Bank Of Canada Rate Cuts: Economists Predict Renewed Cuts Amidst Tariff Job Losses

Table of Contents

Escalating Tariff Impacts on the Canadian Job Market

The ongoing trade war has had a palpable impact on the Canadian job market, particularly in sectors heavily reliant on international trade. The keyword here is the tariff impact Canada. Industries such as automotive manufacturing and agriculture have been disproportionately affected. Statistics Canada reports show a significant increase in unemployment claims in these sectors since the implementation of new tariffs. This is a key driver in the anticipation of Bank of Canada rate cuts.

- Job losses in key sectors: The automotive sector alone has seen an estimated loss of X thousand jobs (insert actual figures from reliable sources like Statistics Canada), with ripple effects impacting suppliers and related industries. The agricultural sector has also faced challenges, with reduced exports leading to Y thousand job losses (insert actual figures and source).

- Ripple effect: The job losses in these key sectors aren't isolated incidents. Reduced economic activity leads to decreased demand for goods and services across the board, resulting in further job losses in other, seemingly unrelated industries.

- Geographic distribution: The impact isn't evenly distributed across Canada. Provinces heavily reliant on specific export-oriented industries are experiencing higher unemployment rates than others. For example, Ontario, a major automotive manufacturing hub, has seen a sharp increase in unemployment claims.

- Expert opinion: Leading economists warn that the situation is worsening. [Insert quote from a reputable economist, citing their credentials and publication]. The severity of these job losses strongly suggests the need for government intervention and, many believe, further Bank of Canada rate cuts.

Economic Indicators Pointing Towards a Rate Cut

Several key economic indicators point towards the likelihood of further Bank of Canada rate cuts. Analyzing these indicators provides crucial context for understanding the potential impact of interest rate decisions. The Canadian inflation rate, GDP growth Canada, and consumer confidence are all factors considered by the Bank of Canada.

- Inflation below target: Current inflation figures (insert latest data from Statistics Canada) are below the Bank of Canada's target range, indicating a lack of inflationary pressure. This allows for more flexibility in lowering interest rates.

- Slowing GDP growth: Recent GDP growth figures (insert latest data and source) show a significant slowdown compared to previous quarters, reflecting weakening economic activity. This slowdown further fuels the argument for Bank of Canada rate cuts.

- Global economic slowdown: The Canadian economy is intrinsically linked to the global economy. The current global slowdown is impacting Canadian exports and investment, adding to the pressure for further rate cuts.

- Bank of Canada forecasts: The Bank of Canada's recent statements and forecasts (cite the source) hint at the possibility of further monetary policy easing, reinforcing the expectation of interest rate reductions.

The Bank of Canada's Response and Potential Actions

The Bank of Canada is likely to respond to the weakening economic conditions with further monetary policy adjustments. The key question is the extent and nature of these actions. Understanding the Bank of Canada policy is crucial in this scenario.

- Magnitude of rate cut: A rate cut of 0.25% or even 0.5% is considered highly probable by many economists. The size of the cut will depend on the severity of the economic downturn.

- Timing of announcement: The timing of any rate cut announcement will depend on the release of further economic data and the assessment of the overall economic situation. Announcements are typically made after the Bank of Canada's Governing Council meetings.

- Quantitative easing: If interest rates reach near-zero levels, the Bank of Canada may resort to quantitative easing (QE) – purchasing government bonds to inject liquidity into the market. This is a less frequently used monetary policy tool, but it may become necessary.

- Risks associated with rate cuts: While rate cuts can stimulate economic activity, there are inherent risks. Excessive rate cuts could lead to increased inflation in the long term and potentially fuel asset bubbles.

Implications for Canadian Consumers and Businesses

Further Bank of Canada rate cuts will have significant implications for Canadian consumers and businesses, impacting everything from mortgage rates Canada to business investment Canada.

- Impact on homebuyers: Lower interest rates will lead to lower mortgage rates, making it more affordable for Canadians to purchase homes. This could stimulate the housing market. Existing mortgage holders could also benefit from refinancing opportunities.

