BofA's View: Understanding And Managing High Stock Market Valuations

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

Valuation Metrics Used by BofA

BofA, like other major financial institutions, employs a range of valuation metrics to gauge the overall health and potential risks within the stock market. These metrics provide a more comprehensive picture than relying on a single indicator. Key metrics likely used by BofA include:

-

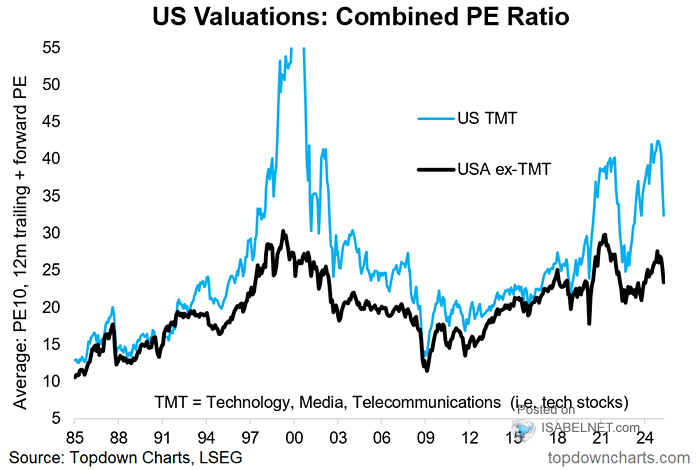

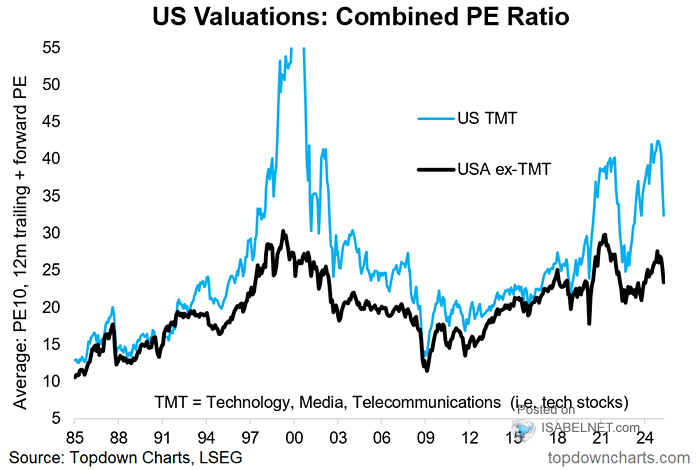

Price-to-Earnings Ratio (P/E Ratio): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. BofA likely tracks the average P/E ratio across the broader market to assess overall valuation levels.

-

Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out short-term earnings fluctuations by using a 10-year average of inflation-adjusted earnings. It offers a longer-term perspective on valuation, helping to identify potential bubbles or undervaluations.

-

Price-to-Sales Ratio (P/S Ratio): This compares a company's market capitalization to its revenue. It's useful for valuing companies with negative earnings or those in high-growth sectors where earnings may not accurately reflect future potential.

-

Other Metrics: BofA likely also considers other metrics, such as dividend yield, price-to-book ratio, and various growth metrics, to arrive at a holistic assessment of market valuations. Accessing specific data points from recent BofA reports requires subscription to their research services.

BofA's View on Overvaluation Concerns

BofA's stance on whether current high stock market valuations are justified is nuanced and likely evolves with changing market conditions. Their analysis considers several key factors:

-

Interest Rates: Rising interest rates can impact stock valuations by increasing the cost of borrowing for companies and making bonds a more attractive investment alternative. BofA’s assessment of interest rate trajectories significantly influences their view on stock market analysis.

-

Economic Growth Projections: Strong economic growth generally supports higher valuations, while slowing growth can lead to downward pressure on stock prices. BofA's economic forecasts are crucial in shaping their valuation assessments.

-

Corporate Earnings Expectations: Future earnings growth is a key driver of stock prices. If BofA anticipates strong earnings growth, it might justify higher valuations. Conversely, disappointing earnings expectations could lead to market corrections.

-

Geopolitical Factors: Global events and uncertainty can significantly influence market sentiment and valuations. BofA’s analysis incorporates these factors into their overall assessment.

While BofA may express concerns about overvaluation in specific sectors or segments of the market, their overall view might be less definitive due to the complexities and interconnectedness of global economic factors. Any caveats or uncertainties in their analysis will likely be explicitly stated in their official reports and presentations.

Strategies for Managing Investments During High Stock Market Valuations

Diversification Strategies

Diversification is paramount when dealing with high stock market valuations. Spreading investments across different asset classes reduces the overall risk of significant losses in any single asset.

