Assessing The Effects Of Low Mortgage Rates On The Canadian Housing Market

Table of Contents

Increased Homebuyer Demand and Price Inflation

Low mortgage rates have undeniably fueled increased demand in the Canadian housing market. While seemingly positive for prospective homebuyers, the resulting surge in demand has significantly outpaced the supply of available homes, leading to substantial price inflation.

H3: Affordability Challenges for First-Time Homebuyers

The dream of homeownership has become increasingly elusive for many first-time buyers. Low mortgage rates, while reducing monthly payments, haven't offset the dramatic rise in home prices. This has created a highly competitive market characterized by:

- Increased competition: Multiple offers and bidding wars are commonplace, pushing prices beyond what many first-time buyers can afford.

- Bidding wars: Buyers often find themselves competing against other buyers, driving up prices well above the asking price.

- Limited inventory: A shortage of homes for sale further intensifies the competition and pushes prices higher.

Statistics from the Canadian Real Estate Association (CREA) consistently show double-digit percentage increases in average home prices in major cities like Toronto, Vancouver, and Montreal over the past few years. This makes homeownership a significant financial hurdle for many young Canadians entering the market.

H3: Impact on Investment Properties

Low mortgage rates have also significantly impacted the investment property market. The lower borrowing costs have made it more attractive for investors to purchase rental properties, leading to:

- Higher returns for landlords: Lower mortgage payments translate into higher potential rental income and profits.

- Potential for rental market saturation: An influx of investment properties could potentially lead to an oversupply in certain areas, impacting rental rates in the long run.

Data on rental vacancy rates and average rental costs vary across the country, reflecting the diverse nature of local housing markets. However, in many urban centers, rental costs have risen significantly, adding to the affordability challenges faced by renters.

Impact on the Mortgage Market Itself

Low mortgage rates have had a profound effect on the Canadian mortgage market, influencing both the volume of mortgages and the associated risks.

H3: Increased Mortgage Originations

The period of low rates witnessed a substantial increase in mortgage applications and approvals. This is reflected in:

- Data on mortgage origination volume: Lenders reported a significant rise in the number of new mortgages issued during this period.

- Types of mortgages issued: The mix of variable-rate and fixed-rate mortgages shifted based on market predictions and borrower preferences.

- Role of different lenders: Both banks and mortgage brokers played a crucial role in facilitating this increase in mortgage originations.

H3: Risk of Mortgage Defaults

While low rates stimulated the market, they also increased the potential for risk. The accessibility of mortgages, coupled with rising house prices, has led to:

- Data on household debt-to-income ratios: These ratios have increased, indicating a growing reliance on debt for housing.

- Potential impact of rising rates on mortgage affordability: A sudden increase in interest rates could put a significant strain on borrowers' finances, potentially leading to an increase in mortgage defaults.

- Government regulations and stress tests for mortgages: The Canadian government has implemented stricter regulations and stress tests to mitigate these risks, ensuring borrowers can handle potential interest rate hikes.

Regional Variations in Market Response

The impact of low mortgage rates has not been uniform across Canada. Regional variations in population growth, economic conditions, and local housing markets have resulted in diverse responses.

H3: Market Differences Across Provinces

Home price changes have varied considerably across different provinces. Factors like population growth, employment rates, and local government policies have influenced the magnitude of price increases.

- Comparative analysis of home price changes in various provinces: While some provinces experienced dramatic price increases, others have seen more moderate growth.

- Impact on specific markets: The impact of low mortgage rates on major metropolitan areas like Toronto, Vancouver, and Montreal differed significantly from smaller cities and rural communities.

H3: Impact on Rural vs. Urban Markets

The contrast between rural and urban markets is also striking. Low mortgage rates have generally had a more significant impact on urban centers characterized by higher demand and limited inventory.

- Comparison of price changes and demand in rural and urban settings: Rural areas often experienced less dramatic price increases due to lower demand.

- Factors contributing to these differences: Population density, job markets, and the availability of amenities all contribute to these regional variations.

Conclusion

Low mortgage rates have profoundly impacted the Canadian housing market, creating a complex interplay of increased demand, price inflation, and heightened risk. The resulting affordability challenges for first-time buyers, the impact on the investment property market, and the regional variations underscore the multifaceted nature of this influence. Understanding the effects of low mortgage rates is crucial for navigating the complexities of the Canadian housing market.

