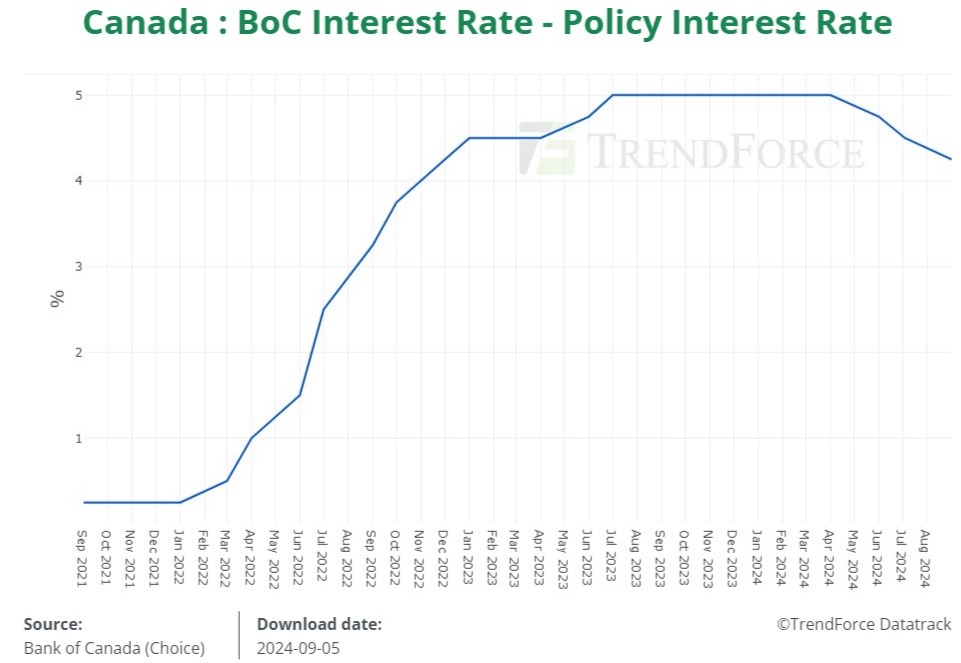

Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Desjardins' Rationale Behind the Prediction

Desjardins bases its prediction of further interest rate cuts on several key economic indicators pointing towards a slowdown in the Canadian economy. The current economic climate is characterized by a confluence of factors influencing the Bank of Canada's monetary policy decisions.

-

Slowing GDP Growth: Canada's GDP growth rate has shown signs of deceleration in recent quarters. While official figures vary slightly depending on the reporting agency, the consensus points towards a significant reduction in the pace of expansion compared to previous years. This slower growth is a primary driver behind Desjardins’ prediction of Bank of Canada rate cuts.

-

Persistent Inflation: Although inflation has begun to cool from its peak, it remains stubbornly above the Bank of Canada's target range of 1-3%. This persistent inflation presents a challenge for policymakers, as aggressive rate hikes risk triggering a recession, while leaving rates unchanged risks allowing inflation to become entrenched. The potential for further interest rate cuts hinges on how effectively the central bank manages this delicate balance.

-

Rising Unemployment: Recent data indicates a gradual increase in the Canadian unemployment rate. While not yet alarming, a sustained rise in unemployment could signal weakening economic conditions, prompting the Bank of Canada to ease monetary policy through Bank of Canada rate cuts to stimulate growth.

-

Recessionary Fears: The risk of a recession in Canada is a major factor influencing Desjardins’ forecast. Several economic models predict a significant chance of a recession in the coming year, and a proactive approach to cutting interest rates might be considered a preemptive measure to mitigate its impact.

Impact of Predicted Rate Cuts on Consumers

Three more interest rate cuts by the Bank of Canada would have a significant impact on Canadian consumers, affecting their borrowing costs, savings, and overall spending habits.

-

Lower Mortgage Rates: Homeowners with variable-rate mortgages would see immediate relief with lower monthly payments. Those looking to purchase a home would also benefit from more affordable financing, potentially boosting the housing market. The predicted Bank of Canada rate cuts represent a significant opportunity for prospective homebuyers.

-

Reduced Borrowing Costs: Lower interest rates would translate to reduced borrowing costs across the board, making it cheaper to obtain personal loans, credit cards, and other forms of debt. This could free up disposable income for consumers.

-

Impact on Savings Accounts: While lower interest rate cuts generally lead to lower returns on savings accounts, the potential benefits of increased consumer spending and a healthier economy could outweigh this negative impact in the long run.

-

Increased Consumer Spending: With lower borrowing costs and increased affordability, consumers might increase their spending, potentially boosting economic activity and growth. This increased consumer confidence is a key factor in evaluating the overall effect of Bank of Canada rate cuts.

