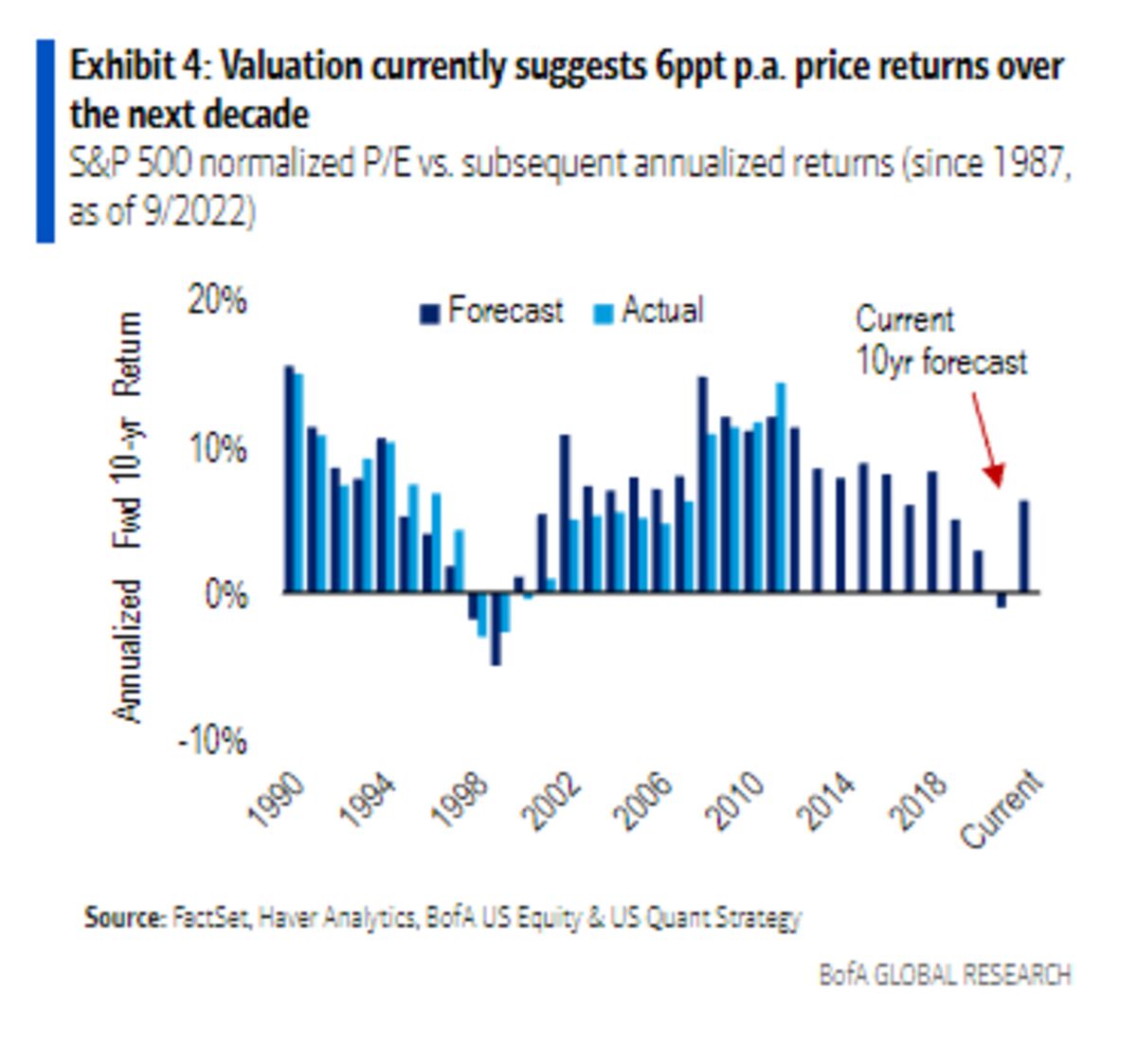

BofA Reassures Investors On Elevated Stock Market Valuations

Table of Contents

BofA's Rationale for Current Market Valuations

BofA's justification for the current high stock market valuations rests on several key pillars. Their analysis points to a confluence of factors contributing to a sustained period of growth, despite the apparent high valuations.

-

Strong Corporate Earnings Growth: BofA cites robust corporate earnings growth across various sectors as a primary driver. Many companies have reported exceeding expectations, fueled by strong consumer demand and efficient operational strategies. This positive trend, they argue, supports the current pricing of stocks. For example, [cite a specific BofA report or financial news source referencing strong Q[Quarter] earnings].

-

Low Interest Rate Environment: The prolonged period of low interest rates, or at least the anticipation of continued low rates, has significantly impacted stock valuations. Low borrowing costs encourage companies to invest and expand, further boosting earnings and attracting investment. BofA's analysis suggests that this favorable interest rate environment is likely to persist for some time, supporting elevated valuations. [Cite a source for BofA's interest rate forecast].

