Bitcoin Price Prediction 2024: Trump's Impact On BTC's Value

Table of Contents

Bitcoin, the world's leading cryptocurrency, is known for its volatility. Its price fluctuates dramatically, influenced by a complex interplay of factors, including macroeconomic conditions, regulatory changes, and market sentiment. As we approach the 2024 US Presidential election, a significant source of uncertainty for Bitcoin investors is the potential impact of Donald Trump's return to the White House. This article aims to explore potential scenarios for Bitcoin's price in 2024, specifically considering the influence of a potential Trump presidency on the crypto market and the resulting Bitcoin price prediction 2024. We'll analyze Trump's potential economic policies, their effect on the cryptocurrency market, and other crucial factors influencing BTC’s value.

Trump's Economic Policies and Their Potential Effect on Bitcoin

H3: Fiscal Policy and Inflation:

Trump's potential fiscal policies, characterized by tax cuts and increased government spending, could significantly impact inflation. A surge in the money supply, a hallmark of such policies, could lead to a devaluation of the US dollar. This scenario might boost Bitcoin's value as investors seek a hedge against inflation. Bitcoin, often seen as a store of value, could benefit from increased demand as a safe haven asset.

- Increased money supply: A key consequence of expansionary fiscal policies.

- Potential for devaluation of the dollar: Eroding purchasing power and driving investors to alternative assets like Bitcoin.

- Bitcoin as a safe haven asset: Its decentralized nature and limited supply make it an attractive alternative during inflationary periods.

H3: Regulation and Cryptocurrency:

Trump's previous stance on cryptocurrency regulation was relatively hands-off. However, a second term could bring a shift in approach. Increased regulatory scrutiny could hinder institutional investment and slow down Bitcoin adoption, potentially depressing its price. Conversely, more lenient regulation could foster greater institutional participation and boost the market.

- Regulatory uncertainty: A major risk factor for Bitcoin's price stability.

- Impact on institutional investment: Stricter regulations may discourage large-scale institutional adoption.

- Effect on Bitcoin adoption: Clearer regulatory frameworks could accelerate wider acceptance of Bitcoin.

H3: Geopolitical Uncertainty and Bitcoin's Safe Haven Status:

A Trump presidency might bring increased geopolitical uncertainty. In times of global instability, investors often turn to safe-haven assets, and Bitcoin could potentially benefit from this "flight to safety" capital. Increased demand during periods of crisis could drive up Bitcoin's price.

- Increased demand during times of crisis: Bitcoin's decentralized nature makes it an attractive option during periods of political or economic instability.

- Flight to safety capital: Investors move their assets into perceived safe havens like Bitcoin.

- Bitcoin's role in a volatile global landscape: Its value proposition as a hedge against geopolitical risk strengthens its appeal to investors.

Alternative Scenarios for Bitcoin's Price in 2024

H3: Scenario 1: A Bullish Market fueled by a Trump Win:

A Trump victory leading to increased inflation and geopolitical uncertainty could significantly boost Bitcoin demand. In this scenario, we might see a price range of $70,000 - $100,000 by the end of 2024. This bullish prediction is contingent on strong investor confidence in Bitcoin as an inflation hedge and safe haven.

H3: Scenario 2: A Bearish Market under a Trump Administration:

Conversely, if a Trump presidency introduces stricter cryptocurrency regulations or fuels market uncertainty through unpredictable policy decisions, it could lead to a bearish market. In this case, the Bitcoin price might range from $20,000 - $40,000 by the end of 2024, reflecting decreased investor confidence and potential regulatory hurdles.

H3: Scenario 3: A Neutral Market Outcome:

It's also possible that the impact of a Trump presidency on Bitcoin is relatively neutral. If regulatory changes are moderate and the overall economic landscape remains relatively stable, the price of Bitcoin might fluctuate within a range of $40,000 - $60,000 by the end of 2024. This scenario assumes a balance between positive and negative factors impacting BTC's value.

Factors Beyond Trump's Influence Affecting Bitcoin Price in 2024:

