Bank Of Canada's April Interest Rate Decision: Impact Of Trump Tariffs

Table of Contents

The Pre-Decision Economic Landscape

Inflationary Pressures

- Inflation Rate: Leading up to the April decision, Canada experienced a [Insert Actual Inflation Rate]% inflation rate. This was [higher/lower] than the Bank of Canada's target of [Insert Bank of Canada's Inflation Target]%.

- Contributing Factors: Several factors contributed to this inflation rate, including rising oil prices, persistent supply chain disruptions stemming from the global pandemic, and increased demand following the easing of COVID-19 restrictions.

- Bank of Canada's Dilemma: The Bank of Canada faced a difficult balancing act. High inflation pressures pushed for an interest rate hike to cool down the economy, while concerns about slowing global growth argued against such a move. The lingering effects of the Trump tariffs added another layer of complexity to this decision.

The high inflation rate presented a significant challenge for the Bank of Canada. The central bank aims to maintain price stability, and exceeding its inflation target necessitates action to curb inflationary pressures. However, raising interest rates too aggressively risks stifling economic growth and potentially increasing unemployment. The delicate balance between these competing priorities was a key consideration in the April decision.

The Lingering Shadow of Trump Tariffs

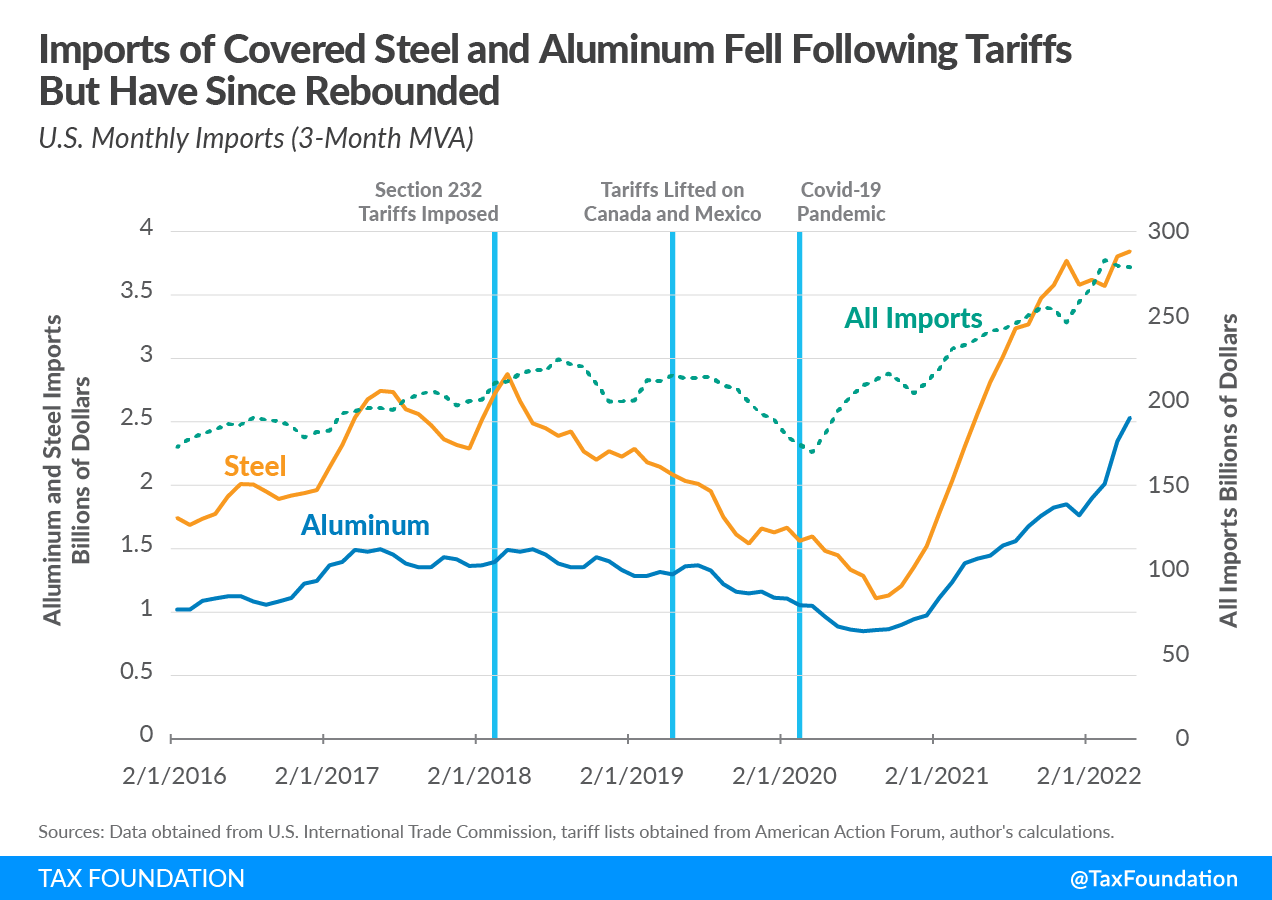

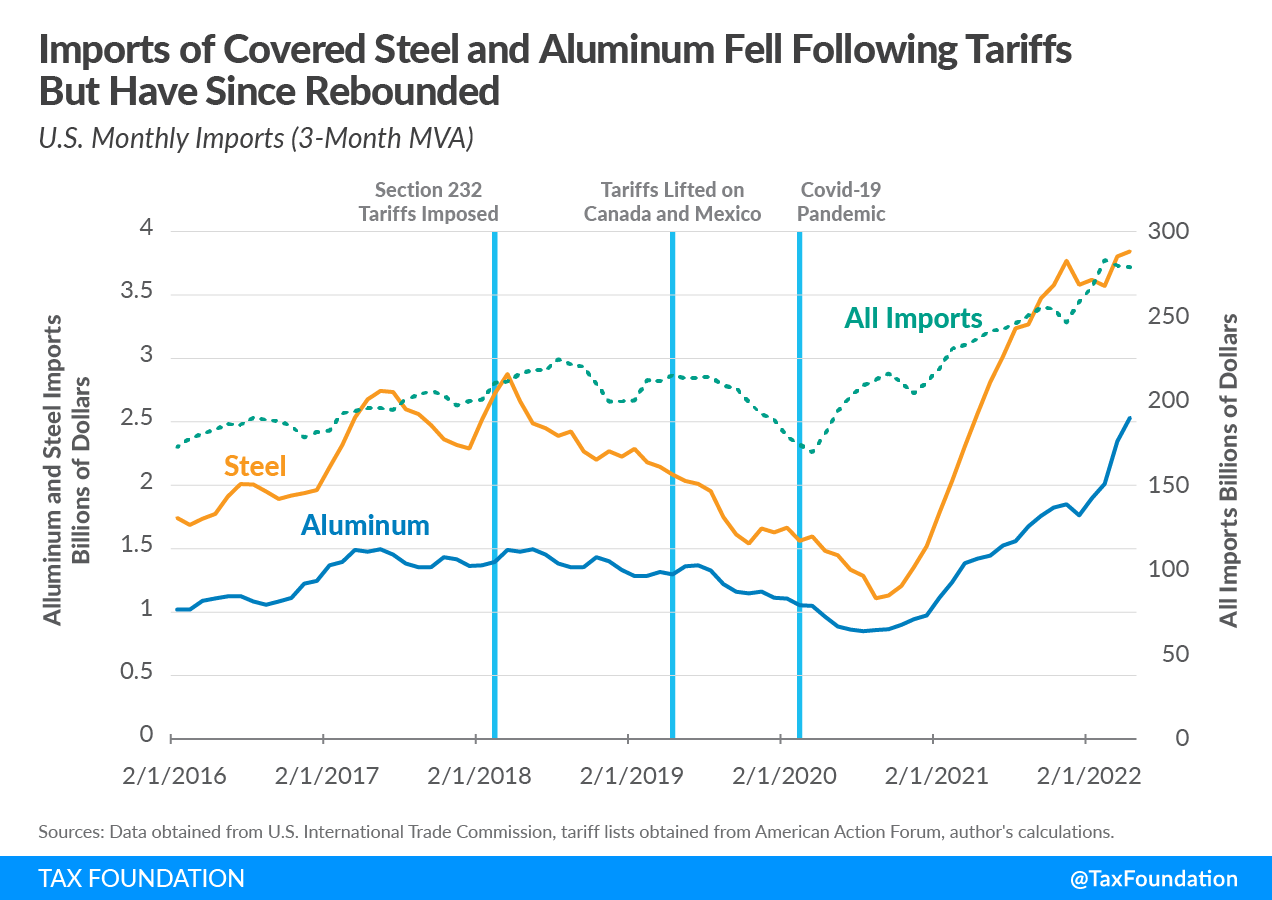

- Specific Tariffs: The Trump administration imposed tariffs on various Canadian goods, including [List specific examples, e.g., lumber, aluminum, steel]. These tariffs resulted in [Quantify the economic impact, e.g., X billion dollars in lost exports, Y thousand job losses].

- Retaliatory Measures: Canada responded with its own retaliatory tariffs on certain US goods.

- Long-Term Effects: The long-term impact of these tariffs extended beyond the initial shock. Key Canadian industries, such as agriculture and manufacturing, faced significant challenges adapting to the new trade environment. This created uncertainty in investment decisions and slowed economic growth in these sectors.

