Bank Of Japan Downgrades Economic Projection Due To Trade War Impact

Reasons Behind the Downgraded Economic Projection

The BOJ's decision to lower its GDP growth forecast stems from a confluence of factors directly linked to the intensifying trade war. The global uncertainty created by protectionist policies is significantly impacting the Japanese economy.

-

Weakening global demand due to trade protectionism: The imposition of tariffs and trade restrictions has dampened global demand for goods and services, reducing export opportunities for Japanese businesses. This is particularly true for sectors heavily reliant on international trade.

-

Reduced exports from Japan to key trading partners: Japan's export-oriented economy is particularly vulnerable to trade disputes. Reduced exports to the US, China, and the EU, key trading partners, have directly impacted numerous industries. The automotive sector, for instance, has seen a significant decline in exports due to increased tariffs.

-

Decreased business investment due to uncertainty surrounding future trade policies: The ongoing uncertainty surrounding trade policies is discouraging businesses from making significant capital investments. Companies are hesitant to commit to large-scale projects when facing unpredictable trade barriers and fluctuating market conditions. This hesitancy translates to slowed economic growth.

-

Negative impact on consumer confidence and spending: The uncertainty surrounding the global economy and the potential for further price increases due to tariffs are affecting consumer confidence. This decreased confidence translates to reduced consumer spending, further hindering economic growth.

-

Supply chain disruptions impacting various sectors of the Japanese economy: The trade war is disrupting global supply chains, causing delays and increasing costs for Japanese businesses. This is particularly problematic for industries with complex global supply chains, such as electronics and manufacturing. Increased production costs lead to reduced competitiveness and profitability.

Specifics of the Downgraded Projection

The BOJ's revised GDP growth forecast represents a significant downward revision from its previous projection.

-

Original GDP growth forecast versus the revised forecast: The BOJ initially projected a [Insert Original GDP Growth Percentage]% growth rate for the fiscal year. However, the revised forecast stands at [Insert Revised GDP Growth Percentage]%, reflecting a substantial decrease. (Source: [Cite Official BOJ Report/Statement])

-

Timeframe for the downgraded projection (fiscal year): This downgrade applies to the fiscal year [Insert Fiscal Year], covering the period from [Insert Start Date] to [Insert End Date].

-

Specific language used by the BOJ in its official statement regarding the downgrade: The BOJ's statement explicitly mentioned the "negative impact of global trade frictions" and the "weakening external demand" as key drivers behind the downward revision. (Source: [Cite Official BOJ Report/Statement])

-

Explanation of the methodology used by the BOJ to arrive at its projection: The BOJ's projection incorporates various economic indicators, including consumer spending, business investment, and export data. Their methodology involves sophisticated econometric models that consider a wide range of factors to produce a comprehensive forecast. (Source: [Cite Official BOJ Methodology Document])

[Insert chart or graph visually representing the revised growth projections here]

Potential Implications of the Downgrade

The downgraded economic projection has several potential implications for the Japanese economy.

-

Possible impact on the yen exchange rate: The weaker economic outlook could lead to a depreciation of the yen against other major currencies. This could, in theory, boost exports in the short term, but also increase import costs.

-

Potential effect on inflation targets: The slower economic growth may make it harder for the BOJ to achieve its inflation targets. Lower demand could exert downward pressure on prices.

-

Likelihood of further monetary policy adjustments by the BOJ (e.g., interest rate changes, quantitative easing): In response to the downgraded projection, the BOJ may consider further monetary policy easing measures, such as lowering interest rates or expanding quantitative easing programs to stimulate economic activity.

-

Consideration of fiscal stimulus measures by the Japanese government: The Japanese government may also implement fiscal stimulus measures, such as increased government spending on infrastructure projects, to counter the negative impact of the trade war.

Impact on Global Markets

The Bank of Japan's downgraded projection is not just a domestic concern; it carries significant implications for global markets.

-

Ripple effects on other Asian economies: Japan's economic slowdown will likely have ripple effects on other Asian economies that are closely tied to Japanese trade and investment.

-

Potential impact on global supply chains: Further disruptions to global supply chains are anticipated as the trade war continues to escalate, impacting production and delivery timelines globally.

-

Effects on global market volatility and investor sentiment: The uncertainty surrounding the global economy and the potential for further economic slowdowns could lead to increased market volatility and negatively impact investor sentiment.

Conclusion

The Bank of Japan's downgraded economic projection underscores the significant negative impact of the escalating trade war on the Japanese economy. The reduced export demand, decreased investment, and dampened consumer confidence all contribute to a less optimistic outlook. The potential implications range from currency fluctuations to adjustments in monetary policy, and the effects will be felt not only domestically but also throughout global markets. Staying informed about the evolving situation and the Bank of Japan's response to the trade war's impact on the Japanese economy is crucial. Continue to monitor updates on the Bank of Japan's economic projections and their implications for global markets. Understanding the Bank of Japan's actions is crucial for navigating these uncertain times.

