Bank Of Canada Interest Rate Policy: Analyzing The Impact Of Tariffs On Employment

Table of Contents

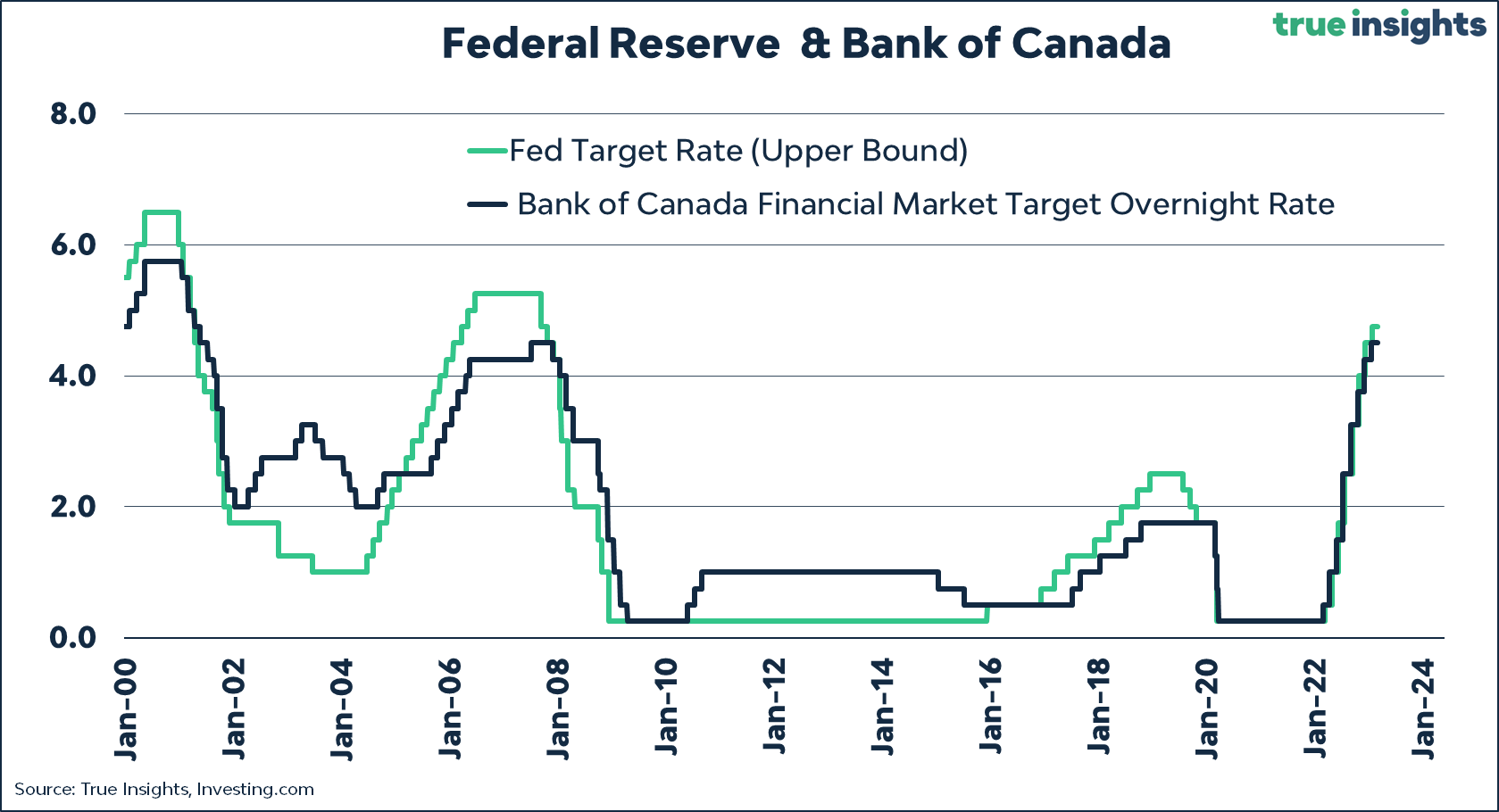

The Bank of Canada's interest rate policy is a cornerstone of Canadian economic stability. However, the intricate relationship between Bank of Canada interest rates and tariffs significantly influences its effectiveness, especially regarding employment levels. This article delves into how tariffs impact the Bank of Canada's decisions and their subsequent effects on Canadian employment. We'll explore the complex interplay between interest rates, tariffs, and job creation/loss within the Canadian economy, providing insights into this critical economic dynamic.