Key Takeaways:

- Low mortgage rates have driven increased demand and price inflation in the Canadian housing market.

- Affordability remains a significant challenge for first-time homebuyers.

- The investment property market has also experienced substantial growth, potentially leading to rental market saturation in some areas.

- Regional variations in market response highlight the diverse nature of the Canadian housing landscape.

Call to Action: Stay informed about changes in interest rates and their potential impact on your financial decisions. Understanding the effects of low (and high) mortgage rates is crucial for navigating the complex Canadian housing market effectively. Consult resources from the Bank of Canada, the Canadian Real Estate Association (CREA), and your financial advisor to make informed decisions.

Fords Brazilian Legacy Fades As Byds Global Ev Dominance Grows

Fords Brazilian Legacy Fades As Byds Global Ev Dominance Grows

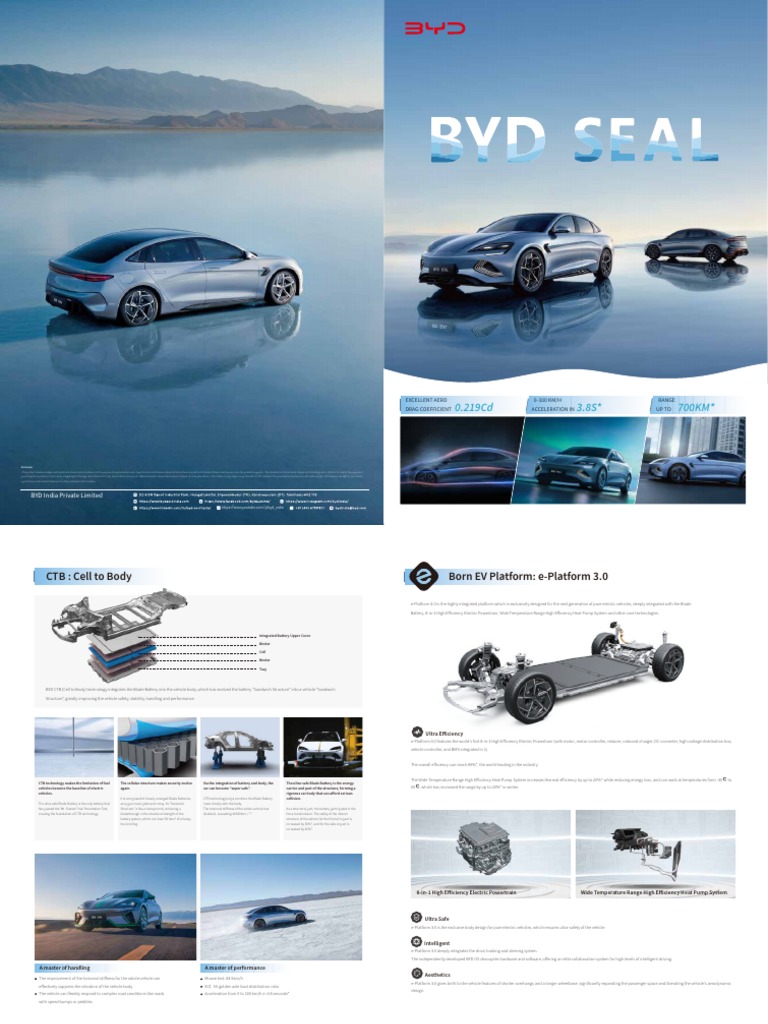

Is The Byd Seal Right For You A Detailed Buyers Guide

Is The Byd Seal Right For You A Detailed Buyers Guide

Elsbeth Season 2 Episode 15 Why The Murderous Murderess Plot Failed

Elsbeth Season 2 Episode 15 Why The Murderous Murderess Plot Failed

Disney Film Premiere Eva Longorias Michael Kors Fashion Moment

Disney Film Premiere Eva Longorias Michael Kors Fashion Moment

Vyplaty Veteranam Velikoy Otechestvennoy Voyny V Eao

Vyplaty Veteranam Velikoy Otechestvennoy Voyny V Eao