BigBear.ai Holdings (BBAI): Evaluating Its Potential As An AI Penny Stock

Table of Contents

Understanding BigBear.ai Holdings (BBAI) and its Business Model

BigBear.ai Holdings (BBAI) is a leading provider of artificial intelligence (AI)-powered solutions, primarily targeting the government and commercial sectors. Their services range from advanced analytics and data science to mission-critical decision support systems. BBAI leverages cutting-edge AI technologies, including machine learning and natural language processing, to offer clients innovative and efficient solutions.

A key competitive advantage for BBAI lies in its deep expertise and experience in working with government agencies and large corporations. This established presence provides a robust foundation for future growth. Their revenue streams are diversified across multiple contracts and projects, reducing reliance on any single client. However, the financial performance has been volatile, reflective of the inherent risks associated with penny stocks.

- Key contracts and partnerships: BBAI boasts numerous significant contracts with government agencies and Fortune 500 companies.

- Recent technological advancements: The company continuously invests in R&D, leading to significant advancements in their AI capabilities.

- Strengths of the business model: Strong government and commercial partnerships; diverse revenue streams; cutting-edge technology.

- Weaknesses of the business model: Dependence on large contracts; exposure to the volatility of the penny stock market; historically inconsistent financial performance.

Analyzing BBAI's Financial Performance and Risk Factors

A thorough analysis of BBAI's financial statements is crucial. While reviewing revenue growth is essential, scrutinizing profit margins, debt levels, and cash flow is equally important. Comparing BBAI's valuation to competitors in the AI sector provides valuable context. Remember, investing in penny stocks like BBAI carries inherent risks, including high volatility and potential for significant losses.

- Key financial ratios and metrics: Investors should carefully review key metrics like revenue growth, profit margins, debt-to-equity ratio, and free cash flow.

- Potential for growth and expansion: BBAI's potential for growth depends heavily on securing new contracts and successfully executing its strategic initiatives.

- Market risks and regulatory hurdles: The AI market is highly competitive, and BBAI faces challenges from established players and emerging startups. Regulatory changes could also impact its operations.

- Debt levels and cash flow: High debt levels and negative cash flow can pose significant risks to the company's financial stability.

Evaluating BBAI's Potential for Growth in the AI Market

The AI market is experiencing explosive growth, presenting significant opportunities for BBAI. Analyzing BBAI's market share and its potential for expansion within this rapidly expanding sector is crucial. The company's strategic initiatives, including investments in R&D and expansion into new markets, will play a critical role in its future success. Assessing the competitive landscape and identifying BBAI's competitive advantages is vital for understanding its growth potential.

- Market size and growth projections for the AI sector: Market research indicates substantial growth for the AI sector over the next decade, providing a favorable environment for BBAI.

- BBAI's market share and potential for expansion: BBAI's current market share is relatively small compared to larger AI companies, however, its potential for expansion remains significant.

- Key competitors and their strengths and weaknesses: BBAI faces stiff competition from established tech giants and innovative startups in the AI field.

- Technological innovation and future prospects: Continuous technological innovation will be vital for BBAI to maintain its competitive edge in the rapidly evolving AI market.

BBAI Penny Stock Valuation and Investment Strategies

Valuing BBAI as a penny stock requires employing various valuation methods, such as Discounted Cash Flow (DCF) analysis and comparable company analysis. These methods help determine a fair value for the stock and assess its potential upside. Remember, however, that even with careful valuation, penny stocks are inherently risky investments. Consider your risk tolerance and diversify your portfolio appropriately.

- Potential price targets and upside potential: Various financial models can be used to estimate potential price targets for BBAI, but remember these are just projections.

- Risk management strategies (stop-loss orders, diversification): Implementing risk management strategies is crucial when investing in penny stocks like BBAI. Stop-loss orders can limit potential losses.

- Long-term vs. short-term investment horizons: BBAI might be more suitable for long-term investors who can tolerate higher risk, rather than short-term traders seeking quick gains.

- Comparison with similar AI penny stocks: Comparing BBAI with its peers provides context and allows investors to identify relative value and potential.

Conclusion: Is BigBear.ai Holdings (BBAI) a Smart Penny Stock Investment?

