Bitcoin's Future: Predicting Price After Trump's 100-Day Speech

Table of Contents

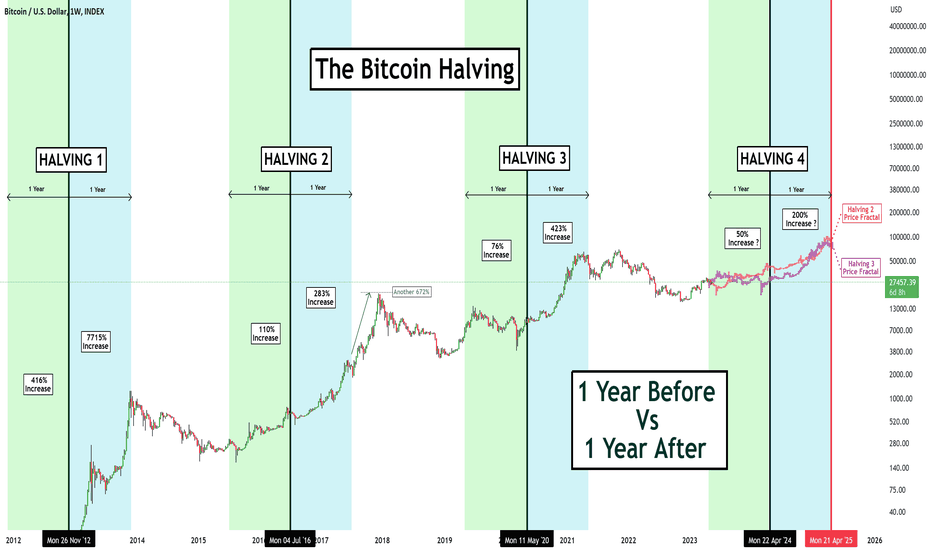

Trump's 100-Day Speech and its Market Impact

Trump's 100-day speech, and the policy announcements surrounding it, created a ripple effect across various asset classes. Understanding how these policies might correlate with Bitcoin's price is crucial for any Bitcoin price prediction.

Economic Policies and Bitcoin's Correlation

Specific economic policies unveiled during this period could have had both positive and negative consequences for Bitcoin.

- Tax Cuts: Large-scale tax cuts could potentially lead to increased inflation, potentially driving investors towards Bitcoin as a hedge against inflation. However, it could also attract more regulatory scrutiny.

- Deregulation: Reduced regulation in the financial sector might initially boost investor confidence, positively impacting Bitcoin's price. However, a lack of regulatory clarity could also create uncertainty and volatility.

- Increased Government Spending: Significant increases in government spending, if not managed effectively, could lead to higher inflation and a weakening dollar, potentially increasing demand for Bitcoin.

Experts like [cite a relevant expert and their opinion on the matter] suggest that the net impact of these policies on Bitcoin's price would depend on the market's overall interpretation and the interplay of various economic factors. Data from [cite a reputable source with relevant data] shows a [mention the observed price reaction, if any, with percentage change].

Geopolitical Uncertainty and Safe-Haven Assets

The overall tone and impact of the 100-day speech on global uncertainty played a vital role in shaping investor sentiment towards Bitcoin.

- Safe-Haven Status: In times of geopolitical uncertainty, investors often seek safe-haven assets. Bitcoin, despite its volatility, has increasingly been viewed as a potential alternative to traditional safe havens like gold.

- Comparison to Gold: While gold's price often rises during times of uncertainty, Bitcoin's decentralized nature and potential for higher returns attract a different segment of investors seeking diversification.

- Market Psychology: Investor fear and uncertainty can significantly inflate Bitcoin's price as investors seek to preserve capital and potentially profit from the increased volatility.

The interplay between these factors makes predicting the precise impact on Bitcoin’s price challenging, but undeniably significant.

