Autonomous Vehicles And Uber: Exploring Investment Opportunities With ETFs

Table of Contents

- The Rise of Autonomous Vehicles and Their Impact on Transportation

- Technological Advancements Driving AV Development

- Uber's Strategic Investments in Autonomous Driving

- Understanding Exchange-Traded Funds (ETFs) and Their Role in Investing

- What are ETFs?

- Identifying ETFs Focused on Autonomous Vehicle Technology and Ride-Sharing

- Strategies for Investing in Autonomous Vehicle and Uber-Related ETFs

- Due Diligence and Research

- Diversification and Risk Management

- Long-Term Investment Strategy

- Autonomous Vehicles and Uber: Making Informed Investment Decisions with ETFs

The Rise of Autonomous Vehicles and Their Impact on Transportation

The development of autonomous vehicles is accelerating at an unprecedented rate, driven by significant technological advancements. This revolution promises to reshape urban mobility, logistics, and even our daily lives.

Technological Advancements Driving AV Development

Progress in artificial intelligence (AI), sophisticated sensor technology (like LiDAR and radar), and high-definition mapping are the cornerstones of AV development.

- Key Players: Waymo, Cruise (General Motors), Tesla (Autopilot), and many smaller innovative companies are pushing the boundaries of what's possible.

- Levels of Automation (SAE Levels): From basic driver-assistance systems (Level 1) to fully autonomous driving (Level 5), the progression is rapid, with Level 4 (highly automated driving in limited areas) already seeing real-world deployment.

- Impact: The widespread adoption of AVs could drastically improve transportation efficiency, reduce accidents caused by human error, and enhance accessibility for individuals with mobility limitations. The potential for reduced traffic congestion and improved fuel economy is also significant.

Uber's Strategic Investments in Autonomous Driving

Uber recognizes the transformative power of AVs and has made substantial investments in this area.

- Past and Current Projects: Uber's Advanced Technologies Group (ATG) has been at the forefront of self-driving car development, though they have faced challenges and restructured their efforts in recent years. They continue to explore partnerships and collaborations to advance their autonomous driving capabilities.

- Synergies: The integration of AV technology with Uber's existing ride-hailing platform could revolutionize the ride-sharing experience, potentially leading to lower costs, increased efficiency, and expanded service areas.

- Market Share Potential: Uber's massive user base and established infrastructure position it to capture a significant share of the future autonomous ride-hailing market, if they successfully navigate the challenges.

Understanding Exchange-Traded Funds (ETFs) and Their Role in Investing

Investing in the burgeoning AV sector can seem daunting, but ETFs provide a simplified and diversified approach.

What are ETFs?

ETFs are investment funds that trade on stock exchanges like individual stocks. They offer a basket of assets, providing instant diversification and reducing reliance on individual stock picking.

- Advantages: ETFs typically offer lower expense ratios than mutual funds, providing cost-effective access to a diverse range of investments. They're also easily traded throughout the day.

- Types: There are sector-specific ETFs focused on technology, transportation, or even specifically on autonomous vehicle technology, as well as broader market index-tracking ETFs.

Identifying ETFs Focused on Autonomous Vehicle Technology and Ride-Sharing

Several ETFs offer exposure to companies involved in AV technology and ride-sharing services. Remember to always perform thorough research before investing.

- Examples (Note: Specific ETF examples are omitted here to prevent outdated information. Always research current offerings.): Look for ETFs with holdings in companies involved in AI, sensor technology, mapping, and ride-sharing services. Check their holdings carefully. You can find relevant ETFs using online brokerage platforms and financial news websites.

- Links: Visit the websites of major ETF providers (e.g., Vanguard, BlackRock iShares, State Street Global Advisors) for detailed information on their offerings.

- Risks and Rewards: While the potential for growth is substantial, investing in the AV sector carries inherent risks, including technological challenges, regulatory hurdles, and market volatility.

Strategies for Investing in Autonomous Vehicle and Uber-Related ETFs

Success in the investment world requires careful planning and due diligence.

Due Diligence and Research

Thorough research is crucial before investing in any ETF.

- Resources: Utilize resources such as ETF.com, Morningstar, and company websites to understand the ETF's holdings, expense ratios, and historical performance.

- Key Metrics: Pay close attention to the expense ratio (fees charged), the ETF's holdings (the companies it invests in), and its tracking error (how closely it follows its benchmark index).

Diversification and Risk Management

Diversification is essential to mitigate risk.