-

Technological Advancements: BofA highlights the transformative role of technology in driving innovation and growth. Specific sectors, such as technology, biotechnology, and renewable energy, are experiencing exponential growth, leading to premium valuations for companies at the forefront of these advancements. This "tech boom" significantly contributes to the overall high stock market valuation.

-

Positive Economic Indicators: Positive economic indicators, including GDP growth and robust employment figures, paint a picture of a healthy and expanding economy. BofA uses these data points to support their argument that the current market valuations are justified by underlying economic strength. [Cite relevant economic data sources used by BofA]. This combination of strong corporate performance, a supportive interest rate environment, technological innovation, and positive economic indicators, according to BofA's analysis, underpins the current high stock market valuation.

Addressing Investor Concerns Regarding Market Risks

While BofA maintains a positive outlook, they acknowledge the valid concerns of investors regarding potential market risks.

-

Market Corrections: The possibility of a market correction is a legitimate concern. BofA addresses this by emphasizing the importance of long-term investment strategies and the need for diversified portfolios. They suggest that short-term volatility should not deter investors with a long-term horizon.

-

Inflation Risk: Inflation is a significant risk that could erode the value of investments. BofA's analysis incorporates inflation forecasts and suggests strategies to mitigate this risk, including diversification into assets that tend to perform well during inflationary periods.

-

Geopolitical Uncertainty: Geopolitical events can significantly impact markets. BofA acknowledges this uncertainty but emphasizes their robust risk assessment strategies, which consider various geopolitical factors and their potential impact on different sectors and asset classes. They may advise investors to focus on sectors less vulnerable to geopolitical shifts.

-

BofA Risk Assessment Strategies: BofA uses sophisticated models to assess risks, considering factors like economic growth, interest rates, inflation, and geopolitical developments. This allows them to provide a more nuanced perspective on market risks and offer advice tailored to different risk profiles. The bank's risk assessment incorporates scenario planning and stress testing to identify potential vulnerabilities and develop mitigation strategies.

BofA's Investment Strategies and Recommendations

Based on their analysis, BofA offers several key recommendations for investors:

-

Asset Allocation Strategies: They generally suggest a diversified approach, allocating assets across different asset classes like stocks, bonds, and potentially alternative investments, depending on individual risk tolerance and investment goals. The specific asset allocation will depend on individual investor profiles.

-

Sector-Specific Recommendations: BofA may highlight specific sectors they believe are poised for growth, considering factors like technological advancements, regulatory changes, and economic trends. This could lead to recommendations for overweighting certain sectors in a portfolio.

-

Portfolio Management Advice: BofA emphasizes the importance of active portfolio management, regularly reviewing and adjusting investment strategies based on market conditions and personal circumstances. They stress the importance of risk management and diversification.

Alternative Perspectives and Criticisms

It's crucial to acknowledge that not all analysts share BofA's optimistic view. Some critics argue that current valuations are unsustainable and predict a significant market correction. These alternative perspectives highlight the inherent uncertainties in market forecasting and emphasize the importance of conducting thorough due diligence before making investment decisions. Other financial institutions may offer different analyses and recommendations, underlining the need for investors to compare multiple perspectives.

Conclusion: Navigating Elevated Stock Market Valuations with BofA's Insights

BofA's reassurances on elevated stock market valuations are based on a combination of strong corporate earnings, a low-interest-rate environment, technological innovation, and positive economic indicators. While acknowledging the inherent market risks such as inflation and geopolitical uncertainty, BofA offers a measured approach, emphasizing the importance of diversification and long-term investment strategies. By understanding BofA's perspective, along with alternative viewpoints, investors can better assess their own investment strategies and make informed decisions. Assess your investment strategy based on BofA's insights on elevated stock market valuations. Understand the risks and rewards of current market valuations with BofA's guidance. Learn more about BofA's perspective on elevated stock market valuations by [link to relevant BofA reports and resources].

