Bank Of England: Is A Half-Point Interest Rate Cut The Right Move?

Table of Contents

Arguments for a Half-Point Interest Rate Cut

A half-point interest rate cut by the Bank of England isn't without its proponents. The potential benefits are significant, focusing on stimulating economic growth and combating recessionary fears.

Stimulating Economic Growth

Lowering interest rates makes borrowing cheaper for both consumers and businesses. This can act as a powerful economic stimulus.

- Increased consumer spending: Lower mortgage rates and personal loan interest translate to increased disposable income, boosting consumer confidence and spending.

- Business investment: Reduced borrowing costs incentivize businesses to invest in expansion, new equipment, and job creation, fueling economic activity.

- Job creation: Increased business investment often leads to higher employment levels, further stimulating the economy.

The impact on GDP growth could be substantial. Studies have shown a correlation between lower interest rates and increased GDP growth, although the magnitude of the effect can vary depending on various macroeconomic factors. For example, a 0.5% interest rate cut could potentially add X% to GDP growth in the next fiscal year (Note: replace X with data from a reputable source). This economic stimulus, combined with increased consumer confidence and investment growth, could help to alleviate economic stagnation.

Combating Recessionary Fears

The specter of recession looms large over the UK economy. A proactive rate cut could act as a preventative measure, mitigating the severity of any potential downturn.

- Reduced borrowing costs: Lower interest rates make it less expensive for businesses to access credit, helping them navigate economic uncertainty.

- Increased liquidity in the market: A rate cut can inject liquidity into the financial system, making it easier for businesses and individuals to access funds.

By proactively addressing recession prevention, the Bank of England aims to maintain financial stability and prevent a more prolonged economic downturn. This proactive approach, while risky, prioritizes averting a potential crisis.

Addressing Inflationary Pressures Selectively

While inflation remains a significant concern, a targeted rate cut could address inflationary pressures in specific sectors without exacerbating overall inflation.

- Targeted support for specific industries: Certain sectors might be disproportionately affected by high inflation. A rate cut could offer targeted support, mitigating the inflationary impact in these sensitive areas.

- Mitigating inflationary impact in sensitive areas: By focusing on specific sectors, the BoE can attempt to control inflation more precisely, avoiding a broad-based inflationary surge.

This approach, using monetary policy tools selectively, focuses on targeted inflation control, aiming to address sector-specific inflation without triggering a wider inflationary spiral.

Arguments Against a Half-Point Interest Rate Cut

Despite the potential upsides, a half-point interest rate cut also carries substantial risks.

Fueling Inflation

Lowering interest rates could stimulate excessive demand, potentially worsening already high inflation.

- Increased consumer spending outpacing supply: Increased purchasing power might outstrip the capacity of businesses to produce goods and services, leading to price increases.

- Potential for wage-price spirals: Higher inflation could lead to demands for higher wages, further fueling inflation in a self-perpetuating cycle.

The resulting inflationary pressure could erode the purchasing power of consumers and create further economic instability. This demand-pull inflation is a significant concern, and maintaining price stability is paramount for the BoE.

Weakening the Pound

A rate cut could negatively impact the value of the pound sterling.

- Decreased investor confidence: Lower interest rates might reduce investor confidence in the UK economy, leading to capital flight.

- Potential for capital flight: Investors might move their money to countries with higher interest rates, weakening the pound's exchange rate.

This currency devaluation could make imports more expensive, further fueling inflation and impacting foreign investment. Managing exchange rate risk is critical in this scenario.

Ineffectiveness in Current Circumstances

A rate cut might be ineffective if the primary cause of the economic slowdown is unrelated to interest rates.

- Supply chain disruptions: Global supply chain issues might be the main constraint on economic growth, rendering a rate cut largely ineffective.

- Geopolitical uncertainty: Geopolitical factors, such as the war in Ukraine, can significantly impact economic performance, irrespective of interest rate policies.

Understanding the underlying macroeconomic factors is crucial. If the economic slowdown stems from supply-side economics issues rather than high interest rates, a rate cut could be a misdirected policy response.

Conclusion: Weighing the Risks and Rewards of a Bank of England Interest Rate Cut

The decision facing the Bank of England is fraught with complexity. A half-point interest rate cut offers the potential to stimulate economic growth and combat recessionary fears, but it also carries the risk of fueling inflation and weakening the pound. The effectiveness of such a move also depends heavily on the underlying causes of the current economic slowdown. Ultimately, the BoE must carefully weigh the potential benefits against the considerable risks before making a decision that could significantly impact the UK economy.

What do YOU think? Is a half-point interest rate cut from the Bank of England the correct response to the current economic climate? Share your thoughts in the comments below.

