Bitcoin Or MicroStrategy Stock: Your Smart Investment Choice For 2025

Table of Contents

Understanding Bitcoin's Potential in 2025

Bitcoin Price Predictions and Market Volatility

Predicting Bitcoin's price is notoriously difficult, given its volatile nature. Various analysts offer widely differing Bitcoin price predictions for 2025, ranging from incredibly bullish to cautiously bearish. Several factors influence these predictions:

- Institutional Adoption: Increasing acceptance by large corporations and institutional investors can drive up demand and price.

- Regulatory Changes: Government regulations, both favorable and unfavorable, significantly impact Bitcoin's market trajectory. Increased clarity could lead to greater stability.

- Technological Advancements: Developments like the Lightning Network aim to improve Bitcoin's scalability and transaction speed, potentially boosting its appeal.

- Macroeconomic Conditions: Global economic factors, such as inflation and recessionary fears, can heavily influence investor sentiment towards Bitcoin.

The Bitcoin halving, a programmed event that reduces the rate of new Bitcoin creation roughly every four years, is a significant factor to consider. Historically, halvings have preceded periods of increased Bitcoin price. This scarcity is a key argument for Bitcoin as a long-term store of value.

Bitcoin as a Hedge Against Inflation

Many investors view Bitcoin as a potential hedge against inflation. This is based on its limited supply (21 million coins) and its decentralized nature, making it less susceptible to government manipulation than fiat currencies.

- Arguments for Bitcoin as a Store of Value: Decentralization, scarcity, growing adoption.

- Arguments Against Bitcoin as a Store of Value: High volatility, regulatory uncertainty, potential for technological disruption.

Historical data shows periods of correlation between Bitcoin's price and inflationary pressures, although the relationship isn't always direct or consistent. Further research is necessary to definitively establish Bitcoin's efficacy as an inflation hedge.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries inherent risks:

- Price Volatility: Bitcoin's price can fluctuate dramatically in short periods, leading to significant potential losses.

- Regulatory Uncertainty: Changes in government regulations could negatively impact Bitcoin's value or even lead to outright bans in certain jurisdictions.

- Security Risks: The risk of hacking, theft, or loss of private keys is a significant concern for Bitcoin investors. Using secure wallets and exchanges is crucial.

Diversification is key to mitigating these risks. Don't invest more than you can afford to lose, and consider spreading your investments across different asset classes.

Analyzing MicroStrategy's Bitcoin Strategy and Stock Performance

MicroStrategy's Bitcoin Holdings and Corporate Strategy

MicroStrategy, a business intelligence company, has made a significant bet on Bitcoin, accumulating a substantial amount of the cryptocurrency. Their strategy aims to benefit from Bitcoin's potential long-term appreciation.

- Benefits: Potential for significant returns if Bitcoin's price rises, diversification of corporate assets.

- Drawbacks: Exposure to Bitcoin's price volatility, potential for impairment losses if Bitcoin's price falls.

Bitcoin's price fluctuations directly impact MicroStrategy's financial statements, affecting both profits and losses.

MicroStrategy Stock Performance and Future Outlook

MicroStrategy's stock performance is closely tied to Bitcoin's price. When Bitcoin rises, MicroStrategy's stock often follows suit, and vice versa. Comparing its performance to other tech stocks and the S&P 500 provides valuable context.

- Potential Catalysts for Appreciation: Further Bitcoin price increases, successful business intelligence projects, positive regulatory developments.

- Potential Catalysts for Depreciation: Decreases in Bitcoin's price, increased competition in the business intelligence market, negative regulatory actions.

Risks Associated with Investing in MicroStrategy Stock

Investing in MicroStrategy stock carries its own set of risks:

- Dependence on Bitcoin: The company's performance is heavily reliant on Bitcoin's price movement, creating significant volatility.

- Competition: MicroStrategy faces competition in the business intelligence market, potentially impacting its core business profitability independent of its Bitcoin holdings.

Thorough fundamental analysis is critical when evaluating MicroStrategy stock, considering both its traditional business operations and its Bitcoin exposure.

