BofA On Stock Market Valuations: A Reason For Investors To Remain Calm

Table of Contents

BofA's Key Findings on Stock Market Valuations

BofA's recent research suggests that while stock market valuations aren't drastically undervalued, they also aren't excessively overvalued, providing a degree of comfort for long-term investors. Their analysis utilizes various metrics, including the widely-used Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), considering historical trends and incorporating the impact of rising interest rates.

- Specific valuation metrics cited by BofA: BofA likely referenced both trailing and forward P/E ratios, comparing current values to historical averages across different market cycles. The Shiller PE ratio, which considers inflation-adjusted earnings over a longer period, also plays a role in their assessment.

- Key sectors highlighted in their analysis: The report likely focuses on key sectors like technology, financials, and consumer discretionary, analyzing their individual valuations and growth prospects within the broader market context.

- Comparison to historical valuations: BofA's analysis almost certainly includes a comparison of current valuations to historical averages, placing the current market within a longer-term perspective. This historical context helps investors understand whether current valuations are unusually high or low compared to past market cycles.

- Consideration of interest rate impacts on valuations: The impact of rising interest rates on discounted cash flow models and the overall attractiveness of equities versus bonds is a crucial element of BofA's analysis, showing how higher interest rates can influence investor sentiment and market valuations.

Factors Contributing to BofA's Optimism

BofA's relatively positive outlook stems from several key factors. Their analysis likely incorporates projections that consider the resilience of the US economy, despite headwinds.

- Projected earnings growth for key sectors: BofA's optimism is likely underpinned by projections of continued, albeit potentially moderated, earnings growth in several key sectors. This suggests that corporate profits are expected to remain robust enough to support current market valuations.

- Anticipated macroeconomic trends (e.g., inflation, interest rates): The analysis likely incorporates expectations for inflation to eventually cool down and interest rate hikes to eventually plateau or even reverse course. This would create a more favorable environment for stock market growth.

- Potential for technological advancements driving growth: Technological advancements and innovation within various sectors, offering new investment opportunities and driving long-term growth, likely feature prominently in BofA's positive assessment.

- Geopolitical factors and their influence on market valuations: While geopolitical uncertainties exist, BofA's outlook likely considers the market’s ability to adapt and overcome these challenges.

Strategies for Investors Based on BofA's Assessment

BofA's assessment doesn't signal a time for reckless abandon, but it does suggest a measured approach for investors.

- Recommendations for portfolio diversification: Maintaining a well-diversified portfolio across different asset classes and sectors remains crucial, regardless of market conditions. This mitigates risk and provides stability.

- Suggestions for sector-specific investments: Based on BofA's sector-specific analysis, investors may choose to adjust their portfolio allocations to favor sectors with stronger projected earnings growth.

- Advice on managing risk in a volatile market: Even with a positive outlook, investors should maintain appropriate risk management strategies, such as stop-loss orders, and consider hedging techniques to limit potential losses.

- Importance of long-term investment horizons: BofA’s analysis underscores the importance of focusing on long-term investment goals and avoiding short-term market reactions.

- The role of a calm and measured investment approach: Maintaining a calm and disciplined approach, avoiding impulsive decisions based on short-term market fluctuations, is vital for achieving long-term investment success.

Addressing Potential Counterarguments

While BofA's analysis provides a reassuring perspective, it's important to acknowledge potential counterarguments.

- Potential risks and uncertainties not fully addressed by BofA: Unforeseen economic downturns, unexpected geopolitical events, or unforeseen regulatory changes represent potential risks not fully accounted for in any market analysis.

- Alternative viewpoints on market valuations: Other analysts may hold differing views on market valuations, potentially highlighting different metrics or emphasizing different risks. A balanced perspective considers these contrasting viewpoints.

- Considerations for investors with different risk tolerances: Investors with different risk tolerances will have varied approaches to portfolio management, even considering the same underlying market analysis.

