Bitcoin Mining Boom: Understanding The Recent Price Surge

Table of Contents

Increased Institutional Investment and Adoption

The growing acceptance of Bitcoin by institutional investors is a primary driver of the recent price surge. This increased institutional involvement signifies a shift in perception, solidifying Bitcoin's position in the financial landscape.

Growing Confidence in Bitcoin as a Store of Value

Institutional investors are increasingly viewing Bitcoin as a hedge against inflation and a valuable asset for diversification. This growing confidence translates directly into increased demand and, consequently, higher prices.

- Major corporations like MicroStrategy and Tesla holding significant Bitcoin reserves: These high-profile adoptions have legitimized Bitcoin in the eyes of many investors, signaling its potential as a long-term store of value.

- Growing acceptance of Bitcoin by institutional investment firms: More and more investment firms are allocating a portion of their portfolios to Bitcoin, driven by its potential for high returns and its position as a decentralized asset.

- Increased regulatory clarity in some jurisdictions fostering adoption: As regulatory frameworks become clearer and more supportive in certain regions, institutional investment is further encouraged, leading to increased demand and price appreciation.

The Role of ETFs and other Financial Products

The emergence of Bitcoin-related exchange-traded funds (ETFs) and other financial products has significantly broadened access to Bitcoin for a wider range of investors. This increased accessibility plays a crucial role in fueling the mining boom and price appreciation.

- Increased liquidity due to ETF availability: ETFs offer increased liquidity, making it easier for investors to buy and sell Bitcoin, thus increasing trading volume and potentially impacting price stability.

- Simplified investment process attracts retail and institutional investors: The streamlined investment process offered by ETFs makes Bitcoin more accessible to both retail and institutional investors, driving up demand.

- Positive impact on Bitcoin price due to increased demand: The combined effect of increased accessibility and simplified investment leads to a surge in demand, directly impacting Bitcoin's price.

Technological Advancements in Bitcoin Mining

Technological advancements have significantly improved the efficiency and profitability of Bitcoin mining, contributing to the current boom. This efficiency translates into lower operational costs and a more sustainable mining ecosystem.

Improved Mining Hardware and Efficiency

The development of more energy-efficient Application-Specific Integrated Circuits (ASICs) has been a game-changer. These advancements have made Bitcoin mining more profitable, leading to increased participation and a subsequent rise in Bitcoin's hash rate.

- Advanced ASICs with higher hash rates: Newer ASICs boast significantly higher hash rates, enabling miners to process more transactions and earn more Bitcoin.

- Reduced energy consumption per hash: Improvements in energy efficiency translate into lower operational costs for miners, increasing their profitability and sustainability.

- Increased competitiveness amongst miners: The advancements in mining technology have intensified competition among miners, driving innovation and pushing the boundaries of mining efficiency.

The Rise of Green Mining Initiatives

The growing focus on sustainable mining practices using renewable energy sources is not only environmentally responsible but also economically beneficial. This shift towards green Bitcoin mining is attracting environmentally conscious investors.

- Increased adoption of hydropower and solar power for mining: Many mining operations are increasingly relying on renewable energy sources like hydropower and solar power, reducing their carbon footprint.

- Positive public perception and reduced regulatory pressure: The adoption of green mining initiatives enhances the public image of Bitcoin and helps mitigate regulatory scrutiny.

- Attracting environmentally conscious investors: This focus on sustainability attracts investors who prioritize environmental, social, and governance (ESG) factors, adding further momentum to the Bitcoin market.

Global Macroeconomic Factors

Broader macroeconomic factors play a significant role in influencing Bitcoin's price. Factors such as inflation and geopolitical instability create a climate where Bitcoin's decentralized and deflationary nature becomes increasingly attractive.

Inflationary Pressures and the Search for Safe Havens

High inflation rates in many countries have driven investors towards alternative assets like Bitcoin, as it is perceived as a hedge against inflation. This demand surge directly influences the price.

- Bitcoin viewed as a hedge against inflation: Bitcoin's limited supply of 21 million coins makes it attractive as a hedge against inflation, especially when traditional currencies are losing purchasing power.

