Bank Of Canada Rate Cut Less Likely After Strong Retail Sales

Table of Contents

Robust Retail Sales Figures Exceed Expectations

Statistics Canada recently released data revealing a substantial increase in retail sales for [Insert Month, Year]. The reported [Insert Percentage]% jump significantly outpaced economist forecasts, which averaged around [Insert Average Forecasted Percentage]%. This constitutes a remarkably strong performance, exceeding both the previous month's figures and the same period last year by a considerable margin. What makes these figures particularly noteworthy is the breadth of growth; it wasn't concentrated in a single sector but rather spread across multiple areas.

- Strong Performing Sectors: The automotive sector saw a particularly impressive [Insert Percentage]% increase, alongside notable growth in [mention specific sector, e.g., furniture and home furnishings] and [mention another sector, e.g., electronics].

- Contributing Factors: Several factors likely contributed to this robust performance, including sustained consumer confidence, the easing of supply chain bottlenecks, and perhaps lingering effects of government stimulus programs.

Implications for Inflation and the Bank of Canada's Mandate

Robust retail sales figures have significant implications for inflation. Increased consumer spending directly fuels demand-pull inflation, putting upward pressure on prices. The Bank of Canada's mandate is to maintain price stability and full employment. Strong retail sales, while positive for employment, could complicate the Bank's efforts to control inflation if the growth proves unsustainable. The relationship between inflation and interest rates is inverse; high inflation typically prompts central banks to raise interest rates to cool down the economy.

- Inflationary Pressures: The surge in consumer spending presents a clear risk of increased inflationary pressures, potentially exceeding the Bank of Canada's target inflation rate.

- Bank of Canada's Interpretation: The Bank will likely interpret these data points as a sign of a stronger-than-expected economy, potentially influencing their assessment of the need for further monetary easing.

Market Reactions and Analyst Predictions Following the Data Release

The release of the robust retail sales data triggered noticeable reactions in the financial markets. Stock markets experienced [Insert description of market movement, e.g., a slight dip] following the announcement, while bond yields [Insert description of movement, e.g., rose slightly], reflecting investors' reassessment of the likelihood of a Bank of Canada rate cut. The Canadian dollar also [Insert description of movement, e.g., strengthened slightly] against other major currencies.

Economists and analysts have offered varied interpretations. Some believe the strong retail sales figures are a temporary phenomenon, driven by [mention potential temporary factors], while others see it as a sign of a more sustained economic recovery.

- Key Predictions: [Name of Economist] at [Institution] predicts that the likelihood of a Bank of Canada rate cut has diminished significantly, stating, "[Insert quote from economist]". [Another Economist] from [Another Institution] holds a more cautious view, suggesting that "[Insert quote from another economist]".

- Market Indices: The TSX Composite Index [Describe market reaction], while the Canadian dollar experienced a [Describe currency reaction] against the US dollar.

- Expert Opinions: The consensus among market experts seems to be leaning towards a [Describe consensus on interest rates], although the uncertainty remains significant.

Alternative Economic Indicators to Consider

While retail sales data provides a valuable insight, the Bank of Canada will also consider other economic indicators before making its decision on interest rates. These include employment figures, housing market data, and the consumer confidence index.

- Other Relevant Data: Factors such as the unemployment rate, housing starts, and consumer sentiment will all play a role in shaping the Bank's overall assessment.

- Potential Impact: A weakening labor market or a significant slowdown in the housing sector could offset the impact of strong retail sales and potentially increase the chances of a Bank of Canada rate cut.

Conclusion

In conclusion, the unexpectedly strong retail sales data significantly diminishes the probability of an imminent Bank of Canada rate cut. While the Bank will undoubtedly consider other economic indicators before making a final decision, the robust consumer spending figures represent a substantial factor influencing their monetary policy approach. The interplay between retail sales, inflation, and other economic variables will determine the future trajectory of interest rates.

Stay tuned for updates on the Bank of Canada's next interest rate announcement and further analysis on the impact of retail sales on monetary policy. Visit the Bank of Canada's website ([Insert Link to Bank of Canada Website]) for the latest information on interest rates and monetary policy decisions. Understanding the implications of a Bank of Canada rate cut, or the lack thereof, is crucial for navigating the current economic landscape.

Featured Posts

-

Sejarah Porsche 356 Pabrik Zuffenhausen Dan Legenda Yang Tercipta

May 25, 2025

Sejarah Porsche 356 Pabrik Zuffenhausen Dan Legenda Yang Tercipta

May 25, 2025 -

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 25, 2025

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 25, 2025 -

Emergency Services Respond To M56 Car Overturn Casualty On Motorway

May 25, 2025

Emergency Services Respond To M56 Car Overturn Casualty On Motorway

May 25, 2025 -

Responding To The Threat Flood Advisories And Severe Weather In Miami Valley

May 25, 2025

Responding To The Threat Flood Advisories And Severe Weather In Miami Valley

May 25, 2025 -

17 Celebrities One Bad Decision Reputation Ruined

May 25, 2025

17 Celebrities One Bad Decision Reputation Ruined

May 25, 2025

Latest Posts

-

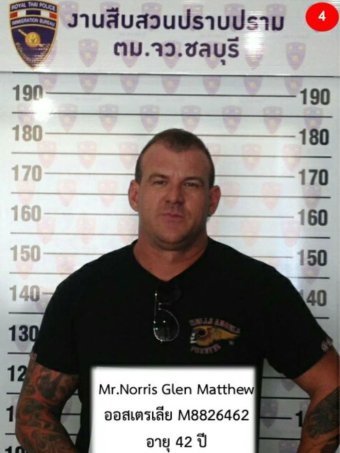

Hells Angels Adaptability Analyzing The Implications Of The Mandarin Killing

May 25, 2025

Hells Angels Adaptability Analyzing The Implications Of The Mandarin Killing

May 25, 2025 -

The Mandarin Killing And The Hells Angels A Shift In Criminal Enterprise

May 25, 2025

The Mandarin Killing And The Hells Angels A Shift In Criminal Enterprise

May 25, 2025 -

Mandarin Killing Incident Sheds Light On Hells Angels Evolving Business Practices

May 25, 2025

Mandarin Killing Incident Sheds Light On Hells Angels Evolving Business Practices

May 25, 2025 -

Hells Angels New Business Model Insights From Mandarin Killing

May 25, 2025

Hells Angels New Business Model Insights From Mandarin Killing

May 25, 2025 -

Mandarin Killing Highlights Hells Angels New Business Model

May 25, 2025

Mandarin Killing Highlights Hells Angels New Business Model

May 25, 2025