Bitcoin Market Update: 10-Week High Cleared, US$100,000 Potential

Table of Contents

Bitcoin Price Surge Breaks 10-Week High: Analyzing the Factors

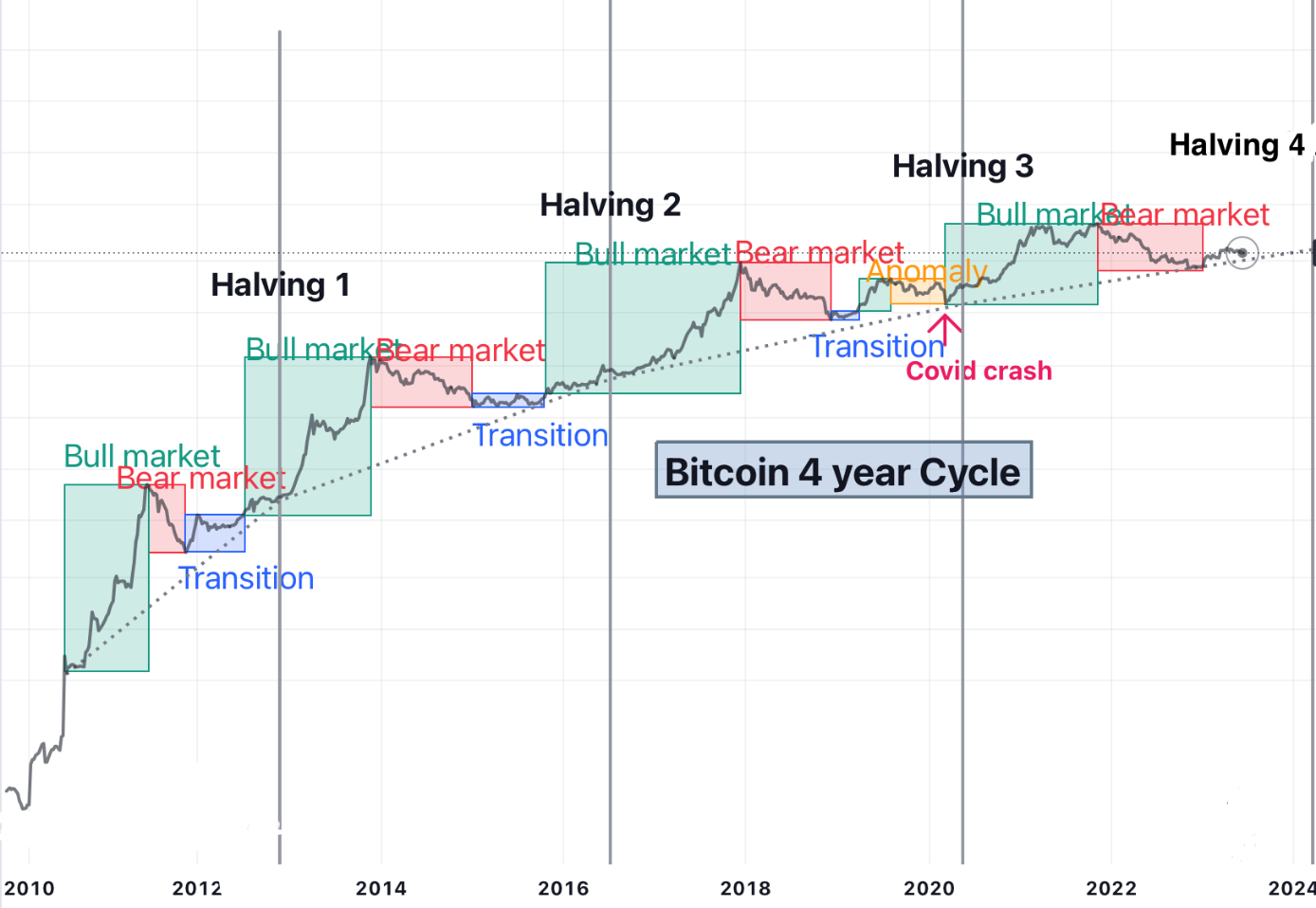

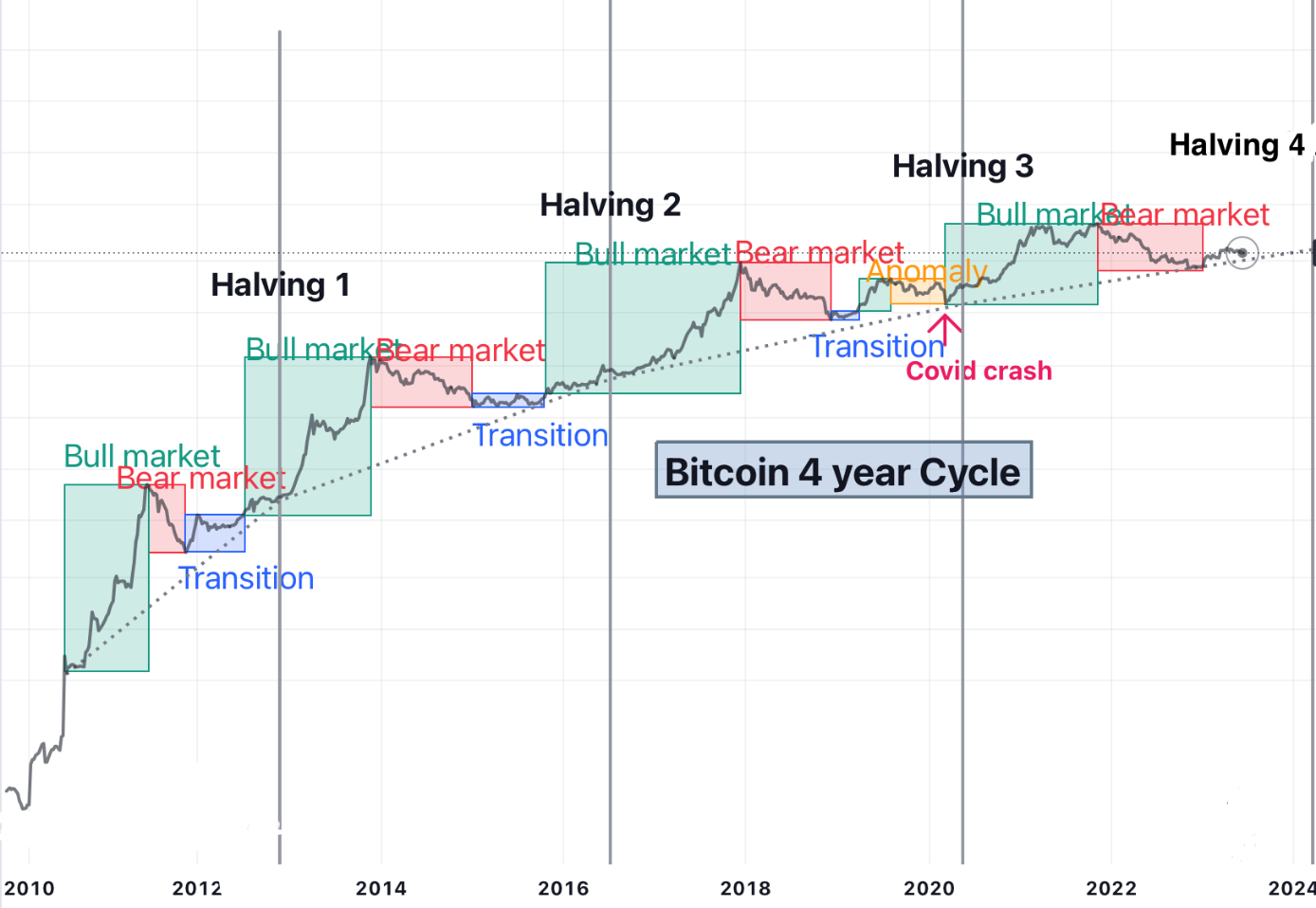

On [Insert Date], the Bitcoin price decisively broke through its 10-week high, reaching [Insert Price]. This significant jump is depicted in the Bitcoin price chart below:

[Insert Bitcoin Price Chart Here - ideally an interactive chart]

Several factors contributed to this remarkable increase in Bitcoin price:

-

Increased Institutional Investment: Major financial institutions are increasingly allocating assets to Bitcoin, viewing it as a hedge against inflation and a potential store of value. This influx of institutional capital has provided significant support to the Bitcoin price. The growing acceptance of Bitcoin by institutional investors is a key driver of its price appreciation.

-

Growing Adoption by Businesses and Individuals: The number of businesses accepting Bitcoin as payment is steadily rising, alongside a growing number of individuals using Bitcoin for transactions and investments. This wider adoption fuels demand and contributes to price appreciation. This increased Bitcoin adoption reflects a growing confidence in the cryptocurrency's long-term viability.

-

Positive Regulatory Developments (or Lack Thereof, if Applicable): [Discuss any recent regulatory developments, either positive or negative, that have impacted the Bitcoin market. If there have been no significant developments, mention the relative stability in regulation as a contributing factor]. This regulatory landscape (or lack thereof) plays a significant role in the overall Bitcoin market sentiment and price stability.

-

Macroeconomic Factors: Global macroeconomic factors, such as inflation and interest rate hikes, are influencing investor behavior. [Discuss how these factors are impacting the Bitcoin price, e.g., Bitcoin as an inflation hedge]. Understanding these macroeconomic trends is crucial for effective Bitcoin price prediction.

