BofA's View: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale Behind a Positive Market Outlook

BofA's positive market outlook isn't based on blind optimism; it's rooted in a thorough analysis of several key economic and financial factors.

Strong Corporate Earnings & Future Projections

BofA's analysts forecast robust corporate earnings growth for the coming quarters. Their projections are supported by:

- Strong performance in key sectors: Technology, healthcare, and consumer staples are expected to show significant earnings per share (EPS) growth, driven by strong demand and innovation.

- Improving profit margins: Many companies are demonstrating an ability to manage costs effectively, leading to improved profit margins despite inflationary pressures.

- Positive economic indicators: Sustained GDP growth, coupled with healthy consumer spending, provides a solid foundation for continued corporate profitability. BofA points to the resilience of the labor market as a key supporting factor.

These positive economic indicators, such as robust consumer spending and continued GDP growth, underpin BofA's confidence in strong corporate earnings.

The Impact of Low Interest Rates and Monetary Policy

The current low-interest-rate environment, while potentially evolving, continues to play a significant role in supporting stock valuations. BofA's analysis highlights:

- Stimulative monetary policy: While central banks are adjusting their policies, the lingering effects of previous quantitative easing continue to provide liquidity in the market, supporting asset prices.

- Attractive yields relative to bonds: Compared to the relatively low yields offered by bonds, equities still present a more attractive return potential for many investors.

- Impact of Federal Reserve actions: The Federal Reserve's actions, while focused on managing inflation, are being carefully considered by BofA in their outlook. Their analysis incorporates potential scenarios resulting from interest rate adjustments.

BofA acknowledges the potential shifts in monetary policy but considers the current landscape, including the impact of quantitative easing and interest rate differentials, to be supportive, at least in the near-to-medium term.

Addressing Inflation Concerns and their Limited Impact

Inflation remains a key concern for investors, but BofA's analysis suggests its impact on stock valuations may be less severe than initially feared.

- Corporate ability to manage inflation: Many companies have demonstrated a capacity to pass on increased costs to consumers or implement efficiency measures to mitigate the effects of inflation.

- BofA's inflation forecasts: While inflation is expected to remain elevated for some time, BofA's forecasts suggest a gradual decline, limiting its long-term impact on earnings growth.

- Inflation hedging strategies: Companies are employing various strategies to hedge against inflation, including price adjustments and operational efficiencies, which mitigate risks.

BofA acknowledges inflation as a factor but believes that corporate strategies and a potential easing of inflationary pressures lessen its overall negative impact on stock valuations.

