Bank Of Canada Rate Cuts On The Horizon: Analyzing The Impact Of Tariffs On Employment

Table of Contents

The Impact of Tariffs on Canadian Businesses

Tariffs, essentially taxes on imported goods, significantly impact Canadian businesses. By increasing the cost of imported raw materials and finished products, tariffs inflate production costs. This directly reduces profit margins, making Canadian companies less competitive in both domestic and international markets. Industries heavily reliant on imported components, such as the automotive and agricultural sectors, are particularly vulnerable.

- Increased production costs: Higher input costs translate to higher prices for consumers, potentially reducing demand.

- Reduced consumer demand: As prices rise, consumers may reduce spending, leading to decreased sales for businesses.

- Potential job losses: To maintain profitability, businesses may be forced to cut costs, leading to layoffs and reduced hiring.

- Impact on supply chains: Disruptions to international trade caused by tariffs can create significant bottlenecks in supply chains, impacting production and delivery timelines. This can further impact business profitability and employment.

For example, the Canadian automotive industry, heavily reliant on imported parts, faces increased costs due to tariffs, impacting its competitiveness and potentially leading to job losses. Similarly, the agricultural sector, which relies on international trade for both inputs and exports, experiences challenges in maintaining market share and profitability when tariffs are implemented.

Tariffs and Their Ripple Effect on Employment

Job losses in specific sectors affected by tariffs aren't isolated incidents; they have a wider ripple effect throughout the economy. Reduced employment in, say, manufacturing, translates to less consumer spending in other sectors like retail and hospitality. This decreased consumer spending further dampens economic activity, leading to a potential slowdown or even recession.

- Direct job losses in tariff-affected industries: These are the immediate and most visible consequences of increased costs and reduced competitiveness.

- Indirect job losses in related sectors: The reduced spending power of those who lost jobs in directly affected industries impacts employment in related sectors.

- Decreased consumer confidence and spending: Uncertainty about the future and higher prices erode consumer confidence, leading to a decrease in overall spending.

- Potential for wage stagnation or decline: In a weakened economy, wage growth often stagnates or even declines, further exacerbating the economic challenges.

This domino effect highlights the interconnected nature of the Canadian economy and the far-reaching consequences of tariffs on employment levels across various sectors.

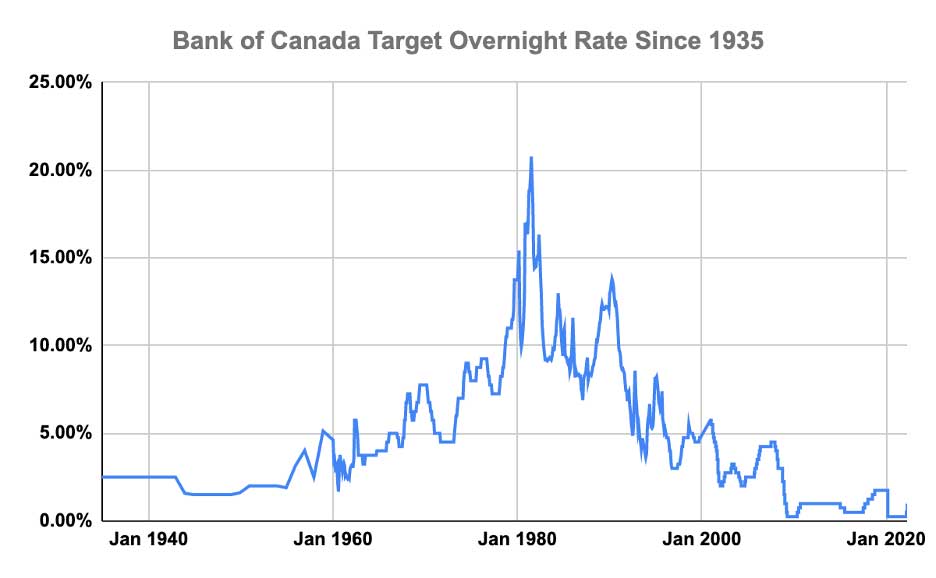

The Bank of Canada's Response: Potential Rate Cuts

The Bank of Canada's primary mandate is to maintain price stability and full employment. If the economic slowdown caused by tariffs becomes significant, resulting in increased unemployment and subdued inflation, the Bank may respond by lowering interest rates. Lowering interest rates makes borrowing cheaper for businesses and consumers, encouraging investment and spending, thereby stimulating economic activity and job creation.

