BofA's Reassurance: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Bullish Outlook and its Underlying Rationale

BofA has recently issued positive market predictions, defying the widespread anxiety surrounding stretched stock market valuations. Their bullish outlook rests on several key pillars:

-

Strong Corporate Earnings Despite Economic Headwinds: Despite persistent inflation and geopolitical uncertainty, many companies have reported surprisingly robust earnings. This resilience demonstrates the underlying strength of the economy and corporate profitability. BofA analysts highlight the adaptability and efficiency improvements many firms have implemented, allowing them to navigate challenging conditions.

-

Resilience of the Consumer: Consumer spending remains relatively strong, defying expectations of a significant economic slowdown. This indicates continued consumer confidence and a robust demand for goods and services, supporting corporate revenue growth. BofA's research points to a healthy employment market and accumulated savings as contributing factors.

-

Positive Long-Term Growth Prospects: BofA emphasizes the long-term growth potential of the US economy and the global markets. Technological advancements, particularly in areas like artificial intelligence and renewable energy, are expected to drive significant future growth. This potential for innovation justifies, in part, the current higher valuations.

-

Specific Sectors Poised for Growth: BofA's analysts have identified specific sectors, such as technology, healthcare, and renewable energy, as particularly well-positioned for growth in the coming years. These sectors are expected to benefit from long-term trends and technological innovation, thus contributing to overall market strength.

-

Referenced BofA Reports and Analysts: These insights are drawn from various BofA Global Research reports and analyses, including [Insert specific report titles and analyst names here if available]. Accessing these reports can offer a deeper dive into BofA's rationale.

Addressing the "High Valuations" Concern

It's undeniable that many stocks trade at high Price-to-Earnings (P/E) ratios and other valuation metrics, fueling investor concerns about stretched stock market valuations. However, several factors mitigate this concern:

-

Low Interest Rates Justify Higher Valuations: Historically low interest rates make it cheaper for companies to borrow money, leading to increased investment and higher future earnings potential. This, in turn, can justify higher current valuations.

-

Technological Innovation Drives Future Earnings Growth: Rapid technological advancements promise significant increases in productivity and efficiency, driving future earnings growth beyond current expectations. This potential for future growth helps justify current valuations, even if they seem high in the short term.

-

Potential for Further Corporate Earnings Growth: BofA analysts believe there is still significant potential for corporate earnings growth to exceed current market expectations, further supporting current valuations.

-

Alternative Valuation Metrics: While P/E ratios are commonly used, other valuation metrics, like Price-to-Sales (P/S) ratios or discounted cash flow models, may paint a less alarming picture of current market valuations. A more holistic assessment incorporating various metrics provides a more nuanced view.

The Role of Inflation and Interest Rate Hikes

Inflation and potential interest rate hikes are legitimate concerns that could impact stock market valuations. However, BofA incorporates these factors into its projections:

-

BofA's Accounting for Inflation and Interest Rate Hikes: BofA's models account for the potential impact of inflation and interest rate increases on corporate earnings and economic growth. Their analysis suggests a manageable impact, considering the strength of the corporate sector and consumer resilience.

-

Potential for a "Soft Landing": BofA’s analysis suggests a possibility of a “soft landing,” a scenario where the Federal Reserve manages to curb inflation without triggering a significant economic recession. Such an outcome would be positive for the stock market.

-

Historical Context: Examining historical cycles of inflation and interest rate hikes offers valuable perspective. While past performance is not indicative of future results, it provides context for understanding potential market reactions.

-

Mitigating Risk in an Inflationary Environment: Investors can mitigate risk by diversifying their portfolios, focusing on companies with strong pricing power, and potentially incorporating inflation-protected securities into their investment strategies.

Diversification and Risk Management Strategies

Despite BofA's positive outlook, diversification and risk management remain crucial for investors navigating stretched stock market valuations:

-

Asset Allocation Strategies: Investors should tailor their asset allocation strategies to their risk tolerance, potentially incorporating a mix of stocks, bonds, and alternative investments. A diversified portfolio helps reduce the overall impact of market fluctuations.

-

Value Stocks and Defensive Sectors: Investing in value stocks (stocks that are undervalued relative to their fundamentals) or defensive sectors (sectors less sensitive to economic downturns) can help mitigate risk.

-

Dollar-Cost Averaging: Implementing a dollar-cost averaging strategy, where regular investments are made regardless of market fluctuations, can help reduce the impact of market timing.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is essential, allowing time to recover from short-term market downturns and benefit from long-term growth.

BofA's Reassurance and a Path Forward for Investors

BofA's positive outlook, supported by strong corporate earnings, consumer resilience, and technological innovation, suggests that stretched stock market valuations may not be as alarming as initially perceived. While acknowledging the risks associated with high valuations, inflation, and interest rate hikes, BofA’s analysis offers a more optimistic perspective. This doesn't mean ignoring these risks; instead, investors should focus on diversification, risk management strategies, and a long-term investment horizon.

Don't let stretched stock market valuations deter you. BofA's insights offer reassurance for investors. By carefully considering the factors discussed and adopting appropriate risk management strategies, investors can take advantage of the opportunities presented by the market. Continue monitoring the market closely, but remember the importance of a long-term perspective. Consider diversifying your portfolio and adopting a strategy suited to your risk tolerance. The current market, despite its challenges, presents opportunities for those who are well-informed and prepared.

