BofA's Reassurance: Are High Stock Market Valuations Justified?

Table of Contents

BofA's Arguments for Justified High Valuations

BofA's justification for currently high stock market valuations rests on several key pillars. They point to strong corporate earnings, the impact of low interest rates, and the potential for future growth fueled by technological innovation.

Strong Corporate Earnings and Profitability

BofA's analysis highlights robust corporate earnings growth across various sectors. This strong performance, they argue, provides a solid foundation for the current high valuations.

- High-Performing Sectors: The technology, healthcare, and consumer staples sectors have shown particularly impressive earnings growth in recent quarters. These sectors are often viewed as more resilient during economic downturns.

- Data Points: BofA's research cites data showing significant year-over-year increases in earnings per share (EPS) for many S&P 500 companies. Specific reports from BofA Global Research should be consulted for detailed figures.

- Justification: This robust earnings growth, BofA contends, directly supports higher price-to-earnings ratios (P/E ratios) and justifies the current elevated market valuations. The argument is that strong corporate profitability can sustain higher stock prices.

Low Interest Rates and Monetary Policy

The prevailing low interest rate environment, largely a consequence of the Federal Reserve's monetary policy, plays a significant role in BofA's assessment. Low interest rates incentivize investment in riskier assets, such as stocks.

- Investor Behavior: Low interest rates reduce the appeal of bonds and other fixed-income investments, driving investors towards higher-yielding equities.

- BofA's Perspective: BofA's analysts likely incorporate the Federal Reserve's forward guidance on interest rates into their valuation models, predicting the continued low interest rate environment will likely support stock market valuations in the near term.

- Impact on Stock Prices: This increased demand for stocks, fueled by low interest rates, contributes to higher stock prices and thus, higher market valuations. This is a crucial aspect of BofA's justification.

Technological Innovation and Future Growth Potential

BofA also emphasizes the transformative potential of technological innovation as a driver of future growth and a justification for high valuations. They believe that the long-term growth prospects offered by emerging technologies warrant premium valuations.

- Key Technological Trends: Areas such as artificial intelligence (AI), cloud computing, and renewable energy are identified as key drivers of future economic growth.

- Sectoral Impact: BofA's analysis likely highlights the positive impact of these technological advancements on specific sectors, projecting strong growth for companies leveraging these innovations.

- Long-Term Valuation: The long-term growth potential offered by these technological advancements, according to BofA's assessment, contributes to a justification for current elevated stock market valuations. Investors are, in essence, pricing in future growth.

Counterarguments and Potential Risks

While BofA presents a bullish case, several counterarguments and potential risks must be considered.

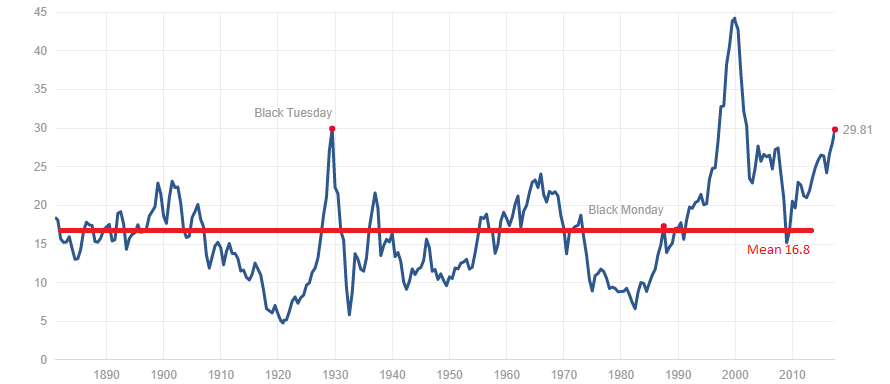

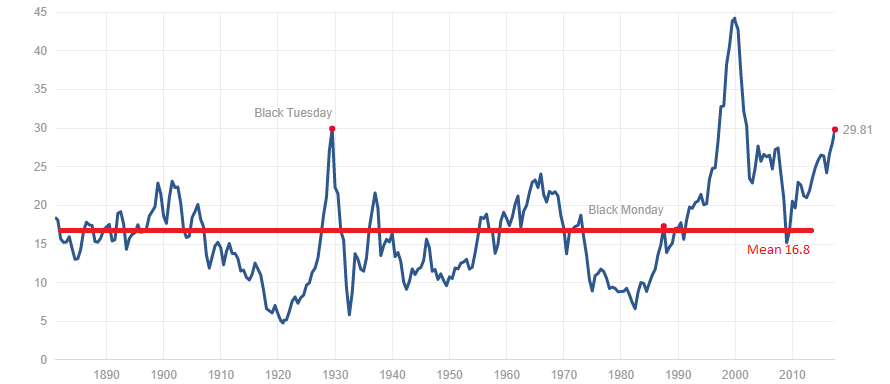

Valuation Metrics and Historical Comparisons

A critical counterargument focuses on whether current valuation metrics are historically high and potentially unsustainable.

- Price-to-Earnings Ratios: Comparing current P/E ratios to historical averages can reveal whether the market is overvalued. High P/E ratios relative to historical norms suggest a potentially elevated risk of a market correction.