The Trump tariffs cast a long shadow over the Canadian economy, creating persistent uncertainty and impacting key sectors. While some retaliatory measures were implemented, the overall effect was a dampening of economic activity and a heightened level of risk for Canadian businesses. The Bank of Canada had to carefully assess the continuing effects of these tariffs when making its interest rate decision.

The Bank of Canada's April Decision

Interest Rate Announcement and Rationale

- Rate Change: In April [Year], the Bank of Canada [increased/decreased/maintained] its key interest rate by [Insert percentage point change or state "no change"].

- Official Statement: The Bank's official statement cited [Summarize key points from the statement, e.g., concerns about inflation, expectations for future economic growth, assessment of labor market conditions].

- Governor's Comments: [Include quotes from the Governor's press conference, highlighting the rationale behind the decision].

The Bank of Canada’s decision reflected its assessment of the overall economic situation. While inflationary pressures were a concern, the Bank likely also considered the potential negative impact of further rate hikes on economic growth, particularly given the lingering uncertainties surrounding the effects of Trump's tariffs.

Market Reaction and Analyst Commentary

- Market Response: The immediate market reaction to the announcement included [Describe changes in the Canadian dollar exchange rate, stock market indices, and bond yields].

- Analyst Opinions: Economists and financial analysts offered varied interpretations of the decision. Some [Describe positive interpretations], while others [Describe negative or cautious interpretations].

The market’s reaction to the Bank of Canada’s April decision provided further insight into its impact. Fluctuations in the Canadian dollar, stock market performance, and bond yields reflected differing views on the appropriateness and efficacy of the rate decision. Analyst commentary highlighted the ongoing uncertainty in the economic outlook and the challenges of navigating both inflationary pressures and the long-term effects of past trade policies.

Long-Term Implications for the Canadian Economy

Impact on Businesses

- Borrowing Costs: The interest rate decision directly affected borrowing costs for businesses. [Increased/Decreased] interest rates made it [more/less] expensive for businesses to borrow money for investments and expansion.

- Investment Decisions: This, in turn, influenced investment decisions and business expansion plans. Sectors heavily impacted by the Trump tariffs likely faced even greater challenges.

- Specific Sectors: [Mention specific sectors particularly affected by the interest rate decision, and explain why].

The Bank of Canada’s decision had a significant impact on the business climate. Increased borrowing costs might curb investment, while decreased rates might stimulate it. The interaction between the rate decision and the lingering effects of the Trump tariffs created a complex environment for business planning and investment decisions.

Impact on Consumers

- Mortgage Rates: The interest rate decision affected mortgage rates, impacting the affordability of housing for Canadian consumers.

- Consumer Spending: Changes in borrowing costs also influenced consumer spending and overall economic demand.

- Financial Situation: The combined impact of interest rate changes and lingering economic uncertainty created by past trade policies affected the average Canadian consumer's financial situation.

Changes in the Bank of Canada Interest Rate directly affect consumers’ purchasing power and their ability to borrow money. Increased interest rates mean higher mortgage payments and increased costs for other types of borrowing, thus reducing disposable income and potentially curbing consumer spending.

Conclusion

The Bank of Canada's April interest rate decision was a complex one, influenced significantly by lingering inflationary pressures and the unresolved economic consequences of the Trump tariffs. The decision, whatever it was, had a ripple effect across the Canadian economy, impacting both businesses and consumers. The long-term implications are still unfolding, and the Bank's future decisions will continue to be shaped by these intertwined factors.

Stay informed about future Bank of Canada interest rate decisions and their impact on the Canadian economy by regularly checking our website for insightful analysis of Bank of Canada Interest Rates and their relation to global economic events, including the lingering effects of past trade policies like the Trump tariffs. Understanding these complexities will help you navigate the Canadian economic landscape effectively.

Featured Posts

-

Kocaeli Deki 1 Mayis Kutlamalarinda Meydana Gelen Arbede

May 02, 2025

Kocaeli Deki 1 Mayis Kutlamalarinda Meydana Gelen Arbede

May 02, 2025 -

Check Daily Lotto Results For Thursday April 17 2025

May 02, 2025

Check Daily Lotto Results For Thursday April 17 2025

May 02, 2025 -

The Rise Of Male Eyelash Shaving Understanding The Motivation

May 02, 2025

The Rise Of Male Eyelash Shaving Understanding The Motivation

May 02, 2025 -

Trust Care Healths New Mental Health Services Launch Date And Details

May 02, 2025

Trust Care Healths New Mental Health Services Launch Date And Details

May 02, 2025 -

Culinary Delights On The High Seas Your Windstar Cruise

May 02, 2025

Culinary Delights On The High Seas Your Windstar Cruise

May 02, 2025