Featured Posts

-

Agents Statement On Klopps Potential Real Madrid Move

May 22, 2025

Agents Statement On Klopps Potential Real Madrid Move

May 22, 2025 -

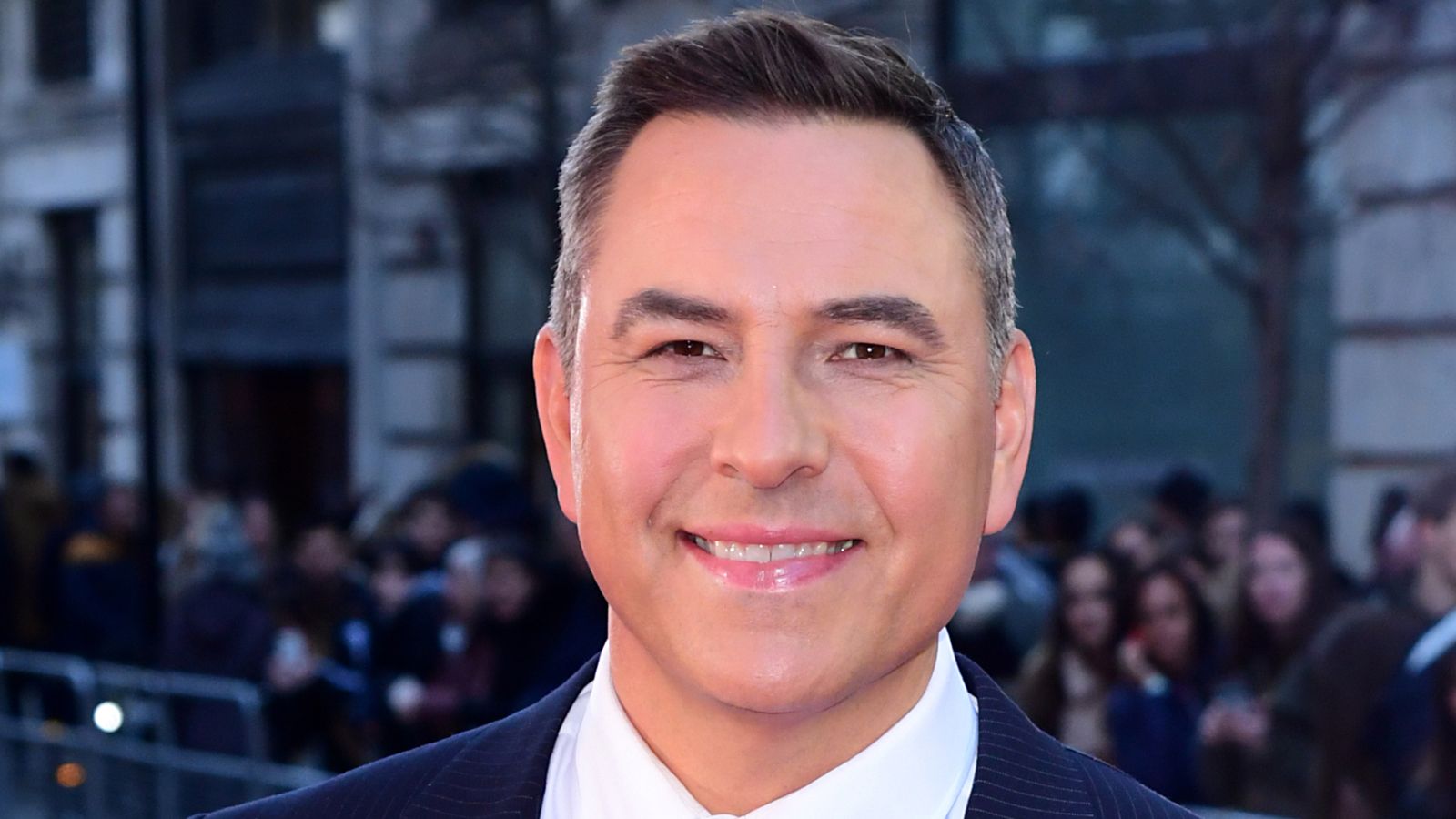

Britains Got Talent Walliams And Cowells Feud Intensifies

May 22, 2025

Britains Got Talent Walliams And Cowells Feud Intensifies

May 22, 2025 -

Karin Polman Nieuwe Directeur Hypotheken Intermediair Abn Amro Florius And Moneyou

May 22, 2025

Karin Polman Nieuwe Directeur Hypotheken Intermediair Abn Amro Florius And Moneyou

May 22, 2025 -

Exclusive Mummy Pigs Gender Reveal Party At A Famous London Spot

May 22, 2025

Exclusive Mummy Pigs Gender Reveal Party At A Famous London Spot

May 22, 2025 -

Police Investigation Ukrainian Ex Politicians Killing In Madrid

May 22, 2025

Police Investigation Ukrainian Ex Politicians Killing In Madrid

May 22, 2025

Latest Posts

-

Blake Lively And The Recent Allegations A Timeline

May 22, 2025

Blake Lively And The Recent Allegations A Timeline

May 22, 2025 -

Addressing The Allegations Blake Livelys Public Image

May 22, 2025

Addressing The Allegations Blake Livelys Public Image

May 22, 2025 -

The Blake Lively Allegations What We Know So Far

May 22, 2025

The Blake Lively Allegations What We Know So Far

May 22, 2025 -

The Blake Lively Taylor Swift And Gigi Hadid Drama Family Stands Strong

May 22, 2025

The Blake Lively Taylor Swift And Gigi Hadid Drama Family Stands Strong

May 22, 2025 -

Blake Lively Allegedly Fact Checking Recent News Stories

May 22, 2025

Blake Lively Allegedly Fact Checking Recent News Stories

May 22, 2025