Are Stretched Stock Market Valuations Justified? BofA Weighs In

Table of Contents

BofA's Stance on Current Market Valuations

BofA's stance on current market valuations is nuanced, leaning towards cautious optimism. While acknowledging the impressive performance of the market, they express concerns about the sustainability of current levels given prevailing macroeconomic conditions. Their key arguments hinge on a careful assessment of several factors:

-

Current interest rate environment and its impact on valuations: BofA highlights the impact of rising interest rates on the present value of future earnings, potentially dampening investor enthusiasm and leading to lower stock prices. Higher interest rates make bonds more attractive, diverting investment away from stocks.

-

Inflationary pressures and their effect on corporate earnings: Persistent inflation erodes corporate profit margins, as rising input costs squeeze businesses. BofA cautions that if inflation remains elevated, corporate earnings growth may not justify current valuations.

-

Projected economic growth and its correlation to stock prices: BofA's analysis incorporates projections for economic growth, recognizing that slower growth could negatively impact corporate performance and subsequently, stock prices. A slowdown could trigger a market correction.

-

Specific sectors BofA deems overvalued or undervalued: The analysis likely identifies specific sectors within the market as overvalued or undervalued based on their earnings potential and growth prospects. For example, they might highlight technology stocks as potentially overvalued compared to more cyclical sectors.

Analyzing the Justification for High Valuations

Despite BofA's cautious outlook, there are arguments supporting the current high valuations. These arguments often center on the strength of the underlying economy and corporate performance:

-

Strong corporate earnings growth: Many companies have reported robust earnings growth, exceeding expectations in various sectors. This strong performance fuels investor confidence and supports higher stock prices. This growth is often backed by data showing revenue increases and improved efficiency.

-

Technological advancements and innovation driving company value: Technological breakthroughs and disruptive innovation are creating new opportunities and enhancing productivity for many companies, which is reflected in their valuations. The continued growth of sectors like artificial intelligence and cloud computing can support higher valuations.

-

Low unemployment and consumer confidence: A strong labor market with low unemployment indicates a healthy economy, boosting consumer spending and bolstering corporate revenues. High consumer confidence further reinforces this positive outlook.

-

Government stimulus and its impact on the market: Previous government stimulus packages have injected significant capital into the economy, stimulating demand and supporting economic activity, thereby impacting market valuations. However, the long-term effects of stimulus need careful consideration.

Counterarguments and Potential Risks of Stretched Valuations

While the case for high valuations is compelling, several counterarguments raise concerns about their sustainability:

-

High P/E ratios compared to historical averages: Current P/E ratios (Price-to-Earnings ratios) for many companies are significantly higher than historical averages, suggesting that stocks might be overvalued relative to their earnings. This suggests a potential vulnerability to market corrections.

-

Potential for a market correction or downturn: The elevated valuations make the market more susceptible to a correction, where prices fall significantly due to factors such as interest rate hikes, inflation, or geopolitical events. A significant correction could wipe out considerable investor gains.

-

Risks associated with rising interest rates and inflation: As mentioned earlier, rising interest rates and inflation can directly impact corporate profitability and investor sentiment, triggering a market downturn. These factors increase the risk of stretched valuations becoming unsustainable.

-

Geopolitical uncertainties and their impact on the market: Geopolitical instability and unexpected global events (wars, pandemics, etc.) introduce significant uncertainty and can trigger market volatility, potentially leading to a correction even if underlying economic conditions are strong.

Alternative Perspectives and Expert Opinions

BofA's analysis is not the only perspective on stretched stock market valuations. Other financial analysts offer varying views on the key factors influencing the market. Some might argue that inflation is transitory and will soon subside, supporting the current high valuations. Others might emphasize the risks associated with rising interest rates more strongly than BofA, predicting a more significant market correction. These differing perspectives highlight the complexity of accurately forecasting market trends and the importance of diversifying investment strategies. It’s crucial to consider a wide range of opinions before making investment decisions.