Featured Posts

-

A Conservative Harvard Professors Prescription For Harvards Future

Apr 26, 2025

A Conservative Harvard Professors Prescription For Harvards Future

Apr 26, 2025 -

The Complex Relationship European Shipyards And Russias Arctic Gas Exports

Apr 26, 2025

The Complex Relationship European Shipyards And Russias Arctic Gas Exports

Apr 26, 2025 -

Liev Schreiber Defends Daughters Modeling Career Amidst Nepo Baby Debate

Apr 26, 2025

Liev Schreiber Defends Daughters Modeling Career Amidst Nepo Baby Debate

Apr 26, 2025 -

2025 Nfl Draft Cam Newton On Shedeur Sanders And His Top Qb Prospect

Apr 26, 2025

2025 Nfl Draft Cam Newton On Shedeur Sanders And His Top Qb Prospect

Apr 26, 2025 -

Shedeur Sanders And The New York Giants A Winning Combination

Apr 26, 2025

Shedeur Sanders And The New York Giants A Winning Combination

Apr 26, 2025

Latest Posts

-

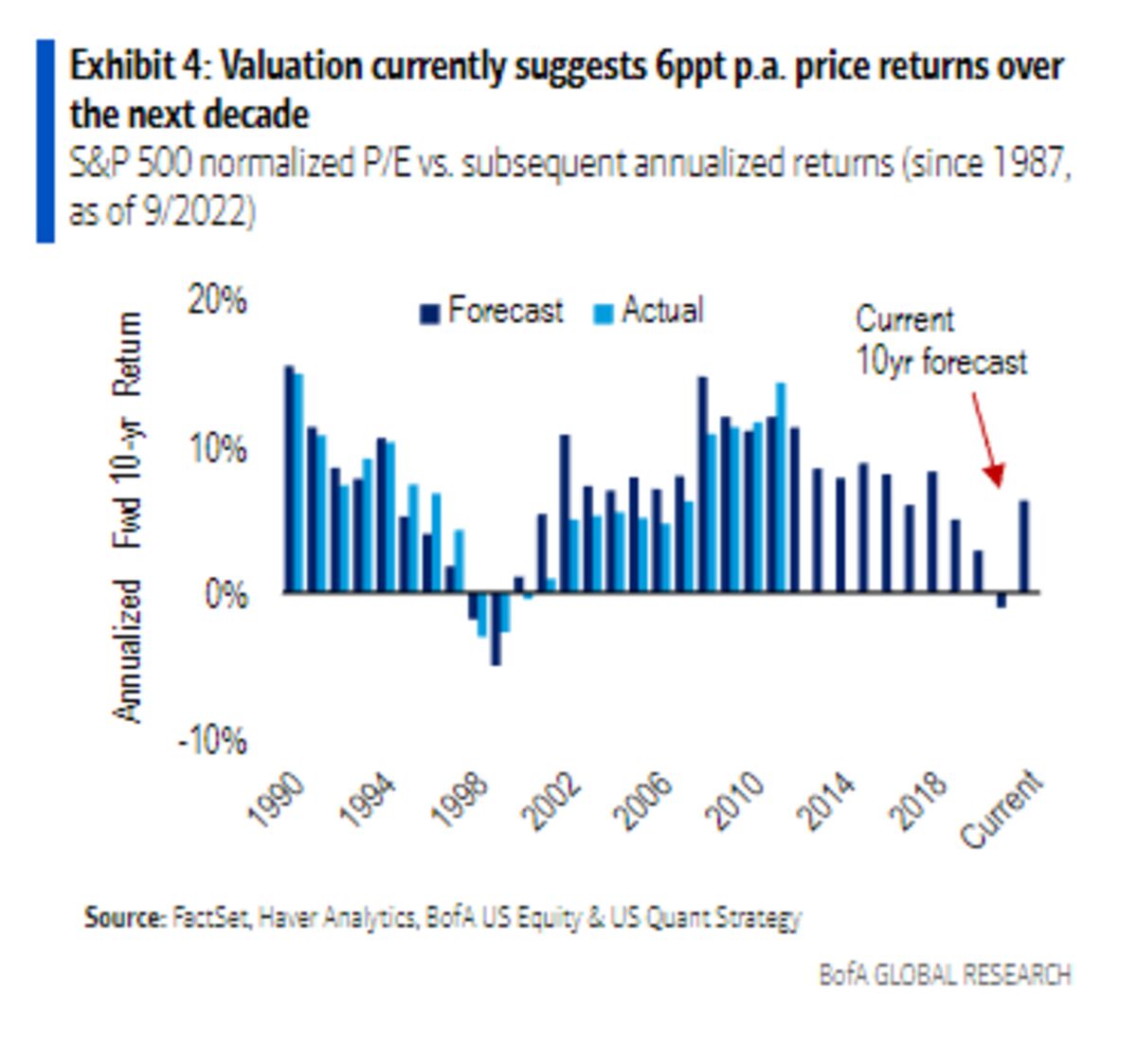

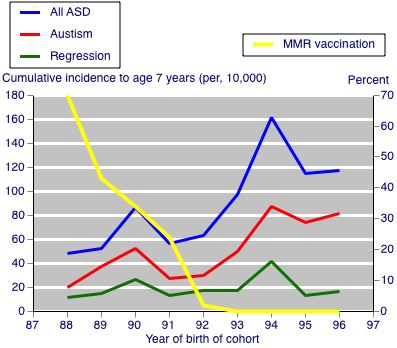

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025 -

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025 -

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025 -

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025