Conclusion

BofA's analysis of stock market valuations offers a degree of reassurance amidst current market uncertainty. While risks remain, their findings suggest that current valuations aren't excessively high, and projected earnings growth supports a relatively optimistic outlook. However, the importance of maintaining a well-diversified portfolio, managing risk effectively, and adopting a long-term investment strategy cannot be overstated. While BofA's assessment provides valuable context, thorough due diligence and a well-informed investment strategy remain crucial. Learn more about BofA's research on stock market valuations and develop a calm and informed approach to your investment portfolio. Don't let market volatility dictate your long-term investment strategy; maintain a calm approach to investing based on sound research and understanding of market valuations.

Featured Posts

-

Rent Freeze Plan Does It Apply To Private Landlords

May 28, 2025

Rent Freeze Plan Does It Apply To Private Landlords

May 28, 2025 -

Index Tavaszias Meleg Es Toebb Hullamban Erkezo Csapadek Varhato Belfoeldoen

May 28, 2025

Index Tavaszias Meleg Es Toebb Hullamban Erkezo Csapadek Varhato Belfoeldoen

May 28, 2025 -

Satu Hektare Taman Kota Untuk Setiap Kecamatan Balikpapan Inisiatif Wawali

May 28, 2025

Satu Hektare Taman Kota Untuk Setiap Kecamatan Balikpapan Inisiatif Wawali

May 28, 2025 -

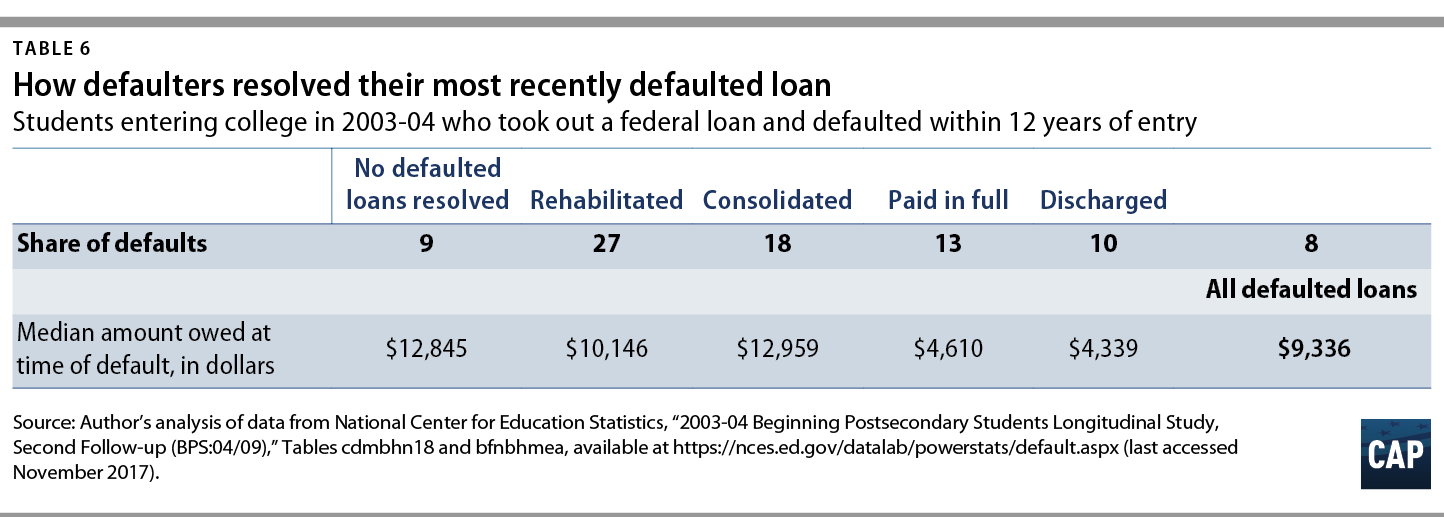

Student Loan Defaults And Their Impact On The National Economy

May 28, 2025

Student Loan Defaults And Their Impact On The National Economy

May 28, 2025 -

Sinners Strong Start Packed Top Half At French Open

May 28, 2025

Sinners Strong Start Packed Top Half At French Open

May 28, 2025