Conclusion: Navigating the Landscape of Stretched Stock Market Valuations

The debate surrounding stretched stock market valuations is multifaceted. While strong corporate earnings and technological innovation support high valuations, risks associated with rising interest rates, inflation, and geopolitical uncertainties cannot be ignored. BofA's analysis highlights a cautious outlook, suggesting a need for vigilance and diversification.

For investors, the key takeaway is the importance of a balanced approach. While ignoring the potential for growth might be detrimental, neglecting the risks of overvalued assets is equally dangerous. Consider diversifying your portfolio across different asset classes, focusing on companies with strong fundamentals and a history of sustainable growth. Regularly review your investments and stay updated on economic indicators and market trends.

To make informed investment decisions, conduct thorough research on stretched stock market valuations, staying informed about market trends and economic indicators. Follow BofA's analysis and other reputable sources for ongoing updates. Remember, understanding the nuances of stretched stock market valuations is crucial for navigating the current market environment effectively.

Featured Posts

-

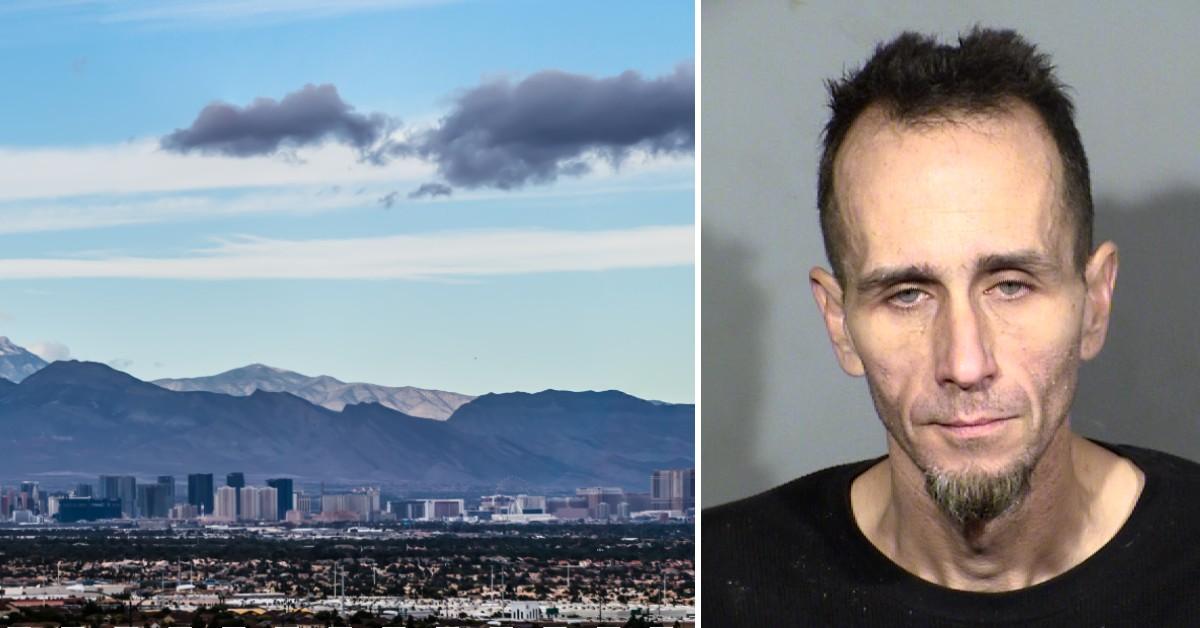

Concerns Grow For Missing British Paralympian In Las Vegas

Apr 29, 2025

Concerns Grow For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Anthony Edwards Grants Ayesha Howard Custody Following Paternity Dispute

Apr 29, 2025

Anthony Edwards Grants Ayesha Howard Custody Following Paternity Dispute

Apr 29, 2025 -

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

Apr 29, 2025 -

Porsche Macan Electric A Deep Dive Into The New Drive Experience

Apr 29, 2025

Porsche Macan Electric A Deep Dive Into The New Drive Experience

Apr 29, 2025 -

Eligibility Of Convicted Cardinal To Vote In Next Papal Conclave

Apr 29, 2025

Eligibility Of Convicted Cardinal To Vote In Next Papal Conclave

Apr 29, 2025