Bitcoin vs. MicroStrategy Stock: A Comparative Analysis

Risk Tolerance and Investment Goals

The choice between Bitcoin and MicroStrategy stock hinges on your individual risk tolerance and investment goals:

| Feature | Bitcoin | MicroStrategy Stock |

|---|---|---|

| Risk Level | High | Medium-High |

| Potential Return | High (but highly volatile) | Dependent on Bitcoin and core business |

| Liquidity | Relatively High (depending on exchange) | High |

Assess your risk tolerance honestly. Are you comfortable with potentially significant short-term losses for the chance of substantial long-term gains? If not, MicroStrategy stock might be a less volatile option.

Diversification and Portfolio Allocation

Diversification is crucial for any investment strategy. Bitcoin and MicroStrategy stock should be considered part of a broader portfolio, not the sole investment.

- Tips for Diversification: Spread investments across different asset classes (stocks, bonds, real estate, etc.), consider alternative investments, and adjust your portfolio based on market conditions and your risk tolerance.

Asset allocation involves strategically dividing your investments across different asset classes to balance risk and reward. The optimal allocation depends on your individual circumstances and financial goals.

Conclusion

Investing in Bitcoin or MicroStrategy stock presents both significant opportunities and substantial risks. Bitcoin offers high potential returns but comes with considerable volatility, while MicroStrategy stock provides a more moderate risk profile but is still heavily dependent on Bitcoin's price. The "smart investment choice" depends heavily on your personal financial situation, risk tolerance, and investment timeline. Thoroughly research both options, consider your individual circumstances, and make an informed decision about whether Bitcoin or MicroStrategy stock aligns with your long-term investment strategy for 2025 and beyond. Remember to consult with a qualified financial advisor before making any investment decisions related to Bitcoin or MicroStrategy stock.

Featured Posts

-

Singapores Largest Bank Advocates For Polluter Reform

May 08, 2025

Singapores Largest Bank Advocates For Polluter Reform

May 08, 2025 -

Sec Review Of Grayscales Xrp Etf Potential For Price Increase

May 08, 2025

Sec Review Of Grayscales Xrp Etf Potential For Price Increase

May 08, 2025 -

Investigation Into Antisemitic Incidents At Boeings Seattle Campus

May 08, 2025

Investigation Into Antisemitic Incidents At Boeings Seattle Campus

May 08, 2025 -

Trumps Crypto Advisors Unexpected Bitcoin Price Surge Prediction

May 08, 2025

Trumps Crypto Advisors Unexpected Bitcoin Price Surge Prediction

May 08, 2025 -

Scathing Report Angels Minor League System Faces Criticism

May 08, 2025

Scathing Report Angels Minor League System Faces Criticism

May 08, 2025

Latest Posts

-

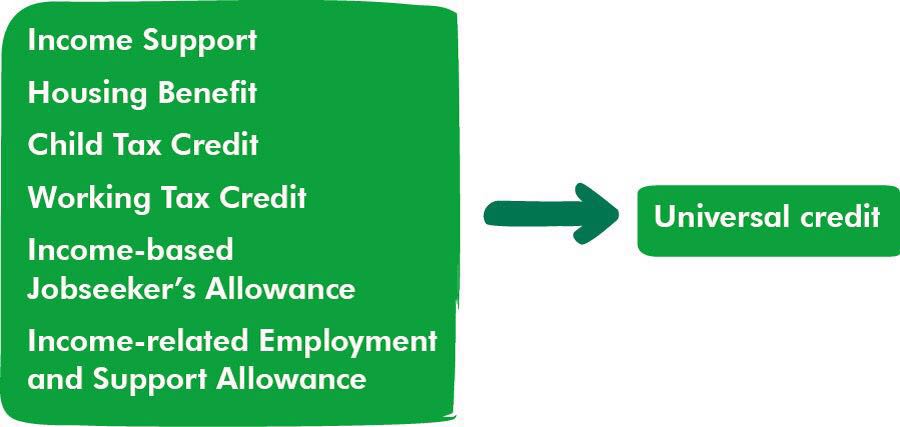

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025 -

Universal Credit Overpayment Reclaiming Money From The Dwp

May 08, 2025

Universal Credit Overpayment Reclaiming Money From The Dwp

May 08, 2025 -

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025 -

Jayson Tatum Injury His Status For The Celtics Vs Nets Game

May 08, 2025

Jayson Tatum Injury His Status For The Celtics Vs Nets Game

May 08, 2025 -

Celtics Vs Nets Jayson Tatum Playing Status And Injury Update

May 08, 2025

Celtics Vs Nets Jayson Tatum Playing Status And Injury Update

May 08, 2025