BofA Reassures Investors: Understanding Current Stock Market Valuations

Table of Contents

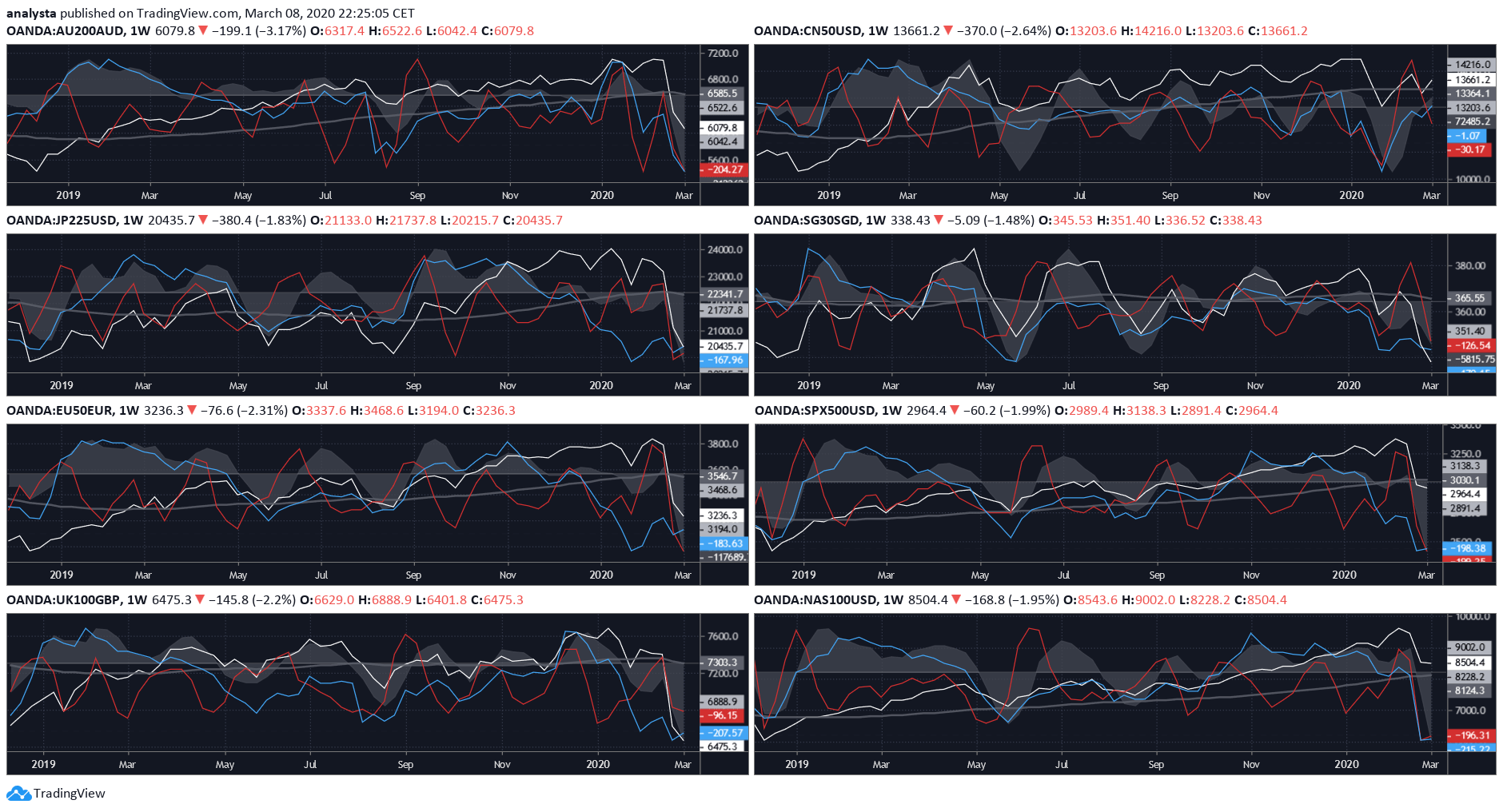

The current stock market volatility has left many investors feeling anxious. Fluctuating prices and uncertain economic conditions are fueling concerns about the future. However, Bank of America (BofA) has recently issued statements aiming to reassure investors and provide clarity on current stock market valuations. This article will delve into BofA's perspective, explaining their assessment of the market and offering insights for navigating these challenging times.

<h2>BofA's Assessment of Current Market Conditions</h2>

BofA's overall view on the current market conditions can be described as cautiously optimistic. While acknowledging persistent challenges, they see pockets of strength and potential for future growth. Their analysis considers various economic indicators and geopolitical factors.

