Booming US-China Trade: The Impact Of The Trade Truce Window

Table of Contents

Increased Trade Volume During the Truce Period

The trade truce has, at least temporarily, led to a noticeable increase in trade volume between the US and China.

H3: Analysis of export and import data showing growth.

- Increased agricultural exports: US agricultural exports to China have seen a significant uptick, particularly in soybeans and corn, following reductions in retaliatory tariffs. Data from the USDA shows a [insert percentage]% increase in [specific period].

- Growth in technology sector trade: Despite lingering concerns about technology transfer, some segments of the technology sector have experienced increased bilateral trade. [Cite source with specific data on technology trade growth].

- Boosted manufacturing exports: Certain manufactured goods have seen a resurgence in trade, reflecting a renewed confidence in the stability of the trade relationship. [Cite source with specific data].

H3: Factors contributing to increased trade volume during the truce.

- Reduced tariffs: The easing or temporary suspension of tariffs on certain goods has been a key driver of increased trade.

- Increased business confidence: The truce has instilled a degree of confidence among businesses, leading to increased investment and trade activity.

- Easing of trade restrictions: Relaxation of certain non-tariff barriers has facilitated smoother trade flows. This includes improved customs procedures and reduced bureaucratic hurdles.

The relative importance of these factors is debatable, with some arguing that reduced tariffs are the primary catalyst, while others emphasize the crucial role of restored business confidence. Further research is needed to definitively determine the weighting of each factor.

Challenges and Uncertainties Remain

Despite the temporary increase in trade volume, significant challenges and uncertainties persist, threatening the sustainability of this "booming" phase.

H3: Lingering trade disputes and potential future escalation.

- Intellectual property rights: Concerns about intellectual property theft remain a major point of contention.

- Technology transfer: The forced transfer of technology continues to be a significant sticking point in negotiations.

- National security concerns: Concerns about national security, especially in relation to technology and critical infrastructure, could lead to renewed trade restrictions.

Future escalation of these disputes could easily reverse the positive trends observed during the truce. The imposition of new tariffs or other trade barriers could severely dampen the current optimism surrounding US-China trade.

H3: Geopolitical risks and their influence on trade relations.

- US-China political tensions: Underlying political tensions beyond trade issues continue to cast a shadow over the relationship.

- Global political instability: Global events unrelated to US-China relations can still impact trade flows and business sentiment.

- Regional conflicts: Regional conflicts and instability can disrupt supply chains and investment plans.

Geopolitical risks are unpredictable and difficult to quantify but represent a significant and ongoing challenge to the stability of the US-China trade relationship.

H3: Supply chain vulnerabilities and diversification strategies.

- Over-reliance on a single trading partner: Many businesses have become heavily reliant on China for manufacturing and sourcing, creating vulnerabilities.

- Diversification efforts: Companies are increasingly exploring diversification strategies to mitigate these risks.

- Reshoring and nearshoring: There's a growing trend towards reshoring (returning production to the US) and nearshoring (moving production to countries closer to the US).

Businesses are actively seeking to diversify their supply chains to reduce their dependence on any single country, including China. This trend is likely to continue regardless of the outcome of the current trade truce.

Opportunities for Businesses During the Trade Truce

While challenges persist, the current trade truce window presents significant opportunities for businesses willing to navigate the complexities.

H3: Market access and expansion for US and Chinese businesses.

- Increased market share for US exporters: The truce creates opportunities for US companies to expand their market share in China.

- New market opportunities for Chinese businesses: Conversely, the truce allows Chinese companies to more easily access the US market.

- Growth opportunities for SMEs: Small and medium-sized enterprises (SMEs) can particularly benefit from the improved trade environment.

H3: Investment opportunities in both countries.

- Infrastructure investments in China: China continues to invest heavily in infrastructure, creating opportunities for foreign investors.

- Technology investments in the US: The US remains a major hub for technological innovation, attracting considerable investment from around the world.

- Risks and rewards: Investing in either country involves weighing the potential rewards against the inherent risks of geopolitical uncertainty.

H3: Potential for innovation and technological collaboration.

- Renewable energy collaboration: There is significant potential for cooperation in the development of renewable energy technologies.

- Artificial intelligence collaboration: The AI sector presents opportunities for joint ventures and technological advancement.

- Benefits of collaboration: Collaborative efforts can accelerate innovation and lead to mutual economic benefits.

Conclusion: Understanding the Booming US-China Trade Dynamics

The current state of US-China trade is characterized by a complex interplay of increased trade volume, persistent uncertainties, and emerging opportunities. The trade truce has provided a temporary respite, leading to a surge in certain sectors, but unresolved disputes and geopolitical risks continue to loom large. Businesses must carefully weigh the potential rewards against the inherent risks associated with this volatile relationship. Successfully navigating this landscape requires a keen understanding of the trade dynamics, proactive risk management strategies, and a willingness to adapt to the ever-shifting geopolitical landscape.

Key Takeaways: While the current trade truce has led to increased trade volume, lingering disputes and geopolitical risks pose significant challenges. Businesses must diversify their supply chains and carefully assess both the opportunities and risks inherent in the US-China trade relationship.

