Assessing Nvidia's Exposure: Geopolitical Risks Exceed China Concerns

Table of Contents

The China Factor: A Significant but Not Defining Risk

China undeniably represents a crucial market for Nvidia's high-performance computing (HPC) and AI chips. However, characterizing it as the defining geopolitical risk for the company oversimplifies a far more nuanced situation.

Market Dependence

Nvidia's revenue from China contributes significantly to its overall financial performance. While the exact percentage fluctuates, it consistently represents a substantial portion of its total sales. A sudden downturn in the Chinese market, driven by geopolitical factors, would undoubtedly impact Nvidia's bottom line. However, it's crucial to remember that Nvidia's revenue streams are diversified across numerous other key markets.

Regulatory Uncertainty

The Chinese government's increasingly assertive regulatory stance on technology, particularly in areas like data security and export controls, presents a significant challenge. Regulations impacting the semiconductor industry, including potential restrictions on the use of Nvidia's chips in sensitive applications like military or high-tech infrastructure, introduce uncertainty into Nvidia's long-term business planning in China.

- Nvidia's China revenue accounts for (insert percentage, source needed) of total revenue.

- Specific regulations like the Cybersecurity Law and Data Security Law pose significant challenges for Nvidia's operations.

- Mitigation strategies might include increased engagement with Chinese regulators, diversification of product offerings, and exploring alternative markets.

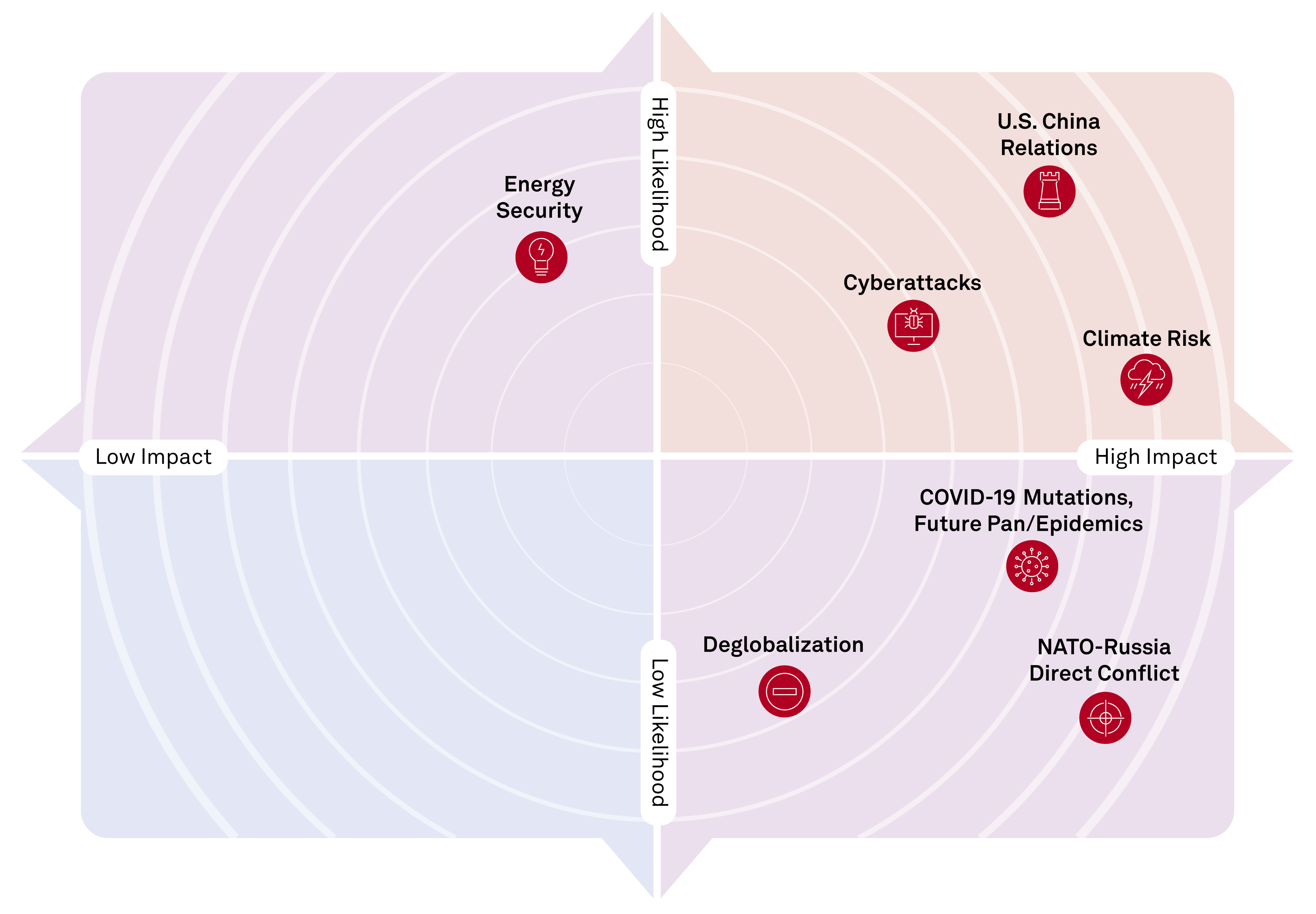

Broader Geopolitical Risks: A More Pressing Concern

While China-specific risks are real, the broader geopolitical landscape presents a far more pervasive threat to Nvidia's success.

