AT&T's Opposition To Broadcom's VMware Deal: A 1050% Price Increase

Table of Contents

The Alleged 1050% Price Increase and its Implications

AT&T's claim centers around a projected astronomical increase in the cost of networking equipment and services should Broadcom successfully acquire VMware. While the exact calculation methodology remains undisclosed by AT&T, the implication is that the combined entity would wield such market dominance that it could significantly inflate prices for essential networking components. This alleged 1050% figure represents a substantial increase, posing a significant threat to AT&T's operational costs and potentially impacting its service offerings.

-

Specific Networking Equipment/Services Impacted: AT&T hasn't publicly specified every impacted product, but the concern likely extends to key networking infrastructure components integral to its operations. This could include software-defined networking (SDN) solutions, virtualization technologies, and other VMware-related products that are currently supplied by either Broadcom or VMware, or soon could be.

-

Impact on AT&T's Operational Costs and Profitability: A 1050% price hike would dramatically increase AT&T's expenses, potentially squeezing profit margins and impacting its ability to invest in network upgrades and expansion. This cost increase would need to be passed down the line, potentially leading to higher prices for consumers.

-

Consequences for AT&T Customers: The increased operational costs resulting from the price increase could lead to higher prices for AT&T's services, reduced service quality, or both. Customers might face higher monthly bills or experience slower internet speeds and reduced network reliability.

-

Supporting Evidence: AT&T has not yet publicly released all its supporting documentation, but its strong opposition and the magnitude of the claimed price increase suggest substantial internal analysis justifying its concerns. Expect further details to emerge during regulatory reviews.

Antitrust Concerns and Competition in the Tech Industry

The proposed Broadcom-VMware merger raises significant antitrust concerns. The combined entity would control a substantial market share in various segments, potentially creating a monopoly or oligopoly, reducing competition and stifling innovation.

-

Market Share: Both Broadcom and VMware hold substantial market share in their respective sectors. The merger would combine their strengths, potentially leading to unprecedented market dominance.

-

Monopoly/Oligopoly Potential: The combined entity could leverage its market power to dictate prices, limit choices for customers, and suppress innovation from smaller competitors. This scenario significantly reduces competition.

-

Previous Antitrust Actions: While neither Broadcom nor VMware has faced major antitrust issues recently, the sheer size and potential market impact of this merger necessitate careful scrutiny by regulatory bodies.

-

Role of Regulatory Bodies: The Federal Trade Commission (FTC) in the US and the European Commission (EC) in Europe are key players in reviewing this merger for potential antitrust violations. Their decisions will significantly impact the deal's fate.

AT&T's Strategic Position and its Role in the Opposition

AT&T's opposition to the Broadcom-VMware deal is not solely based on price concerns. It also reflects a strategic consideration of its long-term network infrastructure plans and reliance on these technologies.

-

Reliance on VMware and Broadcom Products: AT&T, like many telecommunication giants, relies heavily on VMware's virtualization technologies and potentially Broadcom's networking components. A price increase would significantly impact its existing infrastructure investments.

-

Alternative Suppliers and Switching Vendors: Finding suitable alternatives for such critical technologies is challenging and time-consuming. Switching vendors would require extensive testing, integration, and potential disruptions to service.

-

Impact on AT&T's Long-Term Network Plans: The price hike could force AT&T to reassess its long-term infrastructure investments, potentially delaying upgrades or affecting network expansion plans.

-

AT&T's Influence and Leverage: As a major telecommunications player, AT&T's voice carries significant weight in regulatory discussions. Its opposition adds substantial pressure on regulators to thoroughly examine the implications of the merger.

Potential Outcomes and Future Implications

The outcome of the Broadcom-VMware merger remains uncertain. Several potential scenarios exist, each with significant implications for the tech industry.

-

Regulatory Approval/Rejection: The likelihood of regulatory approval depends heavily on the findings of the FTC and EC investigations, considering AT&T's concerns and the potential antitrust issues.

-

Broadcom Concessions: To secure regulatory approval, Broadcom might offer concessions, such as price caps or commitments to maintain competition, addressing AT&T's concerns.

-

Impact on Innovation: A lack of competition could stifle innovation, leading to slower technological advancements and fewer choices for customers.

-

Implications for Other Telecommunications Companies: The outcome will set a precedent for future mergers and acquisitions in the telecommunications industry, influencing other companies' strategies and operational costs.

Conclusion

This article examined AT&T's strong opposition to Broadcom's acquisition of VMware, primarily fueled by concerns over a potential 1050% price increase for critical networking services. The concerns extend beyond simple cost increases, touching upon vital antitrust issues and the overall competitive landscape of the telecommunications and technology sectors. The outcome of this merger will significantly impact the industry's future.

Call to Action: Stay informed on the latest developments regarding the Broadcom-VMware merger and AT&T's continued opposition. Understanding the implications of this significant deal is crucial for anyone involved in the technology or telecommunications sectors. Continue to follow this story for updates on the AT&T/Broadcom/VMware price increase saga and its impact on the future of networking.

