Bajaj Twins Drag On Sensex And Nifty 50: India-Pakistan Tensions Add To Market Uncertainty

Table of Contents

Bajaj Twins' Performance: A Detailed Analysis

The Bajaj Twins have experienced a notable drop in their share prices recently. This decline is impacting investor confidence and contributing to the broader market volatility. Let's analyze this further:

- Bajaj Auto share price: A significant decrease has been observed, impacting its market capitalization. This requires a deeper look into the underlying factors.

- Bajaj Finserv share price: Similarly, Bajaj Finserv has experienced a downturn, mirroring the trend seen in its sister company. Understanding the correlation between the two is crucial.

- Trading Volume and Market Capitalization: Increased trading volume often accompanies price drops, suggesting heightened investor activity and potential profit-taking or panic selling. The market capitalization of both companies has naturally decreased reflecting the share price decline.

- Beyond Geopolitics: While India-Pakistan tensions undoubtedly play a role, other factors could be contributing to the decline. These could include weaker-than-expected quarterly earnings, a general slowdown in the auto sector, or negative industry-specific news. Analyzing these factors separately is essential for a comprehensive understanding.

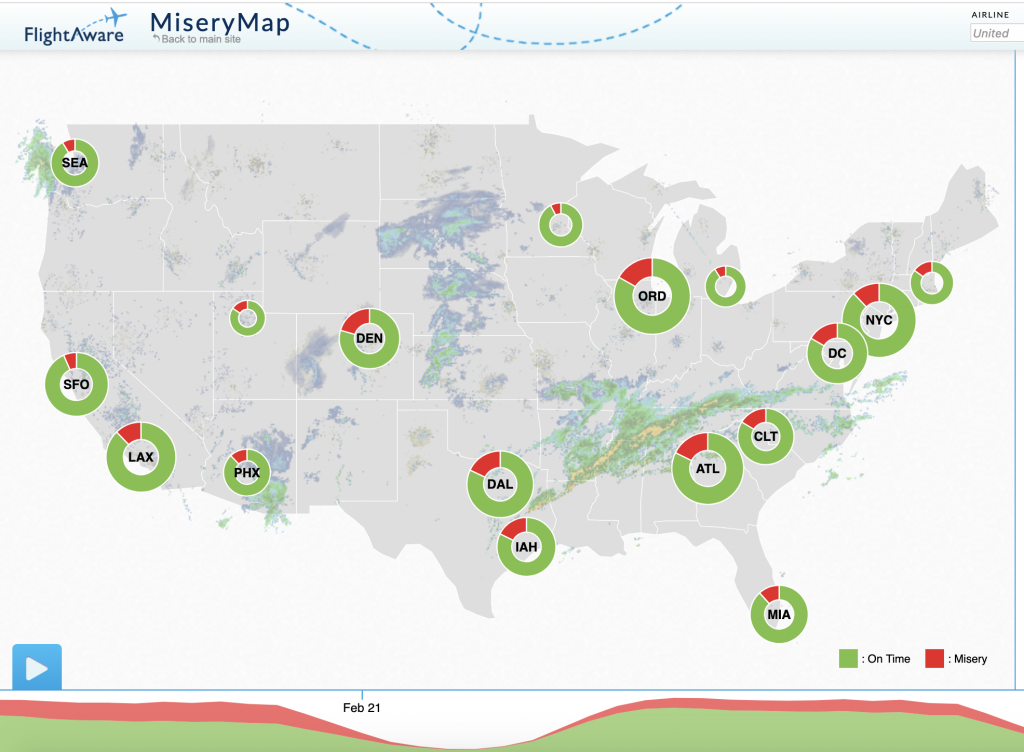

[Insert Chart/Graph showing Bajaj Auto and Bajaj Finserv share price fluctuations over a relevant period].

Geopolitical Risk and Market Sentiment

The current escalation of India-Pakistan tensions is a key driver of market uncertainty. This geopolitical risk significantly impacts investor sentiment:

- Investor Confidence: Heightened tensions lead to a decrease in investor confidence, prompting a flight to safety.

- Flight to Safety: Investors often move their funds into safer assets like government bonds or gold during times of geopolitical instability. This reduces investment in riskier assets, including equities.

- Emerging Market Risk: India, as an emerging market, is particularly vulnerable to global geopolitical events. Increased risk perception leads to capital outflows.

- Foreign Institutional Investors (FIIs): FIIs play a crucial role in the Indian stock market. Their investment decisions, heavily influenced by global events and risk appetite, directly impact market performance. Negative sentiment can result in significant FII selling.

Sectoral Impact and Spillover Effects

The decline in Bajaj Twins' share prices isn't limited to these two companies; it has wider ramifications:

- Auto Sector Performance: The Bajaj Twins' performance is indicative of broader concerns within the Indian auto sector. The ripple effect on other auto manufacturers needs consideration.

- Market Correlation: The correlation between the Bajaj Twins' performance and other related sectors needs analysis. Are other companies in the finance and consumer durables sectors also experiencing similar declines?

- Spillover Effects: The downturn could have spillover effects on other sectors, creating a domino effect across the market. Determining the extent of this is crucial.

Expert Opinions and Market Predictions

To gain a more comprehensive understanding, it’s crucial to consider expert perspectives:

- Financial Analyst Quotes: [Insert quotes from financial analysts regarding the Bajaj Twins' performance and market outlook]. These provide valuable insights into the current situation.

- Market Predictions: Analysts' predictions regarding the future performance of Bajaj Auto, Bajaj Finserv, and the broader Indian stock market vary based on different economic models and assumptions. Understanding these differing viewpoints is essential for informed decision-making.

- Future Market Trends: Analyzing these predictions helps investors understand potential future market trends and adjust their investment strategies accordingly.

Conclusion: Navigating Uncertainty in the Indian Stock Market

The decline of the Bajaj Twins has highlighted the vulnerability of the Indian stock market to both company-specific factors and broader geopolitical risks. The interplay between India-Pakistan tensions, investor sentiment, and sectoral performance underscores the need for careful risk management. Investors should consider diversification strategies, thorough due diligence, and stay updated on evolving geopolitical scenarios. Stay updated on the latest developments regarding the Bajaj Twins and their impact on the Indian stock market. Understanding the interplay between geopolitical events and stock performance is crucial for informed investment decisions.

Featured Posts

-

Uk Citys Transformation Caravan Dwellers And Growing Concerns

May 10, 2025

Uk Citys Transformation Caravan Dwellers And Growing Concerns

May 10, 2025 -

Avoid Travel Delays Check Your Real Id Status Now

May 10, 2025

Avoid Travel Delays Check Your Real Id Status Now

May 10, 2025 -

Analysis Proposed Uk Visa Changes For Pakistan Nigeria And Sri Lanka Applicants

May 10, 2025

Analysis Proposed Uk Visa Changes For Pakistan Nigeria And Sri Lanka Applicants

May 10, 2025 -

Unlocking The Nyt Spelling Bee April 1 2025 Strategy And Answers

May 10, 2025

Unlocking The Nyt Spelling Bee April 1 2025 Strategy And Answers

May 10, 2025 -

Razgrom Na Zolotoy Maline Dakota Dzhonson I Drugie Nominanty Khudshikh Filmov Goda

May 10, 2025

Razgrom Na Zolotoy Maline Dakota Dzhonson I Drugie Nominanty Khudshikh Filmov Goda

May 10, 2025