BofA's Assessment: Why Current Stock Market Valuations Are Not A Threat

Table of Contents

BofA's Methodology and Data Sources

BofA's assessment isn't based on gut feeling; it's rooted in a rigorous analytical framework. Their team leverages a comprehensive approach, incorporating various financial metrics and macroeconomic indicators to arrive at their conclusion. Data sources include detailed financial statements from publicly traded companies, reliable economic indicators from government agencies like the Federal Reserve, and proprietary BofA research.

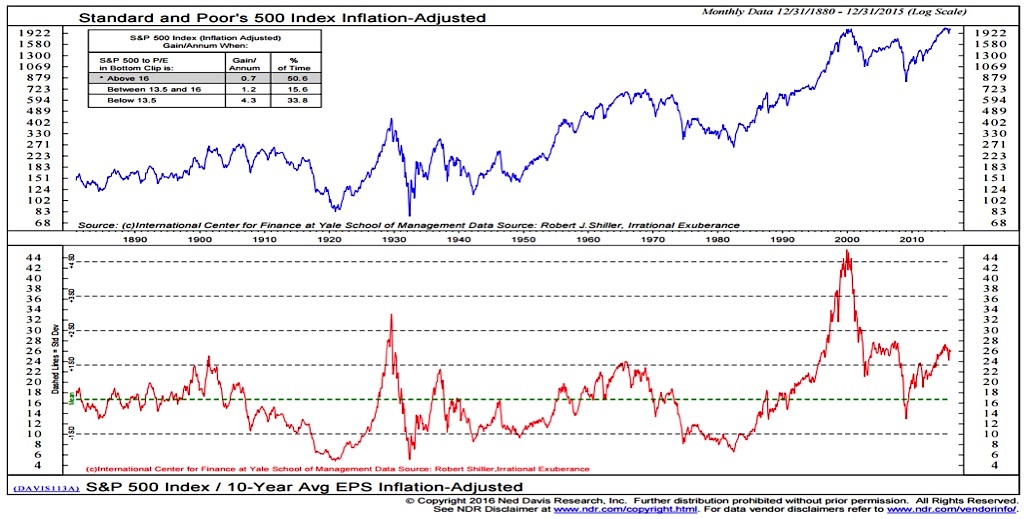

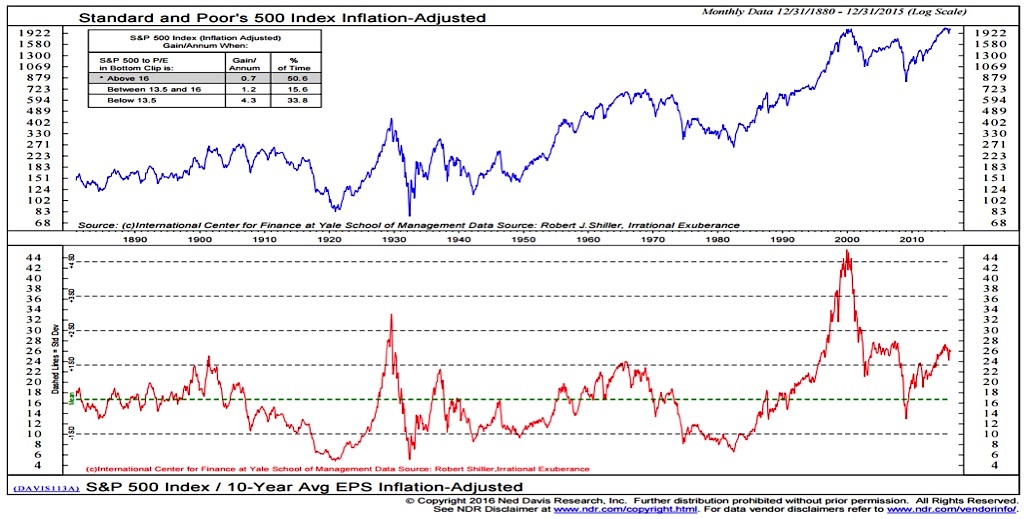

- Valuation Metrics: The analysis considered several key valuation metrics, including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and Price-to-Book ratio (P/B). These metrics were analyzed across different sectors and compared to historical averages.

- Supporting Data Points: BofA's findings point to robust corporate earnings growth, strong balance sheets for many companies, and relatively stable economic indicators. These data points suggest that current valuations, while potentially high in absolute terms, are supported by underlying fundamentals.

- Historical Context: The analysis importantly compared current valuations to historical averages. This comparative analysis reveals that while valuations might appear elevated compared to some past periods, they are not unprecedented, especially when considering the low-interest-rate environment.

