Bitcoin's Recent Rebound: Signs Of A Long-Term Uptrend?

Table of Contents

Analyzing Bitcoin's Recent Price Surge

Bitcoin's recent rebound has been substantial. Over the past [insert timeframe, e.g., month], the price has increased by [insert percentage increase, e.g., 25%], climbing from [insert starting price, e.g., $20,000] to [insert current price, e.g., $25,000]. This surge follows a period of relative stagnation and price correction, making it a noteworthy development for market watchers. Several factors have likely contributed to this positive price action.

- Specific examples of positive news impacting Bitcoin's price: Positive regulatory developments in [mention specific country/region], coupled with announcements of increased institutional adoption by major firms like [mention specific companies], have boosted investor confidence. The successful completion of the [mention specific Bitcoin upgrade/event] also played a significant role.

- Data points showing the scale of the rebound compared to previous market cycles: This rebound is [compare the current rebound to previous rebounds – e.g., "significantly faster" or "more sustained"] than similar price increases observed during [mention previous market cycles].

- Mention of any specific institutional investments fueling the price increase: Reports suggest that significant institutional investment from [mention specific types of investors, e.g., hedge funds, pension funds] has contributed to increased buying pressure, pushing the price upward.

Technical Indicators Suggesting a Potential Uptrend

Technical analysis offers further insights into Bitcoin's recent rebound and its potential to signal a long-term uptrend. Several key indicators support this hypothesis.

- Explanation of each technical indicator and how it relates to Bitcoin's price: The 50-day and 200-day moving averages have shown a clear bullish crossover, a classic sign of a potential uptrend. The Relative Strength Index (RSI) is currently above [insert RSI value, e.g., 50], indicating that the market is not overbought. The Moving Average Convergence Divergence (MACD) is also showing a bullish signal.

- Charts or graphs visualizing the indicators and their trends: [Insert relevant charts and graphs showcasing the mentioned technical indicators. Clearly label axes and provide a concise caption for each chart.]

- Interpretation of the indicators and their implications for future price movements: The confluence of these positive technical signals suggests a strong possibility of continued upward momentum in Bitcoin's price, potentially indicating a sustained bull market.

Macroeconomic Factors Influencing Bitcoin's Rebound

Broader macroeconomic trends are also playing a role in Bitcoin's recent rebound.

- Discussion of inflation and its impact on Bitcoin's value as a hedge against inflation: Persistent inflation in many global economies is driving investors to seek alternative assets that can preserve their purchasing power. Bitcoin, with its limited supply, is increasingly viewed as a hedge against inflation.

- Analysis of how interest rate changes affect investor behavior and Bitcoin's price: While rising interest rates can impact investor sentiment, the current situation suggests that the appeal of Bitcoin as a potentially high-growth asset outweighs these concerns for many.

- Explanation of how geopolitical uncertainty can drive demand for Bitcoin as a safe haven asset: Geopolitical instability often boosts demand for Bitcoin as investors seek a safe haven asset outside of traditional financial systems.

Assessing Market Sentiment and Investor Confidence

Market sentiment and investor confidence are crucial elements driving Bitcoin's recent price action.

- Examples of positive or negative news coverage impacting market sentiment: Recent positive news coverage, focusing on [mention specific positive news, e.g., increased adoption by large corporations], has significantly improved overall market sentiment.

- Analysis of social media sentiment towards Bitcoin: Social media sentiment analysis tools indicate a predominantly positive outlook for Bitcoin, with increased engagement and discussion around potential future price increases.

- Discussion of investor surveys and their findings regarding Bitcoin's future: Several investor surveys show increasing confidence in Bitcoin's long-term potential, suggesting that the current rebound might be sustainable.

Conclusion

This analysis of Bitcoin's recent rebound suggests a potential long-term uptrend, driven by a combination of positive market catalysts, supportive technical indicators, and favorable macroeconomic conditions. While uncertainty remains inherent in the cryptocurrency market, the current signs are encouraging. Bitcoin's recent rebound is a significant development that warrants close observation.