- Consumer spending: Lower borrowing costs may encourage increased consumer spending, boosting economic activity. However, job insecurity may temper this effect.

- Business investment: Lower interest rates reduce the cost of borrowing for businesses, potentially encouraging increased investment and expansion plans. However, uncertainty about future economic conditions may limit this effect.

- Inflationary pressures: While stimulating the economy, lower interest rates could also lead to increased inflation over the longer term, eroding purchasing power.

Conclusion

The Canadian economy is facing a confluence of challenges, including tariff-related job losses and a slowing global economy. The likelihood of further Bank of Canada rate cuts is high, given the current economic indicators. Understanding the implications of these Bank of Canada rate cuts is crucial for both consumers and businesses. Lower interest rates offer potential benefits such as more affordable mortgages and increased borrowing opportunities, but also pose the risk of potential inflation. Stay informed about the evolving economic situation and the Bank of Canada's response by regularly checking reputable financial news sources. Understanding these Bank of Canada rate cuts is crucial for making informed financial decisions.

Featured Posts

-

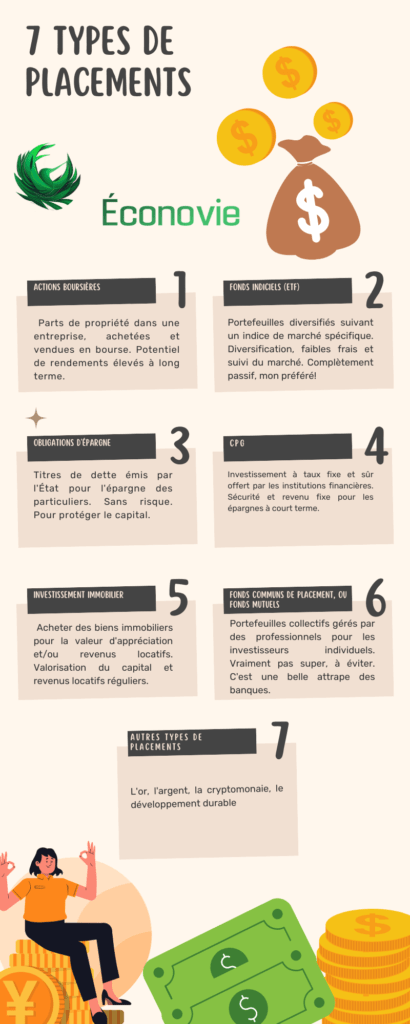

Dans Quoi Investir Mon Argent Strategies D Investissement

May 12, 2025

Dans Quoi Investir Mon Argent Strategies D Investissement

May 12, 2025 -

Salinda And Velo Take The Lead At Zurich Classic With Record Setting Round

May 12, 2025

Salinda And Velo Take The Lead At Zurich Classic With Record Setting Round

May 12, 2025 -

Shane Lowrys Joy For Rory Mc Ilroy A Friends Unwavering Support

May 12, 2025

Shane Lowrys Joy For Rory Mc Ilroy A Friends Unwavering Support

May 12, 2025 -

Nba Sixth Man Award Payton Pritchards Triumph

May 12, 2025

Nba Sixth Man Award Payton Pritchards Triumph

May 12, 2025 -

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Ohne Champions League

May 12, 2025

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Ohne Champions League

May 12, 2025

Latest Posts

-

Bayern Munichs Mueller Weighs Future Options Following Potential Transfer

May 12, 2025

Bayern Munichs Mueller Weighs Future Options Following Potential Transfer

May 12, 2025 -

Mls

May 12, 2025

Mls

May 12, 2025 -

Mueller Open To New Club After Bayern Departure League Options Explored

May 12, 2025

Mueller Open To New Club After Bayern Departure League Options Explored

May 12, 2025 -

Muellers Bayern Exit A New Club And League Beckon

May 12, 2025

Muellers Bayern Exit A New Club And League Beckon

May 12, 2025 -

Bayern Muenchen Het Bittere Afscheid Van Clubicoon Thomas Mueller

May 12, 2025

Bayern Muenchen Het Bittere Afscheid Van Clubicoon Thomas Mueller

May 12, 2025