BofA's View: Why Current Stock Market Valuations Are Not A Threat

Table of Contents

BofA's Rationale: Strong Corporate Earnings and Economic Growth

BofA's optimistic outlook on stock market valuations is primarily rooted in two fundamental pillars: robust corporate profitability and sustained economic expansion. These factors, according to BofA's analysis, effectively counterbalance concerns about potentially high valuations.

Robust Corporate Profitability

BofA's assessment highlights remarkably strong corporate earnings and profit margins across numerous sectors. This robust performance, they argue, underpins the current valuation levels.

- Examples of Strong Performing Sectors: The technology sector, fueled by ongoing digital transformation and cloud computing adoption, has shown exceptional earnings growth. Similarly, the healthcare sector, driven by aging populations and advancements in medical technology, continues to demonstrate strong profit margins. The energy sector has also experienced a significant upswing due to increased global demand.

- Specific Companies Cited by BofA: While BofA's specific company mentions might vary depending on their latest reports, their analysis typically highlights companies demonstrating consistent revenue growth and efficient cost management, leading to impressive profit margins. These are often leaders within their respective sectors, exhibiting exceptional earnings growth.

- Projected Future Earnings Growth: BofA's projections often forecast continued earnings growth across many sectors, driven by innovation, expanding markets, and ongoing economic expansion. This anticipated future growth is a key element in their valuation assessment. These projections generally factor in macroeconomic conditions and industry-specific trends.

Sustained Economic Expansion

BofA's positive outlook on stock market valuations is further strengthened by their assessment of sustained economic expansion. While acknowledging potential headwinds, they believe the underlying economic fundamentals support continued growth.

- Key Economic Indicators Supporting the Positive Outlook: BofA's analysis often points to positive indicators such as strong consumer spending, low unemployment rates, and rising business investment. These factors contribute to their confidence in continued economic growth. They typically consider data from various sources, including government reports and private sector analyses.

- BofA's Forecast for GDP Growth: Their economic forecasts generally predict continued, albeit potentially moderated, GDP growth, indicating a healthy economic environment. These forecasts are dynamic and regularly updated to reflect current economic data and market conditions.

- Discussion of Inflation and Interest Rates and Their Impact on Valuations: While inflation and interest rate fluctuations are acknowledged as potential headwinds, BofA often argues that their impact on valuations is manageable within the context of strong corporate earnings and sustained economic expansion. They carefully analyze the interplay of these factors to assess their overall effect.