- Economic Indicators: BofA closely monitors inflation rates, interest rate adjustments by the Federal Reserve, and GDP growth figures. Recent data suggests a slowing inflation rate, though it remains above the target level. Interest rate hikes are anticipated to continue, aiming to cool the economy and control inflation. GDP growth shows signs of slowing but remains positive in many key sectors. These factors are continuously assessed by BofA in their market analysis.

- Sectoral Outlook: BofA's market analysis points to a mixed bag across sectors. They remain relatively optimistic about the technology sector's long-term prospects, while expressing caution regarding the real estate sector due to rising interest rates. Energy remains a strong performer, though subject to global geopolitical events.

- Geopolitical Factors: The ongoing geopolitical landscape, including the war in Ukraine and trade tensions, continues to impact BofA's economic outlook. These events introduce uncertainty and volatility into the market, requiring careful monitoring and analysis.

<h2>Understanding Stock Market Valuations: Key Metrics</h2>

Assessing whether stocks are fairly valued requires understanding key valuation metrics. These metrics help investors determine if a stock price reflects its intrinsic value.

- Price-to-Earnings Ratio (P/E Ratio): This metric compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests the market expects high future growth, while a low P/E ratio might indicate undervaluation or lower growth expectations.

- Price-to-Book Ratio (P/B Ratio): This compares a company's market capitalization to its book value (assets minus liabilities). A high P/B ratio suggests the market values the company's intangible assets highly, while a low P/B ratio might signal undervaluation or potential financial distress.

- Dividend Yield: This represents the annual dividend payment per share relative to the stock price. A higher dividend yield can be attractive to income-oriented investors, but it's crucial to assess the company's ability to sustain dividend payouts.

Understanding these stock valuation metrics is crucial for making informed investment decisions. Investors should consider these factors alongside BofA's market analysis to determine whether stocks are overvalued or undervalued.

<h2>BofA's Recommendations for Investors</h2>

Based on their market assessment, BofA suggests a diversified investment approach. Their investment advice emphasizes the importance of risk tolerance and long-term financial planning.

- Asset Allocation: BofA recommends a diversified portfolio encompassing a mix of asset classes, including equities (stocks), bonds, and potentially alternative investments depending on risk tolerance. The specific allocation would depend on individual circumstances.

- Risk Tolerance: Investors should assess their own risk tolerance before making any investment decisions. BofA's investment strategies cater to various risk profiles, from conservative to aggressive.

- Diversification: Diversification is crucial to mitigate risk. Spreading investments across different asset classes and sectors helps reduce the impact of any single investment performing poorly. This is a cornerstone of BofA's investment strategies.

<h2>Addressing Investor Concerns and Uncertainty</h2>

Market volatility understandably creates anxiety. BofA addresses these concerns by offering insights and practical advice.

- Inflation Concerns: BofA acknowledges inflation's impact but highlights the Federal Reserve's efforts to control it. Their analysis suggests that inflation is likely to moderate over time, though this remains a key factor in their market analysis.

- Recession Risks: While acknowledging recession risks, BofA's assessment points to a relatively resilient economy with growth in key sectors. They emphasize the importance of monitoring economic indicators and adapting investment strategies accordingly.

- Managing Anxiety: BofA advises investors to maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. They encourage thorough research and seeking professional financial advice if needed.

<h2>BofA Reassures Investors: A Call to Action</h2>

BofA's assessment of current stock market valuations highlights a cautiously optimistic outlook. Their analysis emphasizes the importance of understanding key valuation metrics, adopting a diversified investment strategy, and managing risk effectively. The key takeaway is the need for informed decision-making based on a thorough understanding of current market trends and individual financial goals. We encourage you to conduct further research using BofA's insights on stock market valuations, exploring their website and other reputable financial news sources to develop a well-informed investment strategy aligned with your risk tolerance and financial objectives. Remember, using BofA's reassurances and insights can help you navigate the complexities of the current market and make confident investment decisions.

Featured Posts

-

Nyt Spelling Bee Solutions For February 10 2025

Apr 29, 2025

Nyt Spelling Bee Solutions For February 10 2025

Apr 29, 2025 -

Wnba Bound Diamond Johnson Of Norfolk State Heads To Minnesota Lynx Camp

Apr 29, 2025

Wnba Bound Diamond Johnson Of Norfolk State Heads To Minnesota Lynx Camp

Apr 29, 2025 -

Dynasty Star Linda Evans 82 Shares Heartfelt Valentines Day Post

Apr 29, 2025

Dynasty Star Linda Evans 82 Shares Heartfelt Valentines Day Post

Apr 29, 2025 -

Driving With Adhd A Focus On Vehicle Safety Research

Apr 29, 2025

Driving With Adhd A Focus On Vehicle Safety Research

Apr 29, 2025 -

Global Competition For Us Researchers Heats Up Post Trump Funding Cuts

Apr 29, 2025

Global Competition For Us Researchers Heats Up Post Trump Funding Cuts

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni