Bitcoin Mining: Explaining The Significant Uptick This Week

Table of Contents

Increased Bitcoin Price and Miner Revenue

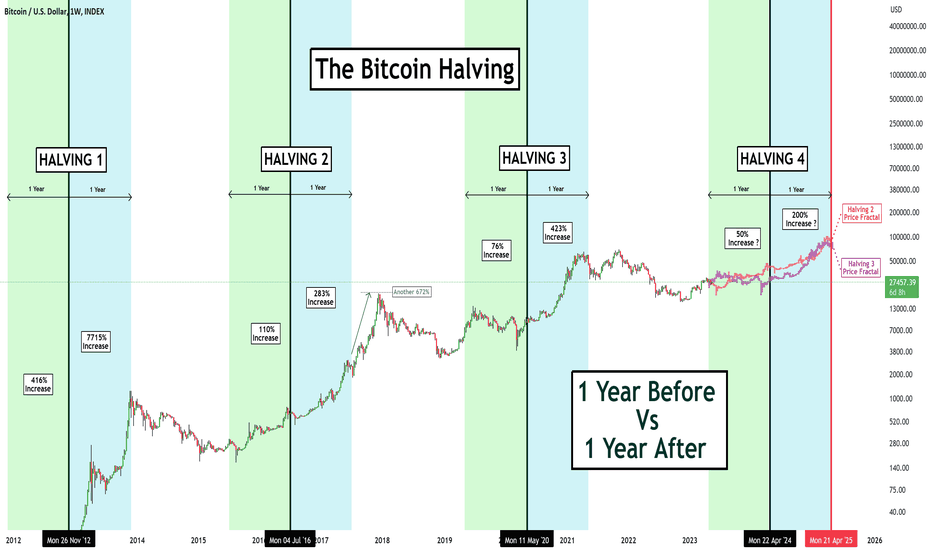

The most significant factor influencing the recent surge in Bitcoin mining is the direct correlation between Bitcoin's price and miner profitability. Simply put, higher Bitcoin prices make mining more lucrative. When the price of Bitcoin rises, the revenue generated from mining each Bitcoin also increases, incentivizing more miners to participate.

- Price Increase: According to CoinMarketCap, Bitcoin's price has seen a notable increase this week, rising from [Insert starting price and date] to [Insert current price and date], representing a [Insert percentage increase]% surge. This significant price jump directly translates into increased revenue for miners.

- Miner Revenue: This price increase means miners receive considerably more fiat currency (USD, EUR, etc.) for each Bitcoin they mine. This increased profitability encourages existing miners to operate at full capacity and attracts new miners to the network.

- Transaction Fees: It's not just the Bitcoin price; transaction fees also play a crucial role in miner profitability. Higher transaction volumes on the Bitcoin network lead to increased transaction fees, further boosting miners' income.

Hash Rate Surge and Network Security

The increase in Bitcoin mining activity directly impacts the network's hash rate – a measure of the total computational power dedicated to securing the Bitcoin blockchain. A higher hash rate signifies a more robust and secure network, making it exponentially more difficult for malicious actors to attack or manipulate the blockchain.

- Hash Rate Data: Recent data shows a significant increase in Bitcoin's hash rate, rising from [Insert previous hash rate and date] to [Insert current hash rate and date], representing a [Insert percentage increase]% jump. This indicates a substantial influx of new mining power.

- Network Resilience: This increased hash rate significantly strengthens Bitcoin's resilience against 51% attacks – a scenario where a malicious actor controls more than half of the network's hash rate, enabling them to potentially reverse transactions or double-spend Bitcoins. The current surge makes such an attack practically infeasible.

- Increased Miner Participation: The heightened profitability and network security attract more miners, creating a positive feedback loop that further strengthens the Bitcoin network.

New Mining Hardware and Efficiency Improvements

Advancements in Application-Specific Integrated Circuit (ASIC) mining technology are another key driver of the recent uptick. More efficient ASIC miners require less energy to produce a Bitcoin, increasing profitability even at relatively stable Bitcoin prices.

- New ASIC Models: Recent releases of new ASIC models from companies like [Mention specific manufacturers] boast significant improvements in hash rate and energy efficiency. These advancements allow miners to generate more Bitcoins with lower operating costs.

- Hash Rate and Energy Efficiency Improvements: These new machines offer a substantially higher hash rate per watt compared to older generations. This means miners can achieve the same mining output with less electricity consumption, making the operation more economically viable.

