Bond Market Reaction: Powell's Remarks Dampen Rate Cut Speculation

Table of Contents

Powell's Hawkish Stance and its Implications

Powell's communication deviated from the more dovish tone anticipated by many market analysts. His statements strongly suggested a continued commitment to a tight monetary policy, even in the face of some softening economic indicators.

Key Phrases Signaling a Continued Tightening Policy:

Powell's press conference and subsequent interviews contained several key phrases that signaled a less dovish, more hawkish approach to monetary policy. These included:

- "Inflation remains too high.": This clear statement underscored the Fed's continued concern about inflation, even with recent declines in certain price indices.

- "Further rate hikes may be appropriate.": This phrase explicitly left the door open for additional interest rate increases, defying expectations of an imminent rate cut.

- "We are data-dependent, but we are not seeing sufficient evidence of disinflation.": This statement highlighted the Fed's commitment to observing incoming data, but also their unwillingness to pivot towards easing until stronger signs of disinflation emerge.

These statements, delivered during a post-FOMC press conference and subsequent interviews with major financial news outlets, significantly impacted market expectations. The overall context emphasized the Fed's determination to maintain its commitment to bringing inflation back down to its 2% target.

Impact on Inflation Expectations:

Powell's remarks directly impacted market sentiment regarding inflation. By emphasizing the persistence of inflationary pressures, he pushed back against expectations of a quick easing of monetary policy. This, in turn, influenced bond yields. Higher inflation expectations generally lead to higher bond yields, as investors demand a greater return to compensate for the erosion of purchasing power. Supporting this market outlook, recent CPI and PPI data, while showing a slight slowdown, still remained above the Fed's comfort zone.

Revised Projections for Future Rate Hikes:

Following Powell’s comments, market projections for future interest rate increases shifted significantly. The CME FedWatch Tool, a widely used gauge of market expectations for Fed policy, showed a marked increase in the probability of further rate hikes in the coming months. [Insert chart or graph illustrating changes in Fed rate hike probabilities from CME FedWatch Tool]. This visual representation clearly demonstrates the impact of Powell's communication on the market's outlook.

The Bond Market's Response: Increased Yields and Volatility

The bond market reacted swiftly to Powell's hawkish stance. This reaction was primarily characterized by increased yields and heightened volatility.

Yield Curve Movements:

The yield curve, which represents the difference in yields between bonds of different maturities, experienced noticeable changes following Powell's statements. A steeper yield curve, where longer-term yields are significantly higher than shorter-term yields, generally indicates expectations of stronger future economic growth. However, in this case the changes were more nuanced and depended on the specific segment of the yield curve observed. [Insert chart illustrating yield curve movements after Powell’s speech]. Analyzing these movements provides further insights into the market’s interpretation of Powell’s message and its implications.

Increased Bond Volatility:

Bond prices exhibited increased volatility in the days following Powell’s comments. This heightened volatility stemmed from the uncertainty created by the unexpected shift in the Fed's perceived trajectory. Investors, faced with less clarity about the future path of interest rates, engaged in more frequent trading, leading to larger price swings. This volatility impacted various bond types, including Treasury bonds and corporate bonds, although the impact varied depending on the credit rating and maturity of the bonds.

Flight to Safety or Risk-Off Sentiment?:

The market reaction wasn't a clear-cut "flight to safety." While some investors did move towards safer government bonds, a significant portion also exhibited risk-off sentiment, reducing overall exposure to riskier assets. This mixed reaction reflects the complexity of the situation and the varying interpretations of Powell’s statements among different investor groups.

Analysis of Long-Term Implications

The dampening of rate cut speculation carries significant long-term implications for the economy and financial markets.

Impact on Economic Growth:

Continued higher interest rates, as signaled by Powell, could negatively impact economic growth. Higher borrowing costs for businesses can stifle investment and expansion, leading to slower job creation and reduced consumer spending. The dampened expectations for rate cuts further solidify this potential economic slowdown.

Implications for Corporate Borrowing Costs:

Businesses will face higher borrowing costs as a result of the increased interest rates, making expansion and investment more expensive. This increased cost of capital can lead to reduced business activity and potentially slower economic growth.

Future Market Outlook and Predictions:

Predicting the future direction of interest rates and their impact on the bond market remains challenging. While Powell’s comments suggest a continued period of tighter monetary policy, the actual path will depend heavily on incoming economic data, including inflation figures and employment data. Significant unexpected economic changes could alter the Fed’s course. It's crucial to monitor economic indicators and central bank announcements closely.

Conclusion: Navigating the Bond Market After Powell's Remarks

In summary, Powell's hawkish remarks significantly impacted the bond market, leading to higher yields, increased volatility, and a dampening of rate cut speculation. Understanding the bond market reaction to central bank communications is crucial for investors. The long-term implications of this shift remain uncertain, but the potential impact on economic growth and corporate borrowing costs is significant. Staying informed about rate cut speculation and Federal Reserve decisions is essential for making sound investment choices in the bond market. Continue to monitor reputable financial news sources and economic data to make informed decisions and navigate the evolving bond market landscape effectively.