Strong Corporate Earnings as a Counterbalance

A key component of BofA's assessment is the strength of corporate earnings. Many companies are exceeding earnings expectations, demonstrating the resilience of the economy and the profitability of businesses. This strong earnings performance justifies, to a significant extent, the current market valuations.

- Examples of Strong Performers: Several sectors, including technology, healthcare, and consumer staples, have shown particularly robust earnings growth. Specific examples of companies exceeding expectations (while avoiding specific company names to maintain objectivity and avoid stock picking advice) can be found in BofA's full report.

- Drivers of Earnings Growth: Factors driving this strong performance include sustained consumer spending, ongoing technological innovation, and a generally positive global economic environment (with caveats regarding geopolitical risks, discussed below).

- Future Earnings Projections: While future predictions are inherently uncertain, BofA's analysis incorporates reasonable future earnings projections which suggest that current valuations are not overly stretched when considering anticipated growth.

Low Interest Rates and Monetary Policy's Influence

Low interest rates play a crucial role in influencing stock market valuations. When interest rates are low, the cost of borrowing is reduced, encouraging companies to invest and expand, and making stocks relatively more attractive compared to bonds. Furthermore, low interest rates typically lead to a lower discount rate used in valuation models, resulting in higher present values for future earnings.

- Impact on Discount Rates: Lower discount rates directly impact the valuation of future cash flows, leading to higher valuations for stocks. This effect is significant and contributes substantially to the current market conditions.

- Potential Interest Rate Increases: BofA’s analysis acknowledges the potential for future interest rate increases by central banks. However, their assessment suggests that the current rate of increase is manageable and unlikely to trigger a dramatic market correction in the near term.

- Quantitative Easing (QE): The impact of past quantitative easing programs continues to influence market liquidity and asset prices. While QE is winding down, its legacy contributes to the current environment.

Addressing Potential Risks and Concerns

It's crucial to acknowledge potential counterarguments. Geopolitical risks, inflation concerns, and supply chain disruptions are valid concerns. BofA’s analysis incorporates these risks, but concludes they are currently manageable.

- Identified Risks: BofA's report clearly identifies these risks and assesses their potential impact on market valuations. The report acknowledges the inherent uncertainty associated with geopolitical events.

- Mitigation Strategies: The analysis considers potential mitigation strategies employed by companies and the government to address these concerns. For example, strategies to reduce inflation or to improve supply chain resilience are discussed.

- Data Supporting Manageable Risks: BofA supports its assessment that these risks are currently manageable with data illustrating the resilience of the corporate sector and the overall economy.

Long-Term Growth Prospects and Market Outlook

BofA maintains a cautiously optimistic long-term outlook for the economy and the stock market. This optimism is based on several key factors.

- Future Economic Growth: BofA's projections suggest continued, albeit potentially slower, economic growth in the coming years. This growth, while perhaps not as rapid as in recent past periods, still provides a foundation for positive market performance.

- Factors Contributing to Stability: Technological advancements, demographic trends, and ongoing innovation contribute to long-term market stability and potential growth.

- Investment Strategies: Based on their analysis, BofA suggests a balanced approach to investing, considering diversification across sectors and asset classes.

Conclusion: BofA's Reassuring View on Stock Market Valuations

BofA's assessment offers a reassuring perspective on current stock market valuations. Their analysis, based on robust data and a comprehensive framework, suggests that current valuations are not inherently unsustainable, supported by strong corporate earnings, low interest rates, and a generally positive long-term outlook, while acknowledging and quantifying potential risks. Don't let unfounded fears about stock market valuations deter you – understand the full picture. Learn more about BofA's market outlook and how to navigate current stock market valuations. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Gibraltar Industries Earnings Preview Analyzing Q Quarter 2024 Results

May 13, 2025

Gibraltar Industries Earnings Preview Analyzing Q Quarter 2024 Results

May 13, 2025 -

Aala Unhala Niyam Pala Navi Mumbais Heatwave Prevention Campaign By Nmmc

May 13, 2025

Aala Unhala Niyam Pala Navi Mumbais Heatwave Prevention Campaign By Nmmc

May 13, 2025 -

Efl Highlights Relive The Action

May 13, 2025

Efl Highlights Relive The Action

May 13, 2025 -

Gatsbys Real Life Inspirations Unveiling The Men Behind The Myth

May 13, 2025

Gatsbys Real Life Inspirations Unveiling The Men Behind The Myth

May 13, 2025 -

2024 Nba Draft Lottery Odds Cooper Flagg And The Toronto Raptors Prospects

May 13, 2025

2024 Nba Draft Lottery Odds Cooper Flagg And The Toronto Raptors Prospects

May 13, 2025