Bitcoin's Record High: Fueled By US Regulatory Optimism

Table of Contents

Gradual Shift in US Regulatory Approach

The recent surge in Bitcoin price is inextricably linked to a perceived shift in the US regulatory approach towards cryptocurrencies. For years, uncertainty surrounding US cryptocurrency regulation hampered institutional involvement. However, recent developments suggest a more nuanced and potentially supportive regulatory environment is emerging. This increased clarity is a major catalyst for the record high.

-

Recent statements from the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC): These regulatory bodies are increasingly engaging in constructive dialogue, moving away from blanket prohibitions towards a more considered approach to regulating different aspects of the crypto market. This includes the potential for clearer guidelines for various crypto assets.

-

Increased dialogue between regulatory bodies and industry stakeholders: This collaborative environment is fostering a better understanding of the complexities of the cryptocurrency space, leading to more tailored and effective regulations. This engagement reduces the uncertainty that previously stifled growth.

-

Potential for clearer guidelines regarding security token offerings (STOs) and exchange-traded products (ETPs) related to Bitcoin: The potential for clearer regulatory pathways for STOs and ETPs will significantly impact institutional participation and liquidity in the Bitcoin market. This clarity attracts more institutional investors seeking regulated investment vehicles.

-

Decreased uncertainty leading to increased institutional investor confidence: The reduction in regulatory ambiguity is a crucial factor driving the recent surge. Institutional investors, known for their risk aversion, are more inclined to invest when regulatory frameworks are clearer and more predictable. This confidence translates directly into increased demand and higher prices for Bitcoin.

Increased Institutional Adoption and Investment

Institutional adoption is another key driver of Bitcoin's record high. Once largely the domain of individual investors, Bitcoin is increasingly finding its place in the portfolios of major financial institutions. This shift represents a significant validation of Bitcoin as a legitimate asset class.

-

Major financial institutions are increasing their Bitcoin holdings: Many large corporations view Bitcoin as a potential hedge against inflation and a valuable tool for portfolio diversification, leading to substantial increases in institutional holdings.

-

Gradual integration of Bitcoin into traditional financial portfolios by asset managers and hedge funds: Asset managers and hedge funds are increasingly allocating a portion of their assets to Bitcoin, recognizing its potential for long-term growth and its uncorrelated nature to traditional markets.

-

Growing number of publicly traded companies adding Bitcoin to their treasury reserves: Several publicly traded companies are adopting Bitcoin as a treasury reserve asset, demonstrating growing confidence in its long-term value and potential as a store of value. This further legitimizes Bitcoin within the mainstream financial world.

-

Increased availability of Bitcoin investment vehicles such as exchange-traded funds (ETFs): The growing availability of Bitcoin ETFs makes it easier for institutional investors to access the Bitcoin market, further boosting demand and contributing to the price increase.

The Role of BlackRock's Bitcoin ETF Application

BlackRock's application for a Bitcoin ETF is a significant development that significantly impacted investor sentiment. The sheer size and reputation of BlackRock lends immense credibility to the Bitcoin market. If approved, it could unlock massive inflows of institutional capital, further driving up the Bitcoin price. BlackRock's entry signifies a crucial turning point, suggesting the integration of Bitcoin into traditional finance is accelerating. The potential approval of a Bitcoin ETF by the SEC remains a key factor influencing market expectations and future price movements.

Global Macroeconomic Factors

Global macroeconomic factors also play a significant role in Bitcoin's recent record high. The current economic climate, characterized by high inflation and geopolitical uncertainty, has driven investors towards alternative assets, including Bitcoin.

-

High inflation rates in several countries are driving investors towards alternative assets like Bitcoin: Investors seeking to protect their purchasing power are turning to Bitcoin as a potential hedge against inflation, driving up demand.

-

Bitcoin's perceived role as a hedge against inflation and currency devaluation: Bitcoin's limited supply and decentralized nature make it an attractive alternative to fiat currencies that are subject to inflationary pressures.

