Bitcoin Hits New High Amidst Positive US Regulatory Outlook

Table of Contents

Positive Shifts in the US Regulatory Landscape for Bitcoin

The recent positive developments in the US regulatory environment surrounding Bitcoin have played a pivotal role in its price surge. This regulatory clarity is bolstering investor confidence and paving the way for greater mainstream adoption.

Reduced Regulatory Uncertainty Boosts Investor Confidence

Reduced uncertainty is a key driver of institutional investment. The lack of clear guidelines previously deterred many large players. However, recent statements and proposed legislation suggest a move towards a more defined regulatory framework. This reduced risk encourages institutional involvement and market stabilization.

- BlackRock's entry into the Bitcoin ETF market is a prime example of growing institutional interest.

- Fidelity's continued support for Bitcoin trading and custody services demonstrates growing confidence.

- Regulatory clarity significantly improves risk assessment models for institutional investors, making Bitcoin a more attractive asset class.

- The impact on Bitcoin volatility is already visible, with periods of relative price stability following positive regulatory news.

Potential for Increased Bitcoin Adoption in the US

Clearer regulatory guidelines are expected to fuel increased Bitcoin adoption among both businesses and consumers. This has the potential to significantly impact the US economy.

- Payments: Easier regulatory pathways could lead to wider acceptance of Bitcoin as a payment method for goods and services.

- Investments: Increased accessibility through regulated investment vehicles will likely draw in a wider range of investors.

- Economic Impact: Widespread adoption could stimulate economic activity and create new jobs in the cryptocurrency sector.

- Challenges: Despite these positive shifts, challenges remain. Scalability issues and the need for user-friendly interfaces are still barriers to mass adoption.

Factors Contributing to Bitcoin's Price Surge Beyond Regulation

While positive US regulatory shifts are a significant driver, other factors are also contributing to Bitcoin's price increase.

Increased Institutional Adoption

Large institutional investors are playing a significant role in driving up Bitcoin demand. Their involvement adds liquidity and stability to the market.

- MicroStrategy's substantial Bitcoin holdings illustrate the commitment of major corporations.

- Tesla's past investments, though subject to changes in strategy, highlight the growing interest from major publicly traded companies.

- Increased institutional buying directly influences market liquidity, helping to smooth out price volatility.

Growing Global Adoption of Bitcoin

Bitcoin's growth is not limited to the US; adoption is expanding globally, particularly in emerging markets where traditional financial systems are less developed.

- El Salvador's adoption of Bitcoin as legal tender is a significant example of global adoption.

- Growing adoption in countries in Africa and Latin America demonstrates the potential for Bitcoin to offer financial inclusion.

- Macroeconomic factors, such as inflation and currency instability in certain regions, are pushing individuals toward Bitcoin as a hedge against financial risk.

Technological Advancements in Bitcoin

Technological improvements are enhancing Bitcoin's efficiency and scalability, further contributing to its attractiveness.

- Advancements in the Lightning Network are improving transaction speeds and reducing fees.

- Increased scalability solutions are addressing concerns about the network's ability to handle a larger volume of transactions.

Potential Risks and Challenges for Bitcoin Despite the High

Despite the positive outlook, certain risks and challenges persist.

Volatility Remains a Key Concern

Bitcoin's inherent volatility remains a significant risk factor. Price fluctuations can be dramatic, creating both opportunities and potential losses for investors.

- Bitcoin's historical price volatility highlights the need for careful risk management.

- Diversification and dollar-cost averaging are strategies to mitigate risk.

Regulatory Uncertainty Still Exists in Other Jurisdictions

While the US regulatory outlook is improving, many other countries still lack clear and consistent regulatory frameworks for Bitcoin.

- Regulatory environments in China, India, and the EU remain uncertain, impacting global Bitcoin adoption and price stability.

Environmental Concerns Related to Bitcoin Mining

Bitcoin mining's energy consumption raises environmental concerns. However, solutions are emerging.

- The shift towards renewable energy sources for Bitcoin mining is mitigating some environmental impacts.

Bitcoin's Future After Hitting a New High

Bitcoin's recent price surge is a testament to the positive regulatory shifts in the US and the broader factors driving its global adoption. While volatility and regulatory uncertainty in some regions remain, the overall outlook is positive. The potential for increased adoption and growth in the Bitcoin market is substantial. Understanding the current positive momentum around Bitcoin is crucial for navigating its future. Stay informed about the evolving regulatory landscape and explore the potential benefits of Bitcoin investment for yourself. Consider researching Bitcoin price prediction models and strategies for Bitcoin trading to capitalize on this exciting market.

Featured Posts

-

Fresh Injury Blow To England Before Zimbabwe Test

May 23, 2025

Fresh Injury Blow To England Before Zimbabwe Test

May 23, 2025 -

Freddie Flintoffs Healed Face A Disney Documentary

May 23, 2025

Freddie Flintoffs Healed Face A Disney Documentary

May 23, 2025 -

Pivdenniy Mist Khto Vikonuye Remontni Roboti Ta Skilki Koshtuye

May 23, 2025

Pivdenniy Mist Khto Vikonuye Remontni Roboti Ta Skilki Koshtuye

May 23, 2025 -

Canadas 7 Eleven Stores To Feature Odd Burgers Vegan Menu

May 23, 2025

Canadas 7 Eleven Stores To Feature Odd Burgers Vegan Menu

May 23, 2025 -

Shtutgart Aleksandrova Obygryvaet Samsonovu

May 23, 2025

Shtutgart Aleksandrova Obygryvaet Samsonovu

May 23, 2025

Latest Posts

-

Alsltat Alalmanyt Wmdahmat Mshjey Krt Alqdm

May 24, 2025

Alsltat Alalmanyt Wmdahmat Mshjey Krt Alqdm

May 24, 2025 -

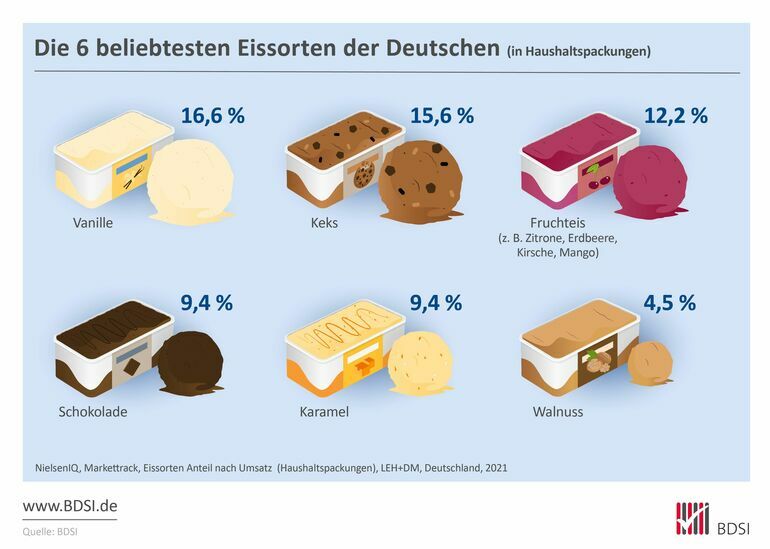

Diese Eissorte Dominiert Nrw Ein Unerwarteter Favorit

May 24, 2025

Diese Eissorte Dominiert Nrw Ein Unerwarteter Favorit

May 24, 2025 -

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025 -

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025 -

Essen Die Beliebteste Eissorte In Nordrhein Westfalen

May 24, 2025

Essen Die Beliebteste Eissorte In Nordrhein Westfalen

May 24, 2025