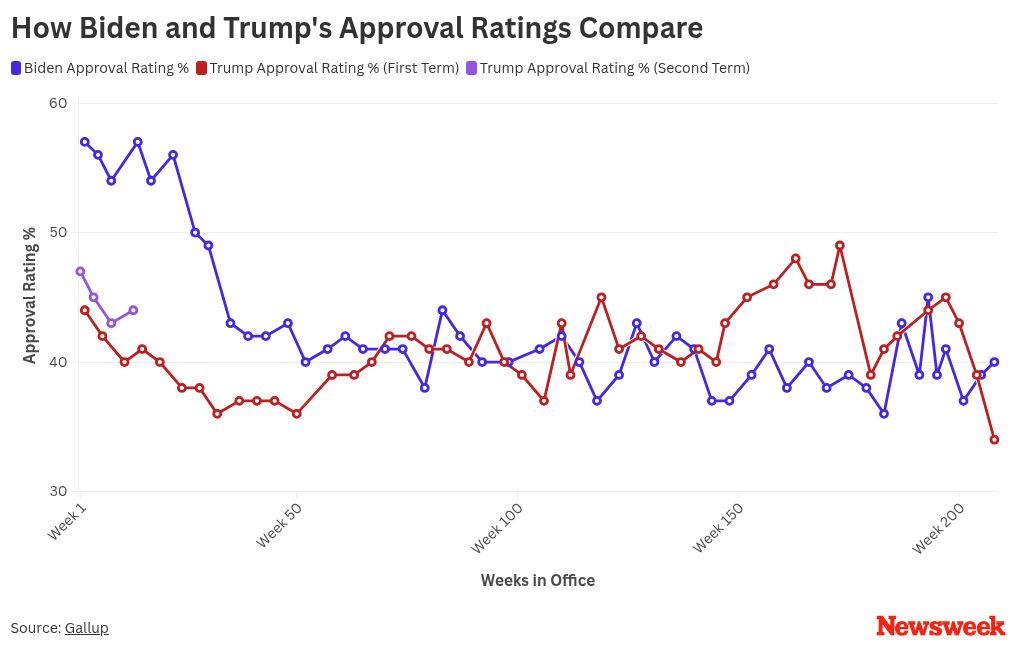

Analyzing Bitcoin's Historical Response to Political Events

Examining Bitcoin's historical price fluctuations in response to past political events can provide valuable insights for forecasting its future behavior.

Past Price Fluctuations and Presidential Actions

Bitcoin's price has demonstrated sensitivity to significant political events throughout its history.

- Example 1: [Specific example of a past political event and its impact on Bitcoin's price, supported by data and charts].

- Example 2: [Another example of a past political event and its impact on Bitcoin's price, supported by data and charts].

These examples highlight the correlation between major political events and Bitcoin's price volatility, but also emphasize the complexity of predicting the precise magnitude and direction of these price movements.

Predictive Modeling and Technical Analysis

While precise Bitcoin price predictions are impossible, technical analysis and predictive modeling can offer potential scenarios.

- Technical Indicators: Tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands can help identify potential price trends and support/resistance levels.

- Predictive Models: These models, however, often rely on historical data and may not accurately capture the impact of unforeseen events, limiting their predictive power.

- Probabilistic Approach: Instead of predicting a specific price point, focusing on potential price ranges and associated probabilities offers a more realistic approach.

Factors Beyond Trump's Speech Influencing Bitcoin's Price

While Trump's 100-day speech undoubtedly played a role, other factors contribute significantly to Bitcoin's price.

Technological Advancements and Adoption Rates

Continuous technological improvements and increasing adoption rates are key drivers of Bitcoin's long-term price.

- Lightning Network: Enhancements to the Lightning Network, for example, improve transaction speeds and scalability, potentially increasing Bitcoin's usability and adoption.

- Institutional Adoption: Increased adoption by institutional investors and corporations adds legitimacy and stability to the market, influencing price positively.

Regulatory Developments and Global Market Sentiment

Regulatory changes worldwide and overall market sentiment significantly influence Bitcoin’s price.

- Varying Regulations: Differing regulatory approaches across countries create uncertainty and potential opportunities, impacting the flow of investment into Bitcoin.

- Social Media Influence: News coverage and social media sentiment can drastically impact investor confidence and, consequently, Bitcoin's price.

Conclusion

Predicting Bitcoin's price after Trump's 100-day speech, or any significant political event, is a complex undertaking. The interplay of economic policies, geopolitical uncertainty, technological advancements, regulatory developments, and market sentiment all contribute to Bitcoin's volatility. While precise price predictions remain elusive, analyzing historical data, considering potential policy impacts, and monitoring technological developments provide valuable insights. Stay updated on the latest developments affecting Bitcoin's future and continue your journey into the world of cryptocurrency.

Featured Posts

-

Analyzing Trumps Influence On The Greenland Denmark Relationship

May 09, 2025

Analyzing Trumps Influence On The Greenland Denmark Relationship

May 09, 2025 -

Bitcoin Seoul 2025 Networking And Innovation In Asias Crypto Hub

May 09, 2025

Bitcoin Seoul 2025 Networking And Innovation In Asias Crypto Hub

May 09, 2025 -

Bitcoin Price Prediction Can Trumps 100 Day Speech Push Btc Past 100 000

May 09, 2025

Bitcoin Price Prediction Can Trumps 100 Day Speech Push Btc Past 100 000

May 09, 2025 -

The Daily Fox News Appearances Of The Us Attorney General Whats Really Going On

May 09, 2025

The Daily Fox News Appearances Of The Us Attorney General Whats Really Going On

May 09, 2025 -

Warming Weather And Soft Mudflats Hinder Anchorage Fin Whale Skeleton Recovery

May 09, 2025

Warming Weather And Soft Mudflats Hinder Anchorage Fin Whale Skeleton Recovery

May 09, 2025

Latest Posts

-

Young Thugs Uy Scuti When Can We Expect The New Album

May 09, 2025

Young Thugs Uy Scuti When Can We Expect The New Album

May 09, 2025 -

Council Approves Rezoning Edmonton Nordic Spa Development Progresses

May 09, 2025

Council Approves Rezoning Edmonton Nordic Spa Development Progresses

May 09, 2025 -

Uy Scuti Album Young Thug Offers Release Date Clues

May 09, 2025

Uy Scuti Album Young Thug Offers Release Date Clues

May 09, 2025 -

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025 -

Young Thugs Uy Scuti Album Speculation And Anticipated Release

May 09, 2025

Young Thugs Uy Scuti Album Speculation And Anticipated Release

May 09, 2025