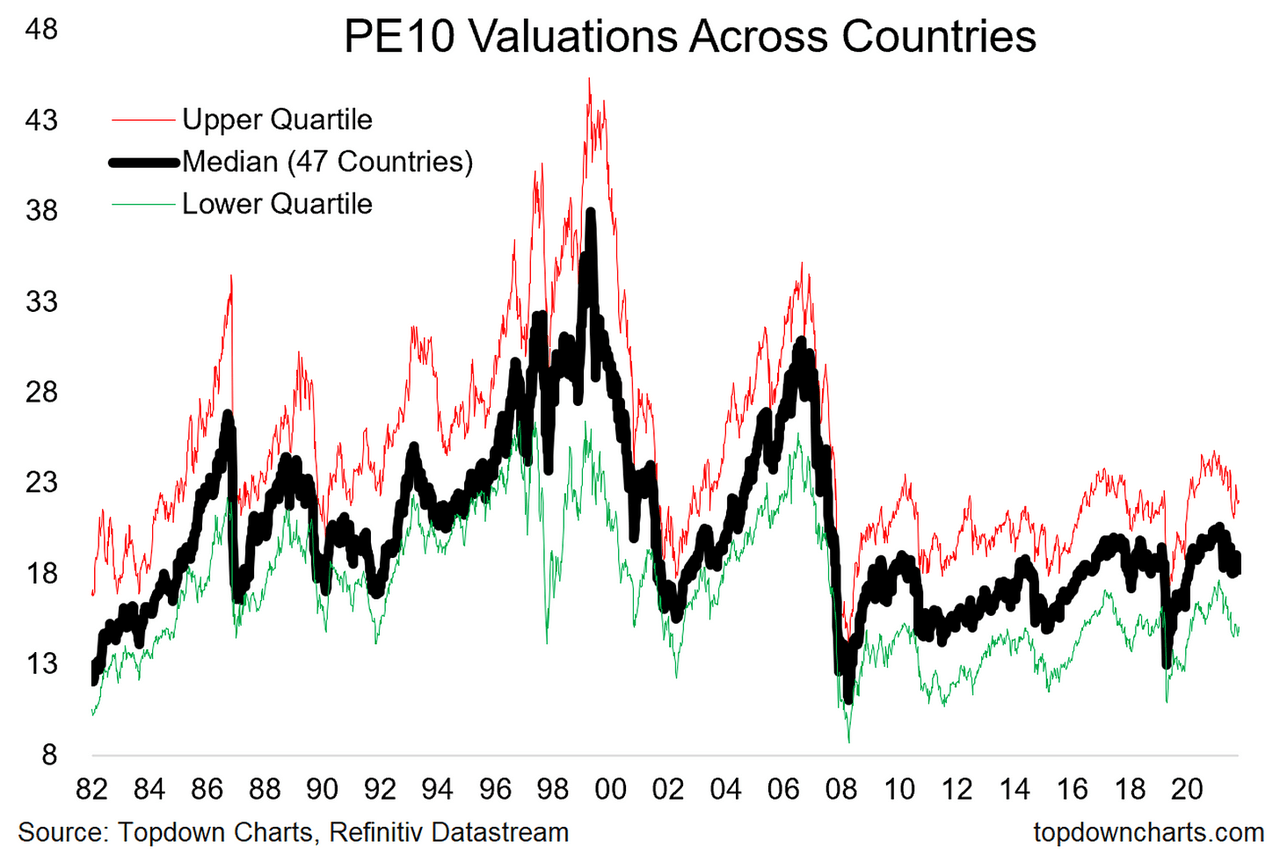

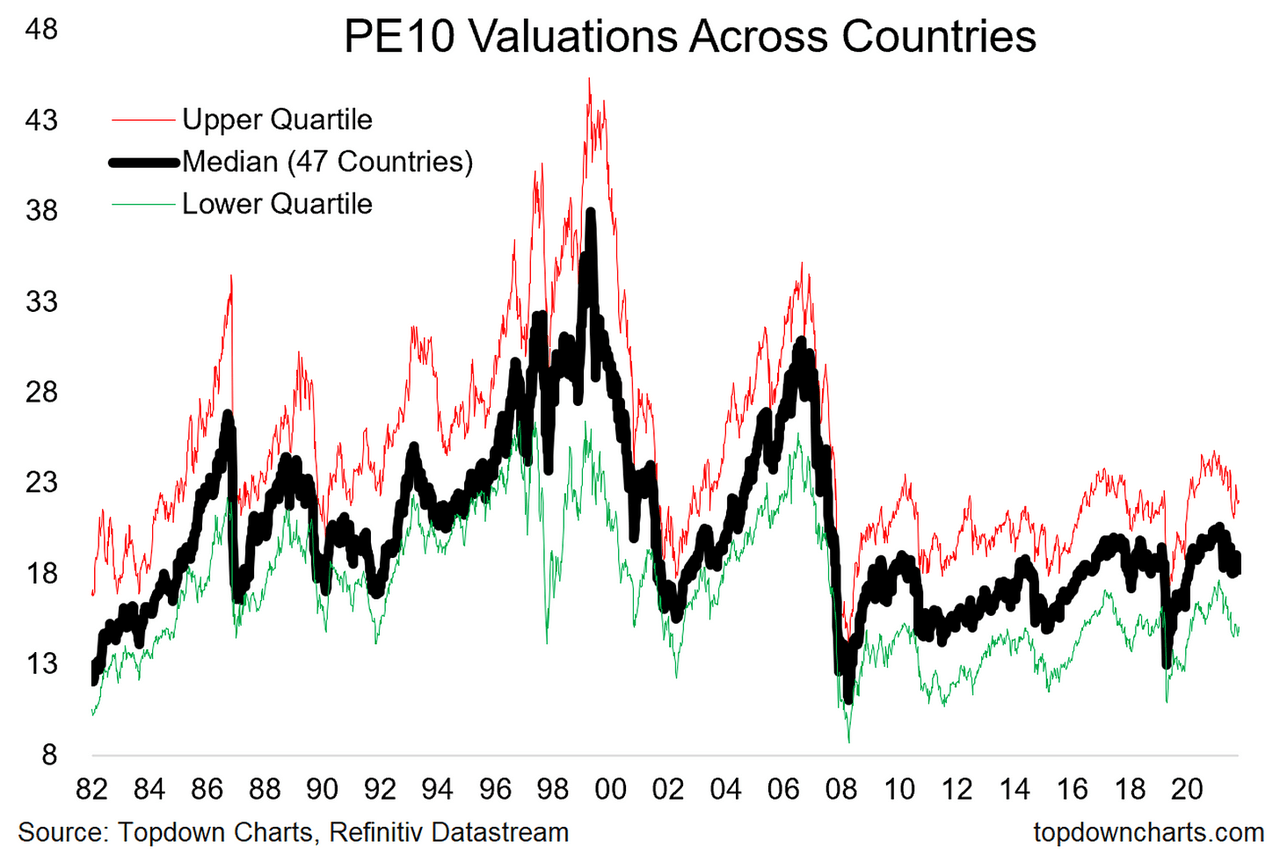

Re-evaluating Valuation Metrics: Beyond Traditional PE Ratios

BofA's analysis goes beyond simply relying on traditional Price-to-Earnings (P/E) ratios to assess stock market valuations. They highlight the limitations of such metrics in the current economic climate and advocate for a more nuanced approach.