-

Technical Analysis Indicators: Technical indicators like moving averages and the Relative Strength Index (RSI) are showing positive signals, suggesting further upward momentum. [Discuss specific technical indicators and their implications for the Bitcoin price]. Technical analysis is a valuable tool for navigating the Bitcoin market volatility.

The Path to US$100,000: Bitcoin Price Prediction and Market Sentiment

The question on many investors' minds is: Can Bitcoin reach US$100,000? While predicting the future price of any asset is inherently challenging, several factors suggest the possibility: continued institutional adoption, increasing network effects, and the potential for Bitcoin to become a more widely accepted form of digital gold.

Analyzing market sentiment reveals a mixture of bullish and bearish predictions. Many analysts forecast significant growth in the Bitcoin price, pointing to factors discussed above. However, others remain cautious, citing potential risks.

-

Bullish Predictions: Several prominent analysts predict a Bitcoin price exceeding US$100,000 within [Timeframe]. Their predictions are often based on technical analysis, fundamental factors, and adoption trends.

-

Bearish Predictions: Conversely, bearish predictions highlight risks such as regulatory uncertainty, market volatility, and competition from alternative cryptocurrencies. These predictions emphasize the need for cautious investment strategies.

-

Social Media Sentiment: Social media sentiment also provides valuable insights into market mood, although it needs to be interpreted with caution, as it can be easily manipulated.

Potential Risks:

- Regulatory Uncertainty: Changes in regulations can significantly impact the Bitcoin price.

- Market Volatility: The Bitcoin market is notoriously volatile, and sharp price swings are common.

- Competition from Other Cryptocurrencies: The emergence of new cryptocurrencies poses a potential threat to Bitcoin's dominance.

Investing in Bitcoin: Risks and Rewards in the Current Market

Investing in Bitcoin offers significant potential rewards, but it’s crucial to acknowledge the associated risks. The high volatility inherent in the cryptocurrency market means substantial gains are possible, but significant losses are also a real possibility.

Potential Rewards:

- High Growth Potential: Historically, Bitcoin has shown substantial growth potential.

- Inflation Hedge: Many investors consider Bitcoin a potential hedge against inflation.

- Decentralization: Bitcoin's decentralized nature offers a degree of protection against government control.

Practical Advice for Investors:

- Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio.

- Risk Management: Only invest what you can afford to lose. Implement stop-loss orders to limit potential losses.

- Due Diligence: Thoroughly research before investing in any cryptocurrency.

Conclusion: Bitcoin Market Update and Future Outlook

This Bitcoin market update highlights the recent significant price surge, exceeding the 10-week high, and the potential for Bitcoin to reach US$100,000. However, it's essential to remember the inherent risks involved. The Bitcoin market remains volatile and subject to various factors, including regulatory changes and macroeconomic conditions. Conducting thorough research and implementing effective risk management strategies are crucial for navigating this dynamic market. Stay tuned for our next Bitcoin market update, follow us for the latest Bitcoin price analysis, and learn more about Bitcoin investment strategies to make informed decisions in the evolving cryptocurrency landscape. Invest wisely in Bitcoin!

Featured Posts

-

Zendaya Dazzles In See Through Gown In Southern France

May 07, 2025

Zendaya Dazzles In See Through Gown In Southern France

May 07, 2025 -

The Last Of Us Fans React Isabela Merceds Dina In Season 2 Episode 1

May 07, 2025

The Last Of Us Fans React Isabela Merceds Dina In Season 2 Episode 1

May 07, 2025 -

Xrp Price Soars Following Presidents Post On Trumps Influence On Ripple

May 07, 2025

Xrp Price Soars Following Presidents Post On Trumps Influence On Ripple

May 07, 2025 -

Check The Daily Lotto Results Tuesday April 15 2025

May 07, 2025

Check The Daily Lotto Results Tuesday April 15 2025

May 07, 2025 -

Seattle Mariners First Inning Powerhouse Delivers 14 0 Win Against Miami Marlins

May 07, 2025

Seattle Mariners First Inning Powerhouse Delivers 14 0 Win Against Miami Marlins

May 07, 2025

Latest Posts

-

The Long Walk Movie Stephen King Cinema Con 2024 Release Date Announcement

May 08, 2025

The Long Walk Movie Stephen King Cinema Con 2024 Release Date Announcement

May 08, 2025 -

Thunders Williams Highlights Exceptional Team Leadership

May 08, 2025

Thunders Williams Highlights Exceptional Team Leadership

May 08, 2025 -

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025 -

Okc Thunders Williams Reveals Unexpected Leadership Figure

May 08, 2025

Okc Thunders Williams Reveals Unexpected Leadership Figure

May 08, 2025 -

The Hunger Games Directors New Stephen King Horror Film 2025 Release Date

May 08, 2025

The Hunger Games Directors New Stephen King Horror Film 2025 Release Date

May 08, 2025