BigBear.ai Holdings (BBAI) presents both significant opportunities and substantial risks as a penny stock investment. Its position in the rapidly growing AI market, coupled with its strong government and commercial partnerships, offers considerable potential for growth. However, the inherent volatility of penny stocks, alongside its historical financial performance and competitive landscape, cannot be ignored. The analysis highlights the need for cautious optimism.

Weigh the risks and rewards of investing in BBAI and other AI penny stocks carefully. Further research into BigBear.ai Holdings (BBAI) and the AI penny stock market is highly recommended before making any investment decisions. Remember, this information is for educational purposes only and is not financial advice. Conduct your own thorough due diligence before investing in any security.

Featured Posts

-

Pregovori S Putinom Analiza Toncija Tadica I Ruski Strateski Ciljevi

May 20, 2025

Pregovori S Putinom Analiza Toncija Tadica I Ruski Strateski Ciljevi

May 20, 2025 -

Can The Us Manufacturing Sector Recover Lost Jobs A Critical Analysis

May 20, 2025

Can The Us Manufacturing Sector Recover Lost Jobs A Critical Analysis

May 20, 2025 -

Find The Nyt Mini Crossword Answers For April 13

May 20, 2025

Find The Nyt Mini Crossword Answers For April 13

May 20, 2025 -

Jutarnji List Fotografije S Premijere Slavni Redatelji Glumci I Voditelji

May 20, 2025

Jutarnji List Fotografije S Premijere Slavni Redatelji Glumci I Voditelji

May 20, 2025 -

Jennifer Lawrences Backless Gown First Public Appearance Since Welcoming Second Child

May 20, 2025

Jennifer Lawrences Backless Gown First Public Appearance Since Welcoming Second Child

May 20, 2025

Latest Posts

-

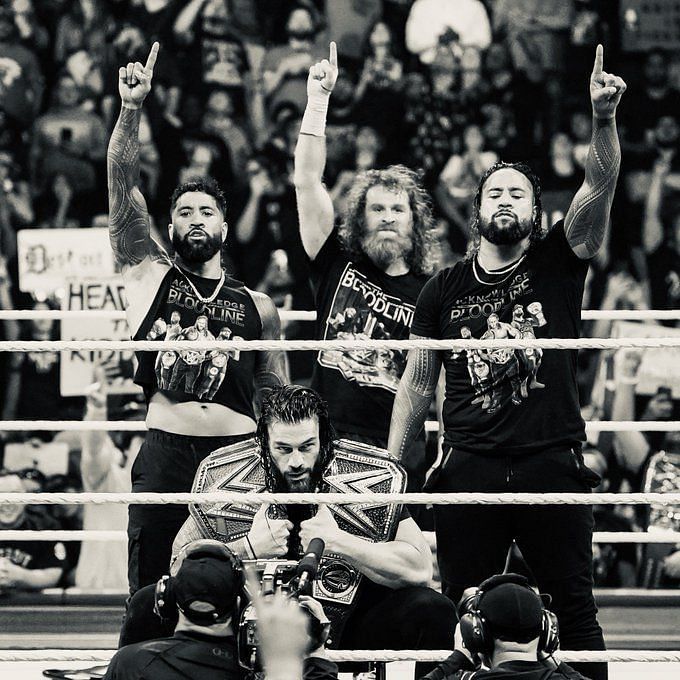

Wwe Raw Sami Zayn Faces Rollins And Breakkers Aggression

May 20, 2025

Wwe Raw Sami Zayn Faces Rollins And Breakkers Aggression

May 20, 2025 -

The Sami Zayn Seth Rollins Bron Breakker Confrontation On Wwe Raw

May 20, 2025

The Sami Zayn Seth Rollins Bron Breakker Confrontation On Wwe Raw

May 20, 2025 -

Wwe Raw The Vicious Attack On Sami Zayn By Rollins And Breakker

May 20, 2025

Wwe Raw The Vicious Attack On Sami Zayn By Rollins And Breakker

May 20, 2025 -

Zayn Under Siege Rollins And Breakkers Wwe Raw Domination

May 20, 2025

Zayn Under Siege Rollins And Breakkers Wwe Raw Domination

May 20, 2025 -

Leeds Championship Lead Secured Tottenham Loanees Crucial Role

May 20, 2025

Leeds Championship Lead Secured Tottenham Loanees Crucial Role

May 20, 2025