BofA On Stock Market Valuations: Why Investors Should Remain Confident

Table of Contents

BofA's Key Arguments for a Positive Stock Market Outlook

BofA's positive assessment of stock market valuations isn't based on blind optimism. Their analysis incorporates several key factors, leading them to believe that the long-term outlook for equities remains strong. While specific data points may fluctuate, their core arguments generally center around several key pillars:

- Perspective on Market Corrections: BofA acknowledges the current market corrections but views them as healthy adjustments within a longer-term upward trend. They emphasize that market dips are a normal part of the investment cycle and shouldn't necessarily trigger panic selling.

- Promising Sectors: The report highlights specific sectors poised for growth, citing factors like technological innovation, evolving consumer preferences, and a resurgence in certain industrial segments. While the specific sectors mentioned may vary based on the report's release date, the emphasis remains on identifying opportunities within the overall market.

- Interest Rate Impact: BofA's analysis incorporates the impact of rising interest rates, acknowledging their potential to influence valuations. However, they argue that current valuations already reflect much of this impact, and projected earnings growth could offset potential interest rate pressures.

- Geopolitical Factors: The report addresses geopolitical uncertainties, acknowledging their potential disruptive effects. However, BofA analysts incorporate these factors into their models, concluding that while there are risks, the overall long-term outlook remains positive. The inclusion of such factors underscores a nuanced and comprehensive approach to their valuation assessment.

Addressing Investor Concerns about Market Volatility

Many investors are understandably concerned about inflation, potential recession, and ongoing geopolitical instability. These anxieties are valid, but BofA's analysis offers counterpoints to these concerns:

- Inflation Concerns: BofA acknowledges inflation's impact but points to the Federal Reserve's actions and the potential for inflation to ease over time. Their analysis incorporates various inflation scenarios to understand their influence on market valuations.

- Recession Fears: While a recession remains a possibility, BofA's models suggest that even a mild recession wouldn't necessarily trigger a dramatic market collapse. They believe the impact would be mitigated by factors such as robust corporate earnings and ongoing technological advancements.

- Risk Mitigation Strategies: BofA emphasizes the importance of diversification and a long-term investment horizon as key strategies for mitigating risk in a volatile market. They encourage investors to avoid making impulsive decisions based on short-term market fluctuations. This advice aligns with established principles of sound financial management.

The Importance of a Long-Term Investment Strategy

Navigating market volatility successfully requires a long-term perspective. Short-term market movements are often driven by emotion and speculation, rather than a reflection of underlying value:

- Short-Term vs. Long-Term Value: History demonstrates that focusing on short-term market fluctuations often leads to poor investment outcomes. Long-term investors are better positioned to weather market storms and capitalize on long-term growth.

- Historical Success of Long-Term Investing: Numerous studies demonstrate the superior returns achieved through long-term investing. Data consistently shows that those who remain invested during periods of market volatility tend to see superior returns compared to those who frequently trade based on short-term market movements.

- Adopting a Long-Term Strategy: Investors can adopt several practices to support a long-term strategy, including dollar-cost averaging (investing a fixed amount at regular intervals), rebalancing their portfolios periodically, and avoiding emotional decision-making.

Beyond BofA: Supporting Evidence from Other Market Analysts

BofA's positive outlook isn't an isolated view. Several other reputable financial institutions and analysts share a similar, cautiously optimistic perspective:

- Converging Opinions: Many prominent financial news outlets and analyst firms have published reports that corroborate BofA's assessment of the market. While specific details may differ, the general sentiment is one of cautious optimism.

- Points of Convergence and Divergence: While there's broad agreement on the overall positive trend, analysts may differ on the timing and magnitude of future growth. Such nuances are expected in market predictions, underscoring the importance of independent research and a balanced perspective.

- Strengthening Investor Confidence: The convergence of views from multiple reputable sources strengthens the overall case for maintaining investor confidence. This collective perspective suggests that the market's positive outlook isn't a single entity's isolated prediction, but rather a reflection of broader market analysis.

Conclusion

BofA's recent report on stock market valuations, supported by corroborating evidence from other market analysts, presents a compelling argument for maintaining investor confidence despite current market volatility. While risks and uncertainties exist, the long-term outlook appears positive, driven by factors such as projected earnings growth and technological innovation. Remember that a long-term investment strategy, focusing on diversification and risk mitigation, remains crucial in navigating market fluctuations.