-

Geopolitical uncertainties influencing investor demand for Bitcoin as a safe-haven asset: In times of global uncertainty, investors often seek safe-haven assets, and Bitcoin's characteristics make it an attractive option.

-

The impact of rising interest rates on Bitcoin's price volatility: While rising interest rates can impact Bitcoin's price, the overall positive sentiment driven by other factors has largely offset this effect.

Conclusion

Bitcoin's recent record high is the result of a confluence of factors, including a more positive regulatory environment in the US, the increased institutional adoption of Bitcoin, and the influence of global macroeconomic conditions. The potential approval of a Bitcoin ETF further fuels optimism for future growth. While the cryptocurrency market remains volatile, the positive regulatory shifts and increased institutional interest suggest a potentially significant future for Bitcoin. Stay informed about the evolving landscape of Bitcoin and US regulation to make well-informed investment decisions. Learn more about Bitcoin's potential and navigate the market with confidence. Understanding Bitcoin's dynamics and the impact of regulatory changes is crucial for anyone considering Bitcoin investment.

Featured Posts

-

Chanted Free Palestine Before Attack Who Is Elias Rodriguez Accused In Jewish Museum Shooting

May 23, 2025

Chanted Free Palestine Before Attack Who Is Elias Rodriguez Accused In Jewish Museum Shooting

