Australia's Opposition: A $9 Billion Budget Improvement Plan

Table of Contents

Key Pillars of the $9 Billion Budget Improvement Plan

The Opposition's $9 billion budget improvement plan rests on three key pillars: targeted tax reforms, increased efficiency in government spending, and investment in job creation and skills development. Each pillar contributes to the overall goal of strengthening Australia's economy and improving the lives of Australians.

Targeted Tax Reforms

This element of the plan focuses on delivering tangible benefits to Australian taxpayers. The Opposition proposes a range of changes designed to stimulate economic activity and ease the burden on low and middle-income earners.

- Tax cuts for low and middle-income earners: Specific proposals include increasing the tax-free threshold and adjusting tax brackets to provide more disposable income for families struggling with the rising cost of living. This directly addresses concerns around the squeeze on household budgets.

- Company tax rate adjustments: The plan suggests potential adjustments to company tax rates to encourage business investment and stimulate job creation. This aims to boost economic growth and create a more favorable business environment.

- Addressing tax loopholes and inefficiencies: The Opposition's plan includes a comprehensive review of existing tax loopholes and inefficiencies, aiming to improve the fairness and effectiveness of the tax system. This promises to increase revenue for the government without increasing taxes for ordinary Australians.

- Examples of specific proposed tax changes:

- Increase the tax-free threshold by $1,000.

- Reduce the GST on essential goods such as groceries and medicines.

- Implement a more progressive system of capital gains tax.

Increased Efficiency in Government Spending

The Opposition argues that significant savings can be achieved by streamlining government operations and eliminating wasteful spending. This focus on efficiency aims to maximize the impact of public funds and ensure they are used effectively.

- Identifying and eliminating wasteful government spending: The plan proposes an independent audit of government spending to identify areas of inefficiency and duplication. This commitment to transparency aims to build public trust.

- Streamlining bureaucratic processes: The Opposition advocates for simplifying bureaucratic processes to reduce delays and costs, freeing up resources for essential services. This includes improving procurement practices and reducing administrative burdens.

- Prioritizing essential services: The plan emphasizes directing funds towards essential services such as healthcare, education, and infrastructure. This strategic allocation of resources is intended to produce the greatest benefit for the Australian population.

- Examples of proposed spending cuts and reallocation:

- Reduction in administrative costs across government departments.

- Improved procurement practices to secure better value for money.

- Reallocation of funds from non-essential programs to vital social services.

Investment in Job Creation and Skills Development

The Opposition's plan emphasizes investing in programs that create employment opportunities and equip Australians with the skills they need for the future.

- Boosting employment opportunities for young Australians: This includes funding for apprenticeships, traineeships, and job placement programs specifically targeting young people.

- Initiatives to upskill and reskill the workforce: The plan promotes investment in training programs and education initiatives that will equip Australians with skills for in-demand industries. This focus on future skills is intended to prepare the workforce for the changing economy.

- Investment in infrastructure projects: The Opposition proposes targeted investments in infrastructure projects to stimulate economic growth and generate jobs. This is a cornerstone of their plan to stimulate economic growth.

- Examples of specific job creation initiatives:

- Funding for a national apprenticeship program.

- Investment in renewable energy infrastructure projects.

- Expansion of skills training programs in areas like technology and healthcare.

Projected Impact and Economic Analysis

The Opposition’s $9 billion budget improvement plan claims significant positive economic impacts. However, an independent analysis is crucial to verify these claims.

- Impact on national debt: The plan’s projected impact on the national debt requires detailed modeling and scrutiny. Independent economists will need to assess the plan's effectiveness in reducing the debt burden.

- Effect on inflation and the cost of living: The potential impact on inflation and cost of living needs careful consideration. Tax cuts might stimulate demand, potentially increasing inflation, while efficiency gains could counteract this effect.

- Stimulating economic growth: The plan's ability to stimulate economic growth hinges on the effectiveness of its tax reforms, spending cuts, and job creation initiatives. Economic modelling is needed to assess its long-term impact.

- Comparison with the current government's budget: A comprehensive comparison with the current government’s budget is crucial for a balanced assessment. This should consider differences in spending priorities, revenue projections, and economic assumptions.

- Expert opinions and economic forecasts: The inclusion of diverse expert opinions and relevant economic forecasts will strengthen the analysis and provide a more complete picture.