Fortnite Servers Down Update 34 40 Brings Planned Offline Time

Fortnite Servers Down Update 34 40 Brings Planned Offline Time

7 Nuevos Vehiculos Para Mejorar La Eficiencia Del Sistema Penitenciario

7 Nuevos Vehiculos Para Mejorar La Eficiencia Del Sistema Penitenciario

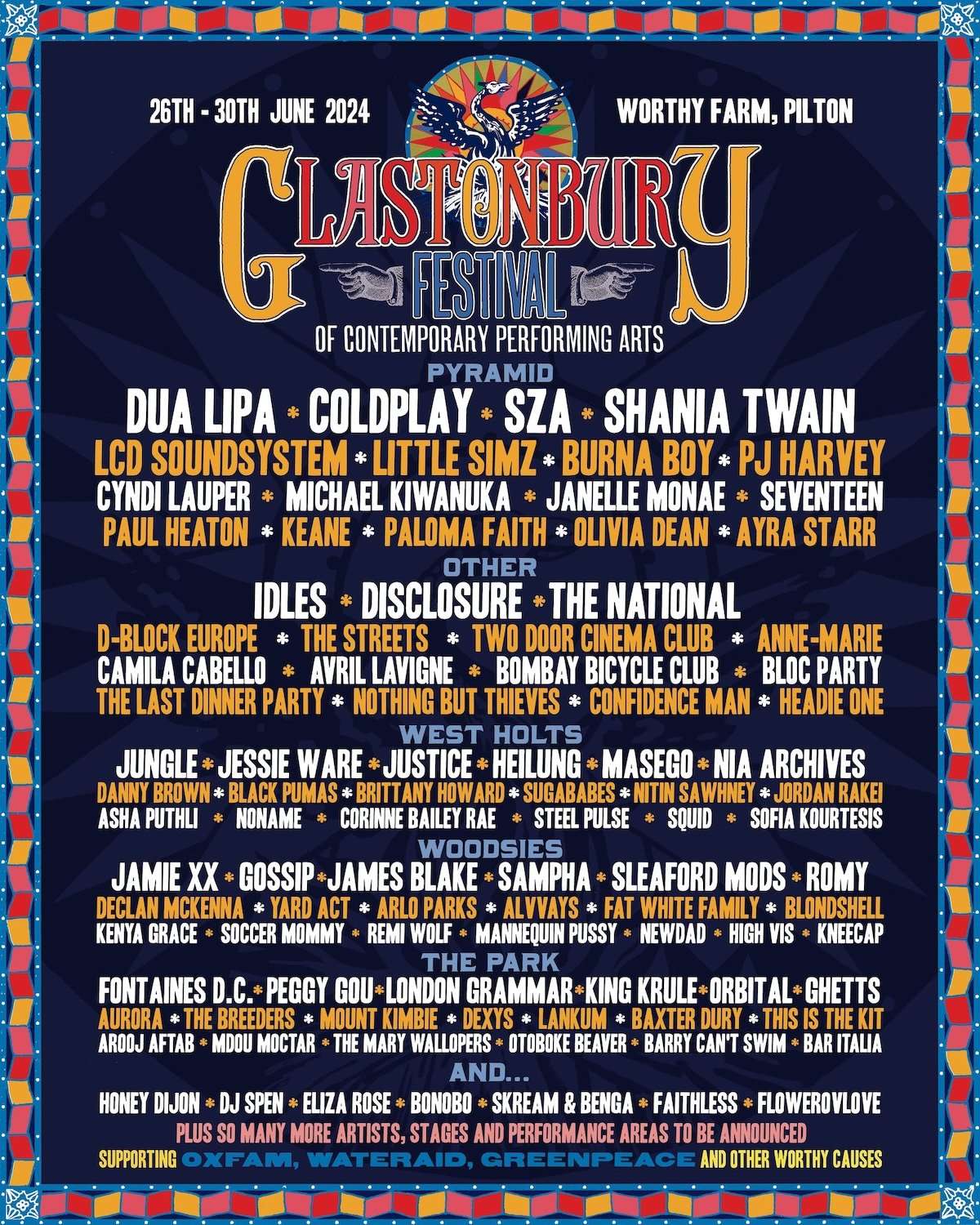

Glastonbury 2024 The 1975 And Olivia Rodrigo Lead The Charge

Glastonbury 2024 The 1975 And Olivia Rodrigo Lead The Charge

Almelwmat Alkamlt En Blay Styshn 6 Ahdth Altsrybat Waltwqeat

Almelwmat Alkamlt En Blay Styshn 6 Ahdth Altsrybat Waltwqeat

Did Christina Aguilera Go Too Far With Photoshop In Her Recent Photoshoot

Did Christina Aguilera Go Too Far With Photoshop In Her Recent Photoshoot