Best Tribal Loans For Bad Credit: Direct Lender Guaranteed Approval?

Table of Contents

<p><strong>Meta Description:</strong> Struggling with bad credit? Explore the options and potential benefits of tribal loans from direct lenders. Learn about guaranteed approval, interest rates, and how to find the best loan for your situation.</p>

<p>Securing a loan with bad credit can feel impossible. Many traditional lenders turn away applicants with low credit scores. However, tribal loans are often presented as a potential solution, sometimes promising "guaranteed approval" from direct lenders. This article explores the reality of tribal loans for bad credit, outlining the benefits, drawbacks, and crucial considerations before applying. We'll delve into what to look for in a reputable direct lender and help you navigate this complex financial landscape.</p>

<h2>Understanding Tribal Loans and Direct Lenders</h2>

<h3>What are Tribal Loans?</h3>

<p>Tribal loans are short-term loans offered by lenders associated with Native American tribes. These loans operate under the principle of tribal sovereign immunity, meaning they are often subject to different regulatory frameworks than traditional lenders. This can impact the interest rates, terms, and overall lending process. While some borrowers find them convenient, it's crucial to understand the implications of this legal protection. Potential advantages may include faster processing times in some cases, while disadvantages can include significantly higher interest rates compared to traditional loans and less stringent consumer protection.</p>

<p>The regulatory aspects of tribal lending are complex and vary depending on the tribe and lender. It's essential to research the specific lender and their licensing to ensure legitimacy and avoid scams. Understanding the role of tribal sovereign immunity is key to evaluating the potential risks and benefits.</p>

<h3>Direct Lenders vs. Brokers</h3>

<p>When searching for a tribal loan, you'll encounter two main avenues: direct lenders and brokers. Direct lenders are the institutions providing the loan funds directly to you. Brokers, on the other hand, act as intermediaries, connecting you with multiple lenders. </p>

<ul> <li><strong>Direct Lenders:</strong> Pros include potentially simpler application processes and clearer communication. Cons may include a limited selection of loan options.</li> <li><strong>Brokers:</strong> Pros include access to a wider range of lenders and potentially better loan terms. Cons may include hidden fees and less transparency regarding the lender selection process.</li> </ul>

<p>Regardless of your chosen route, always thoroughly research the legitimacy of the lender or broker. Check for online reviews, verify their licensing, and be wary of any promises of guaranteed approval with minimal scrutiny.</p>

<h3>"Guaranteed Approval" – Managing Expectations</h3>

<p>The term "guaranteed approval" is frequently used in marketing materials for tribal loans, but it’s often misleading. No legitimate lender can guarantee loan approval. The approval depends on your creditworthiness, income, and debt-to-income ratio. While some lenders may advertise looser approval requirements, this often comes with much higher interest rates and fees. </p>

<p>Manage your expectations realistically. Before applying for any loan, including a tribal loan, assess your financial situation honestly. Factors that heavily influence loan approval include:</p> <ul> <li>Credit Score: A higher credit score significantly increases your chances of approval.</li> <li>Income: Lenders assess your income to determine your ability to repay the loan.</li> <li>Debt-to-Income Ratio: This ratio indicates how much of your income is already committed to debt payments.</li> </ul>

<h2>Finding Reputable Tribal Lenders for Bad Credit</h2>

<h3>Due Diligence: What to Look For</h3>

<p>Finding a reputable tribal lender requires thorough due diligence. Don't rush the process. Take your time to research and compare lenders carefully. Key considerations include:</p>

<ul> <li><strong>Licensing and Registration:</strong> Ensure the lender is properly licensed and registered to operate in your state.</li> <li><strong>Transparency:</strong> Look for clear disclosure of all fees and interest rates upfront.</li> <li><strong>Customer Reviews:</strong> Check online reviews and testimonials from previous borrowers.</li> <li><strong>Secure Platform:</strong> Verify that the lender's online platform is secure and uses encryption to protect your sensitive information.</li> <li><strong>Clear Terms and Conditions:</strong> Review the loan agreement thoroughly before signing to understand all terms and conditions.</li> </ul>

<p>Check the lender's reputation with the Better Business Bureau (BBB) and other reputable consumer protection agencies. Avoid lenders with numerous complaints or negative reviews.</p>

<h3>Comparing Interest Rates and Loan Terms</h3>

<p>Interest rates and loan terms vary significantly among tribal lenders. Comparing Annual Percentage Rates (APRs) is crucial. While tribal loans might offer faster approvals, be prepared for significantly higher interest rates than traditional loans. Always compare multiple lenders to find the most favorable terms for your situation.</p>

<p>Responsible borrowing is paramount. Avoid taking out a loan you can't afford to repay. Carefully calculate your monthly payments and ensure they fit within your budget. High interest rates can quickly lead to a debt trap if not managed carefully. </p>

<h3>Understanding the Loan Application Process</h3>

<p>The application process typically involves providing personal information, verifying your income and employment, and potentially providing supporting documentation. Be prepared to submit:</p> <ul> <li>Proof of Identity (ID)</li> <li>Proof of Income (pay stubs, bank statements)</li> <li>Proof of Address</li> </ul>

<p>The lender will review your application and assess your creditworthiness. Be honest and accurate in your application. Providing false information will severely jeopardize your chances of approval and can have legal consequences.</p>

