Are Universities Facing A Financial Meltdown? Examining The Evidence

Table of Contents

Declining Government Funding and its Impact

Declining government funding is a major contributor to the potential university financial meltdown. Reduced public investment in higher education is impacting institutions globally, leading to significant financial strain and operational challenges.

Shrinking Public Budgets

Many countries are experiencing substantial cuts to public higher education funding. This trend is driven by competing government priorities and overall budget constraints.

- United Kingdom: Significant cuts to university budgets have resulted in program closures and increased tuition fees.

- United States: State-level funding for public universities has declined in many states, forcing institutions to rely more heavily on tuition revenue.

- Canada: Provincial governments are facing pressure to control spending, leading to reduced funding for post-secondary education.

These funding reductions have several severe consequences:

- Program Cuts: Universities are forced to eliminate less popular or less profitable programs, impacting academic diversity and student choice.

- Increased Tuition Fees: To compensate for reduced funding, many universities have significantly increased tuition fees, making higher education less accessible to many students.

- Staff Reductions: Budget cuts often lead to layoffs and hiring freezes, impacting the quality of teaching and research.

Shifting Priorities

Government priorities are shifting away from traditional higher education models, impacting funding allocation.

- Focus on Vocational Training: Governments are increasingly prioritizing vocational training and skills development, diverting funding from traditional liberal arts and sciences programs.

- Competition for Limited Funds: Universities are competing for limited government funds with other sectors, such as healthcare and infrastructure. This competition puts pressure on universities to demonstrate their economic and societal value.

Rising Costs and Stagnant Revenue Streams

The combination of rising operational costs and stagnant or declining revenue streams is exacerbating the potential for a university financial meltdown.

Inflationary Pressures

Universities face significant inflationary pressures, increasing the cost of running their institutions.

- Increased Energy Costs: Rising energy prices are significantly impacting university budgets, particularly for large campuses with extensive facilities.

- Staff Salary Increases: Universities need to compete for talented faculty and staff, leading to increased salary costs.

- Maintenance and Repair Expenses: Maintaining aging infrastructure requires significant investment, putting further strain on budgets.

Tuition Fee Dependence and Limitations

Many universities heavily rely on tuition fees as their primary revenue source, but this model is becoming increasingly unsustainable.

- International Student Recruitment Challenges: Competition for international students is fierce, and changes in immigration policies or global economic conditions can significantly impact enrollment.

- Declining Domestic Student Enrollment: In some regions, the number of domestic students enrolling in higher education is declining, reducing tuition revenue.

- Potential for Tuition Fee Caps: Government regulations or public pressure may lead to tuition fee caps, limiting universities' ability to increase revenue.

The Growing Debt Burden of Students and Universities

The rising debt burden, both for students and universities themselves, presents a significant threat to the financial stability of the higher education sector.

Student Loan Debt Crisis

The soaring student loan debt crisis has significant indirect and direct implications for universities.

- Default Rates: High default rates on student loans can reduce the future earning potential of graduates, impacting their ability to repay loans and potentially affecting future tuition revenue.

- Impact on Student Enrollment: The rising cost of higher education and the burden of student loan debt may deter potential students from enrolling, leading to decreased enrollment numbers.

- Potential for Future Revenue Shortfalls: If fewer students enroll due to financial constraints, universities face reduced tuition revenue, further exacerbating their financial challenges.

University Indebtedness

Universities themselves are accumulating increasing levels of debt through borrowing to fund expansion projects, cover operating costs, or address budget shortfalls.

- Examples of Universities Facing Financial Difficulties Due to Debt: Several universities globally have faced significant financial difficulties, even bankruptcy, due to unsustainable debt levels.

- Consequences of Default: University default on debt can lead to severe consequences, including loss of accreditation, program closures, and even the closure of the institution.

Potential Solutions and Future Outlook

Addressing the potential university financial meltdown requires innovative solutions and proactive strategies.

Innovative Funding Models

Diversifying revenue streams is crucial for universities to enhance financial sustainability.

- Endowments: Universities need to strengthen their endowment management strategies to generate more income from their investment portfolios.

- Private Philanthropy: Increasing fundraising efforts and cultivating relationships with private donors are vital for securing philanthropic support.

- Corporate Partnerships: Collaborations with businesses can provide funding opportunities, access to resources, and practical training for students.

Efficiency and Cost-Cutting Measures

Improving efficiency and implementing cost-cutting measures are crucial to enhance financial stability.

- Mergers and Acquisitions: Consolidating resources through mergers and acquisitions can create economies of scale and reduce administrative costs.

- Streamlining Administration: Optimizing administrative processes and reducing bureaucratic overhead can free up resources for academic priorities.

- Online Education Initiatives: Expanding online learning programs can increase access to education, reach wider audiences, and potentially generate new revenue streams.