May 23, 2025 -

Donde Y Cuando Ver El Partido Mexico Vs Panama Final Liga De Naciones Concacaf

May 23, 2025

Donde Y Cuando Ver El Partido Mexico Vs Panama Final Liga De Naciones Concacaf

May 23, 2025 -

Elena Rybakina Obyektivnaya Otsenka Svoey Formy

May 23, 2025

Elena Rybakina Obyektivnaya Otsenka Svoey Formy

May 23, 2025 -

Zimbabwe Fast Bowlers Impressive Ranking Climb

May 23, 2025

Zimbabwe Fast Bowlers Impressive Ranking Climb

May 23, 2025 -

F1 Russells Final Day Victory

May 23, 2025

F1 Russells Final Day Victory

May 23, 2025

Latest Posts

-

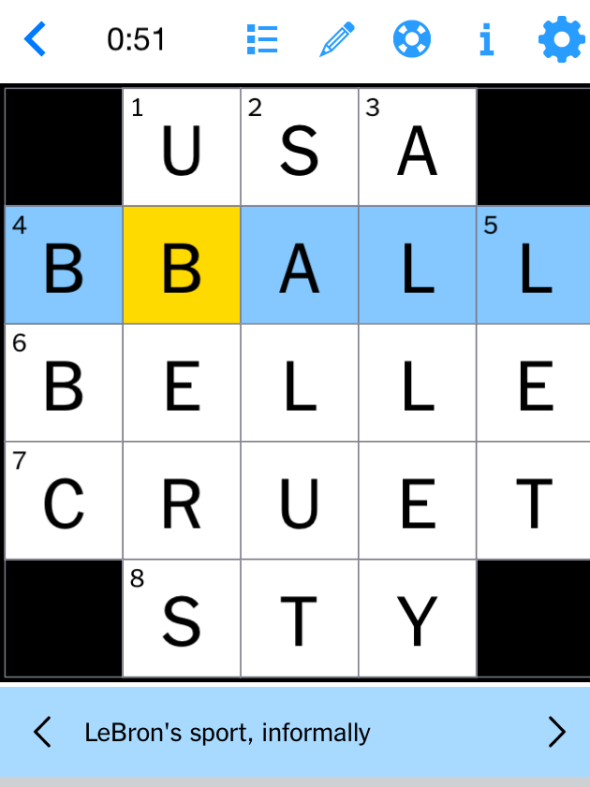

Solve The Nyt Mini Crossword March 13 Answers Hints And Strategies

May 23, 2025

Solve The Nyt Mini Crossword March 13 Answers Hints And Strategies

May 23, 2025 -

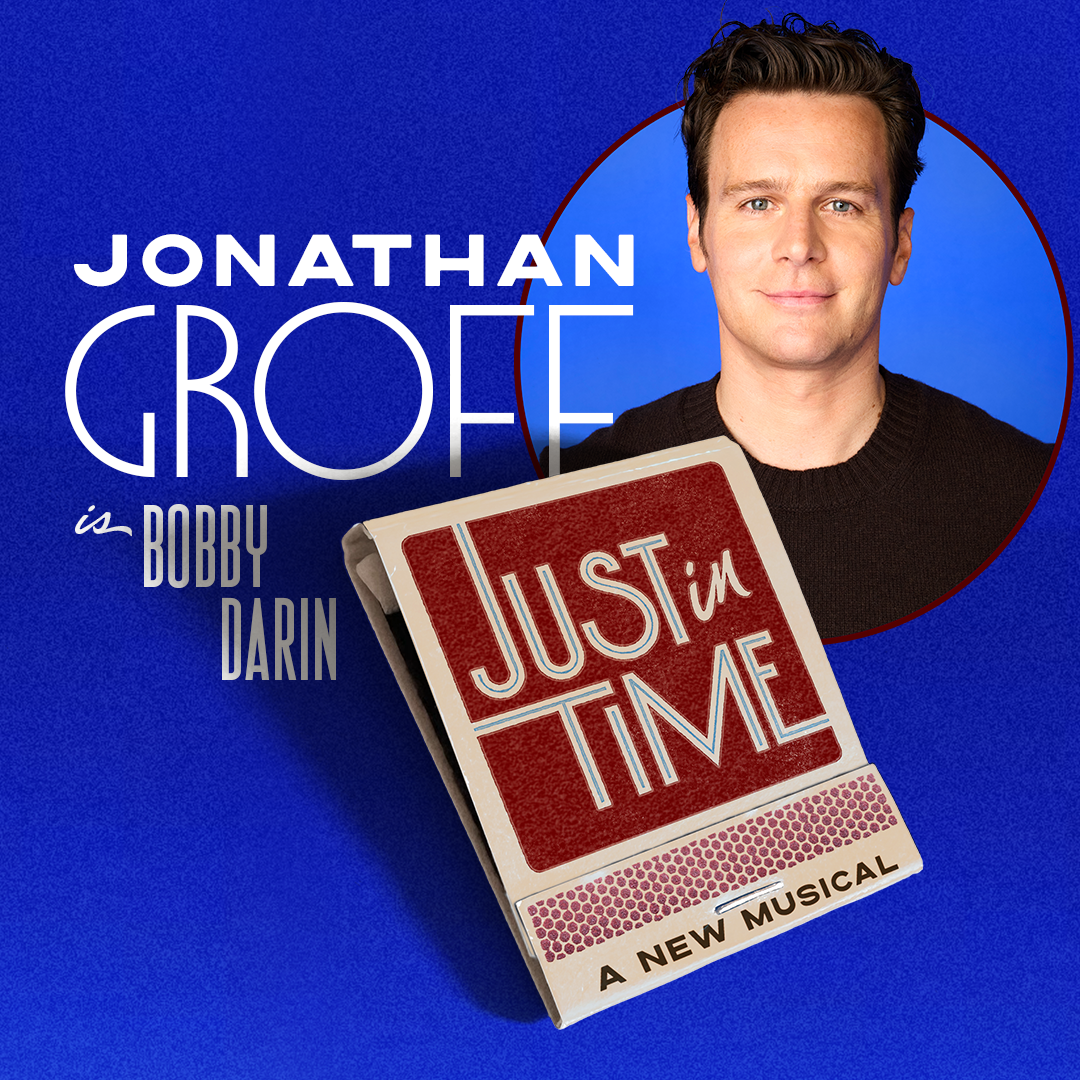

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025 -

Jonathan Groffs Just In Time A 1965 Inspired Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1965 Inspired Musical Triumph

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Actor Jonathan Groff Opens Up About His Past Experiences With Asexuality

May 23, 2025

Actor Jonathan Groff Opens Up About His Past Experiences With Asexuality

May 23, 2025