Bitcoin's Price Action: Post-10-Week High Surge Towards US$100,000

Table of Contents

Analyzing the Recent Bitcoin Price Surge

Technical Indicators Pointing to Continued Growth

Bitcoin's recent rally is supported by several key technical indicators. The Relative Strength Index (RSI), a momentum oscillator, has shown signs of bullish momentum, suggesting further upward movement. Similarly, the Moving Average Convergence Divergence (MACD) indicator has generated a bullish crossover, reinforcing the positive trend. Analysis of Bitcoin chart patterns reveals potential breakouts above significant resistance levels, further bolstering the case for continued growth.

- RSI above 70: Indicates overbought conditions, but in strong bull markets, this can signal continued upward momentum.

- MACD bullish crossover: Suggests a shift from bearish to bullish sentiment.

- Breaking above key resistance levels: Successful breaches of previous resistance levels often signal further price appreciation.

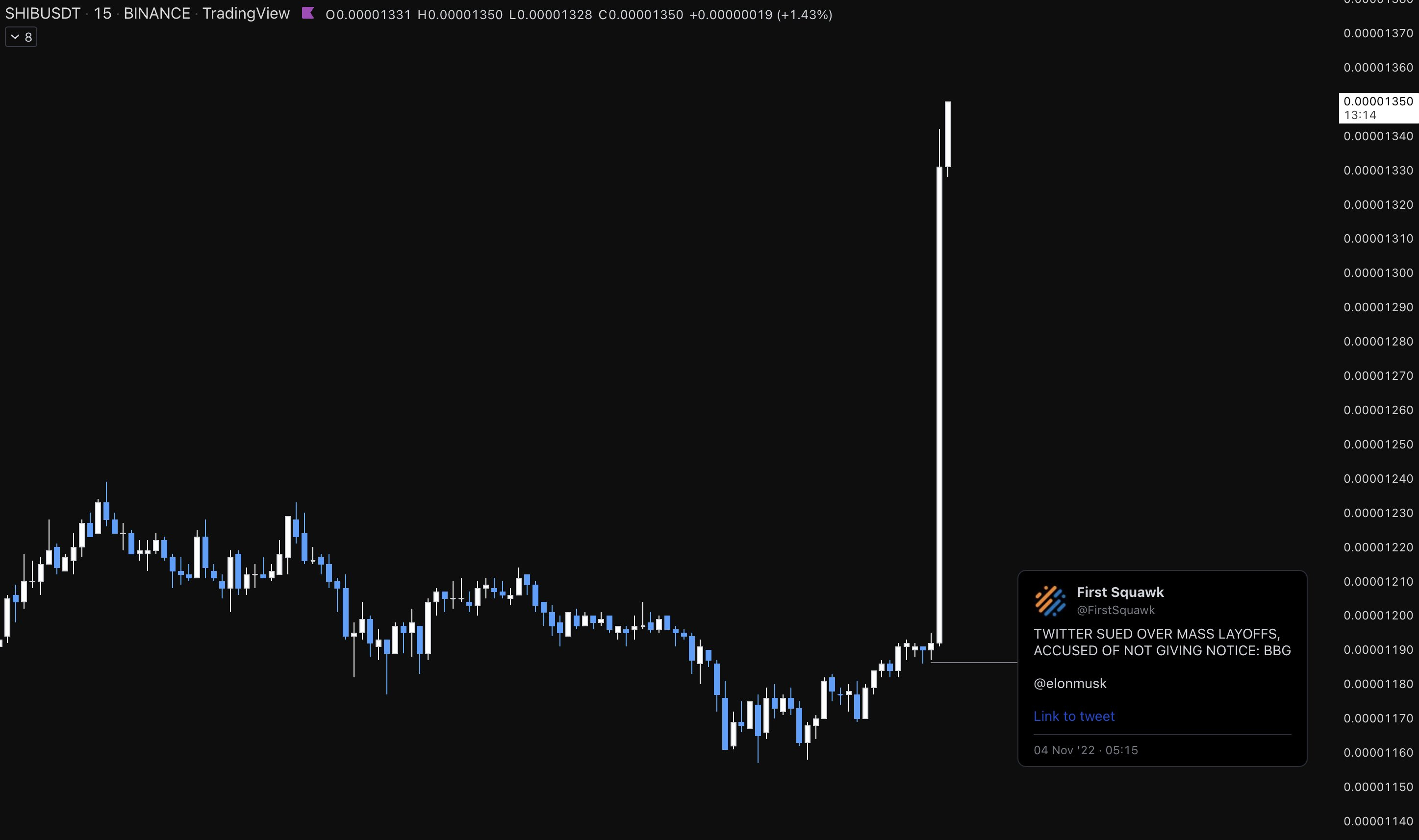

[Insert a chart or graph visually representing Bitcoin's price action and key technical indicators here.]

Analyzing Bitcoin technical analysis requires a comprehensive understanding of these indicators and their interplay. Understanding Bitcoin trading signals derived from these charts is paramount for informed decision-making.

Influence of Institutional Investors

The growing involvement of institutional investors is a significant driver of Bitcoin's price surge. Major players like Grayscale, MicroStrategy, and several other publicly traded companies have significantly increased their Bitcoin holdings, signaling a growing acceptance of Bitcoin as a legitimate asset class. This institutional Bitcoin investment demonstrates a shift in market sentiment, boosting confidence and attracting further investment.

- Grayscale Bitcoin Trust (GBTC): A substantial holder of Bitcoin, its accumulation directly impacts market demand.