-

Bonds: Bonds generally offer lower returns than stocks but also lower risk, serving as a ballast in a portfolio during market downturns.

-

Real Estate: Real estate can provide diversification and potentially inflation-hedging benefits. However, liquidity can be a concern.

-

Commodities: Commodities like gold or oil can offer diversification and a hedge against inflation, but their prices can be volatile.

-

International Diversification: Investing in international markets can reduce portfolio volatility, as different markets often react differently to economic events.

Risk Management Techniques

In a potentially overvalued market, implementing robust risk management techniques is vital:

-

Stop-Loss Orders: These automatically sell a stock when it reaches a predetermined price, limiting potential losses.

-

Hedging Strategies: These involve using financial instruments to offset potential losses in a specific investment. Examples include put options or short selling.

-

Adjusting Portfolio Allocation: Rebalancing the portfolio to reduce exposure to higher-risk assets, such as growth stocks, may be advisable.

The appropriate risk management techniques will depend on an investor's risk tolerance and investment goals. Conservative investors might prioritize capital preservation, while more aggressive investors may accept higher risk for potentially higher returns.

Sector-Specific Opportunities

Even during periods of high stock market valuations, some sectors might be relatively undervalued or less susceptible to market corrections. BofA's research might identify such opportunities.

-

Defensive Sectors: Sectors like consumer staples, healthcare, and utilities tend to be less sensitive to economic cycles and might offer relative stability during market downturns.

-

Value Stocks: Stocks trading at lower valuations relative to their fundamentals might offer attractive entry points, but thorough due diligence is essential.

-

Emerging Markets: Emerging markets can present high-growth opportunities, but they also come with greater risks.

BofA's Outlook and Potential Future Market Scenarios

BofA's Market Predictions

BofA's market predictions are not static; they adapt to changing economic conditions and new data. However, they might forecast several potential scenarios:

-

Bull Market Continuation: Continued economic growth and corporate earnings could support higher stock prices.

-

Market Correction: A temporary pullback in prices, followed by a resumption of the upward trend.

-

Bear Market: A prolonged period of declining prices, potentially triggered by economic recession or major geopolitical events.

BofA's predictions will be supported by their extensive economic forecasts and research, incorporating factors like inflation, unemployment rates, and central bank policies.

Implications for Investors

BofA's outlook should inform investment decisions and portfolio adjustments.

-

Portfolio Adjustments: Based on BofA's forecast, investors might adjust their asset allocation, shifting towards more conservative investments if a market correction or bear market is anticipated.

-

Investment Timing: BofA's insights might influence investment timing, potentially suggesting a more cautious approach or identifying potential buying opportunities during market dips.

-

Ongoing Monitoring: Regularly reviewing and adjusting the investment strategy in line with changing market conditions and BofA's updated forecasts is crucial for long-term success.

Conclusion

Understanding and managing high stock market valuations is crucial for long-term investment success. BofA's insights, while not providing definitive predictions, offer valuable guidance for navigating the complexities of the current market. Their assessment of various valuation metrics, combined with their suggested diversification and risk management strategies, can help investors build resilient portfolios. By incorporating BofA's insights and developing a well-informed investment strategy, you can navigate the complexities of the current market landscape and achieve your financial goals. Remember to conduct your own thorough research and, if needed, seek professional financial advice to create an investment plan tailored to your individual risk tolerance and financial objectives. Don't hesitate to regularly review your approach to managing high stock market valuations to ensure your portfolio remains aligned with your long-term goals.

Featured Posts

-

Amber Heards Twins The Elon Musk Fatherhood Rumors Explained

May 30, 2025

Amber Heards Twins The Elon Musk Fatherhood Rumors Explained

May 30, 2025 -

Is Jacob Alon The Next Big Thing

May 30, 2025

Is Jacob Alon The Next Big Thing

May 30, 2025 -

Setlist Fm Y Ticketmaster Una Integracion Para Mejorar La Experiencia Del Fan

May 30, 2025

Setlist Fm Y Ticketmaster Una Integracion Para Mejorar La Experiencia Del Fan

May 30, 2025 -

Orden Ejecutiva De Trump El Fin De La Reventa Abusiva De Boletos Por Ticketmaster

May 30, 2025

Orden Ejecutiva De Trump El Fin De La Reventa Abusiva De Boletos Por Ticketmaster

May 30, 2025 -

Taylor Swift Ticket Sales Ticketmaster Updates Queue System

May 30, 2025

Taylor Swift Ticket Sales Ticketmaster Updates Queue System

May 30, 2025