The Limitations of Traditional Valuation Metrics

Using solely P/E ratios can be misleading, particularly when considering companies with high growth potential. Low interest rates and the prospect of robust future earnings growth can justify seemingly high P/E ratios.

- Specific Examples of Companies with Seemingly High P/E Ratios but Strong Growth Prospects: BofA’s analysis may cite specific examples of companies in high-growth sectors, such as technology or pharmaceuticals, that have seemingly high P/E ratios but strong projected future earnings growth. These cases highlight the limitations of relying on P/E ratios alone.

- Discussion of Alternative Valuation Metrics (e.g., PEG ratio, discounted cash flow analysis): BofA's analyses often incorporate alternative valuation metrics like the Price/Earnings to Growth (PEG) ratio and discounted cash flow (DCF) analysis to provide a more comprehensive picture. These methods account for future earnings growth and provide a more holistic evaluation of a company's true value.

The Importance of Considering Future Growth Potential

BofA emphasizes the crucial role of long-term growth potential in assessing stock market valuations. Their analysis focuses on future earnings projections to determine whether current valuations are justified.

- BofA's Projections for Future Earnings Growth: BofA's optimistic view is underpinned by their projections for continued earnings growth across various sectors. These projections often incorporate technological advancements and anticipated market expansion.

- Discussion of Technological Advancements and Their Impact on Long-Term Growth: BofA recognizes the transformative power of technology in driving long-term growth, impacting multiple sectors. This factor is central to their future earnings projections.

- Mention of Specific Sectors with High Growth Potential: BofA likely highlights specific sectors poised for significant growth in the coming years, reinforcing their positive outlook on overall valuations.

Addressing Potential Risks: A Balanced Perspective

While presenting a generally optimistic view, BofA acknowledges potential risks and market volatility. This balanced perspective is crucial for a responsible assessment of stock market valuations.

Acknowledging Market Volatility

BofA recognizes the inherent volatility of the stock market and acknowledges various potential risks. However, they emphasize that these risks are not sufficient to negate the positive outlook supported by strong fundamentals.

- Mention Specific Risks (e.g., geopolitical uncertainty, inflation concerns): BofA's analysis will likely acknowledge risks like geopolitical uncertainty, escalating inflation, and potential supply chain disruptions. However, they likely address these as manageable within their overall assessment.

- Counterbalance Each Risk with BofA's Reasoning for Why It's Manageable: For each identified risk, BofA would likely present reasons why it's either manageable or already factored into their broader assessment. This could involve specific strategies or anticipated mitigating factors.

BofA's Risk Management Strategies

BofA likely suggests risk mitigation strategies to help investors navigate market uncertainty. These strategies emphasize a long-term approach and prudent risk management.

- Diversification Strategies: Diversification across asset classes and sectors is a key element of managing risk. BofA likely recommends a well-diversified portfolio to mitigate the impact of any single sector's underperformance.

- Long-Term Investment Horizons: BofA likely emphasizes the importance of a long-term investment strategy, allowing investors to ride out short-term market fluctuations.

- Considering Risk Tolerance: Understanding and aligning investment strategies with individual risk tolerance is essential for prudent investment decision-making.

Conclusion

In summary, BofA's analysis suggests that current stock market valuations, while seemingly high based on traditional metrics, are not necessarily a significant threat. Their positive outlook is grounded in robust corporate earnings, sustained economic growth, and a forward-looking perspective that considers future growth potential. While acknowledging inherent market volatility and potential risks, BofA’s assessment emphasizes the manageable nature of these factors in light of the prevailing economic strengths. To effectively assess stock market valuations and make informed investment decisions, understanding BofA's perspective, along with conducting your own thorough research and consulting with a financial advisor, is crucial. Consider consulting relevant BofA resources for further insights into understanding stock market valuations and developing a sound investment strategy.

Featured Posts

-

Ofilis Strong Showing Third Place Finish At 100 000 Grand Slam Track Event

May 11, 2025

Ofilis Strong Showing Third Place Finish At 100 000 Grand Slam Track Event

May 11, 2025 -

Tres Toros Uruguayos Viajan A China Como Regalo A Xi Jinping

May 11, 2025

Tres Toros Uruguayos Viajan A China Como Regalo A Xi Jinping

May 11, 2025 -

Jessica Simpson Credits Ex Husband For New Music

May 11, 2025

Jessica Simpson Credits Ex Husband For New Music

May 11, 2025 -

Whoop Backlash Users Furious Over Broken Free Upgrade Promises

May 11, 2025

Whoop Backlash Users Furious Over Broken Free Upgrade Promises

May 11, 2025 -

North Dakota Health Officials Quarantine Unvaccinated Students Due To Measles

May 11, 2025

North Dakota Health Officials Quarantine Unvaccinated Students Due To Measles

May 11, 2025