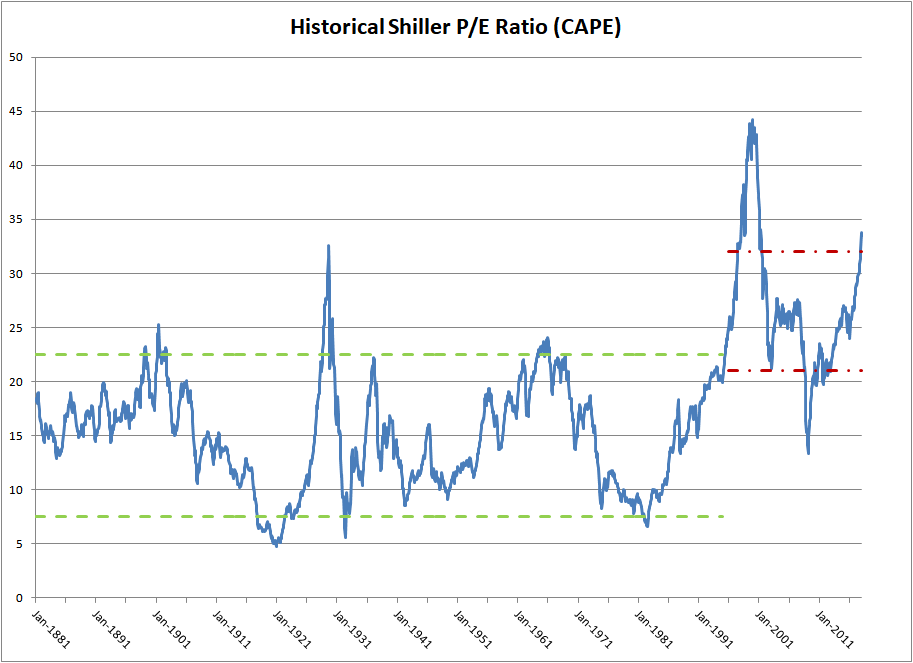

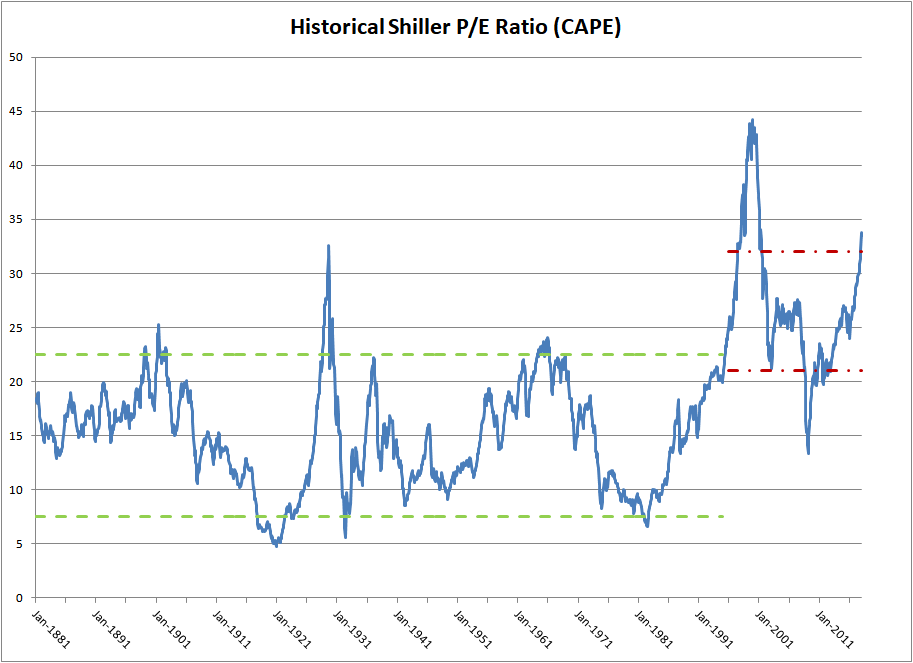

Understanding Current Valuation Metrics

It’s crucial to approach stock market valuations with a holistic perspective, moving beyond simplistic metrics.

Beyond P/E Ratios: A Broader Perspective

Relying solely on Price-to-Earnings (P/E) ratios can be misleading. BofA advocates for a more comprehensive approach, using multiple valuation metrics:

- PEG ratio: This considers the P/E ratio in relation to the company's expected growth rate, providing a more nuanced picture of valuation.

- Price-to-Sales ratio (P/S): Useful for valuing companies with negative earnings or those in high-growth industries.

- Market Multiples: Analysis of industry-specific valuation multiples allows for better benchmarking and comparison between companies.

A more comprehensive approach to valuation considers multiple factors, incorporating long-term growth potential into the assessment.

Considering Long-Term Growth Potential

BofA's analysis emphasizes the significance of long-term growth prospects in determining current valuations.

- Promising sectors: Sectors like renewable energy and technology continue to offer significant long-term growth potential, justifying seemingly higher valuations.

- Future growth potential: BofA incorporates projected future growth in their valuation models, leading to a more optimistic assessment than a purely short-term view might suggest.

- Sustainable growth: The emphasis is on long-term sustainable growth, not short-term market fluctuations.

Focusing on long-term growth potential provides a more balanced and accurate assessment of current valuations.

Managing Risk in the Current Market

Even with a positive outlook, managing risk remains paramount.

BofA's Recommended Diversification Strategies

BofA recommends a well-diversified investment portfolio as a key risk management tool:

- Asset allocation: Strategic allocation across different asset classes (stocks, bonds, real estate) reduces portfolio volatility.

- Geographic diversification: Spreading investments across different geographical markets mitigates risks associated with specific regional economic downturns.

- Sector diversification: Diversification across various industry sectors reduces the impact of underperformance in any single sector.

These strategies help to mitigate potential downside risks, making the portfolio more resilient to market fluctuations.

The Importance of a Long-Term Investment Horizon

Maintaining a long-term investment horizon is crucial for weathering short-term market volatility:

- Market volatility: Short-term market fluctuations are to be expected and should not dictate long-term investment decisions.

- Buy and hold strategy: A disciplined buy-and-hold strategy, combined with regular rebalancing, can help investors achieve their long-term financial goals.

- Ignoring short-term noise: Focus should be on the underlying fundamentals and long-term growth prospects rather than reacting to daily market noise.

Conclusion

This article summarized BofA's optimistic view on the current stock market valuations, highlighting their reasoning based on strong corporate earnings, favorable (though evolving) monetary policy, and a nuanced understanding of inflation and valuation metrics. BofA emphasizes the importance of a long-term perspective and strategic portfolio diversification to navigate market fluctuations effectively. Don't let fluctuating stock market valuations deter your investment strategy. Understand BofA's perspective and learn how you can leverage their insights to make informed decisions about your investments. Consult with a financial advisor to build a robust portfolio aligned with your long-term financial goals and manage your investment risk effectively within the context of BofA's stock market valuation analysis. Remember, a well-considered long-term investment strategy, incorporating BofA's insights, can help you navigate the complexities of stock market valuations.

Featured Posts

-

Damen Csd 650 Engineer Soltan Kazimovs Successful Launch

Apr 26, 2025

Damen Csd 650 Engineer Soltan Kazimovs Successful Launch

Apr 26, 2025 -

Philippine Banking Ceos Dire Prediction Prepare For Economic Downturn

Apr 26, 2025

Philippine Banking Ceos Dire Prediction Prepare For Economic Downturn

Apr 26, 2025 -

Dont Miss Out Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest In April

Apr 26, 2025

Dont Miss Out Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest In April

Apr 26, 2025 -

20 2025 3 17

Apr 26, 2025

20 2025 3 17

Apr 26, 2025 -

Colgates Sales And Profits Fall 200 Million Tariff Impact

Apr 26, 2025

Colgates Sales And Profits Fall 200 Million Tariff Impact

Apr 26, 2025

Latest Posts

-

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025 -

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025 -

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025 -

Thursday Night Football Nfl Drafts First Round Begins In Green Bay

Apr 26, 2025

Thursday Night Football Nfl Drafts First Round Begins In Green Bay

Apr 26, 2025 -

Will Ahmed Hassanein Break Barriers As Egypts First Nfl Draft Selection

Apr 26, 2025

Will Ahmed Hassanein Break Barriers As Egypts First Nfl Draft Selection

Apr 26, 2025