Are We Normalizing Disaster? Examining The Phenomenon Of Wildfire Wagers In Los Angeles

Table of Contents

The Psychology of Normalization

The increasing frequency of wildfires in Los Angeles is fostering a dangerous sense of complacency. This normalization of disaster stems from complex psychological processes.

Desensitization to Risk

The constant barrage of news reports about wildfires, while intending to inform, can paradoxically lead to desensitization.

- Increased frequency of news reports: The sheer volume of wildfire news can make each individual event seem less significant.

- Decreased severity of individual events reported: Unless a wildfire is exceptionally devastating, it might be relegated to a smaller news segment, minimizing its perceived impact.

- Reliance on emergency services: The consistent presence of well-equipped fire departments creates a false sense of security.

- Government response patterns: Predictable government responses, while crucial, can inadvertently reinforce the idea that wildfires are a manageable, if inconvenient, occurrence.

This habituation, a psychological process where repeated exposure to a stimulus diminishes its emotional impact, contributes significantly to the normalization of deviance – the acceptance of dangerous behavior as the norm. Studies on disaster response highlight how communities can become complacent after several close calls, underestimating future risks.

The Impact of Proximity and Personal Experience

Personal experiences profoundly shape individual perceptions of wildfire risk. Those living in close proximity to wildfire-prone areas, or having personally experienced a near-miss, exhibit different levels of concern than those further removed.

- Anecdotal evidence from Los Angeles residents: Interviews with residents reveal a spectrum of responses, from casual acceptance to heightened anxiety.

- Impact of social media: Social media amplifies both the normalization and the anxiety surrounding wildfires, depending on the user's network and information sources.

- Individual risk assessment vs. statistical probability: Individuals often struggle to reconcile statistical probabilities of wildfire risk with their personal lived experiences and perceived control.

Those who have directly experienced property damage or loss due to a wildfire are significantly less likely to normalize the risk. Their personal experiences outweigh any desensitization from repeated news reports. Conversely, those without direct experience might underestimate the potential devastation.

The Mechanics of Wildfire Wagers

The phenomenon of "wildfire wagers" encompasses a spectrum of behaviors, from casual bets to more complex financial speculation.

Informal Bets and Speculation

Informal bets on the severity or location of the next wildfire are surprisingly common amongst Los Angeles residents.

- Examples of informal wagers amongst friends, neighbors, and colleagues: These casual bets often involve small sums of money, reinforcing a sense of trivializing the risk.

- Discussions on social media and online forums: Online platforms amplify these casual bets, creating echo chambers where risk is downplayed.

- Lack of regulation and oversight: The informal nature of these wagers means there is no regulatory framework to address the ethical and societal implications.

These casual bets, while seemingly harmless, normalize the idea of profiting from a natural disaster, obscuring the immense human and economic cost associated with wildfires.

Insurance Market Dynamics and Investment Strategies

The insurance industry plays a pivotal role in assessing and managing wildfire risk. However, the very act of assigning financial values to these risks can unintentionally contribute to the normalization of disaster.

- Discuss the insurance industry’s practices, including risk assessment models and premium adjustments: Insurance companies use sophisticated models to assess risk and adjust premiums accordingly.

- Mention any investment opportunities related to wildfire mitigation or recovery: Investments in wildfire mitigation technology and post-disaster recovery efforts are also emerging.

The potential for speculative behavior within the insurance market is a concern. The pricing of wildfire insurance, and its availability, directly impacts property values and affordability, especially in high-risk areas.

The Socioeconomic Implications

The normalization of wildfire risk disproportionately impacts vulnerable populations within Los Angeles.

Disparities in Risk and Preparedness

Socioeconomic disparities profoundly influence access to resources and preparedness levels.

- Analyze the socioeconomic factors impacting access to insurance and resources in wildfire-prone areas of Los Angeles: Lower-income communities often lack adequate insurance coverage and resources for wildfire preparedness.

- Discuss differences in preparedness levels between wealthier and lower-income communities: Wealthier communities can afford more robust wildfire mitigation strategies and faster recovery efforts.

This disparity exacerbates existing social inequalities, creating a system where the burden of wildfire risk falls disproportionately on the most vulnerable.

The Long-Term Costs of Complacency

Failing to adequately address wildfire risk leads to substantial economic and societal costs.

- Increased insurance premiums: As wildfire risk increases, so do insurance premiums, making homeownership unaffordable for many.

- Rising property damage costs: The cost of rebuilding after a wildfire is immense, placing a strain on individuals, communities, and the economy.

- Potential for mass displacement: Devastating wildfires can lead to mass displacement and homelessness, particularly amongst vulnerable populations.

- Strain on emergency services: Repeated wildfire events strain emergency services and resources, diverting funds from other crucial community needs.

The cumulative cost of complacency far outweighs the cost of proactive wildfire prevention and community preparedness.