Call to Action: Stay ahead of the curve in the ever-evolving landscape of booming US-China trade. Continue your research and explore the opportunities available during this crucial period. [Link to further resources on US-China trade]

Featured Posts

-

Landslide Risk Prompts Urgent Livestock Evacuation In Swiss Alps

May 23, 2025

Landslide Risk Prompts Urgent Livestock Evacuation In Swiss Alps

May 23, 2025 -

This Mornings Cat Deeley Suffers Dress Blunder

May 23, 2025

This Mornings Cat Deeley Suffers Dress Blunder

May 23, 2025 -

Delayed Promotions Accenture To Upgrade 50 000 Staff

May 23, 2025

Delayed Promotions Accenture To Upgrade 50 000 Staff

May 23, 2025 -

Open Ais Acquisition Of Jony Ives Ai Hardware Company A Deep Dive

May 23, 2025

Open Ais Acquisition Of Jony Ives Ai Hardware Company A Deep Dive

May 23, 2025 -

Crawleys Heroics Secure Draw Against Gloucestershire

May 23, 2025

Crawleys Heroics Secure Draw Against Gloucestershire

May 23, 2025

Latest Posts

-

Sylvester Stallones Tulsa King Season 3 Neal Mc Donoughs Return And Latest Updates

May 23, 2025

Sylvester Stallones Tulsa King Season 3 Neal Mc Donoughs Return And Latest Updates

May 23, 2025 -

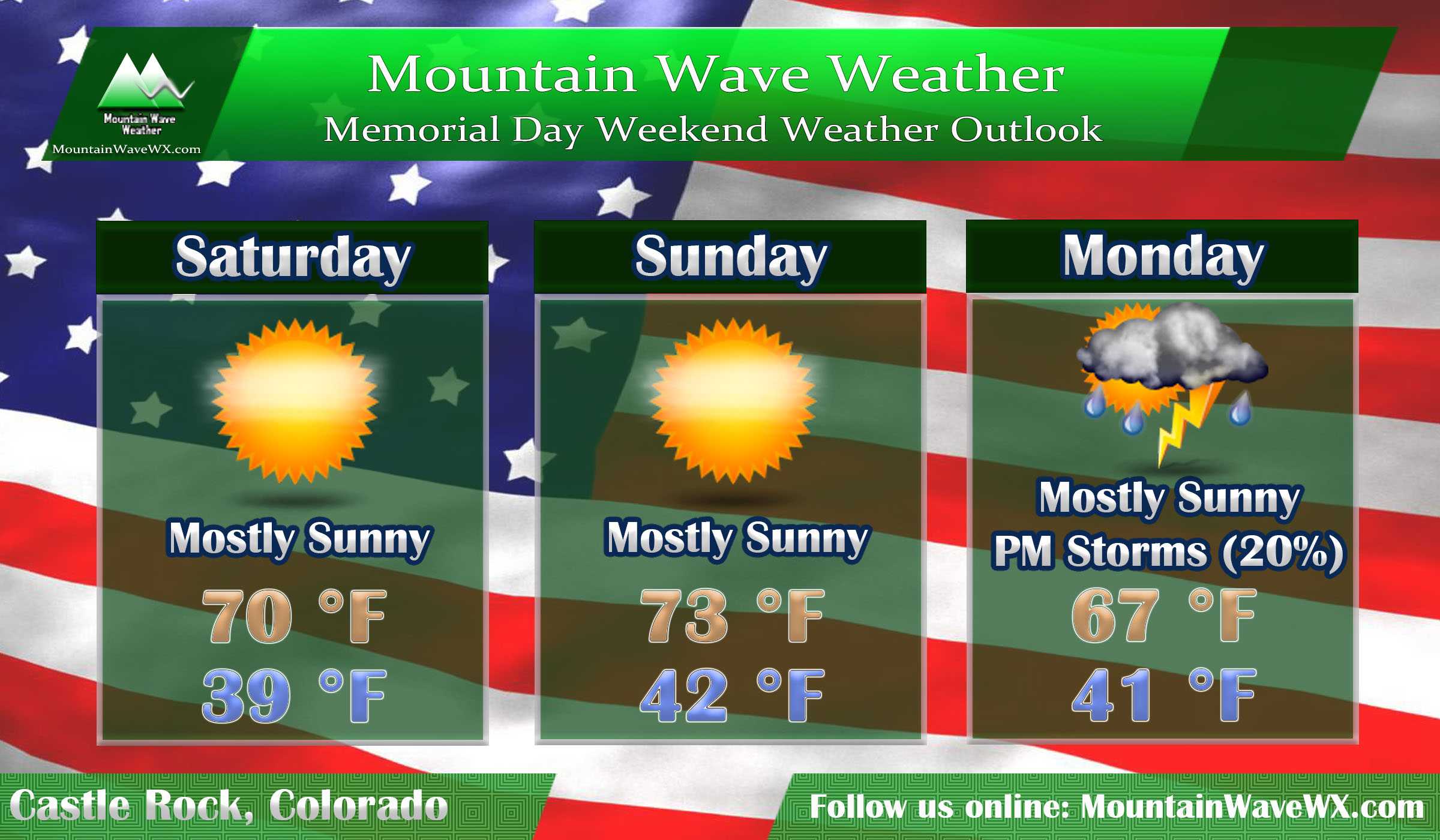

Memorial Day Weekend 2025 Date And Significance Of The Us Holiday

May 23, 2025

Memorial Day Weekend 2025 Date And Significance Of The Us Holiday

May 23, 2025 -

Is It Going To Rain In Nyc During Memorial Day Weekend

May 23, 2025

Is It Going To Rain In Nyc During Memorial Day Weekend

May 23, 2025 -

Memorial Day Weekend In Nyc Rain Forecast And Predictions

May 23, 2025

Memorial Day Weekend In Nyc Rain Forecast And Predictions

May 23, 2025 -

Nyc Memorial Day Weekend Weather Will It Rain

May 23, 2025

Nyc Memorial Day Weekend Weather Will It Rain

May 23, 2025