Implications for Businesses

The predicted Bank of Canada rate cuts would also have significant implications for Canadian businesses, affecting investment decisions, lending rates, and overall economic growth.

-

Increased Business Investment: Lower borrowing costs could incentivize businesses to invest in expansion projects, new equipment, and hiring, potentially leading to job creation and increased economic activity.

-

Impact on Lending Rates: Reduced Bank of Canada rate cuts would likely lead to lower lending rates for businesses, making it cheaper to access credit for operations and expansion. This is a key factor for stimulating business growth.

-

Stimulus to Economic Growth: Lower borrowing costs for businesses can stimulate economic growth by increasing investment and production. The ripple effect of these Bank of Canada rate cuts could lead to significant economic benefits.

-

Corporate Profitability: While lower interest rates can decrease the cost of borrowing, they may also reduce the return on investments. The overall impact on corporate profitability will depend on several factors, including the specific industry and the overall economic climate.

Alternative Perspectives and Risks

While Desjardins’ prediction is compelling, it's essential to acknowledge alternative perspectives and potential risks associated with further Bank of Canada rate cuts.

-

Risk of Fueling Inflation: Lower interest rates could potentially fuel inflation if consumer spending increases dramatically without a corresponding increase in supply. Managing this risk is crucial for the central bank.

-

Uncertainty in the Global Economy: Global economic conditions can significantly impact the Canadian economy. External shocks, such as geopolitical instability or a global recession, could undermine the effectiveness of Bank of Canada rate cuts.

-

Potential for Unintended Consequences: Economic policies often have unintended consequences. Rate cuts could potentially lead to asset bubbles or other undesirable outcomes.

-

Other Economists' Predictions: It's important to note that not all economists agree with Desjardins' prediction. Other forecasts might suggest different scenarios, highlighting the inherent uncertainty in economic forecasting.

Conclusion

Desjardins' prediction of three more Bank of Canada rate cuts is based on several key economic indicators, including slowing GDP growth, persistent inflation, rising unemployment, and recessionary fears. These interest rate cuts could have significant positive impacts on consumers and businesses, leading to lower borrowing costs and potentially increased spending and investment. However, there are also risks associated with rate cuts, including the potential for increased inflation and unintended economic consequences. Staying informed about upcoming Bank of Canada announcements regarding interest rate changes is crucial. Monitor for updates on future Bank of Canada rate cuts and adjust your financial strategies accordingly. Consult with a financial advisor to understand how these potential Bank of Canada rate cuts might impact your personal or business finances.

Featured Posts

-

Unexpected Ranking Success For Zimbabwes Fast Bowler

May 23, 2025

Unexpected Ranking Success For Zimbabwes Fast Bowler

May 23, 2025 -

Big Rig Rock Report 3 12 Mastering Rock 101 Fundamentals

May 23, 2025

Big Rig Rock Report 3 12 Mastering Rock 101 Fundamentals

May 23, 2025 -

How Joe Jonas Handled A Couple Fighting Over Him

May 23, 2025

How Joe Jonas Handled A Couple Fighting Over Him

May 23, 2025 -

Shpani A Khrvatska Penalite Odluchi A Vo Finaleto Na Ln

May 23, 2025

Shpani A Khrvatska Penalite Odluchi A Vo Finaleto Na Ln

May 23, 2025 -

Asear Aldhhb Fy Qtr Alywm Alithnyn 24 Mars Thdyth Mbashr

May 23, 2025

Asear Aldhhb Fy Qtr Alywm Alithnyn 24 Mars Thdyth Mbashr

May 23, 2025

Latest Posts

-

Jonathan Groffs Just In Time Opening Night Lea Michele And Castmates Celebrate

May 23, 2025

Jonathan Groffs Just In Time Opening Night Lea Michele And Castmates Celebrate

May 23, 2025 -

Jonathan Groff And Just In Time A Tony Awards Contender

May 23, 2025

Jonathan Groff And Just In Time A Tony Awards Contender

May 23, 2025 -

Jonathan Groff Could Just In Time Make Tony Awards History

May 23, 2025

Jonathan Groff Could Just In Time Make Tony Awards History

May 23, 2025 -

Etoile A Spring Awakening Reunion For Gideon Glick And Jonathan Groff

May 23, 2025

Etoile A Spring Awakening Reunion For Gideon Glick And Jonathan Groff

May 23, 2025 -

Jonathan Groffs Just In Time Performance A Tony Awards Analysis

May 23, 2025

Jonathan Groffs Just In Time Performance A Tony Awards Analysis

May 23, 2025