H2: The Mechanism: How Tariffs Influence the Bank of Canada's Decisions

H3: Inflationary Pressures:

Tariffs act as a tax on imported goods, directly increasing their prices. This leads to inflationary pressures across the economy. When inflation rises, the Bank of Canada typically responds by increasing its policy interest rate. Higher interest rates aim to cool down the economy by making borrowing more expensive, thus reducing consumer spending and business investment. This, in turn, can curb inflation.

- Example 1: The imposition of tariffs on steel imports increased the cost of construction materials, contributing to higher inflation in the housing sector.

- Example 2: Tariffs on lumber impacted the construction and furniture industries, leading to higher prices for consumers and businesses.

- The Bank's response to these inflationary pressures involves adjusting its overnight rate, influencing lending rates across the financial system.

H3: Reduced Consumer Spending and Business Investment:

Increased prices due to tariffs reduce consumer purchasing power. Consumers have less disposable income to spend, leading to decreased demand for goods and services. Simultaneously, businesses face higher input costs, impacting profitability and potentially leading to reduced investment in new equipment, expansion, and hiring. This decreased economic activity is a key factor the Bank of Canada considers when assessing the overall economic outlook.

- Statistical data from Statistics Canada consistently shows a negative correlation between significant tariff increases and consumer spending in affected sectors.

- Reduced business investment, as evidenced by decreased capital expenditures, further weakens economic growth and job creation.

- The Bank of Canada monitors these trends closely to inform its interest rate decisions.

H3: Currency Fluctuations:

Tariffs can also influence the exchange rate of the Canadian dollar (CAD). If tariffs lead to a decrease in demand for Canadian exports (due to retaliatory tariffs or reduced global demand), the CAD might depreciate. Conversely, a significant increase in import prices due to tariffs could strengthen the CAD. These fluctuations directly impact Canadian businesses, particularly those heavily reliant on exports or imports. The Bank of Canada needs to carefully evaluate these currency movements when setting its interest rate policy.

- A stronger CAD, while potentially benefiting consumers through lower import prices, can hurt export-oriented industries, leading to job losses in those sectors.

- A weaker CAD might boost exports but could also increase import prices, fueling inflation.

- The Bank carefully weighs these competing factors to determine the appropriate monetary policy response.

H2: Impact on Specific Employment Sectors

H3: Manufacturing:

The manufacturing sector is particularly vulnerable to tariff impacts. It relies heavily on imported inputs and exports finished goods. Increased tariffs on imported materials raise production costs, squeezing profit margins and potentially leading to job losses or reduced hiring. Different sub-sectors within manufacturing are affected differently depending on their reliance on specific imported inputs and export markets.

- The automotive industry, for example, relies heavily on imported parts, making it highly susceptible to tariff increases.

- Other manufacturing sectors, such as textiles and apparel, face similar challenges.

- Government support programs and retraining initiatives might be necessary to mitigate job losses in this vulnerable sector.

H3: Retail and Services:

The retail and service sectors are indirectly affected by changes in consumer spending resulting from tariff-driven inflation. Reduced consumer spending translates to lower demand for goods and services, potentially leading to job cuts in these sectors. Import-dependent retailers, for instance, face higher costs, which they may pass on to consumers, further reducing demand.

- Restaurants and entertainment venues, heavily reliant on consumer discretionary spending, are particularly vulnerable to economic downturns triggered by tariffs.

- The impact on retail and services is often lagged, appearing after a period of decreased consumer confidence and spending.

- Monitoring consumer spending patterns is critical in assessing the employment consequences of tariffs on these sectors.

H3: Agriculture:

The agricultural sector experiences a mixed impact from tariffs, depending on the specific tariffs imposed and the country's export markets. While some tariffs might protect domestic farmers from foreign competition, retaliatory tariffs from other countries can severely impact Canadian agricultural exports, leading to job losses in this sector.

- Canadian farmers exporting wheat, canola, and other products might face reduced demand due to retaliatory tariffs.

- The impact varies significantly across different agricultural sub-sectors, depending on their export markets and the nature of the tariffs.

- Government support programs and trade diversification strategies are crucial for mitigating negative impacts on agricultural employment.