Featured Posts

-

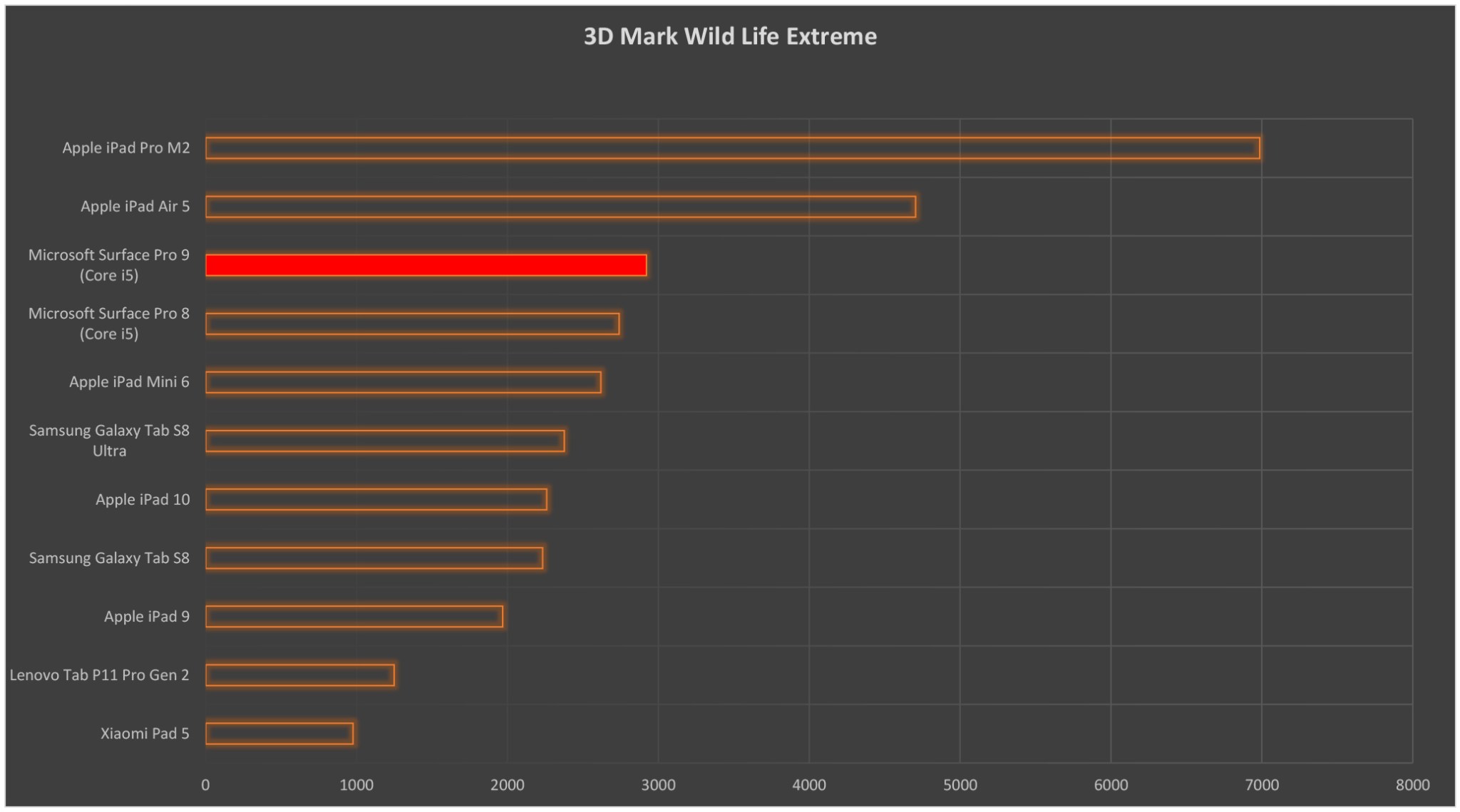

Is The 799 12 Inch Surface Pro Right For You

May 08, 2025

Is The 799 12 Inch Surface Pro Right For You

May 08, 2025 -

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025 -

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025 -

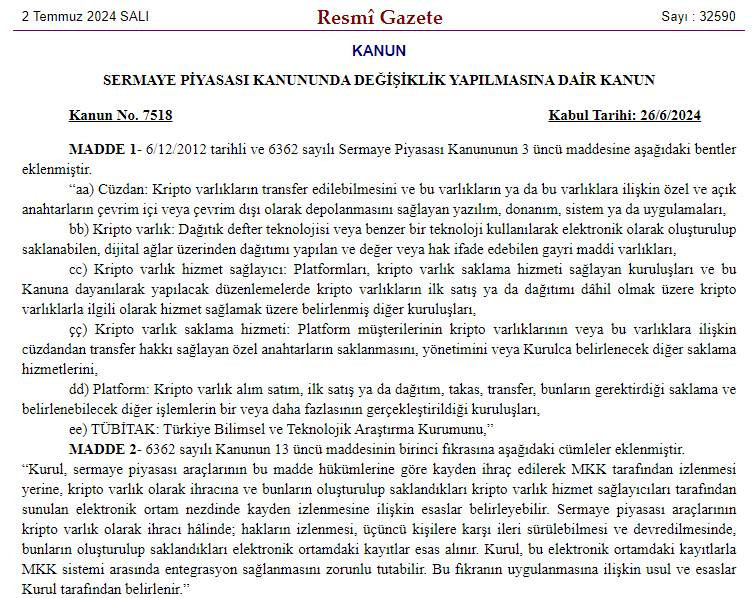

Kripto Varliklar Icin Bakan Simsek Ten Oenemli Aciklama Ve Yeni Kurallar

May 08, 2025

Kripto Varliklar Icin Bakan Simsek Ten Oenemli Aciklama Ve Yeni Kurallar

May 08, 2025 -

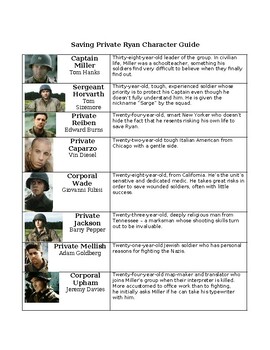

The 10 Greatest Characters From Saving Private Ryan

May 08, 2025

The 10 Greatest Characters From Saving Private Ryan

May 08, 2025

Latest Posts

-

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025 -

Understanding Xrp Ripple Before You Invest

May 08, 2025

Understanding Xrp Ripple Before You Invest

May 08, 2025 -

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025 -

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025 -

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025