- Other Valuation Metrics: Other valuation metrics, such as price-to-sales ratios and market-to-book ratios, should also be analyzed for a comprehensive assessment.

- Overvalued Stocks: The risk of overvalued stocks is inherent in high market valuations. A correction could lead to significant losses for investors.

Geopolitical Uncertainty and Economic Headwinds

Geopolitical uncertainty and potential economic headwinds present significant risks that could negatively impact stock valuations.

- Geopolitical Risks: International tensions, trade wars, and political instability can all disrupt markets and negatively influence investor sentiment.

- Economic Slowdowns: Recessions or significant economic slowdowns can lead to decreased corporate earnings and lower stock prices.

- Market Correction: These factors increase the likelihood of a market correction, potentially wiping out a significant portion of recent gains.

Interest Rate Hikes and Inflationary Pressures

Future interest rate hikes by central banks aimed at combating inflation pose a significant threat to current stock market valuations.

- Mechanism of Impact: Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and reducing corporate earnings. They also make bonds more attractive relative to stocks.

- BofA's Forecasts: BofA's economic forecasts, if available, should be considered for insights into the potential impact of future interest rate changes. Their outlook on inflation is crucial for assessing valuation risk.

- Market Volatility: Interest rate hikes generally increase market volatility, making stock prices more susceptible to significant fluctuations.

Conclusion: Evaluating BofA's Reassurance on High Stock Market Valuations

BofA's reassurance on high stock market valuations rests on strong corporate earnings, the low-interest-rate environment, and the potential for future growth driven by technological innovation. However, counterarguments highlight potentially unsustainable valuation metrics, geopolitical risks, and the threat of future interest rate hikes. Whether BofA's reassurance is ultimately valid depends on the interplay of these factors and future economic developments. While their perspective offers valuable insight, it's crucial to remember that market valuation is complex and subject to significant uncertainty.

Understanding BofA's perspective on high stock market valuations is crucial for making informed investment decisions. Continue your research by consulting BofA's published reports, comparing their analysis with other reputable sources, and considering your own risk tolerance before making any investment decisions. Remember to diversify your portfolio to mitigate risk.

Featured Posts

-

Kawasaki W800 My 2025 Spesifikasi Dan Harga Terbaru

May 30, 2025

Kawasaki W800 My 2025 Spesifikasi Dan Harga Terbaru

May 30, 2025 -

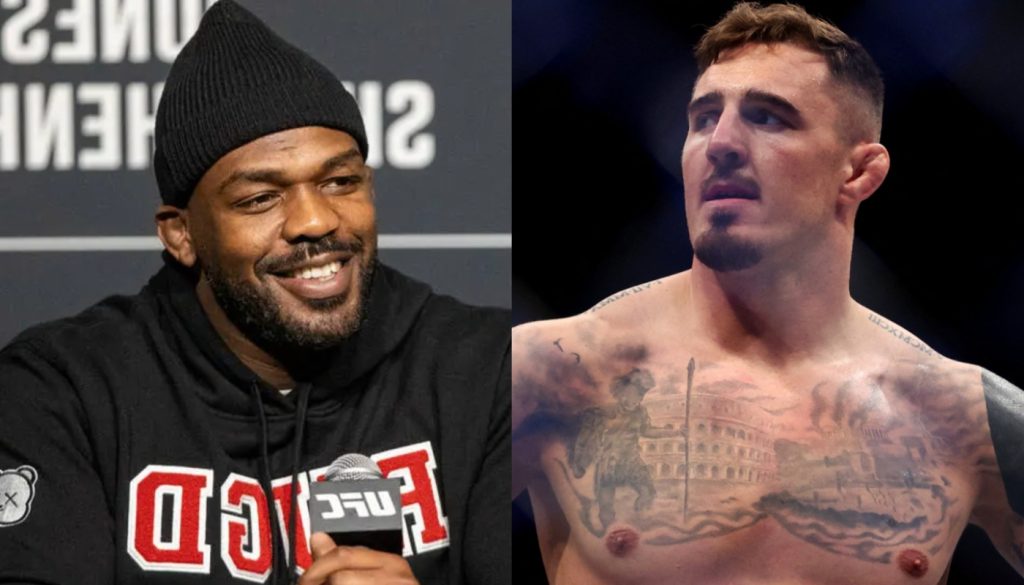

Jones Vs Aspinall Heated Exchange Highlights Ufcs Ongoing Drama

May 30, 2025

Jones Vs Aspinall Heated Exchange Highlights Ufcs Ongoing Drama

May 30, 2025 -

Analyzing The Taco Trade Agreement Causes Of Trumps Outrage

May 30, 2025

Analyzing The Taco Trade Agreement Causes Of Trumps Outrage

May 30, 2025 -

New Bell Ai Data Centres A Boost For British Columbias Tech Sector

May 30, 2025

New Bell Ai Data Centres A Boost For British Columbias Tech Sector

May 30, 2025 -

Motor Klasik Modern Eksplorasi Kawasaki W800 My 2025

May 30, 2025

Motor Klasik Modern Eksplorasi Kawasaki W800 My 2025

May 30, 2025