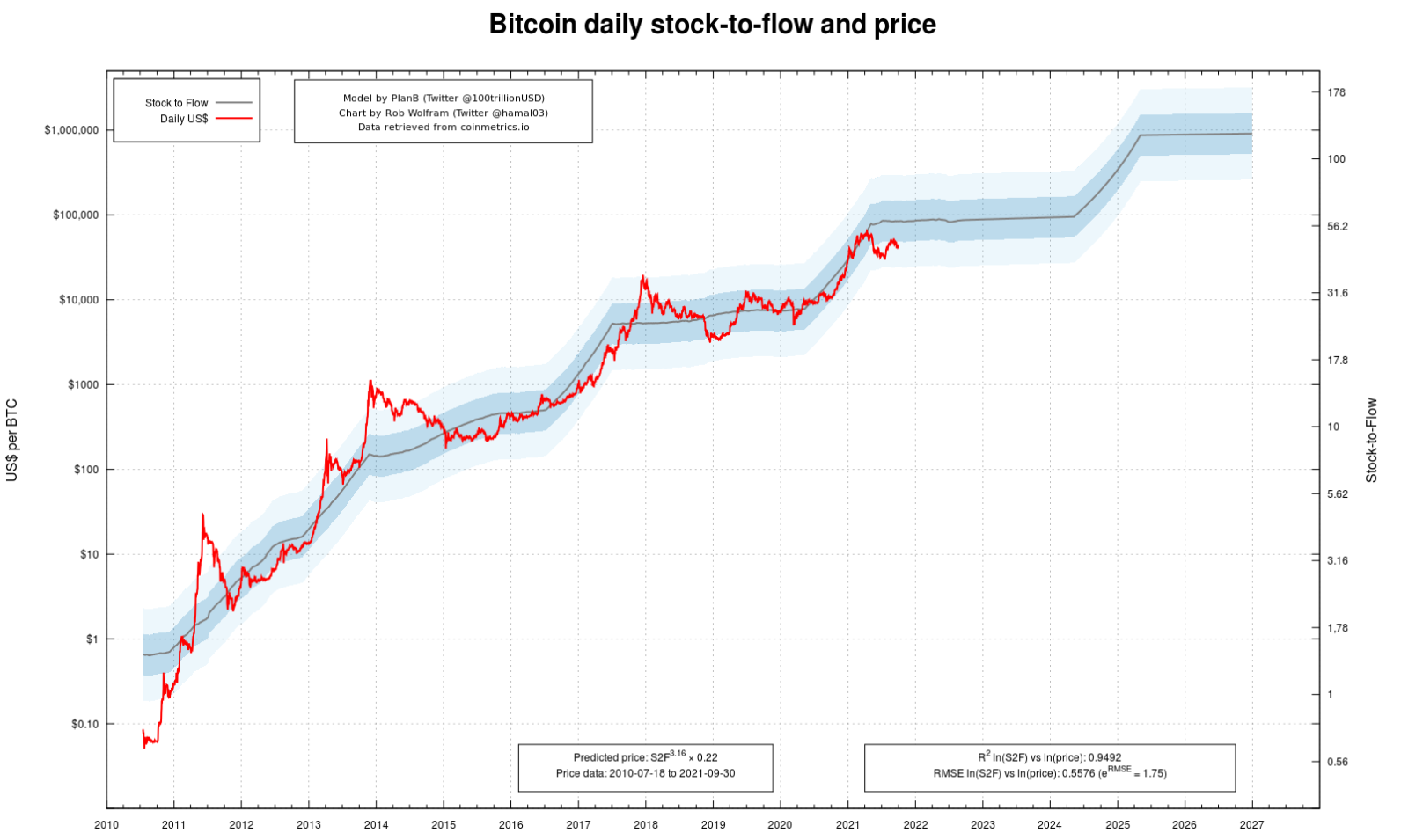

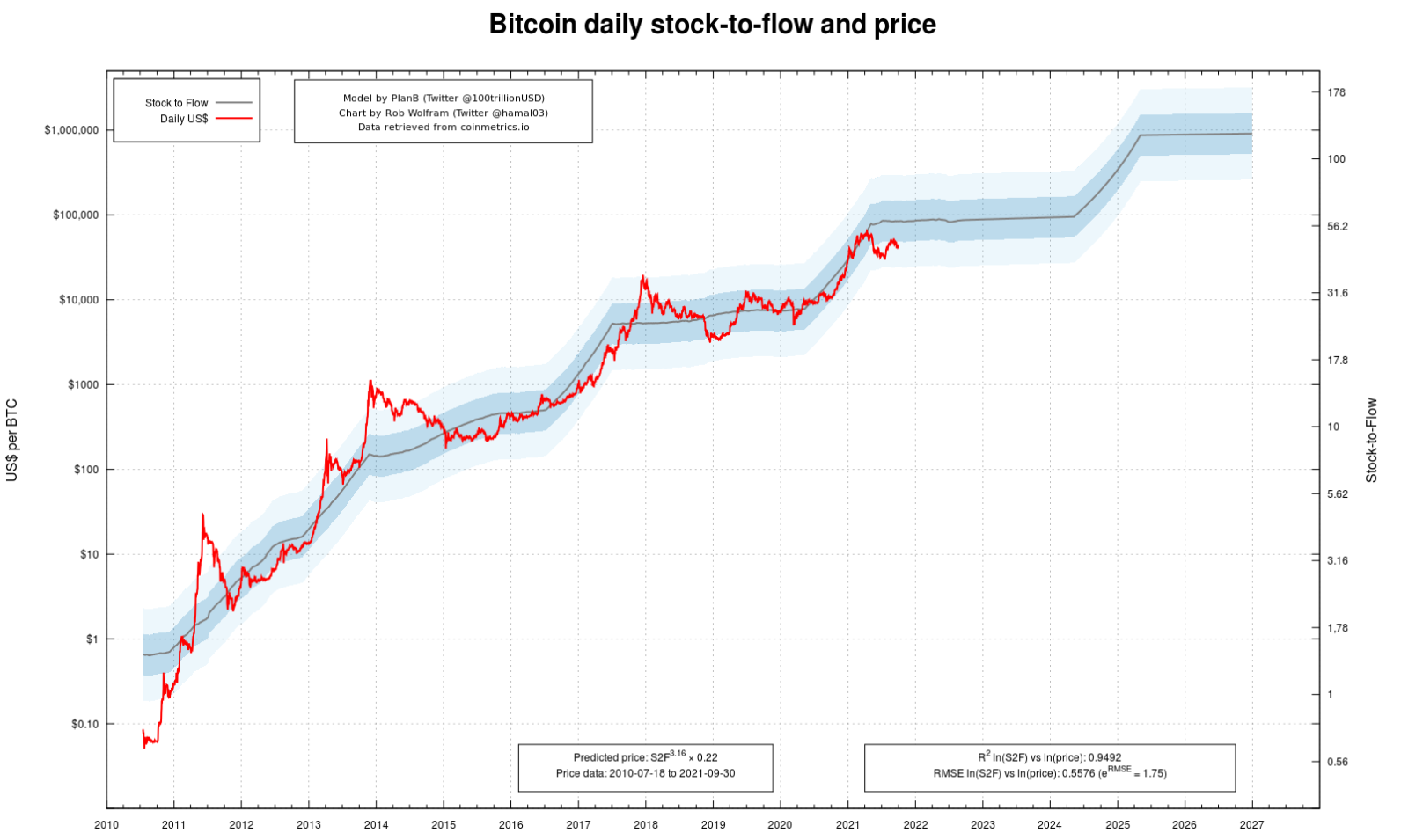

H3: Halving Event:

The Bitcoin halving event, scheduled for 2024, will reduce the rate at which new Bitcoins are created. This reduction in supply, combined with potentially steady or increased demand, could exert upward pressure on the price.

H3: Technological Advancements:

Developments in the crypto space, such as advancements in layer-2 scaling solutions or the emergence of innovative DeFi protocols, could positively influence Bitcoin's price by enhancing its utility and scalability.

H3: Overall Market Sentiment:

The general mood in the crypto market significantly impacts Bitcoin's price. Positive sentiment, driven by adoption growth or positive regulatory news, can push prices higher, whereas negative sentiment can cause sharp drops.

Conclusion: Predicting the 2024 Bitcoin Price: The Uncertainties Remain

Predicting the Bitcoin price in 2024 is inherently challenging, and Donald Trump's potential influence is just one piece of a complex puzzle. While his economic policies could significantly affect inflation and regulation, factors like the halving event, technological progress, and overall market sentiment play equally crucial roles. The scenarios presented showcase a range of possibilities, highlighting the significant uncertainty inherent in the cryptocurrency market. It is essential to remember that these are just potential outcomes, and the actual Bitcoin