Bitcoin Price Prediction: Will Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Trump's Potential Economic Policies and Their Impact on Bitcoin

The potential economic policies of a hypothetical Trump administration could significantly influence the Bitcoin price. Let's explore key areas:

Fiscal Stimulus and Inflation

Increased government spending, a hallmark of fiscal stimulus, can fuel inflation. When the value of fiat currency declines, investors often seek alternative assets to preserve their wealth. Bitcoin, with its fixed supply, has emerged as a potential hedge against inflation.

- Scenario 1: Significant fiscal stimulus leads to higher-than-expected inflation. This could drive investors towards Bitcoin, boosting demand and potentially pushing the price higher.

- Scenario 2: Moderate fiscal stimulus results in manageable inflation. Bitcoin might see moderate price increases, but not a dramatic surge past $100,000.

- Historical Context: Bitcoin's price has historically shown periods of growth during times of high inflation, though correlation doesn't equal causation. Expert opinions on this relationship are varied. Further research is needed to definitively link these factors. Keywords: inflation, Bitcoin hedge, government spending, fiscal policy, Bitcoin price increase.

Regulatory Uncertainty

Trump's stance on cryptocurrency regulation remains uncertain. This ambiguity itself can impact the Bitcoin price.

- Scenario 1: Increased regulation could stifle innovation and reduce investor confidence, potentially leading to a price decline.

- Scenario 2: A more lenient regulatory environment could boost investor confidence and increase adoption, potentially driving price appreciation.

- Scenario 3: No significant policy changes could lead to a continuation of the existing market trends, without a major influence on the Bitcoin price. Keywords: crypto regulation, Bitcoin regulation, US regulatory environment, Bitcoin price volatility.

Geopolitical Instability and Safe-Haven Assets

Geopolitical instability often leads investors to seek safe-haven assets. Bitcoin, with its decentralized nature, has been touted as a potential safe haven.

- Scenario 1: Increased geopolitical tensions could drive investors towards Bitcoin as a store of value, potentially pushing the price upwards.

- Scenario 2: A relatively stable geopolitical environment might see Bitcoin's safe-haven appeal diminish, leading to less dramatic price movements.

- Historical Examples: Bitcoin has historically shown increased demand during periods of global uncertainty, though this effect isn't always consistent. Keywords: safe haven asset, geopolitical risk, Bitcoin investment, Bitcoin price stability.

Market Sentiment and Bitcoin's Price Action

Beyond macroeconomic factors, market sentiment plays a critical role in shaping Bitcoin's price.

Speculation and Hype

The anticipation surrounding any significant political event, including a hypothetical Trump speech, can generate considerable speculation and hype. This can artificially inflate or deflate the Bitcoin price.

- Positive Sentiment: If the speech is perceived as positive for Bitcoin, a surge in speculative trading could push the price higher.

- Negative Sentiment: Conversely, negative sentiment could trigger a sell-off, leading to price declines.

- Past Examples: Numerous instances demonstrate how market hype can drastically influence Bitcoin's price, both positively and negatively. Keywords: Bitcoin speculation, market sentiment, cryptocurrency trading, Bitcoin price pump.

Technical Analysis

While avoiding overly complex technical analysis, we can note that indicators such as moving averages and support/resistance levels can offer insights into potential price movements. A bullish crossover in a moving average could suggest an upward trend, while breaking a significant support level might signal a decline. Keywords: technical analysis, Bitcoin charts, price support, price resistance, Bitcoin price trend.

Adoption Rate and Institutional Investment

Regardless of Trump's speech, increasing Bitcoin adoption and institutional investment remain significant drivers of its price.

- Increased Adoption: Wider adoption by businesses and individuals fuels demand and pushes prices up.

- Institutional Investment: Large-scale investments from institutions legitimize Bitcoin and increase its liquidity, contributing to price stability and growth. Keywords: institutional investment, Bitcoin adoption, cryptocurrency investment, Bitcoin market capitalization.

Bitcoin Price Prediction: The Verdict

Predicting Bitcoin's price with certainty is impossible. While a hypothetical Trump speech could influence market sentiment and indirectly impact the Bitcoin price, it's crucial to remember that numerous other factors are at play. A surge past $100,000 is possible under certain scenarios, particularly if combined with strong positive market sentiment, increased adoption, and institutional investment. However, it's equally plausible that the speech's effect on Bitcoin's price would be minimal or even negative.

Ultimately, forming your own informed Bitcoin price prediction requires considering multiple factors, from macroeconomic trends and regulatory changes to market sentiment and technical indicators. Remember, cryptocurrency investment is inherently risky. Stay informed on the latest Bitcoin price news and analysis to make responsible investment decisions.

