Betting On Natural Disasters: The Los Angeles Wildfire Example

Table of Contents

The Predictability (or Lack Thereof) of Los Angeles Wildfires

Los Angeles wildfires are a terrifying reality, fueled by a confluence of factors. The infamous Santa Ana winds, characterized by their strong, dry gusts, act as a primary accelerant, rapidly spreading flames across tinder-dry vegetation. Years of drought, exacerbated by climate change, create a highly flammable environment. Human negligence, from discarded cigarettes to poorly maintained power lines, further contributes to wildfire ignition. Accurately predicting these events, however, remains a significant challenge.

Current wildfire prediction models, while improving, have limitations:

- Limitations of current predictive models: Models struggle to accurately predict the precise location and intensity of wildfires, especially those ignited by human error.

- Influence of Santa Ana winds on prediction accuracy: The unpredictable nature and sudden onset of Santa Ana winds significantly impact prediction accuracy, making it difficult to provide timely warnings.

- Difficulty in predicting human-caused wildfires: Predictive models primarily focus on environmental factors; human behavior remains a largely unpredictable variable.

Climate change is undeniably increasing the frequency and intensity of wildfires in Los Angeles and across the globe, further complicating prediction efforts and highlighting the growing risk associated with "betting on natural disasters" in this context. This increased risk necessitates improved wildfire risk assessment and mitigation strategies.

The Insurance Industry and Wildfire Risk

The insurance industry bears the brunt of the financial fallout from devastating wildfires like those in Los Angeles. Companies meticulously assess wildfire risk, factoring in factors like proximity to wildlands, vegetation density, and historical wildfire data. This risk assessment directly impacts insurance premiums. Homeowners in high-risk areas face significantly higher premiums, sometimes making insurance unaffordable. Wildfires also lead to substantial payouts, straining insurance company resources.

- Rising insurance premiums in high-risk areas: Homeowners in areas prone to wildfires often face exponentially increasing premiums.

- Increased scrutiny of wildfire-related insurance claims: Insurance companies are increasingly scrutinizing claims to prevent fraud and ensure accurate assessment of damages.

- The role of preventative measures in insurance policies: Many insurers now offer discounts to homeowners who implement preventative measures, such as clearing brush around their homes and installing fire-resistant roofing.

Reinsurance plays a crucial role in mitigating catastrophic losses for insurance companies, distributing the risk across multiple insurers and providing a financial safety net in the event of widespread devastation. However, even with reinsurance, the sheer scale of losses from major wildfires poses significant challenges to the industry's financial stability.

The Ethical Implications of Betting on Natural Disasters

The ethical implications of profiting from the suffering caused by natural disasters are profound. Betting on such events raises serious questions about the commodification of human misery and the potential for exploitation. The possibility of market manipulation and insider trading adds another layer of ethical concern.

- Arguments against disaster betting on ethical grounds: Many argue that profiting from disasters is morally reprehensible, insensitive to victims, and potentially harmful to societal recovery efforts.

- Potential for exacerbating existing inequalities: Those most vulnerable to natural disasters are often the least able to recover financially, making the possibility of others profiting from their misfortune particularly egregious.

- The need for stricter regulations and oversight: The lack of robust regulatory frameworks governing disaster betting highlights the urgent need for greater oversight to prevent exploitation and ensure ethical conduct.

The potential for such activities to undermine trust in institutions and exacerbate societal inequalities necessitates urgent consideration and action.

