BigBear.ai Holdings, Inc.: Securities Lawsuit Filed

Table of Contents

Details of the Securities Lawsuit Against BigBear.ai: Understanding the Allegations Against BigBear.ai

The lawsuit against BigBear.ai alleges securities fraud, specifically focusing on claims of material misrepresentations and omissions in the company's financial statements and public disclosures. While the specifics of the legal complaint are complex, the core allegations revolve around:

- Misleading statements regarding revenue projections: Plaintiffs claim that BigBear.ai presented overly optimistic projections of future revenue, failing to disclose significant risks and challenges impacting their ability to achieve those targets.

- Omission of key information about contracts: The lawsuit alleges the company omitted crucial details about the nature and terms of certain contracts, potentially misleading investors about the company's financial health and stability.

- Failure to disclose material risks: The plaintiffs argue that BigBear.ai failed to adequately disclose material risks associated with its business operations, technology, and market competition. This lack of transparency is central to the securities fraud allegations. These omissions and misrepresentations are reportedly detailed within specific SEC filings that are now under scrutiny.

These BigBear.ai allegations are serious and have far-reaching implications for investors who may have relied on the allegedly inaccurate information when making their investment decisions. Keywords such as securities fraud, misrepresentation, omission, financial statements, and SEC filing are crucial in understanding the gravity of the situation.

Potential Impact on BigBear.ai Stock and Investors: The Impact of the Lawsuit on BigBear.ai Stock Price and Investor Confidence

The lawsuit against BigBear.ai has already had a noticeable impact on its stock price. The immediate effect has been increased volatility and a likely decline in the BigBear.ai stock price. The long-term effects remain uncertain and depend on several factors, including:

- The outcome of the lawsuit: A settlement or a verdict in favor of the plaintiffs could lead to further stock price declines and potentially significant financial penalties for BigBear.ai.

- Investor sentiment: The negative publicity surrounding the lawsuit is likely to erode investor confidence, potentially leading to further selling pressure on the stock.

- Regulatory scrutiny: An ongoing SEC investigation could lead to further regulatory action and penalties, negatively impacting the company's reputation and financial performance. This increased scrutiny could also affect trading volume and cause further uncertainty in the market.

The potential for a lengthy and costly trial adds to the uncertainty. Any rating downgrades from financial analysts could also exacerbate the negative impact on the BigBear.ai stock price and investor confidence.

Legal Implications and Next Steps: Legal Ramifications and Future Developments in the BigBear.ai Lawsuit

Securities lawsuits are complex legal proceedings. The process typically involves:

- Discovery: Both sides gather evidence and information relevant to the case.

- Motion practice: The parties file various motions, seeking to have certain evidence admitted or excluded.

- Settlement negotiations: Attempts may be made to settle the case outside of court.

- Trial: If a settlement is not reached, the case proceeds to trial.

The potential legal outcome could range from a dismissal of the case to a significant monetary judgment against BigBear.ai. Any SEC investigation could lead to separate penalties and sanctions. Investors who believe they have been harmed by the alleged misrepresentations or omissions should consider seeking legal representation to explore their options. The legal process surrounding securities litigation is intricate, emphasizing the importance of expert legal counsel.

Advice for BigBear.ai Investors: What Should BigBear.ai Investors Do Now?

The current situation necessitates careful consideration of your investment strategy. For investors holding BigBear.ai stock, we recommend:

- Monitor the situation closely: Stay informed about the progress of the lawsuit and any related news.

- Seek legal counsel: If you believe you have suffered losses due to the alleged misconduct, consult with a securities attorney to discuss your legal options.

- Diversify your portfolio: Reducing your exposure to BigBear.ai by diversifying your investments can help mitigate potential losses.

- Consider your risk tolerance: Evaluate your comfort level with the level of risk associated with holding BigBear.ai stock given the ongoing lawsuit.

- Consult a financial advisor: Seek professional guidance on how to best manage your investments in light of this development.

Conclusion: Staying Informed About the BigBear.ai Holdings, Inc. Securities Lawsuit

The securities lawsuit against BigBear.ai presents significant challenges and uncertainties for investors. The allegations of securities fraud, the potential impact on the BigBear.ai stock price, and the ongoing legal process all highlight the importance of informed decision-making. By carefully monitoring developments, seeking professional advice, and implementing appropriate risk management strategies, investors can better protect their investments. Stay updated on the BigBear.ai lawsuit and protect your investments. [Link to relevant resources, legal services, or news updates]. Remember to always consult with qualified professionals before making any investment decisions. Understanding the BigBear.ai update is crucial for investor protection. This information is for informational purposes only and not financial or legal advice.

