BBAI Stock: Analyzing The Impact Of The Below-Expectation Q1 Report

Table of Contents

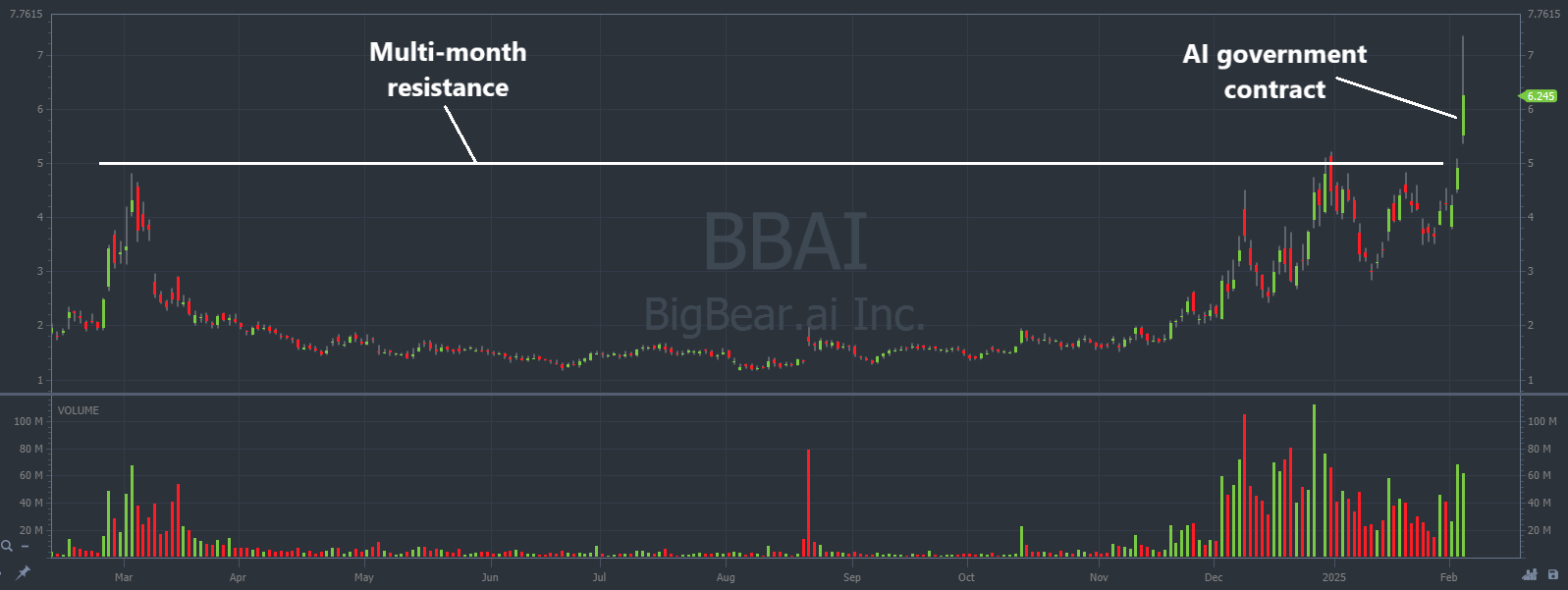

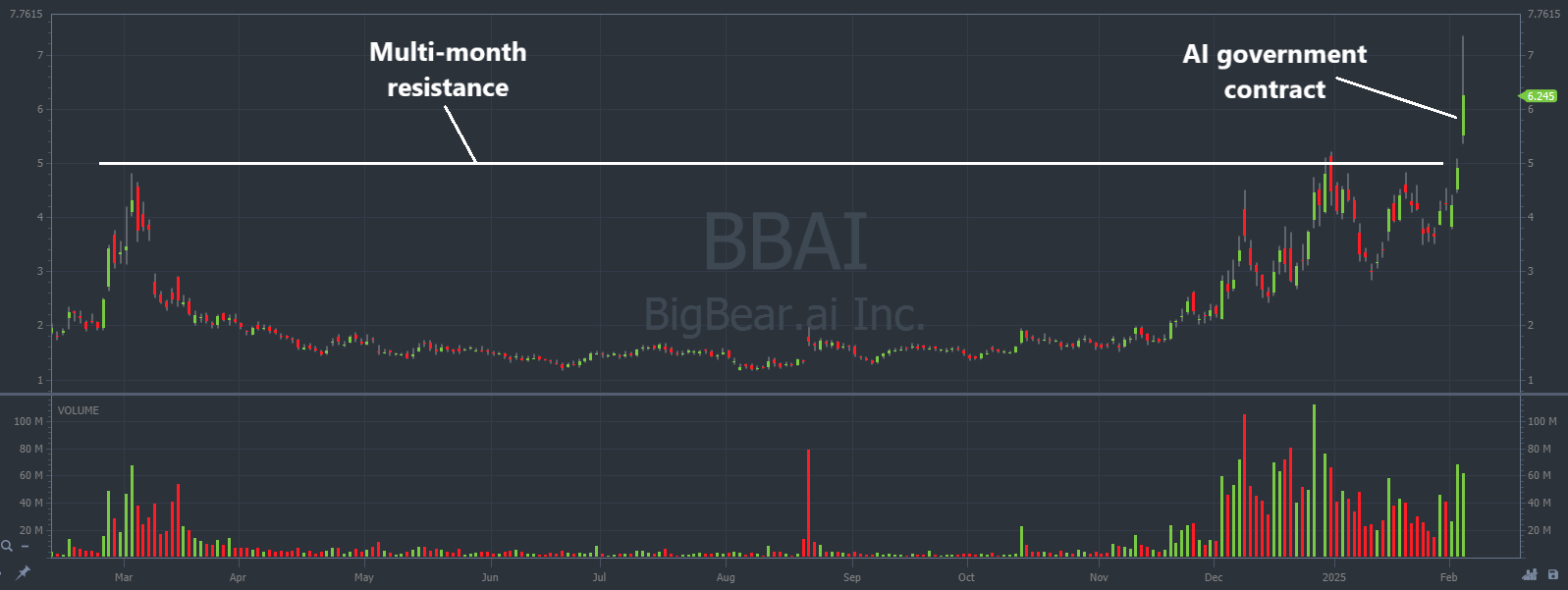

The recent release of BBAI's Q1 2024 financial report sent shockwaves through the market, with the company significantly underperforming expectations and resulting in a sharp decline in BBAI stock price. This article delves into the key factors contributing to this disappointing performance, analyzes their potential impact on BBAI stock's future trajectory, and offers insights for investors navigating this turbulent period. We'll examine the financial highlights, explore potential reasons for the underperformance, and discuss the implications for those considering BBAI investment.

BBAI Q1 Earnings: A Detailed Breakdown

Revenue Shortfall

BBAI's Q1 revenue significantly missed analyst predictions, falling short by [Insert Percentage]% to [Insert Actual Revenue Figure]. This represents a substantial decrease compared to the previous quarter and a year-over-year decline. Specific revenue streams that underperformed include:

- [Revenue Stream 1]: Experienced a [Percentage]% drop, attributed to [Reason for decline].

- [Revenue Stream 2]: Showed a [Percentage]% decrease due to [Reason for decline].

- [Revenue Stream 3]: Underperformed expectations by [Percentage]%, largely impacted by [Reason for decline].

This underperformance can be partly attributed to the challenging macroeconomic environment, including [mention specific external factors like increased competition or slowing Chinese economy]. Comparison to previous quarters reveals a consistent downward trend, raising concerns about the company's overall growth trajectory.

Profitability Concerns

The revenue shortfall directly impacted BBAI's profitability. Net income was [Insert Actual Net Income Figure], significantly lower than the anticipated [Insert Predicted Net Income Figure], resulting in an EPS of [Insert Actual EPS Figure] compared to the projected [Insert Predicted EPS Figure]. Several factors contributed to these lower-than-expected profits:

- Increased operating expenses: [Explain specific areas of increased expenses, e.g., R&D, marketing].

- Higher-than-anticipated cost of goods sold: [Explain the factors driving this increase].

- Lower profit margins: [Explain the decrease in profit margin percentage and reasons behind it].

This paints a concerning picture of BBAI's short-term financial health and raises questions about its long-term sustainability.

Key Metrics and Financial Health

Beyond revenue and profitability, other key metrics reveal further concerns. BBAI's cash flow was [Insert Cash Flow Figure], indicating [Positive or Negative implications]. Debt levels currently stand at [Insert Debt Level Figure], representing [Assessment of debt levels – healthy, concerning, etc.]. While the company's long-term financial health depends on future performance, these Q1 figures suggest a need for a strategic reassessment and potential corrective measures. The implications are particularly concerning given the company's focus on the competitive AI market.