US-China Tech Cold War

The escalating technological competition between the US and China is creating a complex and uncertain environment for Nvidia. The potential for decoupling between the two tech giants, leading to fragmented markets and supply chains, represents a significant long-term risk. This conflict influences everything from export controls to the availability of skilled labor and critical materials.

Global Supply Chain Disruptions

Nvidia's global supply chain, like many tech companies, is vulnerable to geopolitical instability. Trade wars, sanctions targeting specific countries or technologies, and regional conflicts all pose serious disruption risks. A single disruption in any part of its intricate global network could have cascading effects on production and delivery.

Export Controls and Sanctions

US and international export controls directly impact Nvidia's ability to supply its cutting-edge technology to various markets. Restrictions on the sale of high-performance computing chips to certain countries or entities can severely limit Nvidia’s market access and revenue streams.

- A US-China tech decoupling could lead to significantly reduced market access in one of the world's largest markets.

- Key geographical regions like Taiwan (for chip manufacturing) and Eastern Europe (for certain materials) are particularly vulnerable to geopolitical instability.

- Export controls could limit Nvidia’s access to key markets, requiring it to navigate complex regulatory frameworks.

- Diversification strategies include establishing manufacturing facilities in multiple regions and exploring alternative sourcing for key components.

Assessing Nvidia's Resilience and Mitigation Strategies

Nvidia isn't passively accepting these risks. The company is actively implementing several mitigation strategies.

Diversification Efforts

Nvidia is actively diversifying its markets and supply chains to reduce its dependence on any single region or customer. This includes expanding its presence in other key markets like Europe and Southeast Asia, and investing in manufacturing capacity outside of traditional hubs.

R&D Investments

Nvidia's substantial investments in research and development are crucial for maintaining its technological leadership. This ensures that its products remain competitive and less susceptible to substitution by rivals or affected by shifting regulatory landscapes.

Lobbying and Political Engagement

Nvidia actively engages with policymakers globally to influence legislation and regulations impacting its business. This proactive approach helps to shape the regulatory environment and mitigate potential threats.

- Examples of Nvidia's market diversification include (provide specific examples if available).

- Nvidia’s significant R&D spending (insert figures and source) underscores its commitment to maintaining a technological advantage.

- Nvidia’s lobbying efforts often focus on issues relating to export controls and trade policy (provide specific examples if possible).

Conclusion: Navigating the Geopolitical Landscape for Nvidia

In conclusion, while China presents significant risks for Nvidia, the broader geopolitical landscape, encompassing the US-China tech rivalry, supply chain vulnerabilities, and export controls, constitutes a more pervasive and potentially damaging threat to its long-term growth. Nvidia's proactive approach—including market diversification, R&D investment, and political engagement—demonstrates its awareness of these challenges. However, continued vigilance and adaptability will be crucial for Nvidia to navigate the increasingly turbulent geopolitical landscape. Further research into Nvidia’s geopolitical exposure, particularly concerning its supply chain resilience and the long-term impacts of the US-China tech rivalry, is essential for understanding the company’s future prospects within the evolving AI chip geopolitical landscape. Stay updated on industry developments and continue monitoring the evolving geopolitical risks impacting the semiconductor industry, paying close attention to Nvidia's strategies for mitigating these challenges.

Featured Posts

-

Analysis Xrp Price Surge After Us Presidents Trump Related Post

May 01, 2025

Analysis Xrp Price Surge After Us Presidents Trump Related Post

May 01, 2025 -

Chilean Migrants And The Nfl Multi Million Dollar Heist Charges

May 01, 2025

Chilean Migrants And The Nfl Multi Million Dollar Heist Charges

May 01, 2025 -

Eleven Points To Victory Antoine Duponts Impact On Frances Rugby Win

May 01, 2025

Eleven Points To Victory Antoine Duponts Impact On Frances Rugby Win

May 01, 2025 -

Il Caso Becciu Riflessioni Sulle Preghiere E Le Speculazioni Sulle Dimissioni

May 01, 2025

Il Caso Becciu Riflessioni Sulle Preghiere E Le Speculazioni Sulle Dimissioni

May 01, 2025 -

Actor Michael Sheen Pays Off 1 Million In Debt For 900

May 01, 2025

Actor Michael Sheen Pays Off 1 Million In Debt For 900

May 01, 2025