Featured Posts

-

Sec Review Of Grayscales Xrp Etf Potential For Price Increase

May 08, 2025

Sec Review Of Grayscales Xrp Etf Potential For Price Increase

May 08, 2025 -

Trade War Fallout Which Cryptocurrency Will Prevail

May 08, 2025

Trade War Fallout Which Cryptocurrency Will Prevail

May 08, 2025 -

Psg Nantes Beraberlik Karsilasmasinin Detaylari

May 08, 2025

Psg Nantes Beraberlik Karsilasmasinin Detaylari

May 08, 2025 -

Former Okc Thunders Record Breaking Double Performances An Analysis

May 08, 2025

Former Okc Thunders Record Breaking Double Performances An Analysis

May 08, 2025 -

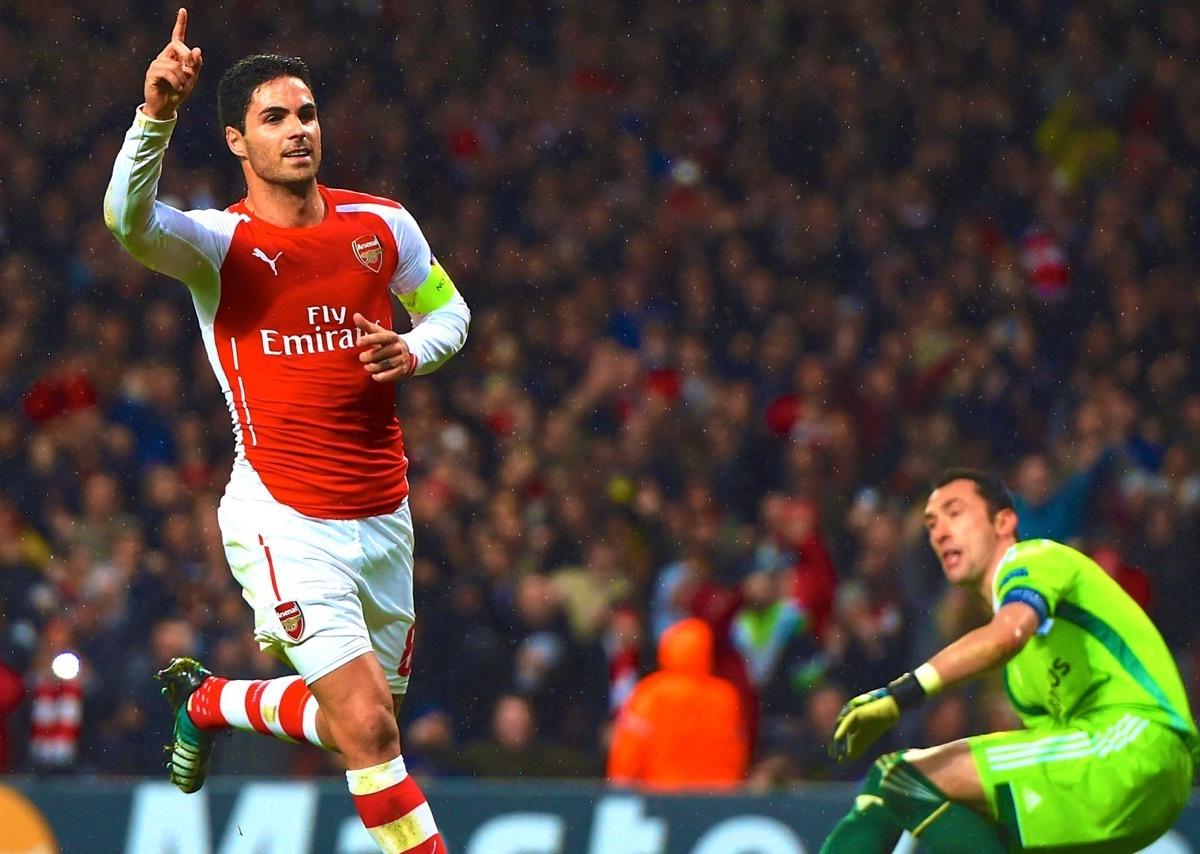

Arteta Faces Scrutiny Reaction To Collymores Comments On Arsenal

May 08, 2025

Arteta Faces Scrutiny Reaction To Collymores Comments On Arsenal

May 08, 2025

Latest Posts

-

Tatums Candid Remarks On Larry Birds Impact On The Boston Celtics

May 08, 2025

Tatums Candid Remarks On Larry Birds Impact On The Boston Celtics

May 08, 2025 -

Jayson Tatum On Larry Bird Respect Influence And The Celtics Legacy

May 08, 2025

Jayson Tatum On Larry Bird Respect Influence And The Celtics Legacy

May 08, 2025 -

Alshmrany Yuelq Ela Mfawdat Jysws Me Flamnghw

May 08, 2025

Alshmrany Yuelq Ela Mfawdat Jysws Me Flamnghw

May 08, 2025 -

Thlyl Alshmrany Ltsryhat Jysws Hwl Antqalh Lflamnghw

May 08, 2025

Thlyl Alshmrany Ltsryhat Jysws Hwl Antqalh Lflamnghw

May 08, 2025 -

Fydyw Rdt Fel Alshmrany Ela Tsryhat Jysws Hwl Flamnghw

May 08, 2025

Fydyw Rdt Fel Alshmrany Ela Tsryhat Jysws Hwl Flamnghw

May 08, 2025