Political Ramifications and Public Opinion

The Opposition's $9 billion budget improvement plan has significant political ramifications and is likely to shape the upcoming election.

- Political implications: The plan’s reception will depend on factors such as public perception of the government's economic management and the Opposition's ability to effectively communicate its proposals.

- Public reaction and media coverage: Media coverage and public opinion will be crucial in determining the plan's success. Monitoring public sentiment through polling data and social media analysis will provide insights into public perception.

- Potential to sway public opinion: The plan’s effectiveness in swaying public opinion will depend on its clarity, perceived feasibility, and alignment with public priorities.

- Polling data and public sentiment analysis: Analyzing polling data and conducting public sentiment analysis will provide a valuable understanding of public response to the plan's proposals.

- Diverse perspectives: It's crucial to consider diverse perspectives, including those from economists, political scientists, and affected communities, to get a complete understanding of the plan’s potential impact.

Conclusion

This article detailed Australia's Opposition's comprehensive $9 billion budget improvement plan, outlining its key proposals related to tax reform, increased government efficiency, and investment in job creation. The plan's potential impact on the Australian economy and its political implications have been analyzed. The success of this plan will depend on careful implementation and effective communication. Independent economic analysis is essential to fully assess its viability and potential effects.

Call to Action: To delve deeper into the specifics of this significant policy proposal and stay informed about its potential impact on Australian citizens, further research into the Opposition's detailed budget documents is encouraged. Understanding the nuances of Australia’s Opposition's Budget Improvement Plan is crucial for informed political participation.

Featured Posts

-

Tuerkiye Nin Avrupa Ile Is Birligi Stratejisi

May 02, 2025

Tuerkiye Nin Avrupa Ile Is Birligi Stratejisi

May 02, 2025 -

Rust A Post Tragedy Film Analysis Featuring Alec Baldwin

May 02, 2025

Rust A Post Tragedy Film Analysis Featuring Alec Baldwin

May 02, 2025 -

Voyage A Velo De 8000 Km Le Recit De Trois Jeunes Ornais

May 02, 2025

Voyage A Velo De 8000 Km Le Recit De Trois Jeunes Ornais

May 02, 2025 -

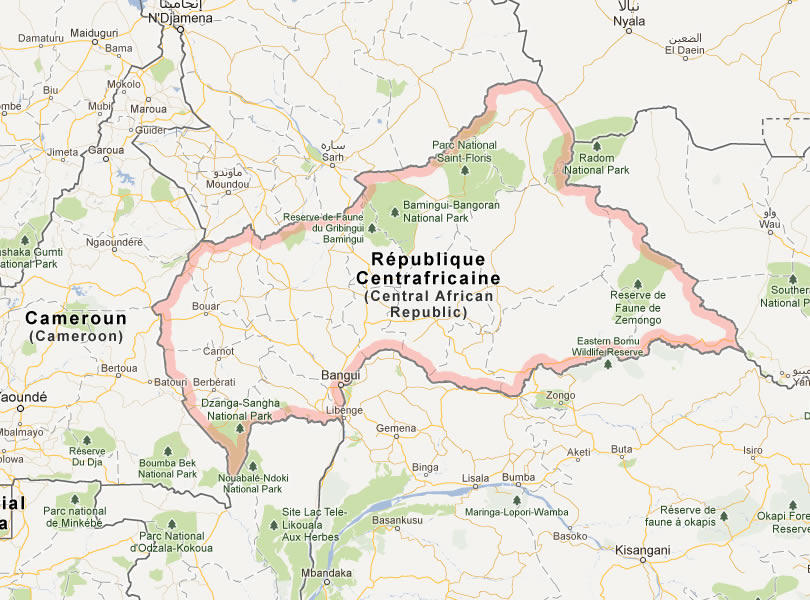

Bae Ve Orta Afrika Cumhuriyeti Yeni Ticaret Anlasmasi

May 02, 2025

Bae Ve Orta Afrika Cumhuriyeti Yeni Ticaret Anlasmasi

May 02, 2025 -

Mqbwdh Kshmyr Myn Eyd Bharty Fwjy Karrwayywn Se Nwjwan Shhyd

May 02, 2025

Mqbwdh Kshmyr Myn Eyd Bharty Fwjy Karrwayywn Se Nwjwan Shhyd

May 02, 2025