BOJ Trims Economic Forecast: Global Trade Disputes Take Toll

Table of Contents

Revised Growth Projections: A Closer Look

The BOJ's latest BOJ Growth Forecast paints a concerning picture for Japan's economic prospects. The magnitude of the downward revision is substantial, reflecting a significant shift in the economic outlook. For instance, the initial projection for GDP growth in fiscal year 2023 might have been 1.5%, but the revised BOJ Growth Forecast now stands at 1.0% or even lower, depending on the specific report. This adjustment isn't isolated; it's a continuation of a trend observed in previous forecasts.

- Original growth projection vs. revised projection: A clear divergence exists between the initial optimistic projections and the more pessimistic revised figures, highlighting the deteriorating economic conditions.

- Specific sectors most affected: The export-oriented sectors, particularly manufacturing and automotive, are bearing the brunt of the slowdown. Weakening global demand directly impacts these industries.

- Comparison to previous forecast revisions: This latest revision represents a more significant downward adjustment compared to previous forecast revisions, signifying a heightened level of concern within the BOJ.

- Changes to inflation forecasts: The revised BOJ Economic Forecast likely includes a corresponding adjustment to inflation projections, reflecting the dampening effect of slower growth on price pressures. Lower growth often correlates with lower inflation.

Impact of Global Trade Disputes

The primary driver behind the downward revision of the BOJ Economic Forecast is the escalating impact of global trade disputes, particularly the protracted US-China trade war. These Trade Disputes have created significant headwinds for the Japanese economy, impacting both exports and investment. The keyword here is the significant ripple effect of these disputes.

- Disruption of supply chains: Trade tensions have disrupted global supply chains, leading to increased costs and uncertainties for Japanese businesses. This uncertainty directly translates into lower investment and production.

- Decreased demand for Japanese goods: Reduced global demand, fueled by trade uncertainty, has significantly impacted exports. Key export markets are experiencing slower growth, directly impacting Japanese businesses relying on foreign markets.

- Impact on specific industries: Industries heavily reliant on exports, such as automotive and electronics, have been disproportionately affected by the decline in global demand and supply chain disruptions.

- Retaliatory tariffs: Japan itself has faced retaliatory tariffs from other countries, further adding to the economic challenges faced by Japanese exporters.

BOJ's Policy Response

In light of the weakened economic outlook, the BOJ's policy response will be crucial in shaping the future trajectory of the Japanese economy. The question many are asking is: Will the BOJ maintain or adjust its current BOJ Monetary Policy? The current tools at their disposal include negative interest rates and Quantitative Easing.

- Analysis of current monetary policy tools: The effectiveness of these existing tools is increasingly being questioned, especially given the prolonged period of low growth. The limitations of monetary policy alone are becoming apparent.

- Possibility of further easing measures: Further easing measures, potentially involving deeper negative interest rates or expanded quantitative easing programs, may be considered to stimulate economic activity.

- Limitations of monetary policy: Addressing structural economic challenges requires more than just monetary policy. Fiscal policy coordination with the Japanese government will likely be necessary for a comprehensive solution.

- Fiscal policy coordination: The possibility of coordinated fiscal stimulus measures from the Japanese government, working in tandem with the BOJ's monetary policy, might offer a more effective approach to economic recovery.

Alternative Perspectives and Future Outlook

The severity of the situation and the potential for recovery are subjects of ongoing debate among experts. Differing opinions exist regarding the Japan Economic Outlook and the potential for Future Economic Growth. A balanced perspective is vital when considering the various forecasts.

- Views from economists and financial analysts: Economists and financial analysts offer a wide range of views, reflecting the inherent uncertainties in the global economic landscape. Some are more optimistic about a swift recovery, while others foresee a prolonged period of sluggish growth.

- Potential catalysts for economic recovery: Resolution of trade disputes, coupled with domestic stimulus measures, could potentially act as catalysts for economic recovery. However, the timing and effectiveness of such measures remain uncertain.