Call to Action: Stay informed on Bitcoin's price movements and market trends. Understanding Bitcoin's recent rebound is crucial for navigating this dynamic market. Continue to research and learn more about Bitcoin's potential for long-term growth. Consider diversifying your portfolio with a strategic allocation to Bitcoin as part of a well-researched investment strategy. Remember to always conduct your own thorough research before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

Is Upi Payment Still Working On Uber Auto Understanding Recent Changes

May 08, 2025

Is Upi Payment Still Working On Uber Auto Understanding Recent Changes

May 08, 2025 -

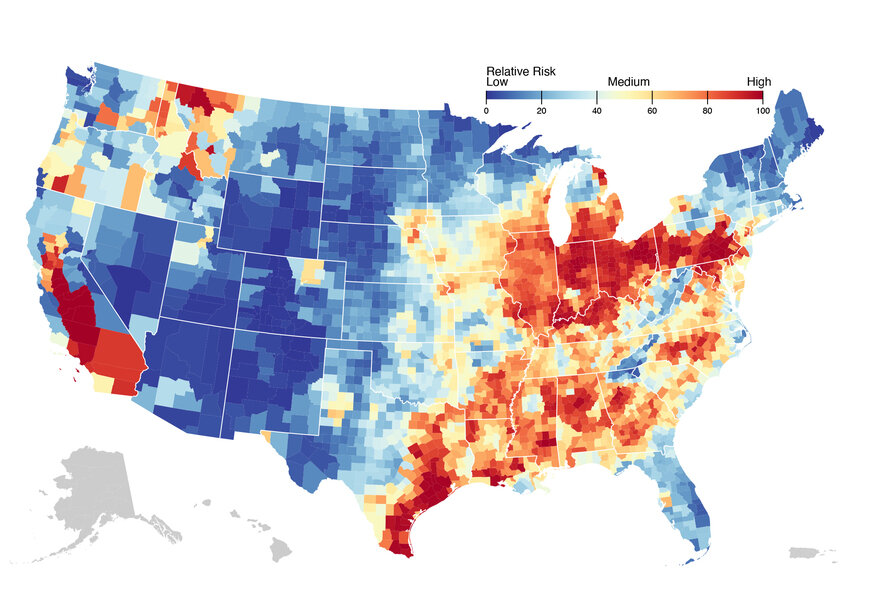

New Business Hot Spots A Nationwide Map And Analysis

May 08, 2025

New Business Hot Spots A Nationwide Map And Analysis

May 08, 2025 -

Sonys Ps 5 Pro Everything We Know About The Performance Boost

May 08, 2025

Sonys Ps 5 Pro Everything We Know About The Performance Boost

May 08, 2025 -

El Gesto De Erick Pulgar Que Conmovio A La Aficion Del Flamengo

May 08, 2025

El Gesto De Erick Pulgar Que Conmovio A La Aficion Del Flamengo

May 08, 2025 -

Inter Milan Upsets Bayern Munich In Champions League First Leg Report

May 08, 2025

Inter Milan Upsets Bayern Munich In Champions League First Leg Report

May 08, 2025

Latest Posts

-

The Essence Of Success Jayson Tatum On Grooming And Confidence

May 09, 2025

The Essence Of Success Jayson Tatum On Grooming And Confidence

May 09, 2025 -

Analyzing Colin Cowherds Criticism Of Jayson Tatums Performance

May 09, 2025

Analyzing Colin Cowherds Criticism Of Jayson Tatums Performance

May 09, 2025 -

Jayson Tatum Opens Up Grooming Confidence And His Coach

May 09, 2025

Jayson Tatum Opens Up Grooming Confidence And His Coach

May 09, 2025 -

Jayson Tatum On Grooming Confidence And A Full Circle Coaching Moment

May 09, 2025

Jayson Tatum On Grooming Confidence And A Full Circle Coaching Moment

May 09, 2025 -

Jayson Tatums Personal Grooming Routine Confidence And Coaching

May 09, 2025

Jayson Tatums Personal Grooming Routine Confidence And Coaching

May 09, 2025