Analyzing Betting Markets Related to Wildfires

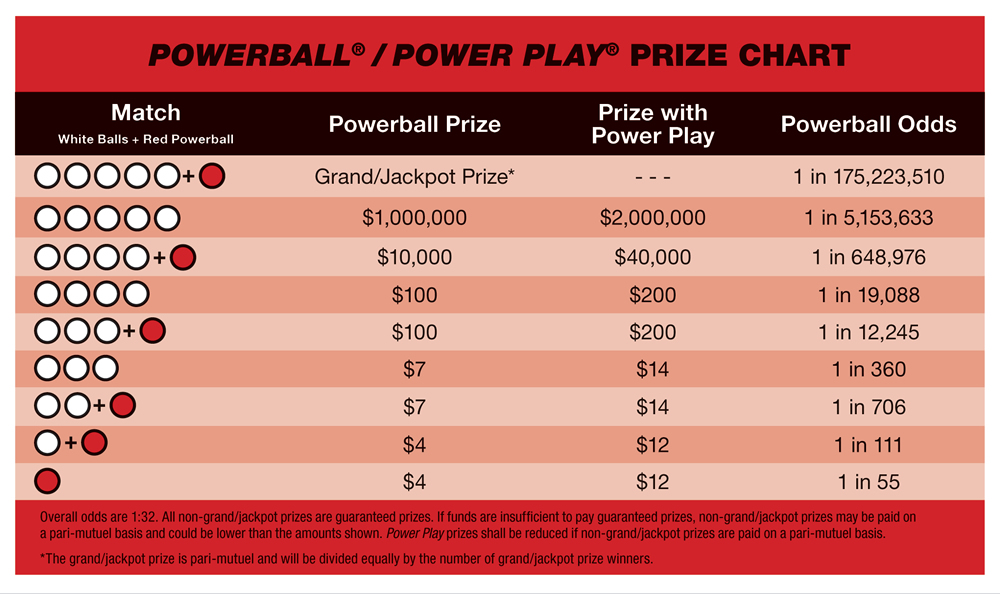

While explicitly betting on the precise occurrence or intensity of a specific wildfire might be limited, related markets could exist. For instance, some sophisticated financial instruments might indirectly reflect wildfire risk. Disaster derivatives, though complex and not directly tied to specific wildfire events, might reflect aggregate risk assessments. These markets, however, would likely be highly regulated and accessible only to specialized financial institutions. The potential for information asymmetry and insider trading within these complex markets raises significant ethical and regulatory concerns.

Conclusion: The Uncertain Future of Betting on Natural Disasters – The Los Angeles Wildfire Example and Beyond

This examination of "betting on natural disasters," using the Los Angeles wildfires as a case study, reveals a complex interplay of unpredictability, financial risk, and profound ethical challenges. The inherent unpredictability of wildfires, compounded by climate change, makes accurate prediction and responsible risk assessment extremely difficult. The insurance industry's struggle to manage wildfire risk highlights the financial stakes involved, while the ethical concerns surrounding profiting from human suffering underscore the urgent need for responsible consideration. We must prioritize responsible disaster preparedness, ethical considerations in disaster betting, and a deeper understanding of wildfire risk. Let's continue the conversation and push for responsible mitigation strategies and ethical guidelines to prevent the exploitation inherent in the speculative markets surrounding natural disasters.

Featured Posts

-

Paramount Leaders Considered 20 Million Settlement In Trump Lawsuit

May 03, 2025

Paramount Leaders Considered 20 Million Settlement In Trump Lawsuit

May 03, 2025 -

Leaked Farage Whats Apps Fuel Reform Partys Integrity Crisis

May 03, 2025

Leaked Farage Whats Apps Fuel Reform Partys Integrity Crisis

May 03, 2025 -

Is A Place In The Sun Right For You Weighing The Pros And Cons Of Overseas Property

May 03, 2025

Is A Place In The Sun Right For You Weighing The Pros And Cons Of Overseas Property

May 03, 2025 -

The Impact Of Nigel Farage On Reform Uks Political Influence

May 03, 2025

The Impact Of Nigel Farage On Reform Uks Political Influence

May 03, 2025 -

April 9th Lotto Jackpot Results Check The Winning Numbers

May 03, 2025

April 9th Lotto Jackpot Results Check The Winning Numbers

May 03, 2025