Conclusion

The evidence suggests that universities are facing significant financial challenges, potentially leading to a university financial meltdown. While the challenges are substantial, they are not insurmountable. The future of higher education depends on proactive measures to diversify funding sources, enhance efficiency, and address the growing burden of student and university debt. The potential for a university financial meltdown is real, but through strategic planning and innovative solutions, many institutions can navigate these difficulties. Stay informed, engage in the conversation, and advocate for sustainable solutions to prevent a full-blown university financial meltdown.

Featured Posts

-

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance

May 18, 2025

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance

May 18, 2025 -

Decoding The Chinese Market Why Bmw And Porsche Face Headwinds

May 18, 2025

Decoding The Chinese Market Why Bmw And Porsche Face Headwinds

May 18, 2025 -

Moodys Downgrade Of Us Debt Rating White House Criticism And Market Impact

May 18, 2025

Moodys Downgrade Of Us Debt Rating White House Criticism And Market Impact

May 18, 2025 -

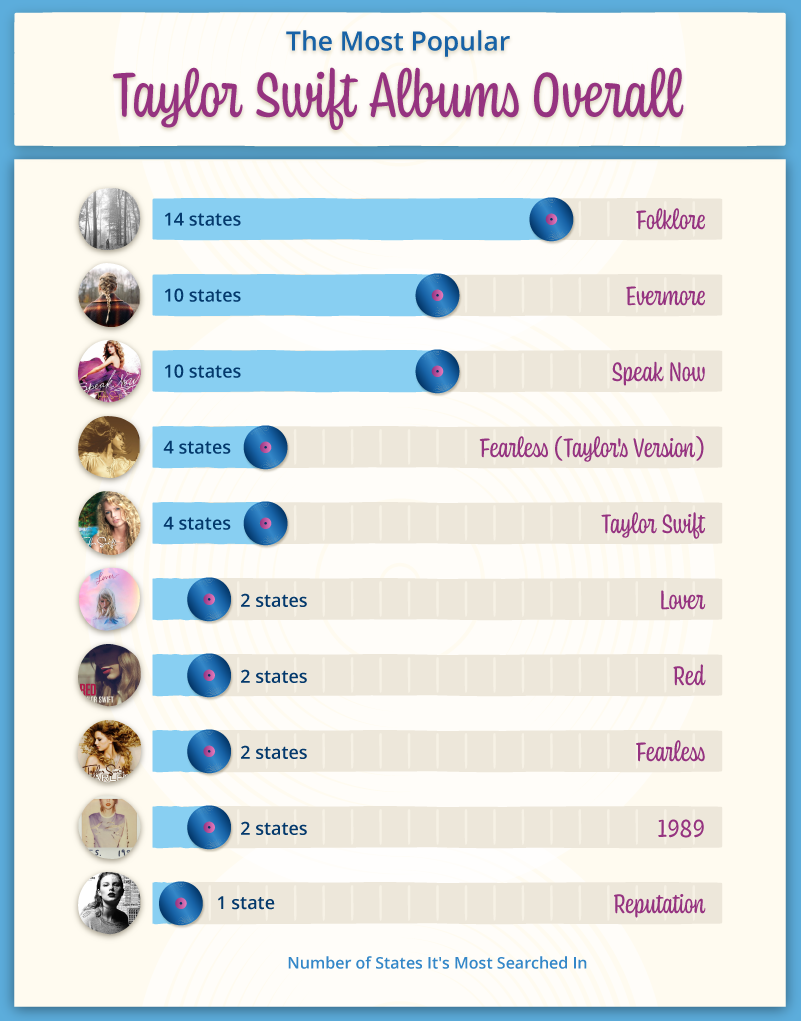

The Ultimate Taylor Swift Album Ranking All 11

May 18, 2025

The Ultimate Taylor Swift Album Ranking All 11

May 18, 2025 -

Dove Cameron And Damiano David Spotted Holding Hands In Nyc Photos

May 18, 2025

Dove Cameron And Damiano David Spotted Holding Hands In Nyc Photos

May 18, 2025

Latest Posts

-

Tigers Riley Greenes Unprecedented Two Ninth Inning Home Runs

May 18, 2025

Tigers Riley Greenes Unprecedented Two Ninth Inning Home Runs

May 18, 2025 -

Riley Greene Makes Mlb History With Two Ninth Inning Home Runs

May 18, 2025

Riley Greene Makes Mlb History With Two Ninth Inning Home Runs

May 18, 2025 -

Dodgers New Acquisition Confortos Potential Compared To Hernandez

May 18, 2025

Dodgers New Acquisition Confortos Potential Compared To Hernandez

May 18, 2025 -

Will Michael Conforto Emulate Teoscar Hernandezs Success In La

May 18, 2025

Will Michael Conforto Emulate Teoscar Hernandezs Success In La

May 18, 2025 -

Confortos Dodgers Debut Can He Follow Hernandezs Lead

May 18, 2025

Confortos Dodgers Debut Can He Follow Hernandezs Lead

May 18, 2025