Featured Posts

-

Adam Sandler Met His Wife The Untold Story Behind Their On Screen Romance

May 12, 2025

Adam Sandler Met His Wife The Untold Story Behind Their On Screen Romance

May 12, 2025 -

Public Intervention During Ice Arrest Results In Disorder

May 12, 2025

Public Intervention During Ice Arrest Results In Disorder

May 12, 2025 -

Guardians Yankees Series Tracking Key Injuries April 21 23

May 12, 2025

Guardians Yankees Series Tracking Key Injuries April 21 23

May 12, 2025 -

Stallones Unmade Sequel A Crime Thriller That Could Have Been Terrible

May 12, 2025

Stallones Unmade Sequel A Crime Thriller That Could Have Been Terrible

May 12, 2025 -

New Family Film Review Anthony Mackie In An Unconventional Role

May 12, 2025

New Family Film Review Anthony Mackie In An Unconventional Role

May 12, 2025

Latest Posts

-

Rozselennya Romiv V Ukrayini Chiselnist Faktori Ta Geografiya

May 13, 2025

Rozselennya Romiv V Ukrayini Chiselnist Faktori Ta Geografiya

May 13, 2025 -

De Zhivut Romi V Ukrayini Kilkist Prichini Ta Detali

May 13, 2025

De Zhivut Romi V Ukrayini Kilkist Prichini Ta Detali

May 13, 2025 -

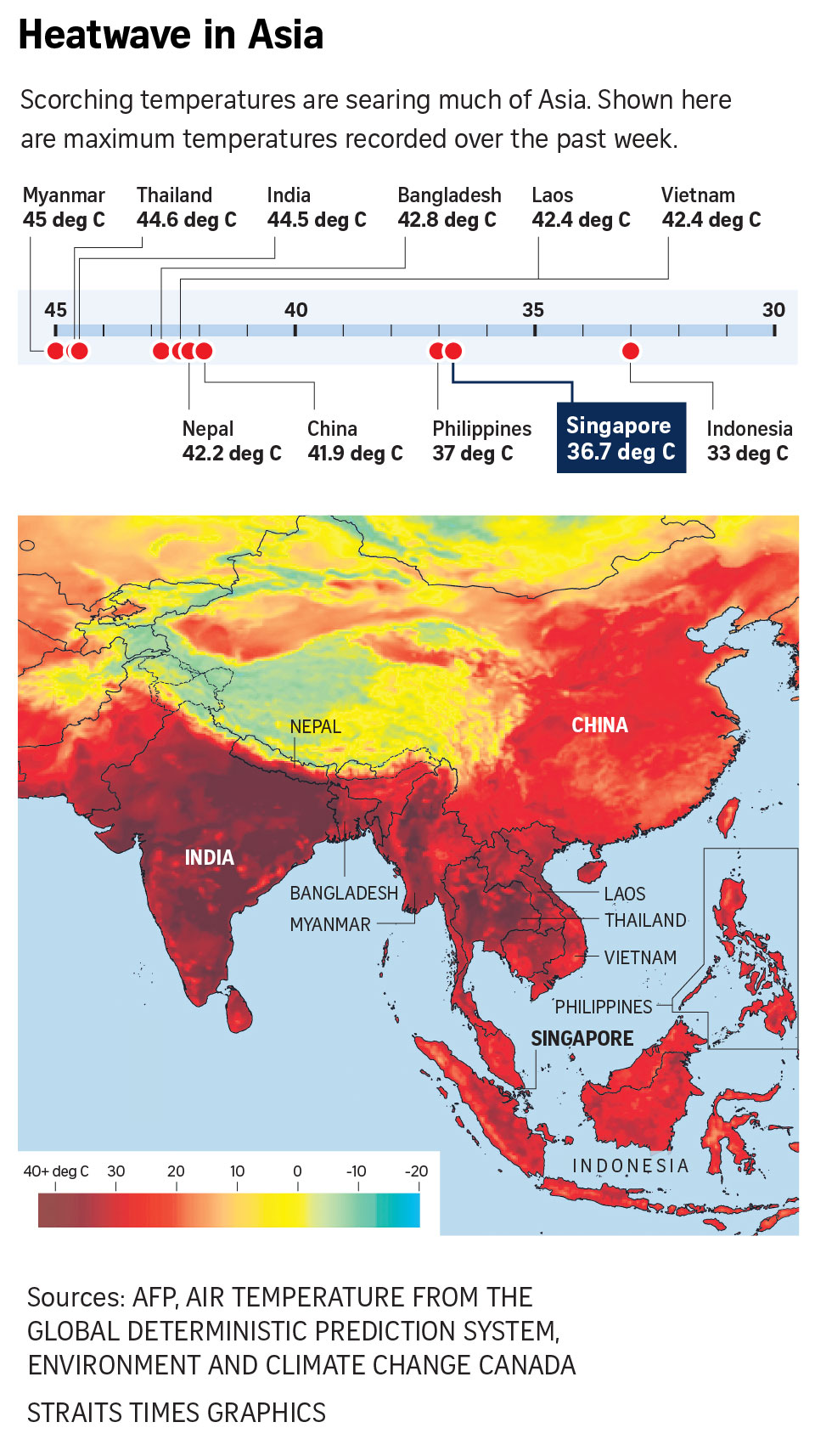

Southern California Scorched Record Breaking Heat In La And Orange Counties

May 13, 2025

Southern California Scorched Record Breaking Heat In La And Orange Counties

May 13, 2025 -

Government Of India Issues Heatwave Advisory To States

May 13, 2025

Government Of India Issues Heatwave Advisory To States

May 13, 2025 -

Heatwave Emergency Record Breaking Temperatures In La And Orange Counties

May 13, 2025

Heatwave Emergency Record Breaking Temperatures In La And Orange Counties

May 13, 2025