<h2>Alternatives to Tribal Loans for Bad Credit</h2>

<h3>Exploring Other Lending Options</h3>

<p>Before committing to a tribal loan, explore alternative options that might offer better terms and lower interest rates.</p> <ul> <li><strong>Secured Loans:</strong> These loans require collateral, reducing the risk for the lender and potentially resulting in lower interest rates. However, you risk losing the collateral if you default.</li> <li><strong>Credit Unions:</strong> Credit unions often offer more favorable loan terms than traditional banks, especially for members with bad credit.</li> <li><strong>Payday Loans:</strong> While readily available, payday loans are notorious for extremely high interest rates and fees. They should only be considered as a last resort.</li> <li><strong>Personal Loans from Banks:</strong> Banks may offer personal loans, though approval is contingent upon your credit history and income.</li> <li><strong>Debt Consolidation:</strong> Combining multiple debts into a single loan can simplify repayment and potentially lower your monthly payments.</li> </ul>

<h3>Credit Building Strategies</h3>

<p>Improving your credit score is a long-term solution that will open doors to more favorable loan options in the future. Focus on:</p> <ul> <li><strong>Paying bills on time:</strong> This is the most critical factor affecting your credit score.</li> <li><strong>Reducing debt:</strong> Lowering your debt-to-income ratio will make you a more attractive borrower.</li> <li><strong>Monitoring your credit reports:</strong> Regularly checking your credit reports for errors and discrepancies is essential.</li> </ul>

<p>Consider seeking guidance from credit counseling services. They can provide valuable advice and strategies for improving your credit score and managing your finances responsibly.</p>

<h2>Conclusion</h2>

While tribal loans from direct lenders might seem like a quick solution for individuals with bad credit, it's crucial to approach them with caution. The promise of "guaranteed approval" often overshadows the potentially high interest rates and complex terms. Thorough research, comparison shopping, and understanding the alternatives are vital before considering a tribal loan. Remember to carefully evaluate your financial situation and explore all available options before committing to any loan, including exploring other avenues for securing funding or improving your credit score. Don't rush the process; responsible decision-making is key to avoiding financial hardship. Explore alternative lending options and credit building strategies before considering a tribal loan. Find the best tribal loan for your specific needs through careful research and comparison.

Featured Posts

-

Friday Euro Millions Draw E245m Jackpot Live Updates

May 28, 2025

Friday Euro Millions Draw E245m Jackpot Live Updates

May 28, 2025 -

Late Game Heroics Stowers Grand Slam Secures Marlins Win

May 28, 2025

Late Game Heroics Stowers Grand Slam Secures Marlins Win

May 28, 2025 -

Lotto Win E1 Million Jackpot Location Announced Urgent Player Alert

May 28, 2025

Lotto Win E1 Million Jackpot Location Announced Urgent Player Alert

May 28, 2025 -

Alcaraz And Swiatek Contrasting Fortunes Ahead Of The French Open

May 28, 2025

Alcaraz And Swiatek Contrasting Fortunes Ahead Of The French Open

May 28, 2025 -

Fan Outrage Over Possible Hugh Jackman Deposition In Blake Lively Legal Battle

May 28, 2025

Fan Outrage Over Possible Hugh Jackman Deposition In Blake Lively Legal Battle

May 28, 2025

Latest Posts

-

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025 -

Situation Du Tunnel De Tende Ouverture Annoncee Pour Juin

May 30, 2025

Situation Du Tunnel De Tende Ouverture Annoncee Pour Juin

May 30, 2025 -

From Page To Screen Gisele Pelicots Rape Survivor Story Coming To Hbo

May 30, 2025

From Page To Screen Gisele Pelicots Rape Survivor Story Coming To Hbo

May 30, 2025 -

Podcast Integrale Europe 1 Soir 19 03 2025

May 30, 2025

Podcast Integrale Europe 1 Soir 19 03 2025

May 30, 2025 -

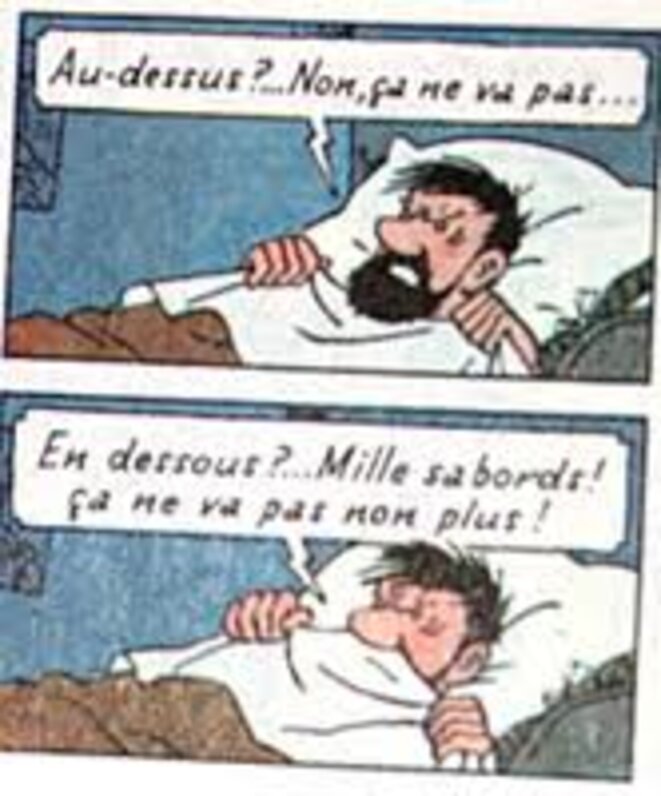

Jacobelli Defend Le Pen Au Dessus Ou En Dessous Des Lois

May 30, 2025

Jacobelli Defend Le Pen Au Dessus Ou En Dessous Des Lois

May 30, 2025