price will depend on various interconnected factors. Conduct thorough research, stay informed on the latest Bitcoin price predictions, and make informed investment decisions. Stay informed on the latest Bitcoin price predictions and make informed investment decisions.

Featured Posts

-

Ps Zh Aston Villa Povniy Oglyad Matchiv U Yevrokubkakh

May 08, 2025

Ps Zh Aston Villa Povniy Oglyad Matchiv U Yevrokubkakh

May 08, 2025 -

Champions League Final Preview Hargreaves Arsenal Psg Prediction

May 08, 2025

Champions League Final Preview Hargreaves Arsenal Psg Prediction

May 08, 2025 -

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

May 08, 2025

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

May 08, 2025 -

Understanding Bitcoins Golden Cross A Comprehensive Guide

May 08, 2025

Understanding Bitcoins Golden Cross A Comprehensive Guide

May 08, 2025 -

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025

Latest Posts

-

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sarti

May 08, 2025

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sarti

May 08, 2025 -

Counting Crows Snl Performance A Turning Point

May 08, 2025

Counting Crows Snl Performance A Turning Point

May 08, 2025 -

Capacites Cognitives Superieures Des Corneilles Une Etude De Cas En Geometrie

May 08, 2025

Capacites Cognitives Superieures Des Corneilles Une Etude De Cas En Geometrie

May 08, 2025 -

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025