- MicroStrategy's Bitcoin strategy: Michael Saylor's company has become a prominent example of corporate Bitcoin holdings.

- Increased ETF applications: The growing number of Bitcoin ETF applications indicates a desire for greater institutional accessibility.

The increasing Bitcoin adoption by institutions signifies a maturing market and a reduced reliance on retail investor sentiment alone.

Macroeconomic Factors Affecting Bitcoin's Price

Macroeconomic factors play a crucial role in Bitcoin's price movement. Global economic uncertainty, high inflation rates, and potentially rising interest rates are all contributing factors. Many view Bitcoin as a hedge against inflation, leading investors to seek refuge in its decentralized nature during times of economic turmoil.

- Inflationary pressures: High inflation can drive investors towards alternative assets like Bitcoin, perceived as a store of value.

- Interest rate hikes: While interest rate increases might initially impact Bitcoin negatively, they can also drive investors towards assets with higher potential returns.

- Geopolitical instability: Global uncertainties can increase demand for Bitcoin as a safe haven asset.

Understanding the interplay between Bitcoin macroeconomic factors and Bitcoin's price action requires a keen eye on global financial news and economic indicators.

Factors Potentially Hindering a Bitcoin Price Rally to $100,000

Regulatory Uncertainty and Government Intervention

Regulatory uncertainty remains a significant headwind for Bitcoin's price. Government interventions and differing regulatory approaches across countries create uncertainty, potentially dampening investor enthusiasm. Stringent regulations could restrict Bitcoin's adoption and limit its price appreciation.

- Varying regulatory landscapes: Different countries have different approaches to regulating cryptocurrencies, creating a fragmented and uncertain market.

- Potential for increased taxation: Higher taxes on Bitcoin transactions could reduce profitability and investment.

- Bans and restrictions: Government bans or restrictions on Bitcoin trading can severely impact its price.

Market Volatility and Correction Risks

The cryptocurrency market is inherently volatile, and Bitcoin is no exception. Sharp price corrections are common, posing a significant risk to investors. Risk management strategies, such as diversification and careful position sizing, are crucial for mitigating potential losses.

- Sharp price swings: Bitcoin's price can fluctuate dramatically in short periods, making it a high-risk investment.

- Market sentiment shifts: Changes in investor sentiment can trigger significant price movements.

- "Black Swan" events: Unexpected events can cause significant market disruptions.

Competition from Alternative Cryptocurrencies

The emergence of alternative cryptocurrencies (altcoins) poses a competitive challenge to Bitcoin's dominance. While Bitcoin remains the largest cryptocurrency by market capitalization, innovative altcoins with unique features could attract investors and potentially erode Bitcoin's market share.

- Increased competition: The growing number of altcoins offers investors alternative options.

- Technological advancements: Improvements in blockchain technology may lead to more efficient and scalable altcoins.

- Innovation in DeFi and NFTs: Growth in decentralized finance (DeFi) and non-fungible tokens (NFTs) could divert investment away from Bitcoin.

Bitcoin's Future: Navigating the Path to $100,000

This article has explored both the bullish and bearish arguments surrounding Bitcoin's price action and its potential to reach US$100,000. While positive technical indicators, institutional investment, and macroeconomic factors suggest potential for further growth, regulatory uncertainties, market volatility, and competition from altcoins present significant challenges. A balanced perspective acknowledges both the opportunities and risks associated with Bitcoin investment.

To make informed investment decisions, it’s crucial to stay updated on Bitcoin's price action, learn more about Bitcoin investment strategies, and carefully analyze Bitcoin's price movement considering all factors. Remember, the cryptocurrency market is highly speculative, and significant losses are possible. Conduct thorough research and only invest what you can afford to lose.

Bitcoin's long-term potential remains a subject of debate, but its growing adoption and underlying technology suggest a continued role in the evolving financial landscape. Careful consideration and responsible investment practices are paramount when navigating this dynamic market.

Featured Posts

-

Boston Celtics Vs Cavaliers 4 Takeaways From The Upset

May 07, 2025

Boston Celtics Vs Cavaliers 4 Takeaways From The Upset

May 07, 2025 -

Assessing The Viability Of Hydrogen And Battery Buses In Europe

May 07, 2025

Assessing The Viability Of Hydrogen And Battery Buses In Europe

May 07, 2025 -

De Bussers Comeback Bosses Shoot Out Secures Go Ahead Cup Final

May 07, 2025

De Bussers Comeback Bosses Shoot Out Secures Go Ahead Cup Final

May 07, 2025 -

Go Ahead Eagles Win Cup Final De Bussers Decisive Shoot Out Performance

May 07, 2025

Go Ahead Eagles Win Cup Final De Bussers Decisive Shoot Out Performance

May 07, 2025 -

The Young And The Restless Spoilers Will Summers Fate Hinge On Claires Pregnancy

May 07, 2025

The Young And The Restless Spoilers Will Summers Fate Hinge On Claires Pregnancy

May 07, 2025

Latest Posts

-

Dogecoin Shiba Inu And Sui Understanding This Weeks Market Gains

May 08, 2025

Dogecoin Shiba Inu And Sui Understanding This Weeks Market Gains

May 08, 2025 -

Navigating The Cryptosphere Why Reliable News Matters

May 08, 2025

Navigating The Cryptosphere Why Reliable News Matters

May 08, 2025 -

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025 -

The Importance Of Trustworthy Crypto News Sources

May 08, 2025

The Importance Of Trustworthy Crypto News Sources

May 08, 2025 -

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind The Rally

May 08, 2025

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind The Rally

May 08, 2025