- Diversified Approach: Consider diversifying across multiple ETFs, including those focused on technology, transportation, and potentially broader market indexes. This reduces reliance on any single sector or company.

- Risk Tolerance: Align your investment strategy with your individual risk tolerance and financial goals. Consider seeking professional advice from a financial advisor.

Long-Term Investment Strategy

The AV sector is likely to experience periods of volatility. A long-term perspective is key.

- Long-Term Growth Potential: The long-term growth potential for the autonomous vehicle market is substantial, but patience is crucial.

- Patience: Avoid impulsive decisions based on short-term market fluctuations. Stick to your investment plan and regularly review your portfolio.

Autonomous Vehicles and Uber: Making Informed Investment Decisions with ETFs

Investing in the future of transportation, particularly the autonomous vehicle revolution and Uber's role in it, presents exciting opportunities. ETFs offer a simplified way to access this dynamic market while minimizing risk through diversification. This article on Autonomous Vehicles and Uber: Exploring Investment Opportunities with ETFs has provided a framework for understanding the potential, the risks, and the strategies for participation.

Remember to conduct thorough research, consider your risk tolerance, and potentially seek professional financial advice before investing in any ETFs. Visit ETF provider websites for detailed information and start building your portfolio today!

Pos Giortazetai O Eyaggelismos Tis T Heotokoy Sta Ierosolyma

Pos Giortazetai O Eyaggelismos Tis T Heotokoy Sta Ierosolyma

Guy Bartkus Suspect In Palm Springs Fertility Clinic Bombing

Guy Bartkus Suspect In Palm Springs Fertility Clinic Bombing

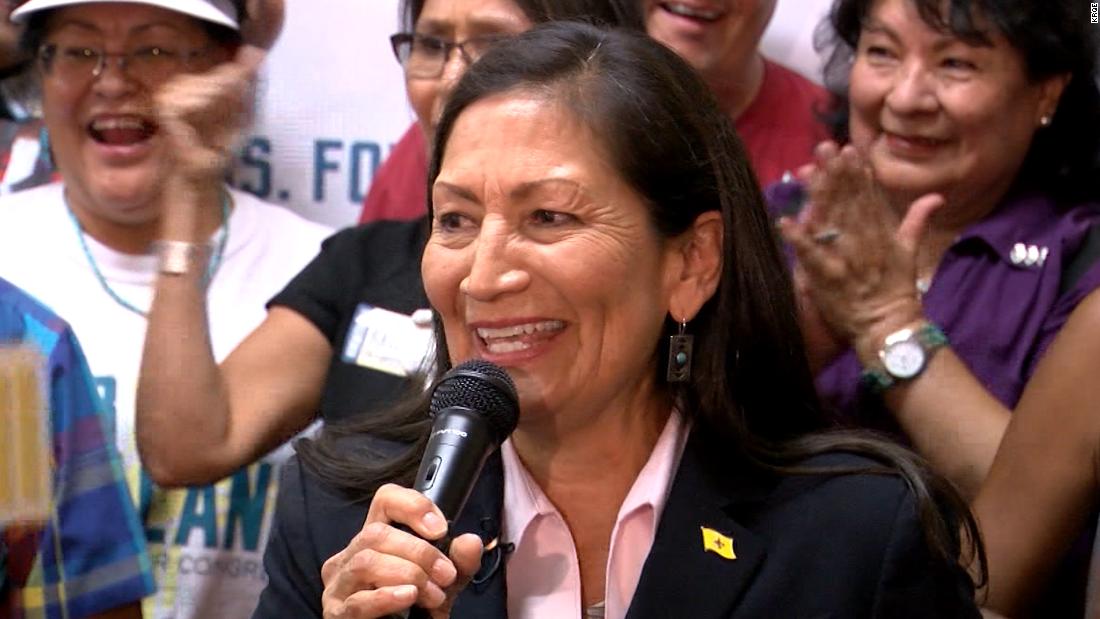

Haaland Announces New Mexico Gubernatorial Bid

Haaland Announces New Mexico Gubernatorial Bid

Live Ufc Fight Night Blog Gilbert Burns Vs Michael Morales Fight Breakdown

Live Ufc Fight Night Blog Gilbert Burns Vs Michael Morales Fight Breakdown

I A Stasi Ton Xairetismon Bima Pros Bima Eksigisi

I A Stasi Ton Xairetismon Bima Pros Bima Eksigisi