Boosting The Euro: Lagarde's Plan To Increase The EUR/USD's Global Influence

Table of Contents

Monetary Policy Adjustments to Boost the Euro

The ECB's monetary policy is a primary tool for influencing the euro's value. Currently, the ECB employs a range of measures to manage inflation and stimulate economic growth. These include setting interest rates, conducting quantitative easing (QE), and managing the money supply. The impact of these policies on the EUR/USD exchange rate is complex and depends on various factors, including global economic conditions and market sentiment.

Potential future adjustments could involve interest rate hikes to combat inflation, or a tapering of QE programs as economic conditions improve. These adjustments aim to increase the attractiveness of the euro for foreign investors, strengthening its value. However, aggressive monetary policy changes carry risks.

- Impact of interest rate changes on attracting foreign investment: Higher interest rates make euro-denominated assets more attractive, potentially increasing demand for the euro.

- Effect of QE on money supply and exchange rates: QE increases the money supply, which can devalue the currency in the long run if not managed carefully.

- Potential risks associated with aggressive monetary policy changes: Rapid changes can trigger market volatility and negatively impact economic growth.

Strengthening the Eurozone Economy for a Stronger Euro

A strong euro is intrinsically linked to a robust Eurozone economy. Structural reforms aimed at improving competitiveness across member states are crucial. This includes measures to enhance labor market flexibility, reduce bureaucracy, and foster innovation. Fiscal policies play a vital role, ensuring sustainable government finances and promoting investment in key sectors.

Initiatives promoting innovation and technological advancements are essential for long-term economic growth and competitiveness. Increased investment in research and development (R&D) is particularly important in boosting productivity and attracting foreign investment.

- Examples of successful structural reforms in Eurozone countries: Germany's focus on vocational training and its strong export sector serves as a model.

- The role of the European Stability Mechanism (ESM) in maintaining financial stability: The ESM provides financial assistance to struggling Eurozone members, preventing contagion effects.

- The impact of increased investment in R&D on economic competitiveness: Higher R&D spending leads to technological breakthroughs and improved productivity, enhancing competitiveness globally.

Geopolitical Factors and the Euro's Global Standing

Geopolitical events significantly influence the euro's value. The ongoing war in Ukraine and the resulting energy crisis have created uncertainty and negatively impacted the euro. The Eurozone's response to such events is crucial in maintaining investor confidence and influencing the currency's strength.

The euro's role in international trade and finance is another critical factor. The ECB is actively working to enhance the euro's role in global payment systems, reducing reliance on the US dollar. This strategy aims to increase the euro's global reach and influence.

- How the Eurozone's response to geopolitical events impacts investor confidence: A decisive and coordinated response can bolster investor confidence, supporting the euro's value.

- The competitiveness of the Euro compared to other major currencies (USD, GBP, JPY): The euro's competitiveness depends on factors like economic growth, inflation, and interest rates relative to other major currencies.

- Potential strategies for reducing the Eurozone’s reliance on energy imports: Diversifying energy sources and investing in renewable energy are key strategies.

Public Perception and the Euro's Strength

Public confidence and market sentiment are powerful drivers of the euro's value. The ECB employs various communication strategies to manage market expectations and maintain stability. Transparent and clear communication about its monetary policy is essential in building trust and influencing market sentiment positively.

- The importance of ECB communication in influencing market sentiment: Clear and consistent communication can reduce uncertainty and stabilize the currency.

- How media coverage and public opinion affect the Euro's value: Negative media coverage can negatively impact market sentiment, leading to a decline in the euro's value.

- Strategies for improving public understanding of the ECB's monetary policy: Simplified explanations and increased public engagement can enhance understanding and trust.

Conclusion: The Future of the Euro under Lagarde's Leadership

Boosting the euro requires a multi-pronged approach encompassing monetary policy adjustments, strengthening the Eurozone economy, navigating geopolitical challenges, and managing public perception effectively. Lagarde's success in strengthening the euro hinges on the effective implementation of these strategies. A strong euro is vital for the Eurozone's economic prosperity and its global influence. The likelihood of success depends on various factors, including global economic conditions, the effectiveness of ECB policies, and the Eurozone's ability to adapt to evolving geopolitical landscapes.

Call to action: Stay informed about the ECB's policy decisions and their impact on boosting the euro. Follow the EUR/USD exchange rate and understand how these factors affect global markets. Learn more about how to invest strategically in a stronger euro and navigate the complexities of the global currency market.

Featured Posts

-

Pirates Game Recap Triolo Stars Bullpen Shines Despite Defeat Against Braves

May 28, 2025

Pirates Game Recap Triolo Stars Bullpen Shines Despite Defeat Against Braves

May 28, 2025 -

Column This Baseball Book Is A Grand Slam For Opening Day

May 28, 2025

Column This Baseball Book Is A Grand Slam For Opening Day

May 28, 2025 -

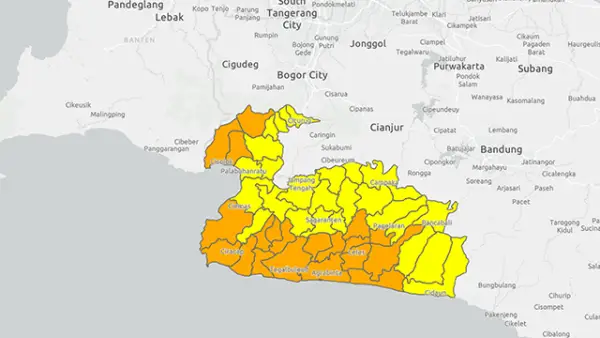

Antisipasi Curah Hujan Tinggi Prakiraan Cuaca Jawa Barat 26 Maret

May 28, 2025

Antisipasi Curah Hujan Tinggi Prakiraan Cuaca Jawa Barat 26 Maret

May 28, 2025 -

Arsenal News Artetas U Turn On 76m Striker And Pursuit Of 60m Mbappe Esque Star

May 28, 2025

Arsenal News Artetas U Turn On 76m Striker And Pursuit Of 60m Mbappe Esque Star

May 28, 2025 -

Analisis Pertandingan Belanda Vs Spanyol 2 2 Di Uefa Nations League

May 28, 2025

Analisis Pertandingan Belanda Vs Spanyol 2 2 Di Uefa Nations League

May 28, 2025