- Increased demand during periods of economic uncertainty: During times of economic instability, investors often seek safe haven assets, driving demand for Bitcoin and pushing its price higher.

- Reduced reliance on traditional financial systems: Concerns about the stability and centralization of traditional financial systems are driving investors towards decentralized alternatives like Bitcoin.

Geopolitical Instability and its Influence

Geopolitical instability often leads to increased demand for Bitcoin due to its decentralized and censorship-resistant nature. This reinforces its role as a safe haven asset.

- Increased demand during times of global conflict: In times of geopolitical uncertainty, investors seek refuge in assets perceived as less susceptible to political or economic shocks.

- Bitcoin's decentralized nature offers resilience against geopolitical risks: Bitcoin's decentralized network operates independently of any single government or institution, offering resilience against geopolitical risks.

- Safe haven asset appeal enhances its price: This increased demand during times of instability significantly enhances Bitcoin's price.

Conclusion

The recent Bitcoin mining boom is a complex phenomenon fueled by a confluence of factors. Increased institutional investment, technological advancements in mining, and significant macroeconomic influences have all contributed to the recent price surge. Understanding these drivers is crucial for anyone navigating the dynamic cryptocurrency market. While predicting future price movements remains challenging, the trends outlined suggest a continued, albeit fluctuating, upward trajectory for Bitcoin’s price. To stay abreast of the latest developments in the Bitcoin market and the ongoing mining boom, continue to monitor the Bitcoin mining landscape, follow reputable sources, and conduct thorough research. Understanding the nuances of this evolving market is key to successful participation.

Featured Posts

-

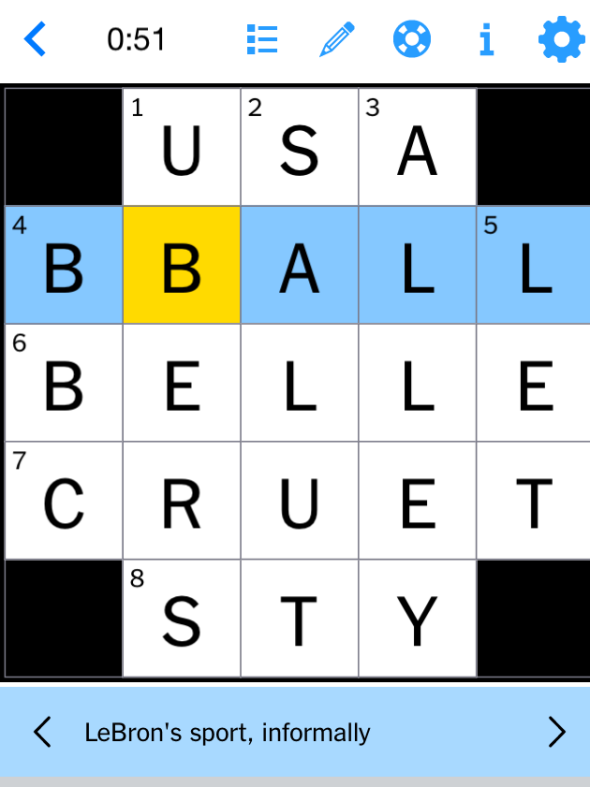

Nyt Crossword Solver April 12 2025 Clues Theme And Solutions

May 09, 2025

Nyt Crossword Solver April 12 2025 Clues Theme And Solutions

May 09, 2025 -

Palantir Technologies Pltr Stock A Current Market Evaluation

May 09, 2025

Palantir Technologies Pltr Stock A Current Market Evaluation

May 09, 2025 -

Space Xs Booming Value Musks Stake Tops Tesla Holdings By 43 Billion

May 09, 2025

Space Xs Booming Value Musks Stake Tops Tesla Holdings By 43 Billion

May 09, 2025 -

The Epstein Client List Ag Pam Bondis Claims And Their Implications

May 09, 2025

The Epstein Client List Ag Pam Bondis Claims And Their Implications

May 09, 2025 -

Palantir Stock Buy Sell Or Hold Evaluating The Investment Opportunity

May 09, 2025

Palantir Stock Buy Sell Or Hold Evaluating The Investment Opportunity

May 09, 2025