- Lower interest rates to encourage borrowing and investment: Reduced borrowing costs incentivize businesses to invest in expansion and hiring.

- Stimulating economic growth and job creation: Increased investment and spending lead to higher economic activity and job creation.

- Counteracting the negative impact of tariffs: Rate cuts aim to offset the negative effects of tariffs on the economy.

- Potential inflation considerations: The Bank must carefully balance the need to stimulate the economy with the risk of fueling inflation.

However, the effectiveness of rate cuts in mitigating the impact of tariffs depends on various factors, including the severity of the tariff-induced slowdown and the overall health of the global economy.

Alternative Economic Indicators and Their Influence

The Bank of Canada's decisions aren't solely based on the impact of tariffs. Other key economic indicators significantly influence their monetary policy decisions. These include inflation rates, GDP growth projections, unemployment statistics, and global economic conditions. The interplay of these factors makes predicting the Bank's actions challenging.

- Inflation rates: High inflation might deter the Bank from cutting rates, even in the face of slowing growth.

- GDP growth projections: Strong GDP growth might lessen the need for rate cuts.

- Unemployment statistics: Rising unemployment is a strong indicator that rate cuts might be considered.

- Global economic conditions: Global economic slowdowns can influence the Bank's decisions, regardless of domestic conditions.

Different economists and forecasting agencies may offer varying perspectives on the likelihood and timing of Bank of Canada rate cuts, reflecting the complexities of economic forecasting and the interaction of multiple economic variables.

Bank of Canada Rate Cuts and the Future of Canadian Employment

In conclusion, the potential for Bank of Canada rate cuts is intricately linked to the impact of tariffs on Canadian businesses and employment. Tariffs increase production costs, reduce competitiveness, lead to job losses in affected industries, and trigger a ripple effect throughout the economy. The Bank of Canada, tasked with maintaining price stability and full employment, might respond to a tariff-induced economic slowdown by lowering interest rates to stimulate growth and job creation. However, their decisions are influenced by a range of other economic indicators, making the situation complex and requiring careful analysis. Stay informed about upcoming Bank of Canada rate announcements and understand how these decisions, driven by factors such as tariffs, will impact your business and employment landscape. Further research into the subject of Bank of Canada rate cuts and their potential effects is crucial for businesses and individuals alike to navigate these uncertain economic times.

Featured Posts

-

Uruguays Energy Future Offshore Drilling And Black Gold Prospects

May 11, 2025

Uruguays Energy Future Offshore Drilling And Black Gold Prospects

May 11, 2025 -

Jose Aldo Inspirations Et Lecons D Un Champion

May 11, 2025

Jose Aldo Inspirations Et Lecons D Un Champion

May 11, 2025 -

The Promise Of Black Gold Offshore Drilling Opportunities In Uruguay

May 11, 2025

The Promise Of Black Gold Offshore Drilling Opportunities In Uruguay

May 11, 2025 -

Teen Mom Fame Did It Hurt Or Help Farrah Abraham

May 11, 2025

Teen Mom Fame Did It Hurt Or Help Farrah Abraham

May 11, 2025 -

Shevchenko Vs Fiorot Ufc 315 Fight Predictions And Betting Odds

May 11, 2025

Shevchenko Vs Fiorot Ufc 315 Fight Predictions And Betting Odds

May 11, 2025