- Risks and uncertainties: Significant risks and uncertainties remain, including the persistence of trade tensions, geopolitical risks, and potential unforeseen economic shocks. These uncertainties make precise forecasting extremely difficult.

- Long-term implications: The long-term implications for the Japanese economy depend largely on the effectiveness of policy responses and the resolution of global trade uncertainties. A protracted period of slow growth could have significant consequences for Japan's long-term economic trajectory.

Conclusion

The BOJ's recent downward revision of its economic forecast underscores the significant negative impact of escalating global trade disputes on the Japanese economy. The weakening of global demand and the uncertainty surrounding international trade relations present substantial challenges. While the BOJ might consider further monetary easing, the effectiveness of such measures in addressing underlying structural issues is questionable. Fiscal policy coordination is increasingly likely to play a vital role in fostering economic recovery. Stay informed on the evolving situation by regularly checking for updates on the BOJ's economic forecasts and analysis of the impact of global trade disputes on the Japanese economy. Understanding the nuances of the BOJ Economic Forecast is crucial for effectively navigating the complex dynamics of the global financial landscape.

Featured Posts

-

Is Reform Uk On The Brink Five Reasons For Worry

May 03, 2025

Is Reform Uk On The Brink Five Reasons For Worry

May 03, 2025 -

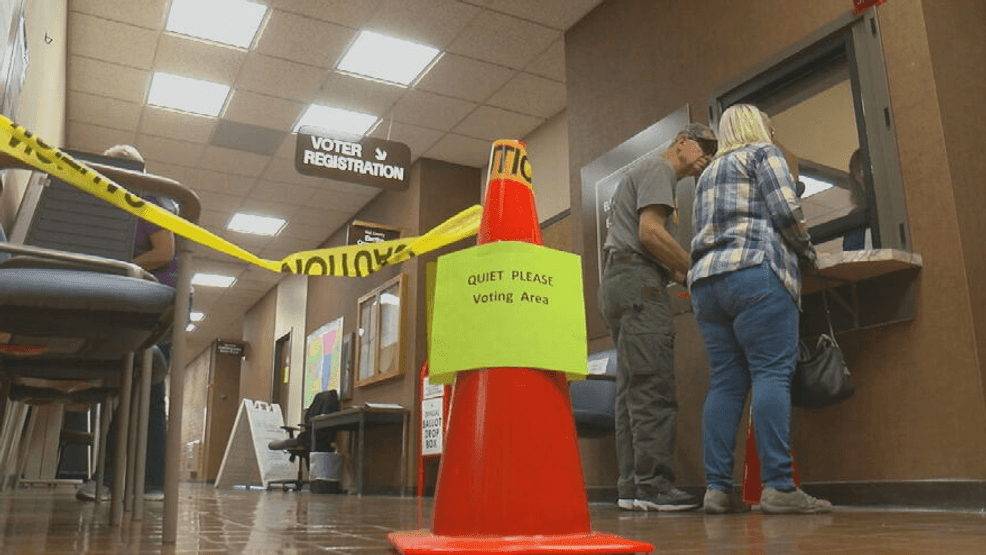

What The Florida And Wisconsin Election Turnout Reveals About The Political Climate

May 03, 2025

What The Florida And Wisconsin Election Turnout Reveals About The Political Climate

May 03, 2025 -

Is Milwaukees Rental Market Too Competitive

May 03, 2025

Is Milwaukees Rental Market Too Competitive

May 03, 2025 -

Joseph Tf 1 Decryptage De La Serie La Creme De La Crim

May 03, 2025

Joseph Tf 1 Decryptage De La Serie La Creme De La Crim

May 03, 2025 -

La Visite De Trump Et Macron Au Vatican Contexte Et Consequences

May 03, 2025

La Visite De Trump Et Macron Au Vatican Contexte Et Consequences

May 03, 2025