H2: Predicting Future Trends and Policy Recommendations

H3: Forecasting Models and Economic Indicators:

Econometric models and key economic indicators are crucial for predicting the impact of future tariffs on the Canadian economy and employment. These models analyze historical data, current trends, and projected tariff changes to forecast potential employment consequences. Key indicators, such as inflation rates, consumer confidence indices, and business investment data, provide valuable insights into the likely impact of tariffs.

- The Bank of Canada uses sophisticated models to assess the potential effects of various scenarios, including different tariff levels and policy responses.

- Accurate forecasting is challenging due to the complexity of global trade relations and the unpredictable nature of tariff policies.

- Continuous monitoring and adjustment of forecasts are essential for effective policymaking.

H3: Policy Recommendations for Mitigating Negative Employment Impacts:

Mitigating the negative employment impacts of tariffs requires proactive measures from both the Bank of Canada and the Canadian government. The Bank can carefully adjust its monetary policy to counter inflationary pressures while supporting economic growth and employment. Government intervention might include targeted support programs for affected industries, retraining initiatives for displaced workers, and financial aid to help businesses adapt to changing conditions.

- Retraining programs can equip workers with new skills needed in growing sectors, reducing unemployment in affected areas.

- Financial assistance to struggling businesses can help them weather the storm and avoid layoffs.

- Diversifying export markets can reduce reliance on countries imposing tariffs.

Conclusion:

The Bank of Canada's interest rate policy is intrinsically linked to the impact of tariffs on Canadian employment. Understanding the complex interplay between inflation, consumer spending, currency fluctuations, and the specific employment consequences in various sectors is paramount for effective economic management. The Bank must carefully consider the ripple effects of tariffs when setting interest rates to maintain economic stability and minimize negative employment consequences. By analyzing relevant economic indicators and implementing proactive measures, Canada can better manage the challenges posed by tariffs and foster a strong, resilient job market. Continued research and ongoing monitoring of Bank of Canada interest rates and tariffs are vital for informed decision-making and effective policy adjustments to mitigate the effects of future tariff changes on the Canadian economy and employment.

Featured Posts

-

Woman Accuses Prince Andrew Of Sexual Assault Claims Imminent Death After Bus Crash

May 12, 2025

Woman Accuses Prince Andrew Of Sexual Assault Claims Imminent Death After Bus Crash

May 12, 2025 -

Plan Trampa Z Pripinennya Viyni V Ukrayini Gostra Reaktsiya Dzhonsona

May 12, 2025

Plan Trampa Z Pripinennya Viyni V Ukrayini Gostra Reaktsiya Dzhonsona

May 12, 2025 -

Ex Sia Flight Attendants Inspiring Career Change From Serving To Flying

May 12, 2025

Ex Sia Flight Attendants Inspiring Career Change From Serving To Flying

May 12, 2025 -

Plan Trampa Po Uregulirovaniyu Konflikta Kritika So Storony Borisa Dzhonsona

May 12, 2025

Plan Trampa Po Uregulirovaniyu Konflikta Kritika So Storony Borisa Dzhonsona

May 12, 2025 -

L Autruche De Mask Singer 2025 Demasquage Et Speculations

May 12, 2025

L Autruche De Mask Singer 2025 Demasquage Et Speculations

May 12, 2025

Latest Posts

-

B And W Trailer Hitches Heavy Hitters All Star Event Smith Mountain Lake Next Week

May 12, 2025

B And W Trailer Hitches Heavy Hitters All Star Event Smith Mountain Lake Next Week

May 12, 2025 -

Jessica Simpsons Snake Sperm Remark Public Reaction And Analysis

May 12, 2025

Jessica Simpsons Snake Sperm Remark Public Reaction And Analysis

May 12, 2025 -

The Truth About Jessica Simpsons Snake Sperm Statement

May 12, 2025

The Truth About Jessica Simpsons Snake Sperm Statement

May 12, 2025 -

Fremonts Wolf River Firefighter A National Fallen Firefighters Memorial Tribute

May 12, 2025

Fremonts Wolf River Firefighter A National Fallen Firefighters Memorial Tribute

May 12, 2025 -

Remembering A Hero Fremont Firefighter Honored At National Memorial Weekend

May 12, 2025

Remembering A Hero Fremont Firefighter Honored At National Memorial Weekend

May 12, 2025