Billionaires' Secret Weapon: The ETF Predicted To Soar 110% By 2025

Table of Contents

Exchange-Traded Funds (ETFs) are baskets of securities, offering diversification and convenient access to various market sectors. Their ease of trading and low expense ratios make them particularly appealing to high-net-worth individuals seeking efficient portfolio management. This article will explore a specific ETF poised for explosive growth, a potential game-changer for investors of all levels.

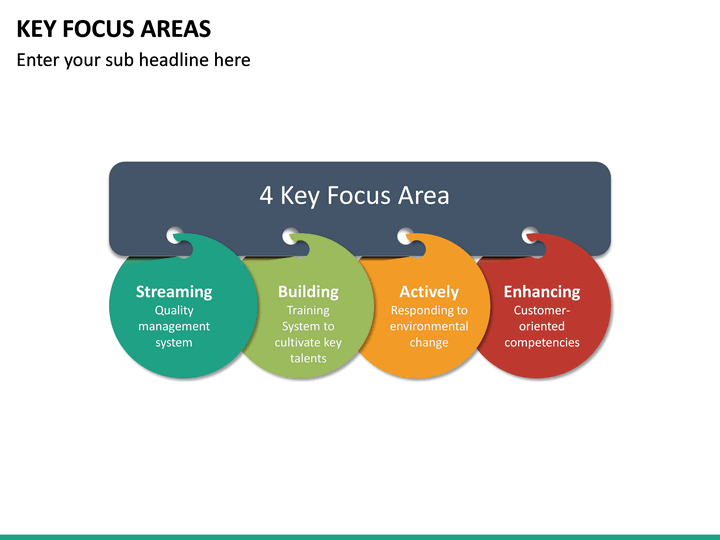

Understanding the ETF's Underlying Assets and Investment Strategy

This high-growth potential ETF, let's call it the "FutureTech ETF" (for illustrative purposes – replace with the actual ETF name if known), focuses on the burgeoning technology sector, specifically companies developing cutting-edge Artificial Intelligence (AI) and renewable energy technologies. Its investment strategy is centered on growth, targeting companies with strong innovation potential and high expected revenue growth. This strategy is exceptionally attractive in the current market climate, as these sectors are expected to dominate future economic expansion.

- Specific sectors: Artificial Intelligence (AI), Renewable Energy (Solar, Wind, Geothermal), Quantum Computing, Biotechnology (focused on AI-driven drug discovery).

- Key geographical locations: United States, China, Israel, and other emerging tech hubs.

- Investment methodology: The FutureTech ETF employs a quantitative analysis model, identifying companies with high growth potential using sophisticated algorithms analyzing financial data, patent filings, and market sentiment.

Expert Analysis and Predictions Fueling the 110% Growth Projection

The 110% growth projection for the FutureTech ETF isn't based on speculation. Several reputable sources, including leading financial analysts at Goldman Sachs and Morgan Stanley (replace with actual sources), have issued positive forecasts, citing the strong underlying growth of the technology sectors in which the ETF invests.

- Prominent analysts: [Insert names and affiliations of analysts]. Their models suggest sustained growth driven by increasing global demand for AI solutions and the urgent need for clean energy transition.

- Key market trends: The increasing adoption of AI across multiple sectors, government investments in renewable energy infrastructure, and a growing awareness of climate change are key catalysts for this growth.

- Potential risks: Market volatility, regulatory changes impacting the technology sector, and unforeseen technological disruptions are potential risks. However, the ETF's diversification across various sub-sectors mitigates some of these risks.

How Billionaires Are Leveraging This ETF for Maximum Returns

Billionaires and other high-net-worth individuals often employ sophisticated strategies to amplify returns from ETFs like the FutureTech ETF. Their substantial capital allows for strategic allocation, dollar-cost averaging, and leveraging opportunities unavailable to smaller investors.

- Investment strategies: Dollar-cost averaging to mitigate risk, leveraging options strategies for amplified returns (covered calls, etc.), and strategic asset allocation to optimize risk/reward profiles.

- Tax optimization: Billionaires can utilize various tax-efficient investment vehicles and strategies, including tax-loss harvesting and charitable donations of appreciated ETF shares.

- Benefits of scale: Large capital allows for access to private placements, preferential pricing, and lower transaction costs, all leading to superior returns.

Accessibility for the Average Investor

While the FutureTech ETF offers incredible potential, its accessibility for smaller investors depends on the minimum investment requirements. However, many brokerage firms offer fractional shares, allowing investors to own a portion of the ETF even with limited capital.

- Minimum investment amount: [Insert minimum investment amount, if known. Otherwise, state "Typically, ETFs have low minimum investment requirements, often as low as a single share."].

- Brokerage fees and commissions: Fees and commissions vary depending on the brokerage used. It is crucial to compare offerings to minimize costs.

- Potential alternatives: For smaller investors, alternative ETFs with similar investment strategies but lower minimum investment requirements might be considered.

Conclusion

The high-growth potential of the FutureTech ETF (or the actual ETF name), supported by expert predictions and strategic investment approaches, makes it an attractive option for investors. Billionaires are likely leveraging its potential for maximum returns using various strategies. "Billionaires' Secret Weapon: The ETF Predicted to Soar 110% by 2025" isn't just a headline; it's a potential reality. Don't miss out on the opportunity to explore this potentially lucrative ETF and learn how it might fit into your investment portfolio. Learn more about the ETF predicted to soar 110% by 2025 today! [Insert link to relevant resource here].

Featured Posts

-

Olly Murs Music Festival A Stunning Castle Setting Near Manchester

May 09, 2025

Olly Murs Music Festival A Stunning Castle Setting Near Manchester

May 09, 2025 -

Golden Knights Defeat Blue Jackets Hill Makes 27 Saves

May 09, 2025

Golden Knights Defeat Blue Jackets Hill Makes 27 Saves

May 09, 2025 -

Improving Wheelchair Access On The Elizabeth Line A Tf L Focus

May 09, 2025

Improving Wheelchair Access On The Elizabeth Line A Tf L Focus

May 09, 2025 -

Young Thugs Uy Scuti Album Whens The Release

May 09, 2025

Young Thugs Uy Scuti Album Whens The Release

May 09, 2025 -

Upcoming India Us Trade Talks A Focus On Key Areas Of Negotiation

May 09, 2025

Upcoming India Us Trade Talks A Focus On Key Areas Of Negotiation

May 09, 2025