Factors Contributing to BBAI's Underperformance

Market Competition

BBAI operates in a fiercely competitive market, facing stiff competition from established players like [List Key Competitors]. These competitors have successfully implemented strategies such as [mention specific successful competitor strategies, e.g., aggressive pricing, innovative product development], putting pressure on BBAI's market share and revenue generation. The company's apparent inability to effectively counter these competitive pressures contributed to the disappointing Q1 results.

Macroeconomic Headwinds

The global macroeconomic environment presents significant headwinds for BBAI, particularly the slowdown in the Chinese economy. [Explain specific macroeconomic factors impacting BBAI's performance, e.g., decreased consumer spending, government regulations]. These factors significantly constrained BBAI's ability to achieve its projected revenue and profit targets. The persistence of these headwinds in the near future represents a significant risk to the company's outlook.

Internal Challenges

Internal challenges may also have contributed to BBAI's underperformance. [Discuss potential internal issues such as management decisions, operational inefficiencies, or internal restructuring]. A thorough review of internal processes and strategies is necessary to address these shortcomings and improve future performance. The effectiveness of BBAI's response to these challenges will be crucial in determining its future trajectory.

The Impact on BBAI Stock Price and Investor Sentiment

Immediate Market Reaction

The immediate market reaction to the BBAI Q1 report was swift and negative. The BBAI stock price experienced a sharp [Percentage]% drop, accompanied by a significant increase in trading volume, reflecting widespread investor concern. Analyst downgrades followed the report, further contributing to the negative sentiment surrounding the stock. This reflects a significant loss of investor confidence in the short-term.

Long-Term Implications for Investors

The long-term implications for BBAI stock and investor confidence are uncertain. Future performance will depend on the company's ability to address the challenges discussed above, including strengthening its competitive position, navigating macroeconomic headwinds, and resolving any internal issues. Whether this represents a buying opportunity or a signal to sell depends on individual investor risk tolerance and long-term outlook for the company's prospects within the AI sector and the Chinese tech market. Careful consideration of these factors is vital before making any investment decisions regarding BBAI stock.

Conclusion

BBAI's Q1 report revealed a significant revenue shortfall, impacting profitability and leading to a sharp decline in BBAI stock price. Contributing factors include intense market competition, challenging macroeconomic conditions, and potential internal challenges. The immediate market reaction was overwhelmingly negative, reflecting a loss of investor confidence. While the short-term outlook remains uncertain, investors need to carefully assess the long-term prospects of BBAI and its potential for recovery before making any investment decisions. Further research, monitoring of future BBAI stock performance, and diversification of your portfolio are crucial for mitigating risk in this volatile market. Stay informed about future announcements and updates regarding BBAI stock and its performance.

Featured Posts

-

Trump Tariffs Statehood And Gretzky A Canadian Loyalty Debate

May 21, 2025

Trump Tariffs Statehood And Gretzky A Canadian Loyalty Debate

May 21, 2025 -

Live Bundesliga Matches Tv Channels And Online Platforms

May 21, 2025

Live Bundesliga Matches Tv Channels And Online Platforms

May 21, 2025 -

Quantum Computing Stocks A Focus On D Wave Quantum Inc Qbts

May 21, 2025

Quantum Computing Stocks A Focus On D Wave Quantum Inc Qbts

May 21, 2025 -

Investigating Recent Red Light Reports Over France

May 21, 2025

Investigating Recent Red Light Reports Over France

May 21, 2025 -

Reddit Post To Become Feature Film Sydney Sweeney Lands Lead Role Warner Bros

May 21, 2025

Reddit Post To Become Feature Film Sydney Sweeney Lands Lead Role Warner Bros

May 21, 2025

Latest Posts

-

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 22, 2025

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 22, 2025 -

Councillors Wife Faces Jail After Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Faces Jail After Anti Migrant Social Media Post

May 22, 2025 -

Southport Stabbing Mums Tweet Costs Her Freedom And Home

May 22, 2025

Southport Stabbing Mums Tweet Costs Her Freedom And Home

May 22, 2025 -

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 22, 2025

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 22, 2025 -

Councillors Wife Fails To Overturn Sentence For Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Fails To Overturn Sentence For Anti Migrant Social Media Post

May 22, 2025