Conclusion

The normalization of wildfire risk in Los Angeles is a multifaceted problem stemming from psychological desensitization, casual "wildfire wagers," and significant socioeconomic disparities. Ignoring this phenomenon has substantial long-term costs. We need to move beyond the casual acceptance of wildfire risk and engage in proactive measures to mitigate the threat. Understanding the phenomenon of wildfire wagers is a critical first step in fostering a more responsible and resilient community. We must actively challenge the normalization of disaster and invest in proactive wildfire prevention and community preparedness in Los Angeles. Let's work together to protect our city from the devastating consequences of wildfire and reduce the troubling rise of wildfire wagers.

Featured Posts

-

Where To Stream Ghost Season 4 Finale For Free A Complete Guide

May 27, 2025

Where To Stream Ghost Season 4 Finale For Free A Complete Guide

May 27, 2025 -

Podcast Preparing For Post Low Inflation A Financial Podcast

May 27, 2025

Podcast Preparing For Post Low Inflation A Financial Podcast

May 27, 2025 -

Transfer Battle Newcastle And Chelsea Target Ligue 1 Forward

May 27, 2025

Transfer Battle Newcastle And Chelsea Target Ligue 1 Forward

May 27, 2025 -

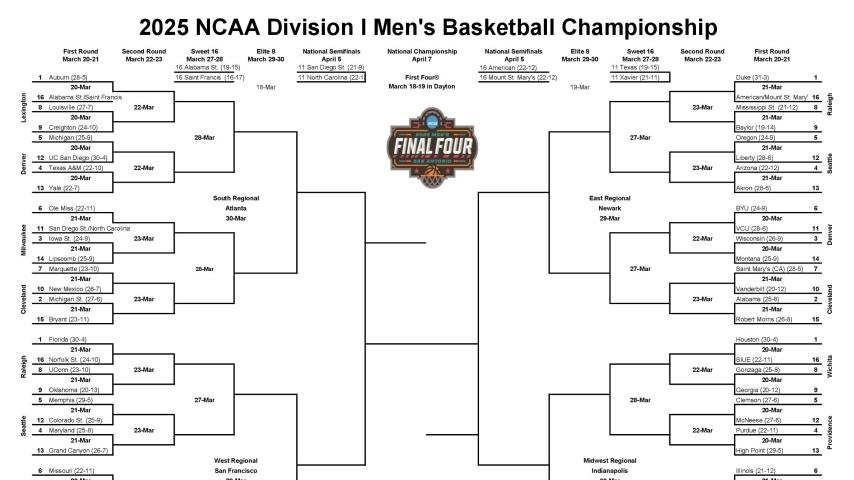

Ncaa Tournament 2025 Second Round Dates Times And Where To Watch

May 27, 2025

Ncaa Tournament 2025 Second Round Dates Times And Where To Watch

May 27, 2025 -

Enflasyon Ve Kueresel Ticaret Ecb Baskani Lagarde Nin Analizi

May 27, 2025

Enflasyon Ve Kueresel Ticaret Ecb Baskani Lagarde Nin Analizi

May 27, 2025

Latest Posts

-

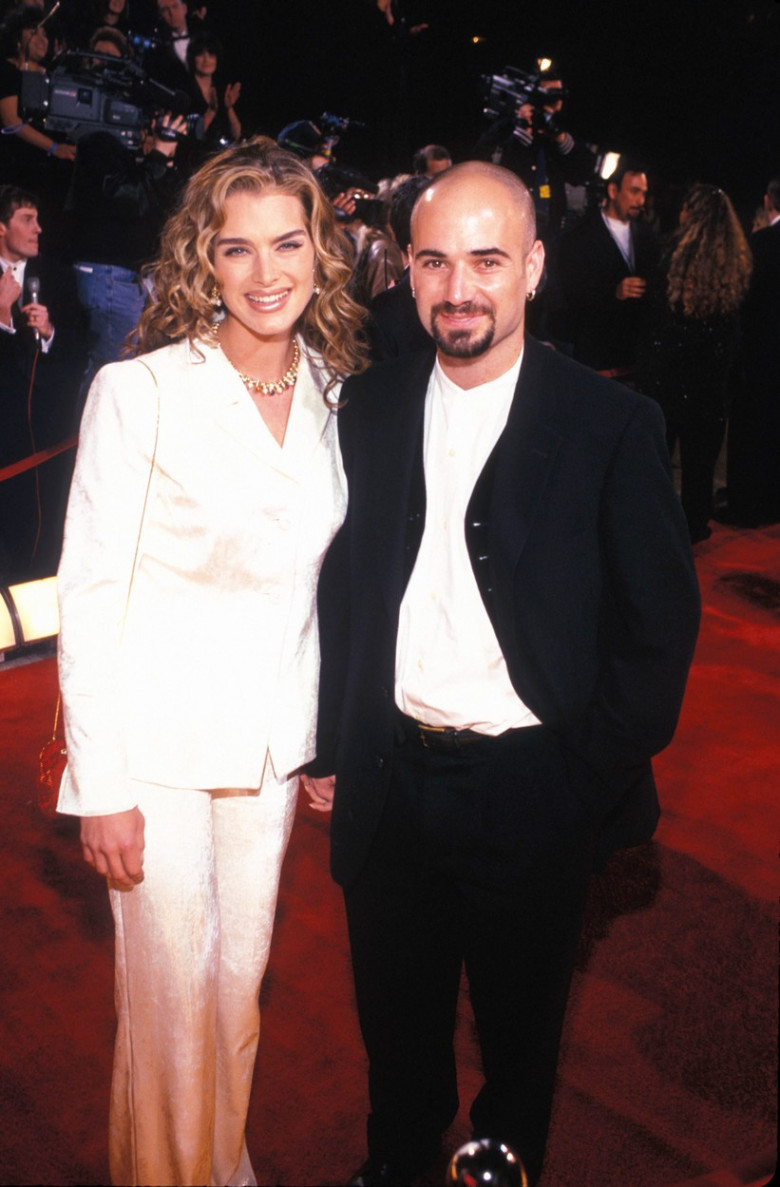

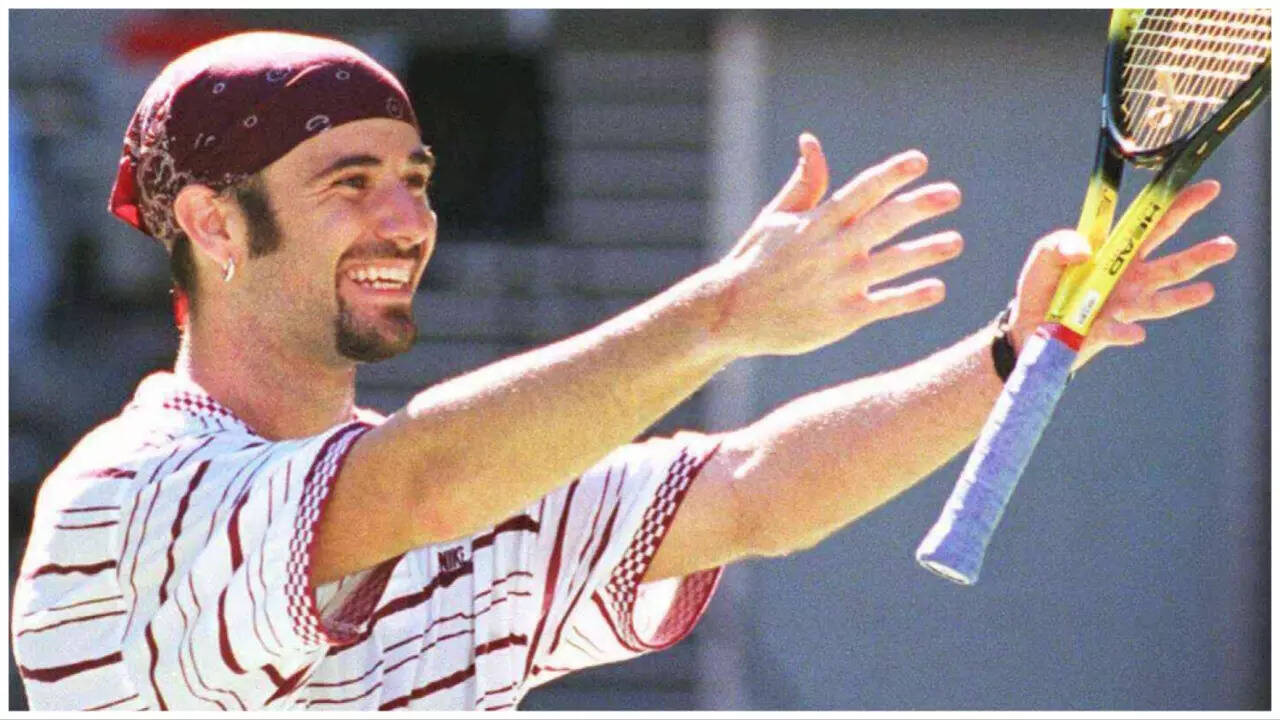

Tenisul De Elita Marturia Lui Andre Agassi Despre Presiune

May 30, 2025

Tenisul De Elita Marturia Lui Andre Agassi Despre Presiune

May 30, 2025 -

Nervi De Otel Andre Agassi Vorbeste Despre Anxietatea Sa

May 30, 2025

Nervi De Otel Andre Agassi Vorbeste Despre Anxietatea Sa

May 30, 2025 -

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025 -

Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Marturie Sincera

May 30, 2025

Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Marturie Sincera

May 30, 2025 -

Andre Agassi And Ira Khan An Unexpected Encounter And Revelation

May 30, 2025

Andre Agassi And Ira Khan An Unexpected Encounter And Revelation

May 30, 2025