Call to Action: Stay informed on BofA's stock market valuations and understand BofA's perspective on navigating market volatility. Review BofA's full report and build your investment strategy with confidence based on BofA's insights and other credible market analyses. [Insert links to relevant BofA resources here].

Featured Posts

-

Funeral Service For Poppy Atkinson Remembering A Beloved Manchester United Supporter

May 02, 2025

Funeral Service For Poppy Atkinson Remembering A Beloved Manchester United Supporter

May 02, 2025 -

Mp Treatment Sparks Mass Resignation Of Reform Uk Branch Officers

May 02, 2025

Mp Treatment Sparks Mass Resignation Of Reform Uk Branch Officers

May 02, 2025 -

Is Xrp Ripple A Good Investment Below 3

May 02, 2025

Is Xrp Ripple A Good Investment Below 3

May 02, 2025 -

Social Media Frenzy Kashmir Cat Owners On High Alert

May 02, 2025

Social Media Frenzy Kashmir Cat Owners On High Alert

May 02, 2025 -

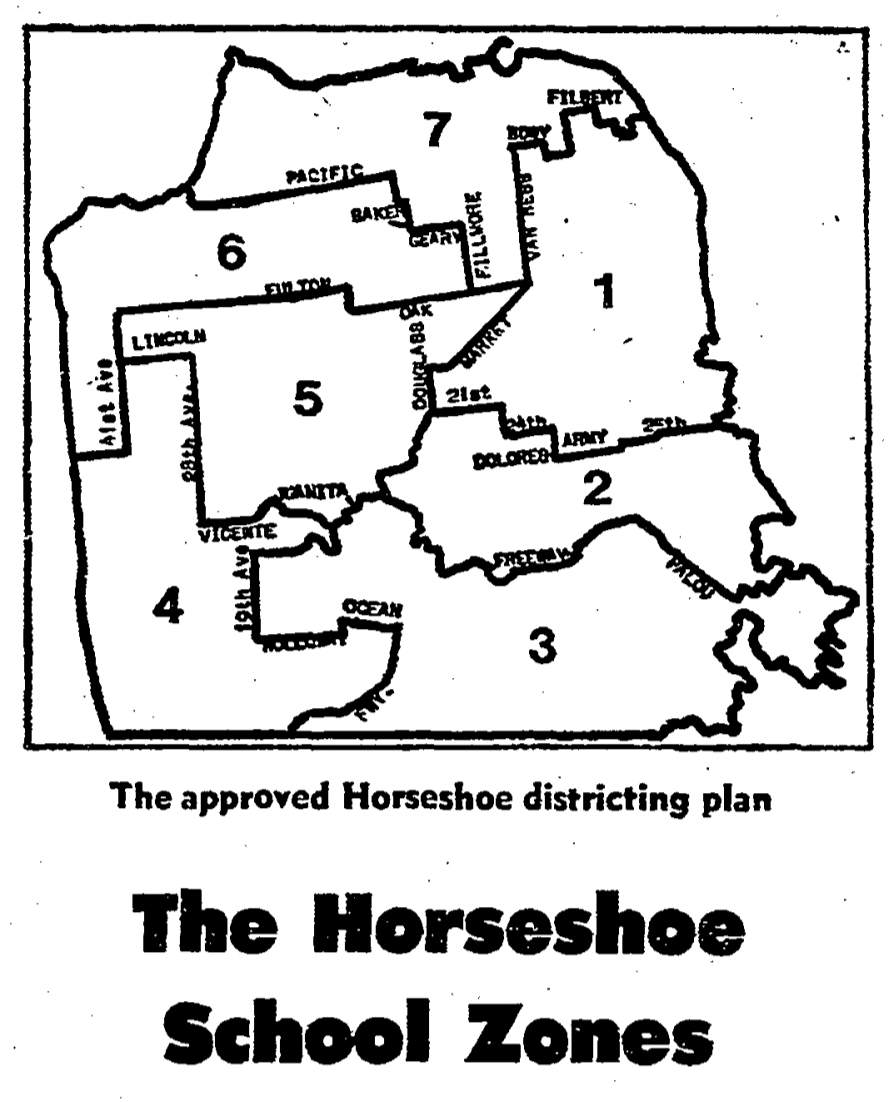

The Fallout Justice Departments School Desegregation Order And Future Legal Challenges

May 02, 2025

The Fallout Justice Departments School Desegregation Order And Future Legal Challenges

May 02, 2025