Featured Posts

-

Uspesny Tim Home Office Kancelaria Alebo Kombinacia Obidvoch

May 20, 2025

Uspesny Tim Home Office Kancelaria Alebo Kombinacia Obidvoch

May 20, 2025 -

Quick Facts About Wayne Gretzky A Concise Biography

May 20, 2025

Quick Facts About Wayne Gretzky A Concise Biography

May 20, 2025 -

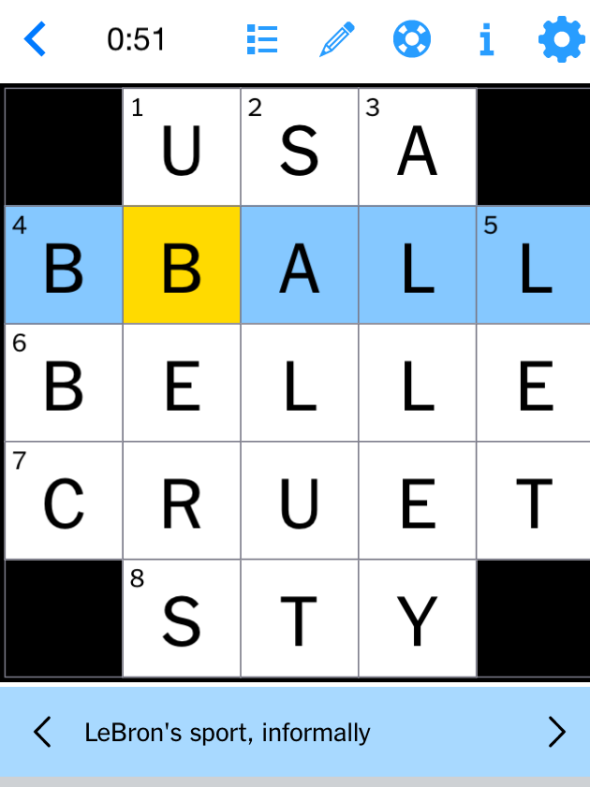

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 20, 2025

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 20, 2025 -

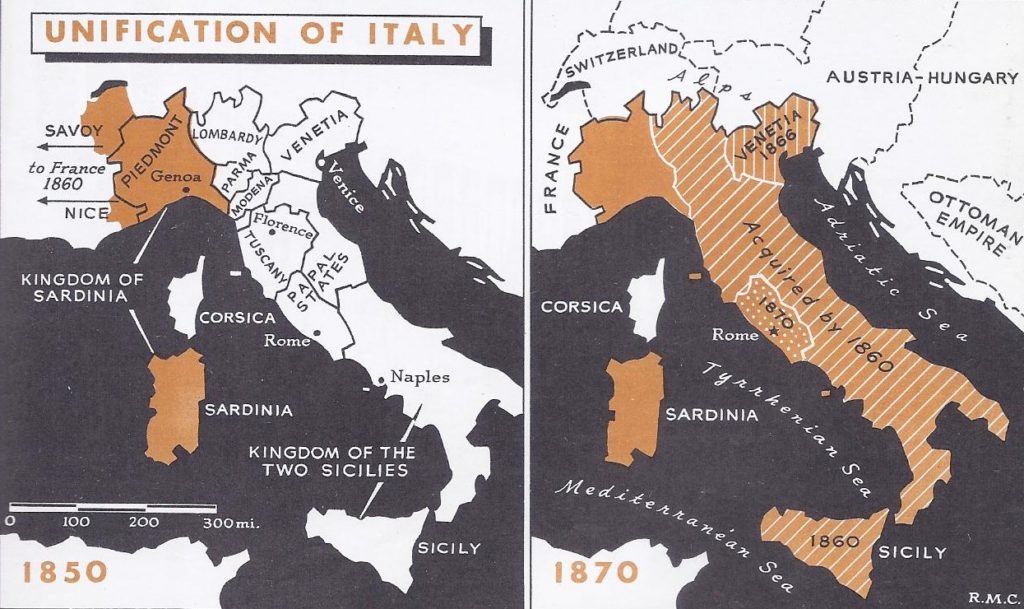

Germany Defeats Italy 5 4 On Aggregate To Reach Uefa Nations League Final Four

May 20, 2025

Germany Defeats Italy 5 4 On Aggregate To Reach Uefa Nations League Final Four

May 20, 2025 -

Paulina Gretzkys Sopranos Inspired Leopard Dress A Look At The Photos

May 20, 2025

Paulina Gretzkys Sopranos Inspired Leopard Dress A Look At The Photos

May 20, 2025

Latest Posts

-

Sydney Sweeney And Julianne Moore In Echo Valley New Images Offer A Glimpse Of The Thriller

May 21, 2025

Sydney Sweeney And Julianne Moore In Echo Valley New Images Offer A Glimpse Of The Thriller

May 21, 2025 -

Barry Ward An Interview With The Irish Actor

May 21, 2025

Barry Ward An Interview With The Irish Actor

May 21, 2025 -

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025 -

Irish Actor Barry Ward A Conversation On Casting And Character

May 21, 2025

Irish Actor Barry Ward A Conversation On Casting And Character

May 21, 2025 -

Interview Barry Ward On Playing Cops And Casting

May 21, 2025

Interview Barry Ward On Playing Cops And Casting

May 21, 2025