Featured Posts

-

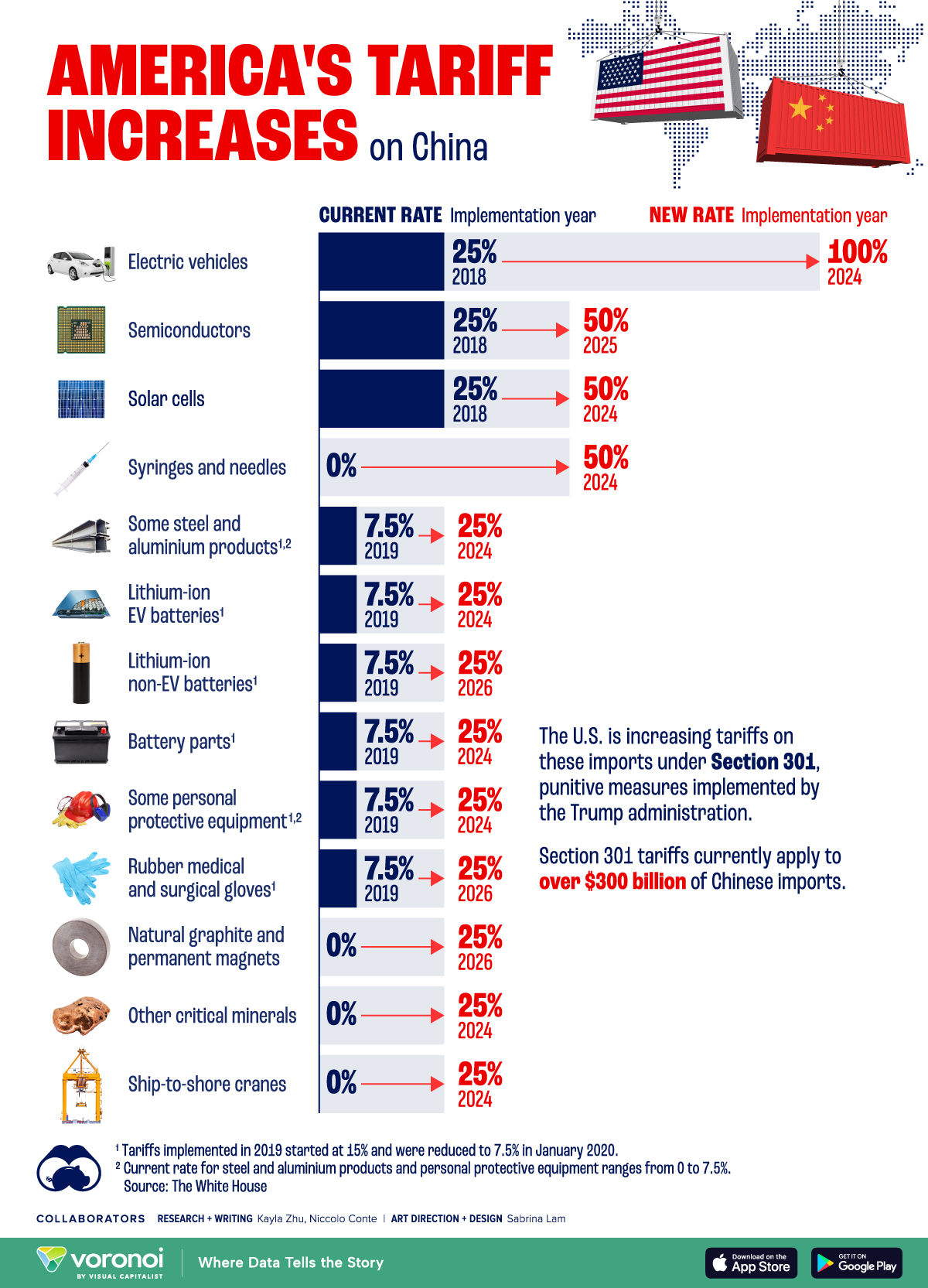

Southwest Washington Facing The Impact Of Tariffs

May 18, 2025

Southwest Washington Facing The Impact Of Tariffs

May 18, 2025 -

May 8th Mlb Home Run Prop Bets Analysis And Predictions

May 18, 2025

May 8th Mlb Home Run Prop Bets Analysis And Predictions

May 18, 2025 -

Amanda Bynes Only Fans Debut Strict Rules And New Beginnings

May 18, 2025

Amanda Bynes Only Fans Debut Strict Rules And New Beginnings

May 18, 2025 -

Oleksiy Poroshenko Novini Foto Ta Fakti Pro Yogo Ninishnye Zhittya

May 18, 2025

Oleksiy Poroshenko Novini Foto Ta Fakti Pro Yogo Ninishnye Zhittya

May 18, 2025 -

Offseason Tragedy Angels Stars Family Health Issues Revealed

May 18, 2025

Offseason Tragedy Angels Stars Family Health Issues Revealed

May 18, 2025

Latest Posts

-

9 Nyc Bridges Face Urgent Inspection After Baltimore Bridge Collapse

May 18, 2025

9 Nyc Bridges Face Urgent Inspection After Baltimore Bridge Collapse

May 18, 2025 -

Disturbing Brooklyn Attack Woman Groped Sex Act Simulated

May 18, 2025

Disturbing Brooklyn Attack Woman Groped Sex Act Simulated

May 18, 2025 -

Baltimore Bridge Collapse Sparks Urgent Inspection Of 9 Nyc Bridges

May 18, 2025

Baltimore Bridge Collapse Sparks Urgent Inspection Of 9 Nyc Bridges

May 18, 2025 -

Brooklyn Fleas Dumbo Archway Plaza Extension Confirmed Until 2027

May 18, 2025

Brooklyn Fleas Dumbo Archway Plaza Extension Confirmed Until 2027

May 18, 2025 -

Brooklyn Bridge To Host Tens Of Thousands For Nyc Half Marathon Debut

May 18, 2025

Brooklyn Bridge To Host Tens Of Thousands For Nyc Half Marathon Debut

May 18, 2025