- Impact on Mining Landscape: The introduction of these more efficient miners has lowered the barrier to entry for smaller mining operations, contributing to the overall increase in mining activity.

Regulatory Changes and Geographic Shifts

Regulatory changes in different jurisdictions significantly impact Bitcoin mining activity. Some regions are becoming increasingly miner-friendly, while others are implementing stricter regulations.

- Supportive Regulations: [Mention specific countries with supportive regulations, e.g., some regions in the US, certain areas of Central Asia]. These regions offer favorable regulatory environments, including access to cheap energy and tax incentives, attracting miners seeking better conditions.

- Restrictive Regulations: Conversely, [Mention specific countries with restrictive regulations, e.g., China]. Stricter regulations in certain countries have led to a geographic shift in mining operations, with miners relocating to jurisdictions with more supportive frameworks.

- Decentralization Implications: These geographic shifts have implications for the decentralization of Bitcoin mining. While concentration in certain regions remains, the overall distribution continues to evolve.

Renewable Energy Adoption in Bitcoin Mining

The growing trend of utilizing renewable energy sources for Bitcoin mining is gaining significant traction, contributing to the recent uptick while addressing environmental concerns.

- Renewable Energy Examples: Several large-scale Bitcoin mining operations are now powered by renewable energy sources like solar, wind, and hydroelectric power. [Mention specific examples of such operations].

- Environmental Impact: This shift towards renewable energy is vital in mitigating environmental concerns often associated with Bitcoin mining’s energy consumption. It reduces the carbon footprint and makes the process more environmentally sustainable.

- Attracting Investors: The adoption of renewable energy in Bitcoin mining is attracting environmentally conscious investors and organizations, further fueling growth in the sector.

Conclusion

This week's significant uptick in Bitcoin mining activity is a multifaceted event, driven by a confluence of factors including a rising Bitcoin price, improved mining hardware, shifting regulatory landscapes, and a growing focus on renewable energy sources. Understanding these interconnected elements provides crucial insight into the dynamism of the Bitcoin ecosystem. To stay informed about future fluctuations in Bitcoin mining and its impact on the cryptocurrency market, keep monitoring industry news and analyzing market trends. Continue learning about Bitcoin mining and its various aspects to make informed decisions in this ever-evolving space.

Featured Posts

-

Documents On Epstein Diddy Jfk And Mlk Pam Bondi Announces Impending Release

May 09, 2025

Documents On Epstein Diddy Jfk And Mlk Pam Bondi Announces Impending Release

May 09, 2025 -

Attorney Generals Threat A Warning From Trumps Administration

May 09, 2025

Attorney Generals Threat A Warning From Trumps Administration

May 09, 2025 -

Nova Reviravolta No Caso Madeleine Mc Cann Prisao De Suspeita Na Inglaterra

May 09, 2025

Nova Reviravolta No Caso Madeleine Mc Cann Prisao De Suspeita Na Inglaterra

May 09, 2025 -

Bitcoin Price Prediction Can Trumps 100 Day Speech Push Btc Past 100 000

May 09, 2025

Bitcoin Price Prediction Can Trumps 100 Day Speech Push Btc Past 100 000

May 09, 2025 -

Prognoz Pogody V Mae Pochemu Snegopady Tak Trudno Predskazat

May 09, 2025

Prognoz Pogody V Mae Pochemu Snegopady Tak Trudno Predskazat

May 09, 2025

Latest Posts

-

Blue Origin Flight Young Thug Not Among Passengers

May 09, 2025

Blue Origin Flight Young Thug Not Among Passengers

May 09, 2025 -

Young Thugs New Song A Promise To Stay Faithful

May 09, 2025

Young Thugs New Song A Promise To Stay Faithful

May 09, 2025 -

The Imminent Arrival Of Young Thugs Back Outside Album

May 09, 2025

The Imminent Arrival Of Young Thugs Back Outside Album

May 09, 2025 -

Singer Summer Walker Shares Terrifying Birth Story

May 09, 2025

Singer Summer Walker Shares Terrifying Birth Story

May 09, 2025 -

Young Thug Reacts The Not Like U Name Drop And His Post Prison Interview

May 09, 2025

Young Thug Reacts The Not Like U Name Drop And His Post Prison Interview

May 09, 2025