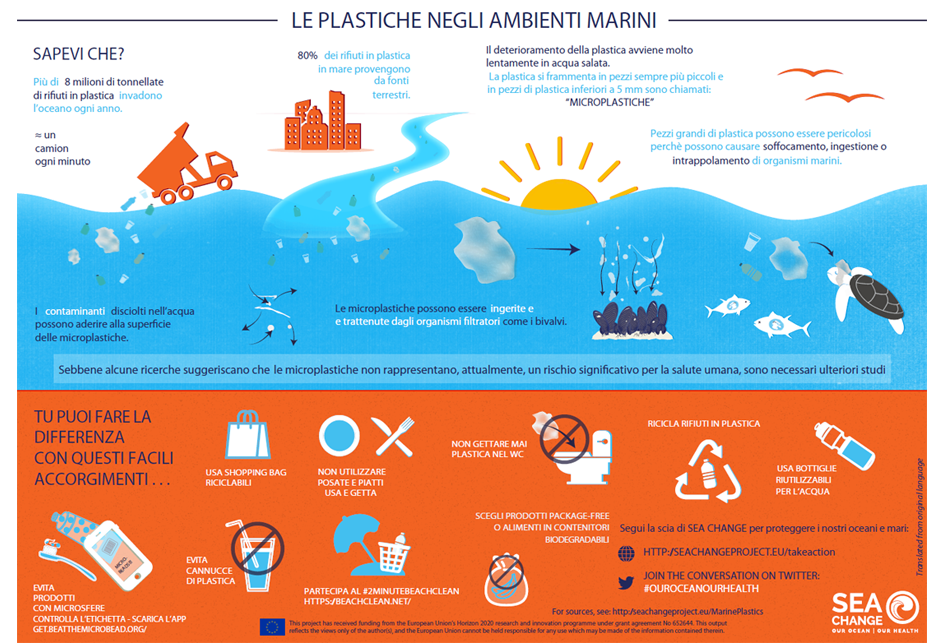

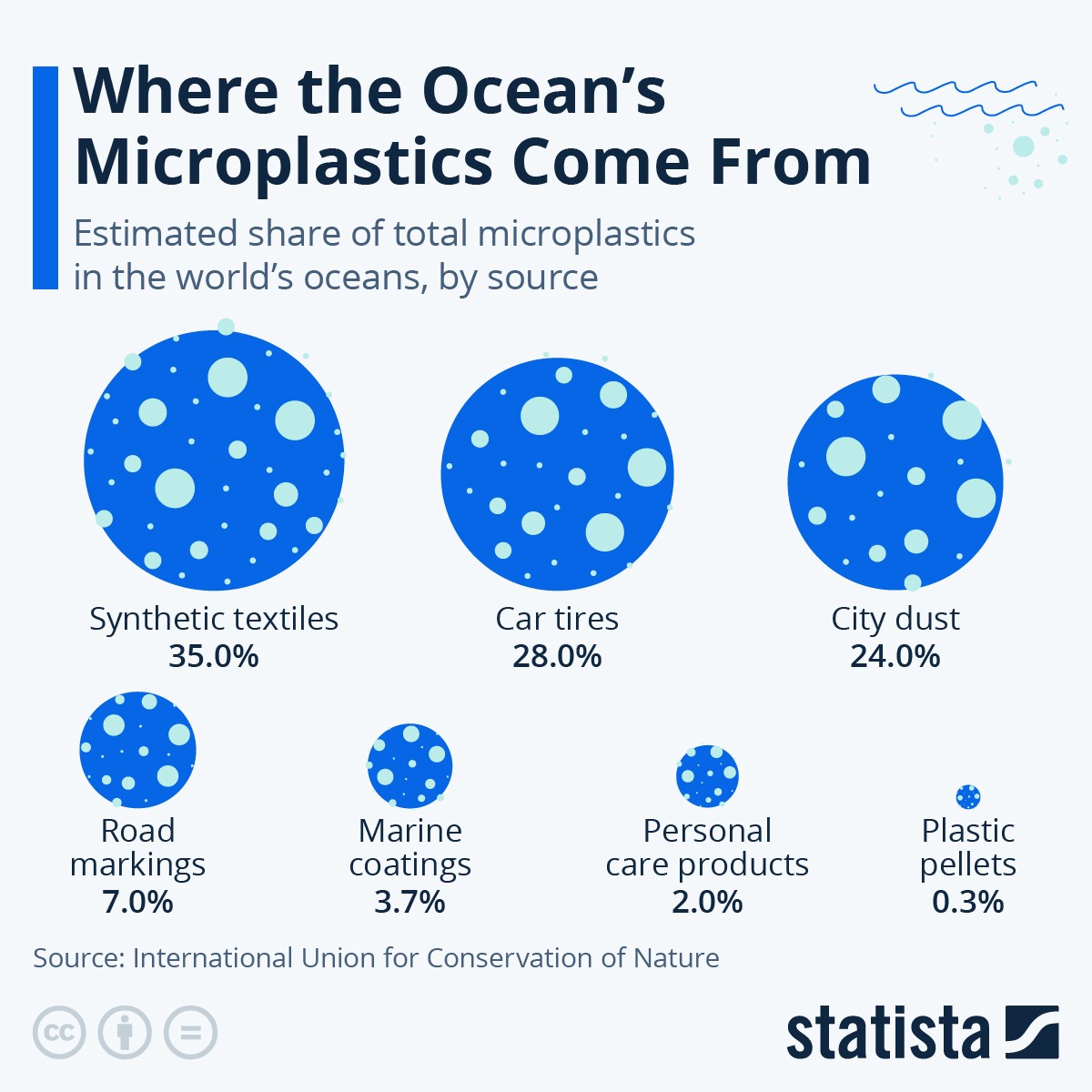

Microplastiche Un Confronto Tra Acque Di Mare Fiumi E Laghi

May 15, 2025

Microplastiche Un Confronto Tra Acque Di Mare Fiumi E Laghi

May 15, 2025 -

Bringing Back The Thrill Heavyweight Champions Reno Boxing Vision

May 15, 2025

Bringing Back The Thrill Heavyweight Champions Reno Boxing Vision

May 15, 2025 -

Inquinamento Da Microplastiche Quali Acque Sono Maggiormente Colpite

May 15, 2025

Inquinamento Da Microplastiche Quali Acque Sono Maggiormente Colpite

May 15, 2025 -

Indagine Sulla Presenza Di Microplastiche In Diverse Fonti D Acqua

May 15, 2025

Indagine Sulla Presenza Di Microplastiche In Diverse Fonti D Acqua

May 15, 2025